Summary:

- Verizon’s stock has been performing well recently, keeping pace with the S&P 500 index. Will the show go on? I believe it must – read on.

- Despite weak financial results, I think the market has already priced in the risks and the stock has continued to rally, focusing on prospects.

- Verizon’s management has outlined plans for revenue growth, cost reduction, and debt reduction, which could drive the rebound to keep going.

- Assuming higher FCF by the end of 2024 and stable growth thereafter, the dividend of over 6% seems safe today. My calculations indicate an upside potential of over 20% (without the dividend yield).

- I’m therefore reiterating my previous “Buy” rating today.

hapabapa

Instead Of An Investment Thesis

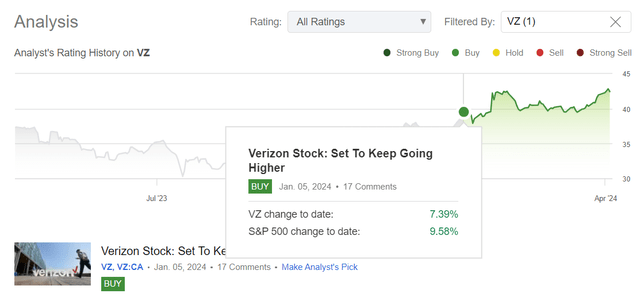

My first and only piece on Verizon Communications Inc. (NYSE:VZ) stock was published 3 months back in January 2024. Since then, it’s been riding the wave upward, keeping pace with the S&P 500 index (SPX), although it’s lagging behind just a tad.

Seeking Alpha, Oakoff’s VZ coverage

Based on the latest data from Verizon and some macro/industry tailwinds, I’m inclined to believe that the current rally is just the beginning. “The show must go on,” as a great artist sang.

My Reasoning

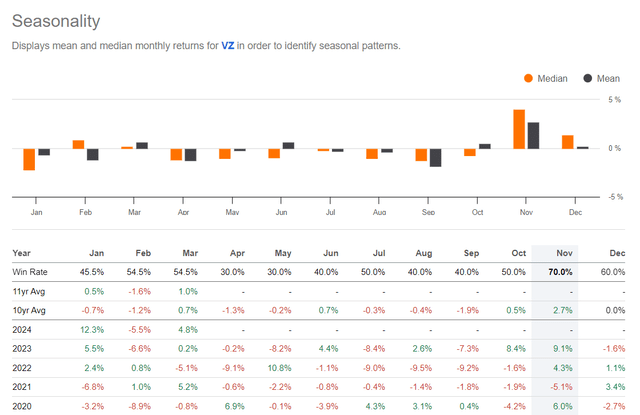

In my previous article about Verizon, I wrote about the strong pressure on quotes from rising interest rates, Amazon’s (AMZN) plans to offer a low-cost mobile service for its Prime customers, and the Wall Street Journal’s investigation. But apparently, the market has already priced in these risks, as VZ shares have continued to rally rapidly in recent months – according to Seeking Alpha’s seasonal chart, Verizon’s recovery has breached the usual historical seasonal factor for this period of the year.

Seeking Alpha, VZ’s Seasonality

Something out of the ordinary happened with the company’s stock, defying the typical market response to financial results.

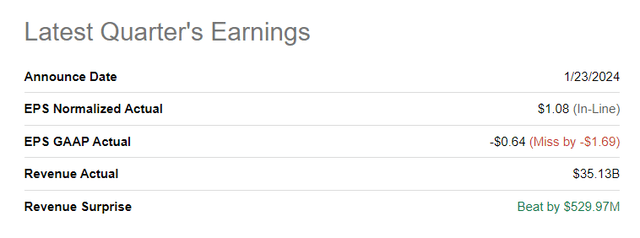

When the company reported its Q4 2023 results in late January, its stock skyrocketed by 6.7% in a single trading day. What’s noteworthy here isn’t just the rise itself, but rather the extent of the market’s reaction – VZ reported a significant GAAP EPS miss for Q4 (the normalized EPS was in line with consensus). Usually, the market does not forgive this.

Seeking Alpha, VZ

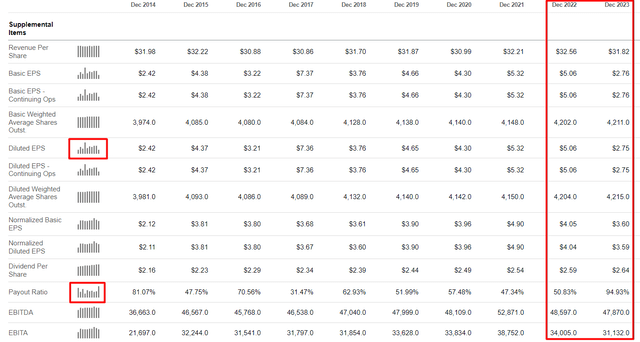

According to Seeking Alpha, VZ’s revenue dipped by 0.34%, and the notable uptick in gross profit (+2.4% YoY) didn’t save the EBIT from taking a hit of nearly 6% YoY. The interest payments saw a QoQ increase of 11.5% and a significant YoY surge of ~44.7% while the net debt increased by ~1.6% in Q4 YoY. What’s striking is that net profit actually turned negative for the first time in many quarters (I’m looking at specifically the GAAP net profit):

Seeking Alpha, VZ’s income statement, Oakoff’s notes

Sales declined even further in 2023, plummeting by 2.1% to $134 billion. However, GAAP net earnings stood at a positive $2.75 per share—barely half of the $5.06 per share Verizon racked up for FY2022.

Seeking Alpha, VZ, Oakoff’s notes

In my view, the fact that the stock rose alongside the market following such a weak report, rather than continuing its multi-year correction, strongly suggests that much of the negativity has already been factored in (as I assumed above). As you might be aware, the market operates on future expectations, and in that regard, VZ boasts numerous prospects and strategies to show a rebound in revenue (and consequently, net profit).

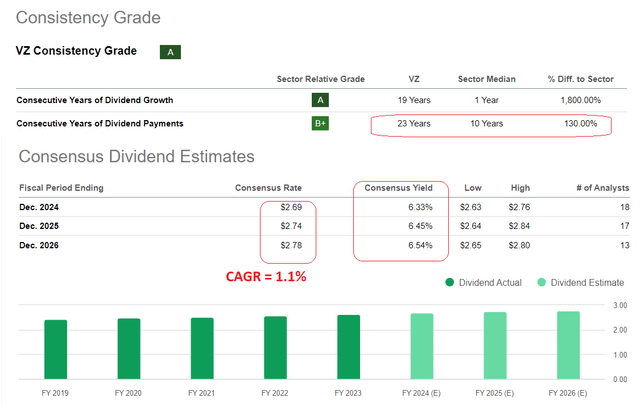

For 2024 and beyond, Verizon’s management expects revenue growth in wireless services to accelerate and targets an increase of 2% to 3.5%. This growth will be driven by factors such as the “positive postpaid phone net additions, the increase in fixed wireless access subscribers, the broader acceptance of unlimited premium plans, and increased sales of products and services.” VZ’s executives also expect consolidated adjusted EBITDA to grow by 1-3% YoY (it slightly dipped in 2023), supported by higher wireless service revenue and ongoing cost reduction initiatives. Also, the adjusted EPS should be between $4.50 and $4.70 (vs. $3.59 in 2023), impacted by factors such as increased interest and pension expenses. The capital expenditures (‘CAPEX’) are expected to decline to $17-17.5 billion (vs. $18.8 billion in FY2023), and this is perhaps one of the most important points because it testifies to the potential strength of future FCFs. While Verizon doesn’t provide specific guidance for FCF this year, it indeed anticipates strong performance in this area and expects to use it to “prioritize capital allocation and significantly reduce unsecured debt in 2H 2024”. In this way, the management stoked hopes for the market for 2024 and a few years into the future. In any case, the probability that the ideal track record in terms of dividend payments will continue has risen sharply following these forecasts.

Seeking Alpha, VZ’s Dividends, Oakoff’s notes

According to the CEO’s comments during the recent Deutsche Bank conference, the firm sees convergence between mobile and fixed-line broadband as a significant opportunity for growth. By bundling services like

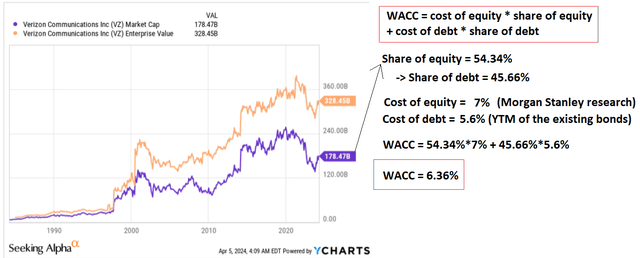

The CEO added that by offering Fios and fixed wireless access (‘FWA’) with mobile plans, VZ aims to drive customer satisfaction, reduce churn, and increase ARPU. These more concrete plans explain the above-described guidance—I believe that management can succeed.Apart from all that, Verizon seems to be a very cheap stock today. This is due to the relatively low cost of capital. Many analysts and investors fear that the company has very high levels of debt on its balance sheet. However, they forget that financial theory says that debt is always cheaper than equity – accordingly, VZ’s WACC should theoretically be much lower than that of a debt-free company. Let’s check it out.

YCharts, Oakoff’s notes

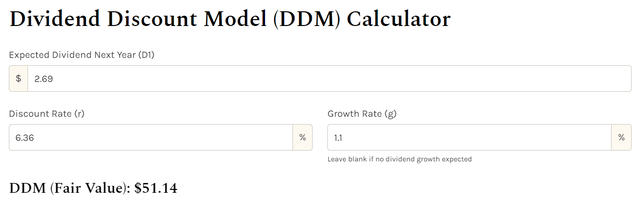

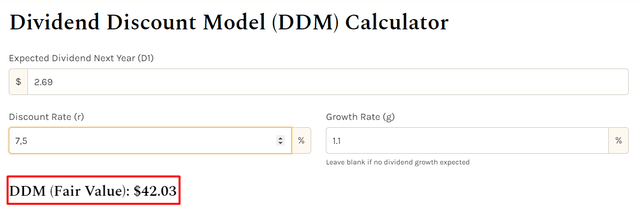

Using StableBread’s dividend discount model template and inserting the FY2024 expected dividend payout amount along with the targeted dividend growth rate and the WACC, we’re getting a price target of $51.14. That is almost 20.5% more than the stock price closed on the trading day of April 4, 2024.

StableBread’s DDM, Oakoff’s inputs

Given Verizon’s undervaluation and the high stability of its dividend amid the expected improvement in business growth and the increase in free cash flow, I think the recovery show must go on.

Downside Risks To My Thesis

In fact, the company’s most important risk factors have not changed significantly in the last three months.

Despite Verizon’s dominance in 4G and progress in 5G, disruptive technological shifts present challenges for the company. The competition in today’s fast-evolving, already saturated telecommunications market may interfere with management plans to re-accelerate business growth. If that happens, then my whole thesis comes to nothing.

It’s also important to remember the legacy infrastructure risks, highlighted by the Wall Street Journal investigation into outdated copper cables. Though Verizon moved away from such cables in the 1950s, uncertainty persists about their presence in the network, potentially leading to liabilities, especially from past acquisitions.

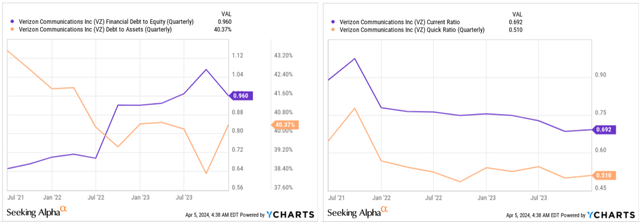

I also don’t like the fact that VZ keeps increasing its debt profile. This move decreases the WACC, but alongside industry-wide risks, Verizon’s increasing debt-to-equity ratio and declining liquidity indicators raise concerns:

YCharts, Oakoff’s notes

Furthermore, there is a risk that my calculations of the fair value of the VZ stock are not correct. For example, if we apply a discount rate of at least 7-8%, this will radically change all the conclusions of my DDM:

StableBread’s DDM, Oakoff’s inputs and notes

Your Takeaway

Of course, we can’t call Verizon a risk-free dividend idea – from both a financial and operational perspective, the risk factors are sufficient and shouldn’t be ignored. Nevertheless, it seems to me that management’s plan has every chance of coming to fruition, as some of the company’s end markets have good prospects for future growth, and cost optimization efforts are basically just beginning.

If we assume that FCF will actually be higher at the end of 2024 vs. 2023 and that corporate growth will remain stable at 1-3% per year in 2025 and beyond, then nothing should jeopardize the forecast dividend of over 6% today. With a current WACC of 6.36% and forecast dividend growth of just 1.1% per year, the upside potential is over 20%, not including the dividend yield, based on my calculations. I’m therefore reiterating my previous “Buy” rating today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in VZ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.