Summary:

- Verizon’s shares have rebounded about 30% and still appear undervalued.

- Concerns about Verizon’s $137 billion debt should focus on the company’s ability to service and repay it.

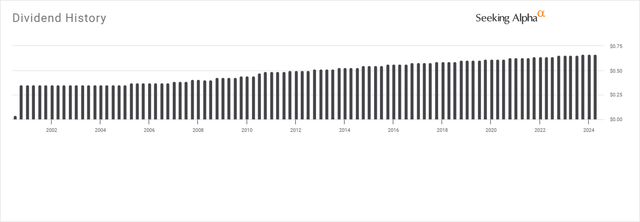

- Verizon’s dividend yield is currently at 6.69% and the company is expected to strengthen its balance sheet and reward investors.

PM Images

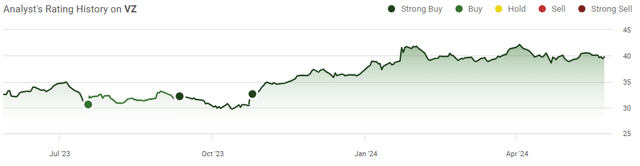

Verizon’s shares (NYSE:VZ) aren’t as cheap as they were in October 2023 when they reached $30.14, but after rebounding roughly 30%, they still look undervalued. Over the past 5 years, shares of Verizon are down -33.80% as they gradually decreased in value during the Fed tightening cycle. While some investors are worried about the $137 billion in long-term debt on the balance sheet, I look at a company’s ability to service the debt and repay maturities rather than stressing out about the amount of debt it has. After Verizon’s shares broke through the $43 level in April, they retraced back under $40, which pushed the dividend yield back up to 6.69%. I think that Mr. Market is giving income investors another opportunity to grab shares of VZ at an attractive level heading into a rate-cutting cycle. I am long Verizon, as I believe they will continue to strengthen their balance sheet by reducing their debt level and rewarding investors through a growing dividend.

Seeking Alpha

Following up on my previous article about Verizon

I wrote my previous article about Verizon on 10/25/23 (can be read here), and since then, shares of VZ have appreciated by 13.87%. Verizon is trailing the performance of the S&P 500 as the S&P has climbed 25.29% since then, and when the dividends are factored in, Verizon has a total return of 17.66%. In the article, I discussed how Verizon’s increased free cash flow (FCF) guidance should drive shares higher as it would provide Verizon with additional liquidity to repay debt maturities and increase the dividend. While things are looking better, shares are starting to sell off, and I think Mr. Market is placing too much of a discount on Verizon’s shares. Today, you are able to purchase shares at less than 9 times the earnings as the dividend continues to grow. I think there is still a long-term opportunity for value to be unlocked within shares of Verizon while generating substantial dividend income. I am following up with a new article to dive through the numbers and look at why I think the opportunity is alive and well.

Seeking Alpha

Risks to investing in Verizon

While Verizon is one of the most well-known companies in the United States, with physical locations across the nation, there are still risks to investing in this company. The first risk is opportunity cost, as Verizon has underperformed the S&P 500 over several different time periods, especially over the previous 5-years. Just investing in a standard S&P 500 index fund would have generated around 87% in appreciation, while shares of Verizon declined by -33.8%. Verizon’s dividend has been yielding in the mid to high single digits, but it’s not enough to close the gap between how much value has been lost in Verizon’s shares compared to the appreciation from the S&P 500. The other risks are its debt and the competitive factors to its business. Verizon can’t control the macroeconomic environment, and if the progress that’s been made unwinds, it could cause the Fed to take rates higher. If that were to occur, it would be negative for Verizon because the debt it plans to refinance would come with higher carrying costs and would eat into their profitability. This would also make any new debt that they need to borrow more expensive. On a competitive level, change is constant, and innovation such as Starlink could start to take share away from the incumbents as service becomes cheaper. Verizon also faces direct competition from T-Mobile (TMUS) and AT&T (T).

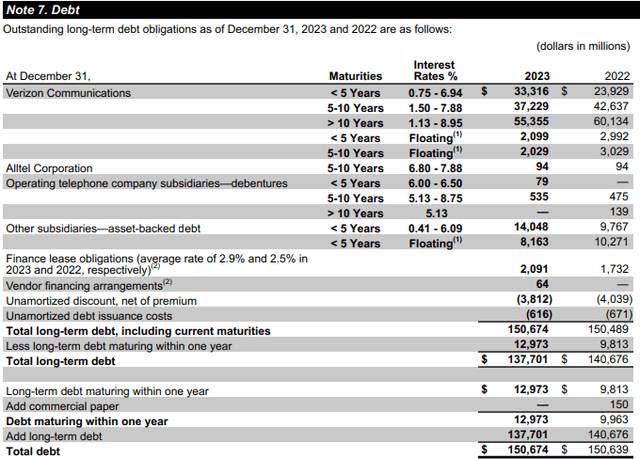

Why Verizon’s debt level isn’t the critical fear that some make it out to be

Some may look at Verizon’s balance sheet and immediately move on without understanding the rest of the financials. Having $137.35 billion in long-term debt is definitely a large number, and more than most companies, but it’s less about the amount of debt than the ability to service the debt. In Verizon’s 2023 10-K, which was released during Q1 of 2024, Verizon had $137.7 billion in long-term debt and $150.67 billion in total debt on the balance sheet. At the close of Q1, Verizon still had $137.35 billion of long-term debt, so it’s safe to say that the outstanding maturities are similar to the 10-K. There is $33.32 billion in debt maturing over the next 5-years and another $37.23 billion of debt maturing over the next 5 years. This brings Verizon’s debt obligations over the next decade to $70.55 billion, which is more than half of its total long-term debt.

Verizon

One of the investment cases for Verizon is the dividend, as its yield has been in the mid to high single digits. Verizon pays a dividend of $2.66 per share and has 4.21 billion shares outstanding. On an annualized basis, Verizon is committed to paying out $11.2 billion of its earnings in dividends. The street is expecting Verizon to generate $4.58 of EPS in 2024, then $4.69 in 2025, and $4.83 in 2026. If Verizon generates $4.58 of EPS in 2024, that means that its earnings from operations will be $19.28 billion in 2024. After the $11.2 billion in dividends are paid, Verizon would be left with $8.08 billion in earnings that can be used to cover its debt maturities. To be conservative, I will speculate that Verizon doesn’t grow their EPS, and over the next 5-years they generate $4.58 of EPS each year while increasing the dividend annually by $0.02. This would mean that Verizon would produce $96.39 billion in earnings from operations and pay out $56.83 billion in dividends, leaving $39.57 billion in retained earnings. This is an additional $6.25 billion than the amount of debt maturing over the next 5-years.

In 2023, Verizon generated $47.87 billion in EBITDA and has consistently produced more than $47 billion in EBITDA since the 2018 fiscal year. Verizon is a cash cow that has the ability to pay down maturing debt or refinance if they choose to. Putting the 12-digit debt number aside, VZ can facilitate its debt obligations, which is what really matters. Verizon needed to tap the debt markets to grow the business, and this is the cost of Verizon doing business. The debt load would be a problem if Verizon wasn’t able to meet its maturities or make the interest payments, but that isn’t happening. Verizon also has an additional $2.43 billion sitting in cash on its balance sheet, with another $1.21 billion in long-term investments. While the debt structure may cause some investors to look at Verizon negatively, I think that Verizon is well-equipped to handle its obligations, and as it eliminates some of its maturities, the market will look at Verizon from a different lens.

Besides being able to manage its debt liabilities, there are other reasons I am bullish on Verizon

Verizon is delivering on critical metrics to sustain future top and bottom-line growth. What I don’t want to see is competitors squeezing Verizon’s territory. In Q1, Verizon added 2.4 million wireless customers YoY, while adding 53,000 Fios internet subscribers. Verizon was able to grow its top-line by 0.2% YoY in Q1 to $33 billion, while growing its Adjusted EBITDA by 1.4% to $12.1 billion YoY. Verizon is also able to reduce the amount of capital they need to allocate toward CapEx as this expenditure declined by $1.6 billion YoY in Q1 to $4.4 billion. On the earnings call, senior leadership indicated that they expect FCF to expand throughout the year and follow the same path it did in 2023. This will put Verizon in a position to continue growing the dividend annually as its dividend payout ratio continues to improve.

Verizon projected that they would produce between $4.50 and $4.70 of EPS in 2024, while the street is looking for $4.58. The consensus estimate is just below the midpoint of Verizon’s guidance, which places their 2024 forward P/E at 8.68. In 2025, the street is looking for $4.69 of EPS, which is at the top end of the 2024 guidance, and that is a forward P/E of 8.48x. Verizon is a slow-growth company, and in some cases it’s stagnant or declines YoY, but it’s still producing tens of billions in profitability annually. Verizon is not a growth company, but trading at less than 9 times earnings is overdoing it also. I think investors are getting a lot for their capital at these valuations, considering the dividend is yielding almost 7%, and Verizon is in a position to change the narrative as it eliminates debt maturities.

Seeking Alpha

Nobody knows when the Fed is going to cut rates. Many investors were adamant that the Fed would pivot in March, and we could get up to 6 rate cuts in 2024. That is obviously not occurring, and I am on the verge of also being incorrect, as I had been saying June was a more likely target for a cut rather than March. The next Fed meeting is quickly approaching, and CME Group has taken a rate cut off of the table based on their predictions. We know from Fed Chair Powell’s last conference that the Fed feels the next move will be lower, not higher, but when that happens, it is still a mystery. If you look at the U.S. debt clock, we are now paying $838.51 billion in annualized interest payments on the national debt, which is 17.26% of the U.S. federal tax revenue of $4.86 billion. I think the Fed is going to pivot in July because there isn’t another meeting until September, and they can see if a cut negatively impacts the progress on inflation. The bottom line is that the U.S. can’t afford to pay over $800 billion in interest on the debt and if the Fed doesn’t cut rates, the U.S. is going to have an even bigger problem when it needs to refinance some of this debt next year at the current rates.

Verizon has provided investors with 17 annualized dividend increases, and the dividend yield is 6.69%. As the FCF improves and Verizon continues to make progress on its KPIs, I believe it will attract investors looking to redeploy capital back into the market as the Fed cuts rates. When a pivot actually happens, money markets will start to lower the amount of interest they pay, while CDs, and bonds will follow. The time will come when CD and bond ladders won’t be as enticing, and bond ETFs will lose some of their attraction. I think that strong companies such as Verizon, with a track record of dividend growth and a large yield, will attract income investors as the risk-free rate of return starts to decline.

Seeking Alph

Conclusion

I think Mr. Market is wrong when it comes to Verizon, and shares trading under $40 is a steal. Verizon shares could continue to sell off and decline in value, but I think the market will eventually change its perception of this great American company. Verizon is in a position to manage its debt maturities, grow its FCF, and increase its dividend. Today, investors can pay less than 10 times earnings for Verizon, and while this isn’t a growth company, Verizon can eventually put itself into a position where it can start doing billions of dollars worth of buybacks, which will help boost EPS and make the valuation even more attractive. As rates start to decline, Verizon’s yield will continue to look better, especially since the dividend will grow rather than decline. Verizon isn’t one of the most exciting companies, but I believe its share price is this low because of a misconception regarding its ability to manage its debt, and eventually, this will change.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ, T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.