Summary:

- Verizon stock has outperformed the S&P 500 for the past year, with a 23.1% total return. But I believe we haven’t seen anything yet.

- Stable operating metrics, decreasing debt, and potential for margin expansion make VZ a compelling investment opportunity, in my view.

- My updated DCF model suggests the Company is undervalued by 46.25%, excluding the attractive dividend yield, which significantly adds value to the stock.

- I believe Verizon offers a compelling medium-term investment opportunity.

RiverNorthPhotography

Intro & Thesis

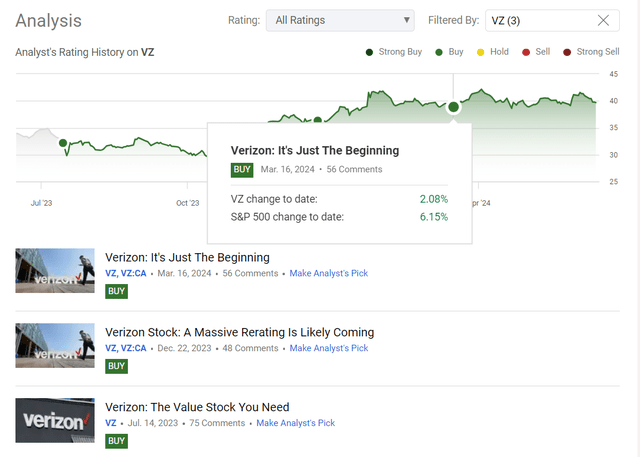

I initiated coverage of Verizon Communications Inc. (NYSE:VZ) stock back in mid-July 2023, that’s almost a year ago. Since then, VZ’s total return has amounted to 23.1% compared to the S&P’s (SP500) (SPX) return of around 20.5%. Throughout the year, I have confirmed my rating twice. However, after the last update in March 2024, the stock started lagging behind the broader market. This underperformance can be explained by the surge in tech companies like Nvidia (NVDA) and others from the “MAG 7” (this particular sector accounts for >33.5% of the whole SPY holdings structure), which helped the S&P 500 index to keep reaching new highs in 2024. Value stocks have been lagging significantly for the past few months, hence the difference.

Seeking Alpha, my coverage of VZ stock

In my opinion, this lag represents an excellent opportunity for value investors. I remain convinced that VZ is undergoing a rapid business turnaround and its consistently high dividend has become even more attractive in recent months. My valuation analysis confirms previous findings that VZ is an undervalued stock with strong growth potential for medium-term holding. I think VZ shareholders haven’t seen anything yet in terms of the stock’s real potential – Verizon could be a great value stock pick at least in the medium term.

Why Do I Think So?

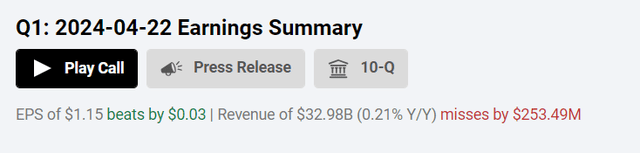

I’d like to begin by analyzing the most recent quarter’s financials (Q1 FY2024, for which the company reported on April 22, 2024). Verizon posted revenue of $30.98 billion, representing a YoY increase of 22 basis points; however, this figure fell short of the consensus forecast by ~$253.5 million. On a more positive note, adjusted EPS amounted to $1.15, beating the consensus forecast by 3 cents:

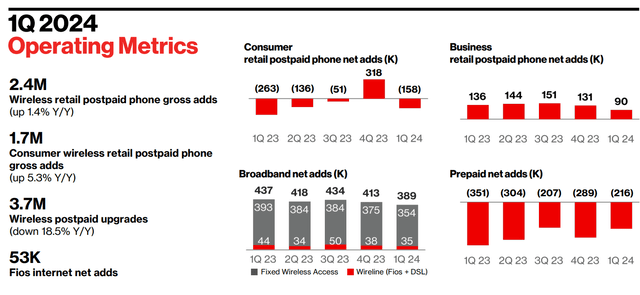

Verizon’s Q1 total Wireless Service revenue of $19.5 billion marked a 3.3% YoY increase. Despite experiencing retail postpaid phone net losses of 68,000, they gained 253,000 retail postpaid net additions with a retail postpaid phone churn rate of 0.89% and a retail postpaid churn rate of 1.15%. In the Broadband Segment, Verizon achieved total net additions of 389,000, including 53,000 Fios Internet net additions, and reported a record 151,000 fixed wireless net additions in the Verizon Business sector. The total number of broadband subscribers reached 11.1 million, with 3.4 million on fixed wireless. So basically VZ added ~3 million broadband subscribers in the last 2 years, which looks solid to me. Fixed wireless revenue for Q1 was $452 million, an increase of $197 million from the previous year.

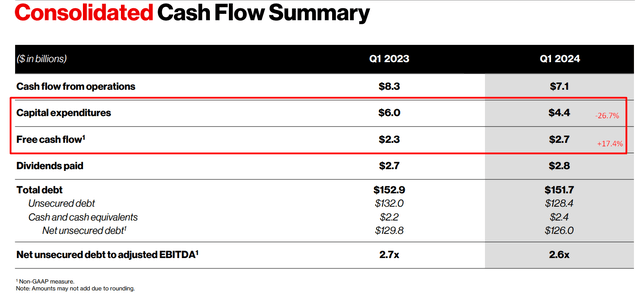

Overall, based on the company’s consolidated results, the situation doesn’t look too bad, actually. Revenue was almost flat (as I said above, VZ’s operating revenues for Q1 2024 increased by ~20 basis points). On the other hand, the structure of operating costs hasn’t changed significantly. The EBIT margin decreased from 23% to 20.8%, and net income decreased in absolute terms from $5 billion to $4.7 billion (a decline of 5.9% YoY). However, a significant factor here was the increase in interest payments by 35.45% YoY. Despite this, the company managed to pay off long-term debts and finance lease obligations amounting to $4.5 billion during Q1 2024, which is ~3.4x more than during the same period last year.

Looking at the company’s balance sheet, it continued to improve. Long-term debt decreased by 1.16% YoY, while the total amount of current liabilities remained almost unchanged. Although the cash on the balance sheet is relatively modest compared to the company’s market cap, it increased by 14.5% to ~$2.4 billion, thanks to the strong generation of free cash flow (+17.4% YoY) and lower CAPEX (-26.7% YoY).

VZ’s IR materials, notes added

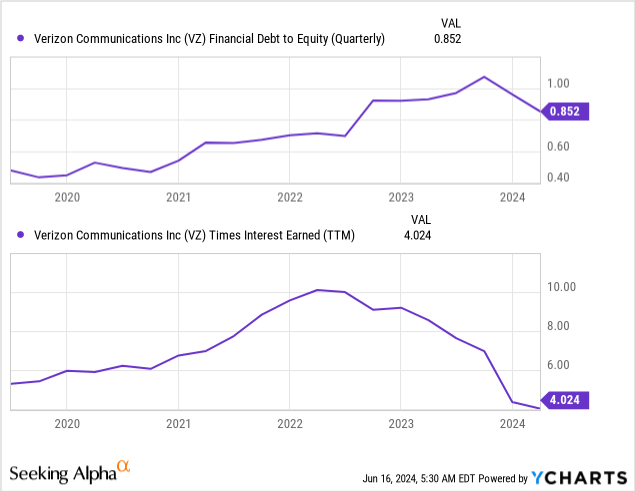

When I last wrote about the company, its debt-to-equity ratio was around 0.96. At that time, I predicted that this metric would fall further as the firm had plans to continue its deleveraging process. Today, we see that my assumption was correct, as the leverage ratio has fallen to 0.85, a decrease of more than 11%. Although there are some challenges in the dynamics of the times interest earned ratio (TIE, the ratio of operating profit to interest payments), this metric is still above 4, which in my opinion is acceptable.

From what I see, it seems to me that Verizon is doing exceptionally well considering the current developments in the segments. The company is sticking closely to its business model by focusing primarily on service revenue, while taking steps to ensure that it remains well-positioned in all of its end markets overall. Comments in the earnings call indicate that VZ has streamlined its go-to-market approach, improved its customer segmentation strategy, and taken significant pricing actions to increase its wireless service revenues. The company has also invested heavily in its fixed wireless access and private networks and has achieved significant growth in these areas. However, Verizon hasn’t overspent, considering its lower CAPEX on a YoY basis. In addition, Verizon has pushed ahead with its C-band expansion and achieved coverage targets ahead of schedule, as well as deployed AI technologies to optimize internal processes and improve the product experience.

Looking ahead, Verizon plans to maintain this momentum by continuing to scale its fixed wireless access and private network services. They’re also looking for more ways to further integrate AI into their operations to drive cost efficiencies and improve customer experiences. With stagnant revenues, as at Verizon, it’s critical to keep margins at a relatively high level – preferably above average. If recent AI initiatives (and overall business development strategy) continue to be implemented effectively, I believe that management’s plans have a good chance of success and could lead to margin expansion.

As the management explained, VZ is focusing on “maintaining its high dividend yield and reducing its debt through sound cash flow management.” With a roughly 40% share of the U.S. postpaid phone market – about a third more than AT&T (T) or T-Mobile (TMUS), according to Morningstar – Verizon is looking to capitalize on its robust network infrastructure to support new AI-driven services and maintain its leadership position in consumer and enterprise connectivity solutions. With these efforts, I believe Verizon is well-positioned to achieve sustainable growth and deliver value to its shareholders.

Regarding guidance, we know that Verizon expects total wireless service revenue growth of 2.0% to 3.5%, adjusted EBITDA growth of 1.0% to 3.0%, and adjusted EPS between $4.50 and $4.70. Capital expenditures are projected to be $17.0 billion to $17.5 billion, with an adjusted effective income tax rate of 22.5% to 24.0%.

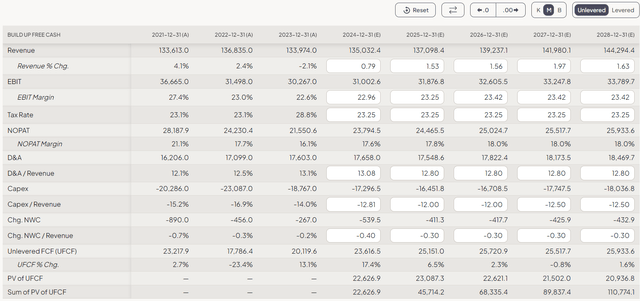

With all that in mind, let’s update my DCF model for Verizon, incorporating the latest data we now have. If we take a look at Wall Street analysts’ long-term estimates, we’ll see a CAGR of ~1.5% for EPS and ~0.72% for revenue (over the next 5 years). This suggests the market assumes the company’s margins should gradually improve, leading to higher earnings growth compared to revenue growth. Alternatively, the market might expect an acceleration in share buybacks, but I doubt it since we haven’t seen it in recent years. So, based on both management and Wall Street forecasts, the average annual revenue growth rate should be around 1.5%. As we know, the management is more optimistic, predicting revenue growth of 2% to 3.5% this year, while Wall Street is more conservative, expecting a growth rate of 0.79% for FY2024 (but an acceleration for 2025-2028). I think this discrepancy could allow the company to exceed Wall Street’s lower expectations, but for our model, I’ll take the more pessimistic forecast, assuming revenue growth of 0.79% in FY2024, then averaging out to 1.97% in FY2027 and 1.63% in FY2028.

As already mentioned, I assume that VZ’s EBIT margin will stabilize and reach 23.42% in the long term. For the effective tax rate, I use the middle value of the management’s guidance, which is 23.25%. I also expect the ratio of CAPEX-to-sales to be between 12% and 12.5% starting in FY2025. Here’s the operational model I have at this stage:

Let’s proceed with the calculation of the discount rate. In my previous model, I assumed that the cost of debt would be around 8%. VZ’s long-term bonds, which are quite liquid, currently offer a yield to maturity of ~5.5% (based on the bid). However, to be more conservative, I’ll add an extra 200 b.p. and assume that the cost of debt is now 7.5%. Taking into account a risk-free interest rate of 4.46% and a risk premium of 5% as well as an effective tax rate of 23.25%, this results in a WACC of 6.1%. This relatively low WACC is primarily due to the high proportion of debt in the company’s capital structure.

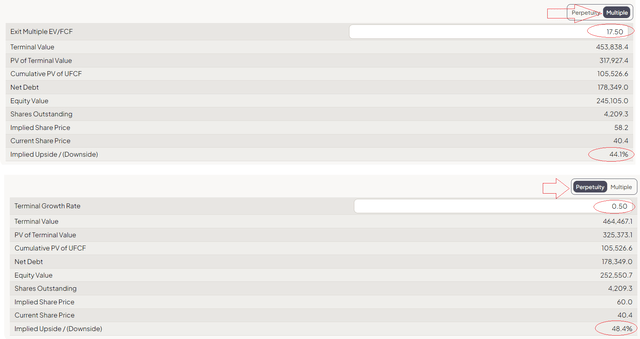

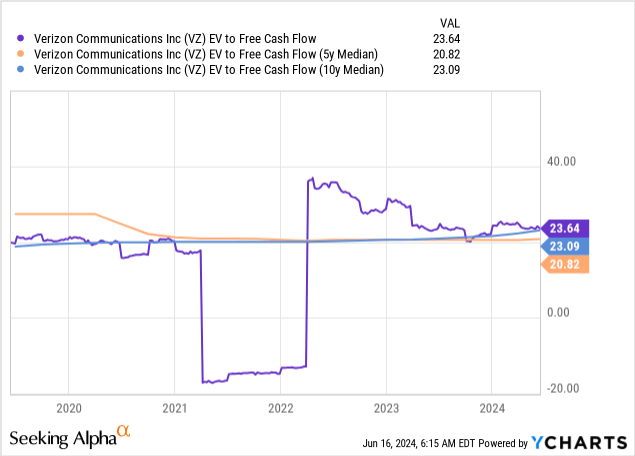

Now let’s tackle the most challenging part: calculating the terminal value. There are two approaches I can consider. First, I can use the exit multiple method, which uses the company’s EV/FCF ratio. Alternatively, I can extrapolate the growth of the free cash flow on an annual basis in perpetuity. I have chosen to use both methods to calculate an average and draw a more balanced conclusion about the potential upside or downside.

Looking at the exit multiple approach, the EV/FCF ratio has fluctuated significantly over the last 10-15 years. However, if we look at the median values, the current ratio of 23.64 is actually very close to both the ten-year and five-year medians.

I estimate that this multiple will be lower by the end of FY2028, in the range of 15x to 20x, giving me an average of 17.5x. This results in an undervaluation of 44.1%.

To validate this, I also use the Gordon Growth Model, which assumes a perpetual free cash flow growth rate of 50 basis points or 0.5% per annum. This model shows an even greater undervaluation, with an upside potential of 48.4%.

Based on my analysis and valuation results discussed above, I conclude that Verizon’s stock is currently undervalued by approximately 46.25%.

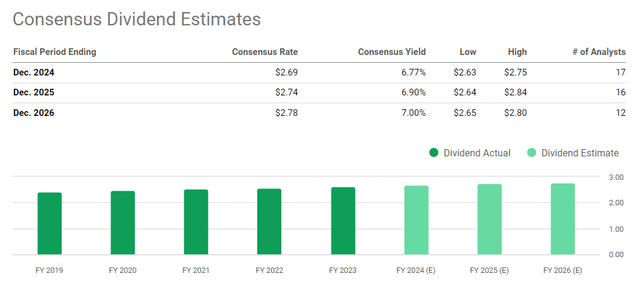

It should be noted that this growth potential does not take into account the dividends that investors receive while holding their long VZ position. I believe that a dividend yield of over 6.5%, 6.77% this year to be precise, rising to 7% by FY2026, is a very attractive addition to the potential stock price appreciation suggested by my DCF model. If capital expenditure falls a bit as expected and EBIT margin stabilizes, these dividend yields are likely to become even more robust.

Seeking Alpha, VZ’s estimated dividends

Where Can I Be Wrong?

Of course, the stock couldn’t be as undervalued as I’m suggesting today if it had no risks. First, the telecommunications industry is highly susceptible to technological disruptions, and Verizon, traditionally a technology leader, has recently lagged in the 5G service rollout, as Argus Research analysts wrote in their recent note (proprietary source). Verizon’s primary competitor, AT&T, has long been a formidable rival, creating a duopoly in the wireless telecom market. However, the merger of T-Mobile and Sprint has significantly altered the competitive dynamics, enabling T-Mobile to challenge Verizon’s leadership with enhanced scale and spectrum assets. This heightened competition, coupled with changing customer behaviors and longer handset retention periods due to rising prices, has impacted Verizon’s equipment sales and overall revenue. Competition itself does not mean that an investment in one of the competing companies is unwise per se. It simply means that the risk of such an investment is higher than that of investing in a company with a greater moat. If Verizon is unable to compete effectively with its main peers, the projected revenue growth figures I put in my current DCF model may prove to be completely unsustainable.

It is also important to consider the risks highlighted by the technical analysis. Despite its recent performance, the stock has twice (or even 3 times) failed to break through the resistance zone established in January 2023. Currently, the price is consolidating just below this zone, suggesting that future movements could determine whether the downtrend that began in 2020 will continue or whether we will finally see a reversal. Historical seasonality data (10 years) shows that June is typically not a profitable month: Positive performance was recorded only 36% of the time. The situation usually improves significantly towards the end of the year. Therefore, investors buying Verizon stock now may have to wait out the current consolidation period until the end of Q3 before seeing a potentially significant upside move. So be prepared for this potential waiting period.

TrendSpider Software, VZ weekly, notes added

The Verdict

I believe that Verizon, with a significant share of the U.S. postpaid phone market and a robust network infrastructure, is well-positioned to achieve its growth objectives and create value for shareholders. Verizon continues to rapidly build out the C-band spectrum, which is essential for both its 5G network service and its new fixed wireless access business. Historically, a leader in next-generation wireless technology, including 4G, and may now be playing catch-up with T-Mobile in 5G, but I believe management is on the right track by focusing on higher-margin businesses and conducting a comprehensive strategic overhaul. This approach should have a positive long-term impact on the company’s bottom line, in my view.

Based on my updated DCF model, which incorporates the latest financial data and forecasts, I conclude that Verizon is currently undervalued by about 46.25%. This estimate doesn’t even take into account the attractive dividend yield, which adds significant value to holding the stock. So given all that, I believe Verizon offers a compelling medium-term investment opportunity.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in VZ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!