Summary:

- VZ stock has underperformed the major market indices for the past few months. I believe this picture should change shortly.

- Verizon’s revenue remained flat in Q1, but FCF increased by 16% YoY, leading to a positive outlook for the company.

- Verizon’s recent data on key operating metrics seems more than solid to me if we take the stagnant state of the telecom industry as a whole as a benchmark.

- With a current WACC of 6.5% and a projected dividend growth rate of 1% annually, the stock has over 22% upside potential, excluding the dividend yield.

- Therefore, I’m reiterating my previous “Buy” rating today.

hapabapa

My Thesis Update

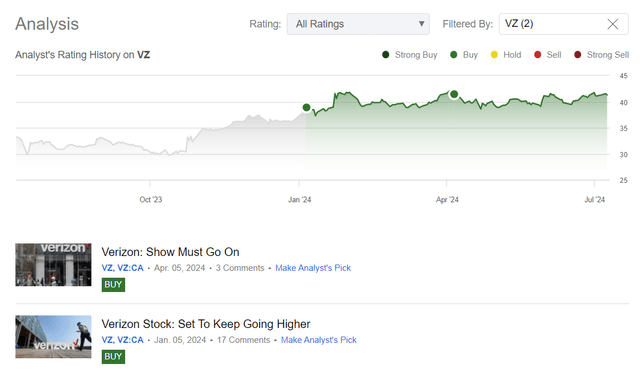

I started covering Verizon Communications Inc. (NYSE:VZ) stock in January 2024 and updated it in April stating that VZ stock had a 20% nominal upside potential, not including the very high 6% dividend yield. In general, the stock has gone nowhere since I started covering it, and it has underperformed the major broader market indices such as the S&P 500 (SPX) (SP500) – just like most other value stocks out there in general.

Seeking Alpha, Oakoff’s coverage of VZ

Despite the relatively weak performance, I’m glad that VZ hasn’t been sold off recently. I think that VZ will still have the opportunity to realize its growth potential in the future, which I confirm today based on my updated analysis.

My Reasoning

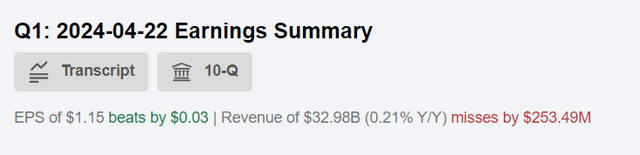

Verizon’s Q1 2024 consolidated revenue was basically flat at almost $33 billion due to a balance between the growth in wireless service revenue, which increased by 1.3% YoY, and a decline in wireless equipment revenue (-7% YoY). The slight increase in wireless service revenue was driven by recent price hikes, higher adoption of premium plans, and growth from the company’s fixed wireless access (FWA) initiatives, according to the press release notes. Despite lower COGS for both segments, higher SG&A and D&A expenses led to an increase in consolidated OPEX, so VZ’s unadjusted Q1 EBIT figure fell slightly by 0.84% YoY. However, Verizon’s consolidated adjusted EBITDA increased by 1.4% from the previous year, reaching $12.07 billion. This led to a slight improvement in the EBITDA margin, which widened by 40 basis points to 36.6%. Unfortunately, VZ’s adjusted diluted Q1 EPS fell by 4.2% YoY to $1.15, primarily due to higher interest expenses; anyway, it was enough to beat relatively modest Wall Street EPS expectations for the quarter (though the same can’t be said about revenue expectations):

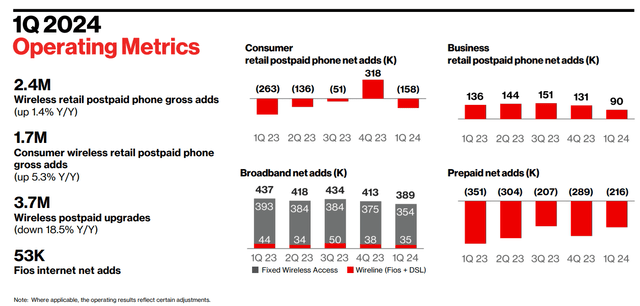

Verizon added >3 million broadband subscribers in just the last 2 years, which looks good to me; by the end of Q1 2024, VZ had served 11.1 broadband subscribers. As Verizon only has ~1.1 million subscribers from the ACP program, the management has estimated that this program could be eliminated and its effect on EBITDA would be minimal; such a reaction qualitatively distinguishes VZ from other small-cap players like SurgePays (SURG). I expect the government to relaunch the ACP program in some form or another, which might even grow Verizon’s EBITDA going forward. In the meantime, Verizon’s recent data on key operating metrics seems more than solid to me if we take the stagnant state of the telecom industry as a whole as a benchmark.

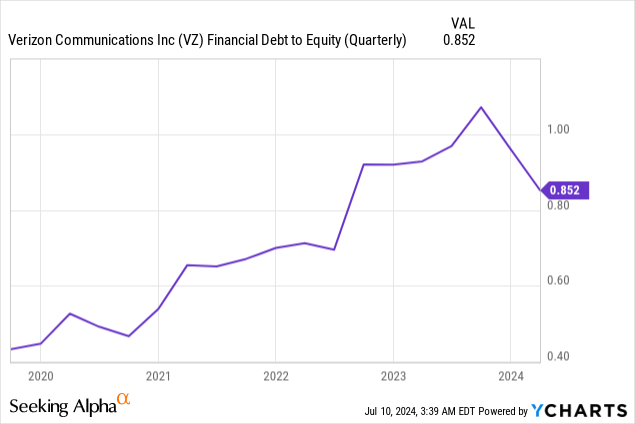

One can’t ignore the discussion of free cash flow. Although higher interest expenses put some pressure on cash flow from operations, this metric amounted to $7.1 billion in Q1, which led to an FCF in Q1 2024 (+16% YoY, amounting to $2.7 billion). And it’s not just a temporary FCF tailwind, as for the full year, Verizon expects cash flow to grow steadily, similar to what we saw last year. On the leverage side, we see that Verizon’s net unsecured debt improved, standing at $126 billion – that’s a $3.7 billion reduction from last year. The company also issued a $1 billion green bond to fund renewable energy purchases. So the net debt to EBITDA is now standing at 2.6x compared to 2.7x last year, which seems like a minor change, but is still positive, especially considering that the debt-to-equity has dipped below 1, according to YCharts data:

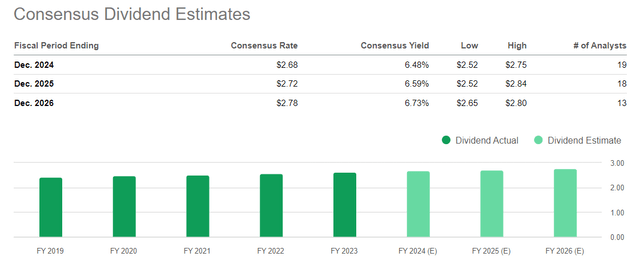

In this respect, I believe that Seeking Alpha Quant’s assessment of VZ’s dividend safety should actually be higher than the current “C+” grade. With FCF stabilizing, Verizon’s dividend should be much more sustainable. And even taking into account current dividend estimates, which may prove to be too pessimistic in terms of actual potential payouts, VZ will likely continue to increase its dividends for at least the next few years. At the same time, the implied dividend yield is likely to remain consistently above 6.5% from 2025 onwards, which is quite a lot considering the potentially imminent turnaround in the Fed’s monetary policy.

I think Verizon’s business is likely to remain stable and potentially see revenue growth in the long term due to its quick roll-out of the C-band spectrum, which is vital for its 5G network and new fixed wireless access services. The company benefits from strong customer loyalty, higher adoption of premium plans, and reduced churn in C-band markets. Nonetheless, Verizon has a history of leading in next-gen wireless technology, and its strategic moves like exiting the volatile Media business put it in good stead for future stability and growth even though it faces competition against T-Mobile (TMUS) in the 5G market, in my view. Tracfone’s acquisition adds another possible opportunity for expanding revenues, although it poses challenges as regards the pre-paid market.

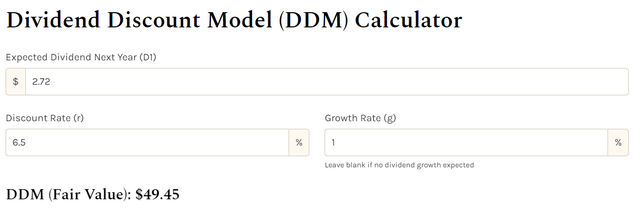

In my last article, I provided detailed calculations on the discount rate I use to value the company through the DDM model. My calculations initially led me to a conclusion at a WACC of 6.36%. However, I’m now raising this rate to 6.50% because the share of debt in the company’s capital structure has slightly declined. To account for the changing environment, I used StableBread’s dividend discount model template again, inserting the FY2025 expected dividend payout amount, the targeted dividend growth rate of 1% (my basic assumption), and the WACC I mentioned above. This results in a price target of $49.45, which is almost 22.3% higher than the stock price at the close of trading on July 10, 2024.

StableBread.com, DDM model template, Oakoff’s notes

So I again come to the conclusion, that given Verizon’s undervaluation, the stability of its dividend, the expected improvement in business growth, and the increase in free cash flow, the VZ stock recovery momentum should continue.

Risks To My Thesis

In fact, the company’s key risk factors have not changed significantly in the last three months.

Despite its 4G dominance and advances in 5G, Verizon still faces disruptive technological changes that pose a risk to its business. I also should note that the presence of severe competition could hinder management’s plans to reaccelerate business growth in an already oversaturated telecom market, as I warned my readers in my previous VZ article. Should this be the case, my entire thesis would be wrong.

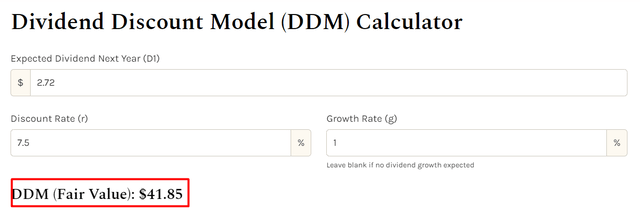

It’s also worth remembering the dangers associated with legacy infrastructure, as the Wall Street Journal’s report on obsolete copper cables shows. Although they have not been used since the mid-20th century, there are still questions about their presence in the system that can lead to liability claims, especially those originating from previous acquisitions. In addition, there is a risk that I have made some mistakes while calculating the fair value of VZ share prices. For example, if we use a discount rate of 7-8%, all the conclusions from my DDM will change meaningfully:

StableBread.com, DDM model template, Oakoff’s notes

Concluding Thoughts

While Verizon is not a risk-free dividend investment due to various financial and operational challenges, I think it has a strong chance of success given the positive growth prospects in some of its end-markets and ongoing cost optimization efforts. I definitely like what I’m seeing from the company’s latest financials – I hope Verizon continues to beat EPS estimates and deleveraging, making the dividend even safer.

Assuming free cash flow increases by the end of 2024 compared to 2023, and corporate growth remains stable at 1-3% per year from 2025 onwards, the currently estimated dividend yield of ~6.5% (in FY2025) should remain secure, in my opinion. With a current WACC of 6.5% and a projected dividend growth rate of 1% annually, the stock has over 22% upside potential, excluding the dividend yield. Therefore, I’m reiterating my previous “Buy” rating today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in VZ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.