Summary:

- Verizon’s strong brand reputation, market share, and 5G leadership create high barriers to entry and support premium pricing and customer loyalty.

- The company’s focus on expanding fiber networks and wireless spectrum enhances network capacity, distinguishing it from competitors like AT&T.

- Verizon’s current stock price is undervalued, offering an attractive discount to its intrinsic value based on normalized earnings estimates.

- Key catalysts include increased free cash flow, higher 5G adoption, market share gains in broadband, and higher ARPU through service bundling.

hapabapa

The following segment was excerpted from this fund letter.

Headquartered in New York, Verizon (NYSE:VZ) is one of the largest telecommunications companies in the U.S. The company was formed in 2000 with the combination of Bell Atlantic Corp. and GTE Corp., businesses with roots dating back to the late 19th century and the beginning of the telephone business.

Over the years, Verizon has expanded through strategic acquisitions and innovations, particularly in wireless technology, which has become the cornerstone of its business. Unlike its competitor AT&T’s (T) strategy of vertical integration through the acquisition of media and entertainment companies, which AT&T is now unwinding, Verizon has instead focused on expanding its fiber networks in major cities and acquiring wireless spectrum to increase network capacity and performance. Today, Verizon’s wireless services account for approximately 70% of its revenue (serving over 90 million postpaid and 20 million prepaid phone customers), making it the country’s largest wireless carrier. Verizon also offers fixed-line operations with local networks in the Northeastern U.S., serving over 30 million homes and businesses and nine million broadband customers. In early September, Verizon announced the $20 billion all-cash acquisition of Frontier, the largest pure-play fiber internet provider in the U.S. Upon closing (expected within 18 months), Verizon’s fiber network will expand to 31 states.

High-Quality Business

Some of the quality characteristics we have identified for Verizon include:

- Strong brand reputation for network reliability and speed, along with the broadest wireless coverage in the industry, supports premium pricing and customer loyalty in the form of low churn;

- Leading market share in wireless and economies of scale allow Verizon to generate high margins and returns on invested capital; and

- Verizon’s position at the forefront of 5G technology, combined with its spectrum licenses and the capital-intensive nature of building and maintaining network infrastructure, creates high barriers to entry.

Attractive Valutaion

Based on our estimates of normalized earnings, we believe Verizon’s current stock price is offered at a discount to the company’s intrinsic value. More specifically, we believe the company is trading at a CFRoEV greater than 10%, which translates to an attractive discount to intrinsic value.

Compelling Catalysts

Catalysts we have identified for Verizon, which we believe will cause its stock price to appreciate over our three- to five-year investment horizon, include:

- Higher FREE cash flow generation as prior large investments (e.g., 5G rollout and spectrum purchases) season, resulting in lower capital intensity;

- Enhanced revenue as more consumers upgrade to 5G-enabled devices, which should lead to increased data usage, higher-value service plans and an expanded customer base;

- Market share gains in broadband internet service as customers switch from traditional cable companies; and

- Increased connections per account and higher ARPU by way of Verizon’s ability to bundle services (like wireless, home internet and media content), which encourages adding more devices and drives higher overall spending.

|

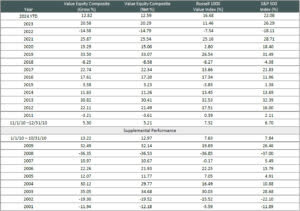

Disclosures The opinions expressed herein are those of Aristotle Capital Management, LLC (Aristotle Capital) and are subject to change without notice. Past performance is not a guarantee or indicator of future results. This material is not financial advice or an offer to purchase or sell any product. You should not assume that any of the securities transactions, sectors or holdings discussed in this report were or will be profitable, or that recommendations Aristotle Capital makes in the future will be profitable or equal the performance of the securities listed in this report. The portfolio characteristics shown relate to the Aristotle Value Equity strategy. Not every client’s account will have these characteristics. Aristotle Capital reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased. The securities discussed may not represent an account’s entire portfolio and, in the aggregate, may represent only a small percentage of an account’s portfolio holdings. The performance attribution presented is of a representative account from Aristotle Capital’s Value Equity Composite. The representative account is a discretionary client account which was chosen to most closely reflect the investment style of the strategy. The criteria used for representative account selection is based on the account’s period of time under management and its similarity of holdings in relation to the strategy. Recommendations made in the last 12 months are available upon request. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. All investments carry a certain degree of risk, including the possible loss of principal. Investments are also subject to political, market, currency and regulatory risks or economic developments. International investments involve special risks that may in particular cause a loss in principal, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging markets. Securities of small‐ and medium‐sized companies tend to have a shorter history of operations, be more volatile and less liquid. Value stocks can perform differently from the market as a whole and other types of stocks. The material is provided for informational and/or educational purposes only and is not intended to be and should not be construed as investment, legal or tax advice and/or a legal opinion. Investors should consult their financial and tax adviser before making investments. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Information and data presented has been developed internally and/or obtained from sources believed to be reliable. Aristotle Capital does not guarantee the accuracy, adequacy or completeness of such information. Aristotle Capital Management, LLC is an independent registered investment adviser under the Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Aristotle Capital, including our investment strategies, fees and objectives, can be found in our ADV Part 2, which is available upon request. ACM-2410-38 Performance Disclosures  Sources: CAPS CompositeHubTM, Russell Investments, Standard & Poor’s  Composite returns for all periods ended September 30, 2024 are preliminary pending final account reconciliation. Past performance is not indicative of future results. The information provided should not be considered financial advice or a recommendation to purchase or sell any particular security or product. Performance results for periods greater than one year have been annualized. The Aristotle Value Equity strategy has an inception date of November 1, 2010; however, the strategy initially began at Mr. Gleicher’s predecessor firm in October 1997. A supplemental performance track record from January 1, 2001 through October 31, 2010 is provided above. The returns are based on two separate accounts and performance results are based on custodian data. During this time, Mr. Gleicher had primary responsibility for managing the two accounts, one account starting in November 2000 and the other December 2000. Returns are presented gross and net of investment advisory fees and include the reinvestment of all income. Gross returns will be reduced by fees and other expenses that may be incurred in the management of the account. Net returns are presented net of actual investment advisory fees and after the deduction of all trading expenses. Index Disclosures The Russell 1000 Value® Index measures the performance of the large cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. The S&P 500® Index is the Standard & Poor’s Composite Index of 500 stocks and is a widely recognized, unmanaged index of common stock prices. The S&P 500 Equal Weight Index is designed to be the size-neutral version of the S&P 500. It includes the same constituents as the cap-weighted S&P 500, but each company in the S&P 500 Equal Weight Index is allocated the same weight at each quarterly rebalance. The Russell 1000® Growth Index measures the performance of the large cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Dow Jones Industrial Average® is a price-weighted measure of 30 U.S. blue-chip companies. The Index covers all industries except transportation and utilities. The NASDAQ Composite Index measures all NASDAQ domestic and international based common type stocks listed on The NASDAQ Stock Market. The NASDAQ Composite includes over 3,000 companies, more than most other stock market indexes. The Bloomberg U.S. Aggregate Bond Index is an unmanaged index of domestic investment grade bonds, including corporate, government and mortgage-backed securities. The WTI Crude Oil Index is a major trading classification of sweet light crude oil that serves as a major benchmark price for oil consumed in the United States. The 3-Month U.S. Treasury Bill is a short-term debt obligation backed by the U.S. Treasury Department with a maturity of three months. The Consumer Price Index is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The volatility (beta) of the Composite may be greater or less than its respective benchmarks. It is not possible to invest directly in these indexes. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.