Summary:

- Verizon stock’s attractive valuation and solid profitability have likely driven its recent outperformance.

- The Frontier acquisition is expected to enhance Verizon’s wireless and broadband market position.

- Income investors should find VZ’s forward dividend yield of more than 6% attractive, as the Fed could cut more through 2025.

- I also explain why VZ’s price action is underpinned by its solid fundamentals and attractive valuation.

- With VZ poised for a potentially decisive upside breakout, investors should capitalize and add more shares. Here’s why.

hapabapa

Verizon: Investors Expecting Calm Heading Into Q3 Earnings

Verizon Communications (NYSE:VZ) (NEOE:VZ:CA) investors have outperformed the S&P 500 (SPX) (SPY) since its long-term lows in July 2023. Buyers have managed to hold on to their gains, corroborating the significant improvement in market sentiments. The Fed’s more dovish posture through 2025 is expected to provide valuation support to Verizon income investors, as VZ’s forward dividend yield of 6.2% remains well above its communications sector (XLC) median. It is also markedly over its 10Y average, corroborating its relative undervaluation (“B” valuation grade).

In my previous July 2024 Verizon article, I reiterated my bullish thesis on the stock. Given its solidly profitable business and relatively attractive dividend yield, I urged investors to ignore the initial post-earnings pessimism. Coupled with constructive price action, I’m not surprised by VZ’s market outperformance since then, corroborating my optimism.

Verizon’s Q3 earnings release will be delivered on October 22. The stock has remained close to its September 2024 highs. Hence, investors are likely not expecting unanticipated “nasty” surprises, given its recent update as Verizon announced its acquisition of Frontier Communications (FYBR). In a recent September conference, CEO Hans Vestberg reiterated the strategic rationale of offering $20B (transaction value) to acquire Frontier. The acquisition is also anticipated to be revenue and adjusted EBITDA accretive when closed (in about 18 months).

Verizon Strengthens Its Position By Acquiring Frontier

As a reminder, Verizon’s significant consumer wireless footprint can potentially benefit from Frontier’s portfolio in the wireless and broadband market. The company anticipates continued convergence in these technologies. However, it has also introduced intense competition with broadband providers, justifying Verizon’s need to improve its offerings and bundling opportunities.

Notably, VZ has already secured a bridge loan to finance the deal, improving the clarity of deal execution. With an anticipated $500M or more in annualized run-rate cost synergies to be extracted from the deal, Verizon possesses robust profitability to assure investors about its financial profile.

In maintaining its full-year 2024 guidance, investors are likely expecting “business as usual” in the upcoming Q3 call, with a hint of potential upside surprise as Apple (AAPL) launched its iPhone 16 series in Q4. However, investors must remain cautious about the iPhone “supercycle” thesis, as Verizon observed an extended upgrade cycle. Management has also underscored the need to stay disciplined and prudent in their promotional strategies. Therefore, it could impact near-term growth prospects as the focus turns to improving profitability.

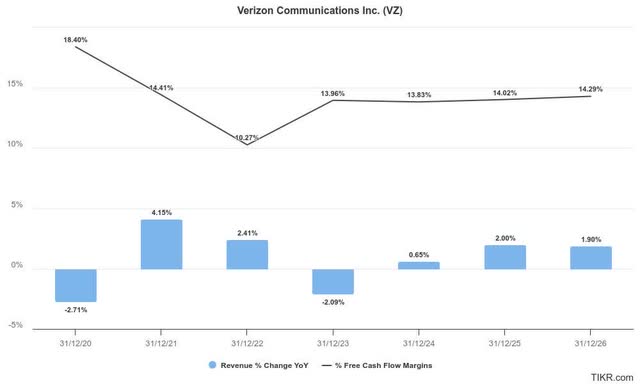

Verizon: Top Line Growth Prospects Appear Muted

Therefore, investors should not expect a significant growth inflection in Verizon’s top line growth prospects over the next two years. The maturity of the smartphone upgrade cycle suggests an iPhone supercycle should be considered more of a bull case proposition and less of a base case thesis.

Despite that, VZ’s “A+” profitability grade should provide investors with assurance about its ability to digest the recent Frontier acquisition. While integration challenges could persist, Verizon’s free cash flow profitability is expected to remain stable.

Hence, income investors aiming to reallocate from cash as the Fed reduces its interest rates should find its valuation relatively attractive. Management’s decision not to use stock in the Frontier acquisition underscores its conviction about VZ’s relative undervaluation. In addition, recent reports indicating that Verizon has likely gotten a decent deal on the Frontier acquisition could assure the market that Verizon didn’t overpay for growth.

Is VZ Stock A Buy, Sell, Or Hold?

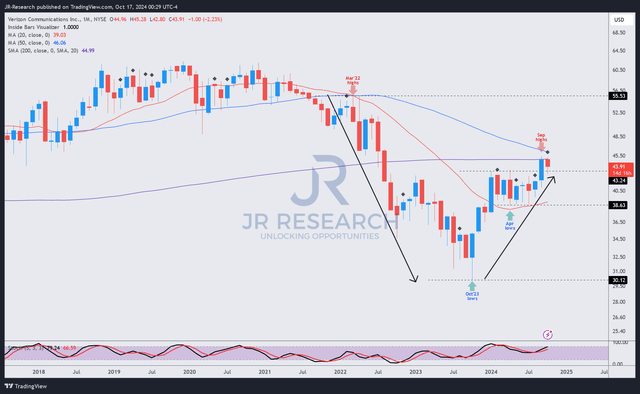

VZ price chart (long-term, monthly) (TradingView)

VZ’s price action suggests it has continued its recovery from its 2023 lows after suffering a massive collapse from its March 2022 highs. VZ’s robust buying momentum (“B” valuation grade) corroborates my observation, as the stock attempted to break out of the $45 resistance zone. The support zone above $40 seems robust, as the stock consolidated for over three months before its recent upward surge.

VZ’s relatively attractive valuation underpins my conviction about its recovery, suggesting income investors have reallocated to solidly profitable value stocks like Verizon. As investors navigate a potentially more dovish Fed through 2025, it should provide robust valuation support for a further re-rating. In addition, a more robust Apple Intelligence-driven “supercycle” could provide possible upside surprises not baked into Verizon’s estimates over the next few years.

Notwithstanding my optimism, investors must remain cautious about potentially more aggressive competitive forays from broadband competitors. Also, Verizon’s leverage ratio could be impacted in the near term as it navigates its Frontier acquisition. While a more dovish Fed is expected to lower its financing risks, the extent of the accretion to Verizon’s revenue and adjusted EBITDA remains uncertain for now.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!