Summary:

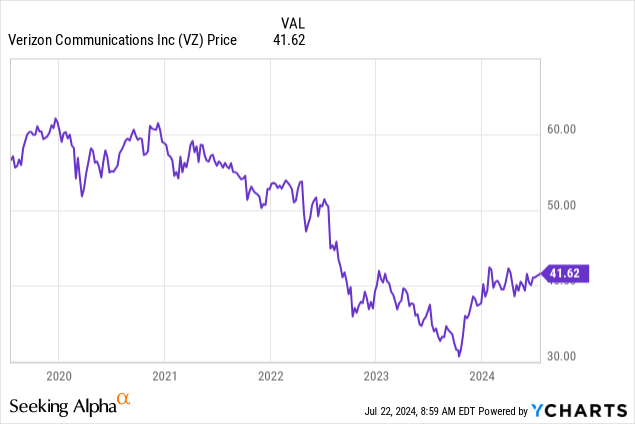

- Verizon is down by more than 6% after reporting a somewhat mixed quarter.

- The stock is nearly flat year-to-date, which goes against the meaningful progress being made in certain areas.

- The dividend appears safe, and we are likely to witness a notable improvement in profitability and free cash flow through the rest of 2024.

hapabapa

After reporting a somewhat mixed quarter, Verizon Communications (NYSE:VZ) appears less attractive for investors, with the stock falling by more than 6% on the day of the report.

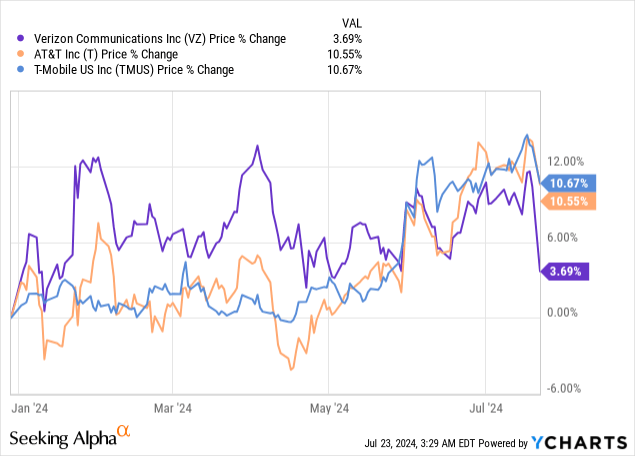

Following the earnings release, VZ stock is now almost flat year-to-date while its major peers – AT&T (T) or T-Mobile (TMUS), are up by more than 10%.

While Verizon’s the recent quarter was not perceived well by investors, and it seems that the market is not complacent with the company’s business performance in recent months, I’m gradually becoming more optimistic after downgrading the stock a few months ago in January.

It seems that the revenue growth, or lack thereof, is the main issue that investors have after the company failed to meet quarterly consensus targets on the top line.

Although these might be legit concerns in the short run, long-term investors should be more concerned with the progress being made in profitability and securing the attractive dividend. That is the main reason why, VZ is now looking increasingly attractive, in spite of faltering investor sentiment.

The Operational Perspective

While short-term speculators and sell-side analysts remain focused on quarterly revenue, connections, net additions figures and churn rates, long-term investors should put more emphasis on Verizon’s profitability and return on capital.

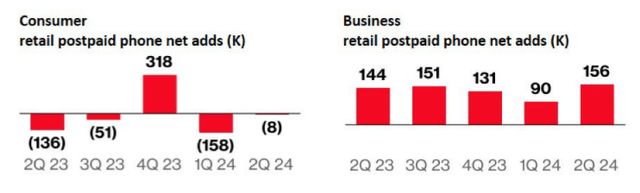

On the surface, it appears that Verizon’s business is struggling in the consumer postpaid segment, which continued to bleed customers during the second quarter of 2024.

Verizon Investor Presentation

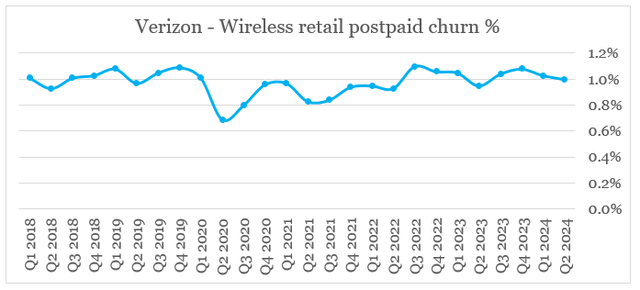

This, however, is a notable improvement from a year ago and is a result of improved gross adds by 12% from the second quarter of 2023 in consumer wireless retail postpaid. The second quarter is usually a seasonal low for churn rates, which makes it hard to draw any conclusions, but it’s worth mentioning that in spite of the recent price increases, churn in wireless retail postpaid remained under control.

prepared by the author, using data from quarterly reports

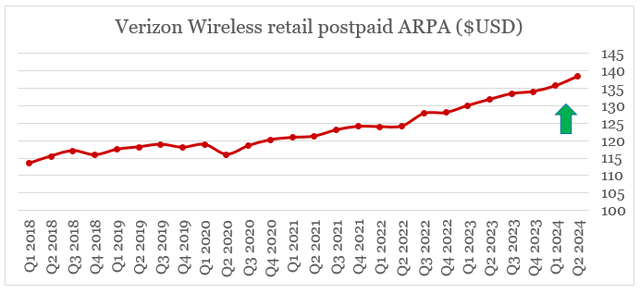

More importantly, however, is the fact that the quarterly increase in average revenue per account in the wireless postpaid segment has accelerated (see the graph below). This was one of my main concerns back in January of this year, when Verizon’s management reported a negligible increase in ARPA. In Q2 of 2024, however, wireless retail postpaid ARPA reached $138.4 – a 5% increase from a year ago.

prepared by the author, using data from quarterly reports

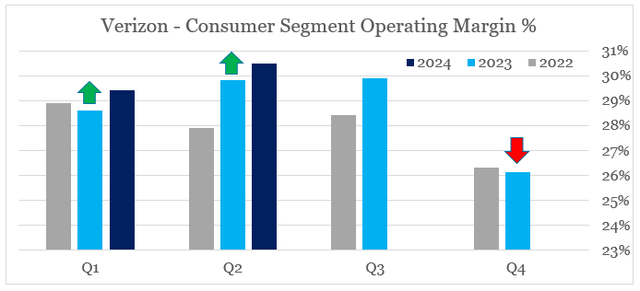

As a result, we now have a second consecutive quarter of operating margin improvement within the consumer segment from the same quarter a year ago. This is in stark contrast to the last quarter of 2023, when margins declined and is very encouraging for overall profitability through the rest of 2024.

prepared by the author, using data from quarterly reports

With all that in mind, should inflationary pressures continue to decline through the rest of the year, then I see a very high probability of Verizon delivering a significant improvement in margins for the whole fiscal year 2024 and beating its current outlook.

The Dividend Perspective

Arguably, the high dividend yield is one of the main reasons why investors flock to a stock like Verizon. Therefore, improving profitability plays a key role in securing this dividend and is also allowing for gradual increases over the years.

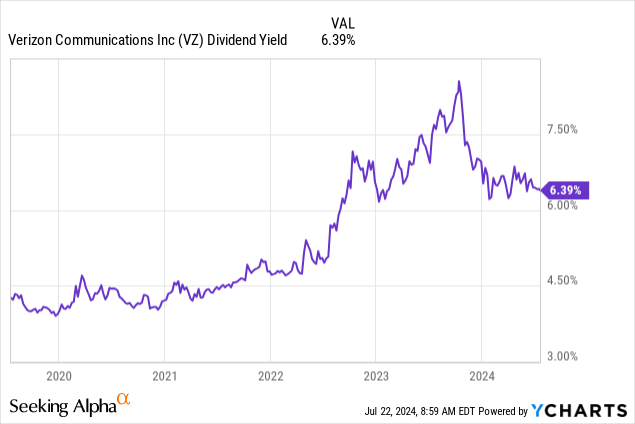

Although the current yield is way-below the 2023 high, it’s still high on a historical basis and above the current yield on U.S. Treasuries, which is a rare sight in today’s market.

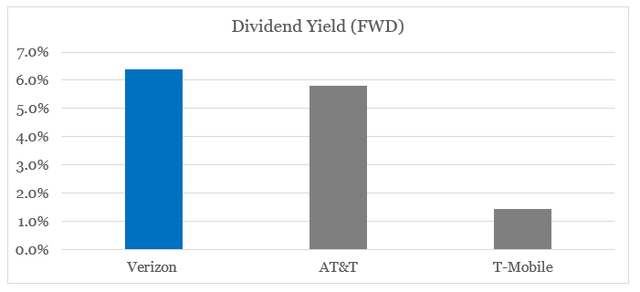

Moreover, Verizon’s forward dividend yield is also the highest among its major peers – AT&T and T-Mobile which makes the stock highly attractive for yield-seeking investors.

prepared by the author, using data from Seeking Alpha

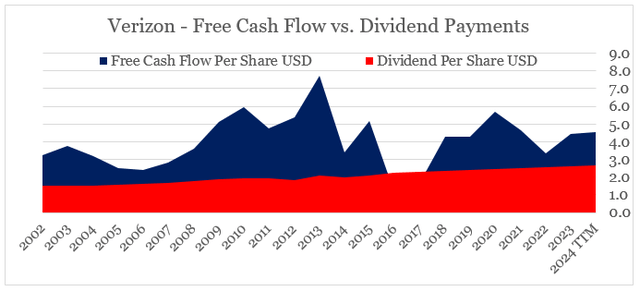

The safety of this dividend has been the main risk for investors for quite some time, as lower profitability and increases in capital expenditure, caused almost a perfect storm in recent years. This culminated in fiscal year 2022 when Verizon’s free cash flow per share fell close to the annual dividend payment per share. As we see from the graph below, however, the gap between the two has widened considerably since then and no longer appears to be an issue.

prepared by the author, using data from quarterly reports

* excluding acquisitions of wireless licenses

Spooked by the possibility of a dividend cut, many investors sold VZ in the second half of 2022, thus causing a sharp drop in share price. What we note, however, is that VZ share price has not fully recovered since then, even though the free cash flow to dividend gap has improved materially in the past 12 months.

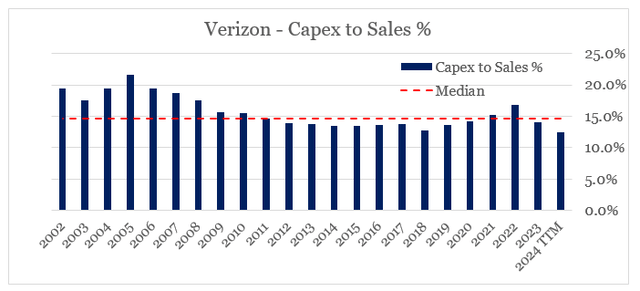

In 2022, we also had a cyclical peak in capital expenditures, which resulted in a capex to revenue ratio reaching almost 17%. As expected, the amount spent on capital expenditures has declined meaningfully since then – from $23bn in FY 2022 to $16.8bn for the past 12-month period.

prepared by the author, using data from quarterly reports

This has been a major tailwind for Verizon’s free cash flow, and although the capex to sales ratio is now way below the historical average, it will remain low through the rest of FY 2024 as the annual capex is expected to be within the range of $17bn to $17.5bn.

Our full-year guidance for capex spending remains unchanged at a range of $17 billion to $17.5 billion. The net result of cash flow from operations and capital spending is free cash flow of $8.5 billion for the first half of 2024. This represents an increase of nearly 7% or approximately $550 million from the prior year period, despite higher cash taxes and interest expense. We expect to generate strong cash flow in the back half of the year that will support paying down debt.

Source: Verizon Q2 2024 Earnings Transcript

As noted in the extract above, the higher free cash flow in 2024 will be used to pay down debt, which makes a dividend increase an unlikely event at this point. Having said that, however, if margins continue to improve and revenue growth stabilizes, then Verizon’s management will be in a very good spot to increase the dividend next year.

Conclusion

Verizon’s stock appears to be oversold on fears of short-term revenue growth pressures. At the same time, meaningful progress is being made on the profitability side. With capex requirements falling, we’re likely to see a meaningful improvement in free cash flow in 2024, which could soon be enough to justify a dividend increase.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking similarly well-positioned high quality businesses in defensive areas of the market?

You can gain access to my highest conviction ideas by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.