Summary:

- Cannibalization from the value segment risks hindering core postpaid wireless business growth.

- After two rounds of cost cuts propped up EBITDA, Verizon is out of options and facing 3%+ expense growth.

- I rate Verizon stock a hold at a price target of $38.

jetcityimage

I am initiating coverage on Verizon Communications (NYSE:VZ) following some interesting trends I noticed while researching an analysis on a competitor.

Verizon is down significantly from its historical high 50s, low 60s performance, although there has been a slight uptick over the last six months. The 6%+ dividend yield continues to be the value driver for the stock.

VZ Price Trend (Seeking Alpha)

Despite the strong dividend and the fact that this business isn’t going anywhere, my research suggests the decrease in share price is deserved, and the stock is fairly priced today. Verizon’s multiple forays into the value segment present a significant risk of cannibalization (not to mention distraction) to the core business, and the cracks are starting to show. In addition, much of the EBITDA growth over the past few years has been the result of cost cutting.

With the above in mind, as well as balanced upside potential and downside risk, I rate Verizon a hold at a price target of $38.

Cannibalization Risks Core Business Growth

At the end of the day, wireless service borders on being a commodity. The primary differentiators are the quality of the service (i.e. network and customer service) and all of the various add-ons and incentives used to entice consumers to sign up. Verizon has worked hard to build up “the best network” as its primary differentiator to support premium pricing.

So when you’ve built your entire business and pricing strategy on the quality of your network, you would not want to undercut it. But that is exactly what Verizon has done with its moves into the value segment. They operate not one, but three value players:

- TracFone Wireless

- Visible By Verizon

- Total By Verizon

And Verizon’s network is a prominent value proposition for all three carriers. Just check out this ad from Total By Verizon:

Total By Verizon Ad (Total By Verizon)

In a perfect world, the value carriers would grow by taking share from competitors like Mint, Cricket, and Metro PCS, and over time Verizon would convert value customers to postpaid customers. However, there is a significant risk of cannibalization for Verizon customers downgrading to the value segment since they can get the exact same high value product (the network) for a lower cost.

For reference, Total’s base offer for one line is for $50 unlimited talk, text, data, and mobile hotspot with zero taxes and fees. Verizon’s base offer is $75 for talk, text, and data with no hotspot and taxes and fees on top ($80-90 total depending on where you live).

While still early, I am starting to see the cracks emerge in Verizon’s business to suggest that the postpaid business is struggling to hold on to its customers.

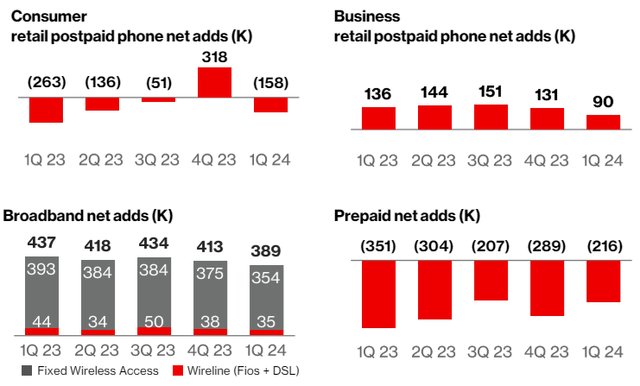

Verizon is rapidly losing subscribers on both its postpaid and prepaid plans, while T-Mobile (TMUS) and AT&T (T) grow.

Net Adds (VZ Investor Relations)

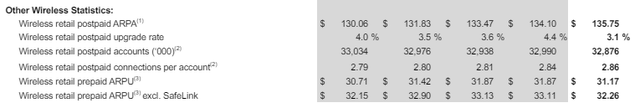

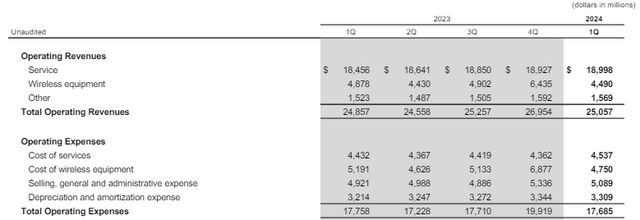

In the earnings call and press releases, Verizon attributes much of this to recent aggressive pricing increases. However, looking at postpaid ARPA and prepaid ARPU, I am not seeing it. Postpaid ARPA is up only 1% while telecom overall grew roughly 3% during the same time period. Prepaid ARPU excluding SafeLink is essentially flat year-over-year.

Wireless Metrics (VZ Investor Relations)

In addition, the cost of wireless equipment relative to revenue continues to grow, signaling that Verizon has to cover more and more devices to maintain customers.

Consumer P&L (VZ Investor Relations)

Costs Can Only Be Cut So Far

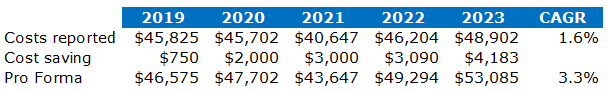

It will come as no surprise to most investors that Verizon’s revenue has been essentially stagnant the last few years. Overall revenue grew at a disappointing 0.4% CAGR from 2019 thru 2024. To offset the impact, Verizon went through two rounds of aggressive cost cuts. The first delivered $10 billion of cumulative savings from 2017 thru 2021 (we will say $3 billion of run-rate savings) and the second has been promised to deliver $2-3 billion in savings by 2025.

Despite the two rounds of growth, costs still grew at a 1.6% CAGR, outpacing revenue and deteriorating margin. For demonstration purposes, I reversed out the savings to examine the underlying cost growth. This yields an underlying cost base growth of ~3% versus the 1.6% actualized.

Pro Forma Expense Trend (Seeking Alpha)

There are only so many costs to cut, especially given the complexity of the network and the fixed costs that come along with it. Once Verizon is through this round, we have to assume costs will return to 3%+. Keep in mind, Verizon has a large union workforce and their largest union contract was only extended through 2025.

Valuation

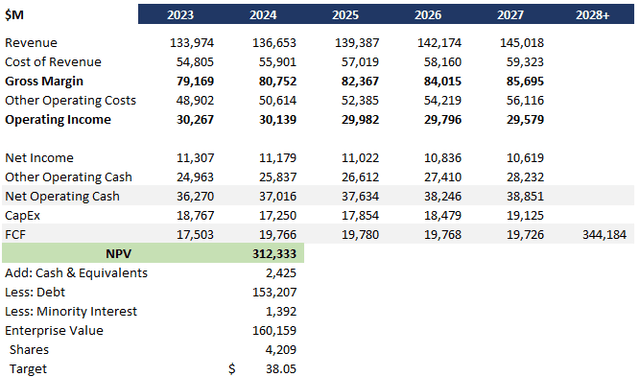

With all of the above in mind, I ran a DCF analysis on Verizon using the following assumptions:

- Revenue growth of 2% based on management guidance, business trend, and overall industry performance

- Cost growth of 3.5% based on the analysis above

- Discount rate of 7% based on WACC of 6.5% adjusted up for deleveraging

- Long-run growth rate of 1% to adjust industry expectations against Verizon’s cost challenges

This DCF analysis yields a price target of $38.05, a slight downside from today’s pricing, although still generating a generous dividend.

VZ DCF Analysis (Data: SA; Analysis: Mike Dion)

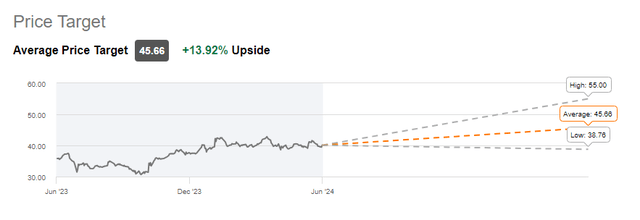

Wall Street is running slightly higher at $46, although I am in line with their low end.

VZ Price Trend (Seeking Alpha)

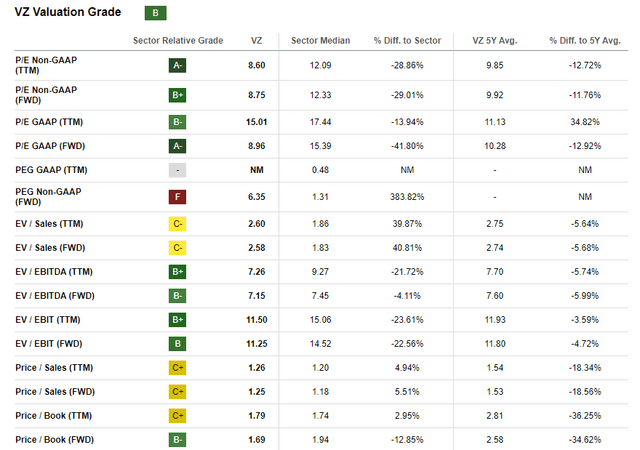

Similar to my concern about revenue performance relative to peers, EV / Sales and Price / Sales are lagging, signaling an issue in revenue performance.

Upside Potential And Downside Risk

Upside potential for Verizon comes in three forms. First, the consumer wireless strategy could start working, and both the postpaid and prepaid businesses could begin growing again. Second, Verizon business could land additional high value contracts that offset risk in Verizon consumer. And third, fixed wireless access could grow by taking share from cable companies in new regions.

On the downside, the biggest risk is that Verizon can’t stop the losses in its Consumer business and those losses, along with stagnating performance in wireline, pressure pricing and marketing expense deteriorating EBITDA faster than expected and ultimately impacting cash available for dividend.

Verdict

I believe Verizon has mispositioned its value segment by focusing so heavily on Verizon’s network across three distinct brands. Multiple signals show that Verizon’s heavy hitting postpaid business is struggling on both the volume and rate side, while competitors, especially AT&T, are not seeing the same challenges.

In addition, Verizon has largely maintained EBITDA using two rounds of major cost cutting. Going forward, there are few options left for cost cutting and the underlying cost growth will quickly outpace revenue.

Upside growth opportunities are well-balanced against downside risks, and this could truly swing either way. Over the next several quarters, I will be close tracking rate and volume movement relative to the industry to see which way this swings.

With all of the above said, I rate Verizon a hold with slight downside on the stock price at a target of $38, offset by the robust dividend.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.