Summary:

- I sold my Verizon shares recently due to consideration of compressed dividend yield and tepid growth outlook.

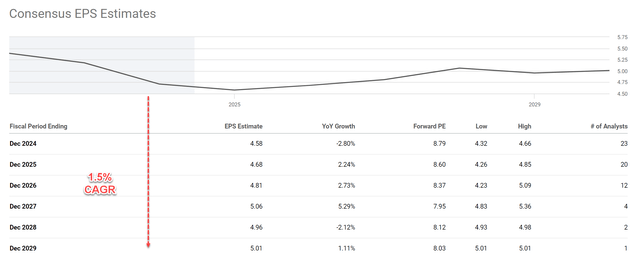

- I expect the annual growth rate to be only around 1.5% and see other income options that provide both higher yield and higher growth potential.

- In particular, I used covered-call options to sell my shares, a proven strategy to help boost effective yield.

3D_generator

VZ stock: I used to love it too

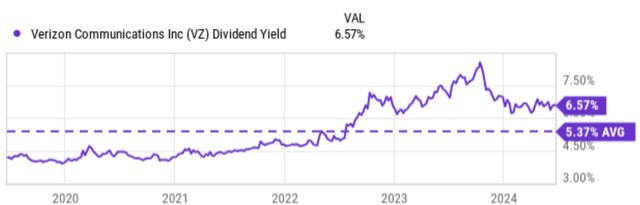

I have been accumulating and holding shares of Verizon Communications Inc. (NYSE:VZ) in our income account over the past two years or so. My shares were mostly purchased when the dividend yields were around 7%. The recent price rallies have compressed the yield considerably to ~6.6% as seen in the next chart below. Combined with a few other factors (and I will detail them later), I have sold my shares at a price of around $41 per via the use of call options.

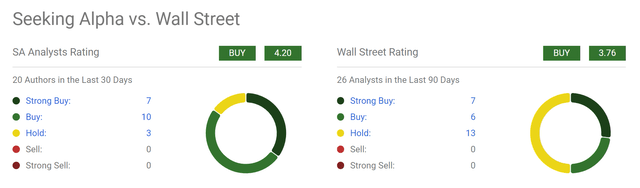

Of course, there are still plenty of good reasons to like the stock under current conditions, and the prevailing sentiments are indeed quite strong as you can see from the chart below. Over the last 90 days, 26 Wall Street analysts offered ratings on VZ, with an average rating of 3.76, translating into a solid “Buy” rating. Notably, seven of them (i.e., close to a quarter of them) rated the stock as a “Strong Buy.” Seeking Alpha writers gave VZ an even stronger rating with an average score of 4.2 as seen. A few factors are behind such bullish sentiment. First, the current yield of 6.6% is still attractive both in absolute and relative terms. For example, it’s significantly above its five-year average of 5.37% as seen in the second chart below. Second, as a sector leader trading at a single-digit P/E, VZ offers a textbook value opportunity. Lastly, there are some growth prospects too considering the rollout of 5G.

However, next, I will argue that under current conditions, there’s no obvious alpha from this stock compared to other options or the broader market.

VZ stock: Growth outlook is uninspiring

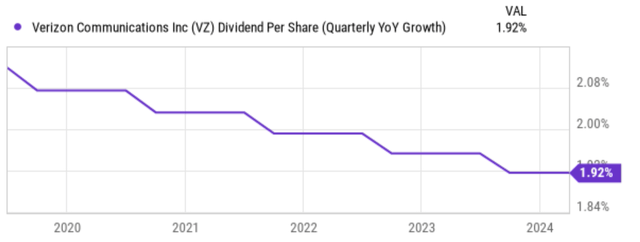

I firmly believe that valuation and dividend yield have to be always interpreted in the context of growth. I see a very tepid growth curve for VZ ahead as reflected in the dividend growth rate in recent years. As you can see from the chart below, the dividend growth rates have been slowing down to the current level of 1.92%. For our income account, I see other options with similar yield (or even higher yield), similar P/E, with much better growth prospects (Enterprise Products Partners, EPD, is a good example that comes to mind).

Looking ahead, the growth picture is quite uninspiring too. The next chart below shows the consensus EPS estimates for VZ in the next six years. The chart shows that analysts expect VZ’s EPS to fluctuate YOY in the next few years with an overall CAGR (compound annual growth rate) of only 1.5%. I indeed see many uncertainties for its growth and believe such a tepid projection is very plausible. The top two uncertainties on my list include the competition in its consumer segment and the decline of its wireline segment.

With the price competition, I think VZ will keep struggling to grow its consumer segment (which grew by only 0.8% YOY in the last quarter, mostly driven by service revenues). Its business segment continued to feel the effects of decreases in wireline revenue and wireless equipment revenue. For example, the revenues decreased by about 1.6% last quarter YOY. I do not see a clear timeline and extent of such wire-cutting and anticipate the pressure to persist for the years ahead.

Other risks and final thoughts

Also, I think the particular way of selling is worth mentioning here. I often use covered-call options as a way to sell positions that are approaching my target price. In this case, I want to exit my VZ shares at a price of around $41. In particular, I sold a few covered call options in late May – covered by the VZ shares I hold in our income account. The details of the options are listed in the chart below. They have a strike price of $40 and an expiry date of June 21. The option traded within a range of $0.55 to about $1 at that time and my average premium was about $0.8.

As a result, in this case, I get paid a premium of about $0.8 in a month (i.e., about 2% of its current prices). The annualized yield is thus about 24% – a very crude estimate to illustrate the method. The shares were called as VZ share prices were a bit above the strike at the expiry date. If the shares were not called, I would have kept writing similar call options until they are called.

The advantage of this method is that the option premium helps to boost the return a bit (actually quite a bit as illustrated above in this case). Furthermore, I still get to collect dividends in the meantime (unless the shares get called, and they can be called before the expiration date). Many popular funds use a similar strategy (such as JEPI or SPYI) to boost yield. I like doing it myself because the fees charged by these funds are too high for my liking. These funds typically generate about 7%~10% yield sustainably and charge about ~0.7% fees. The fees are thus about 10% of the yield. When I sell our own options, each option costs 65 cents (I trade on Merrill Edge’s platform). Even for VZ shares with a relatively low price of ~$40 (thus each option is about $4k), the trading cost is totally negligible (about 0.01%).

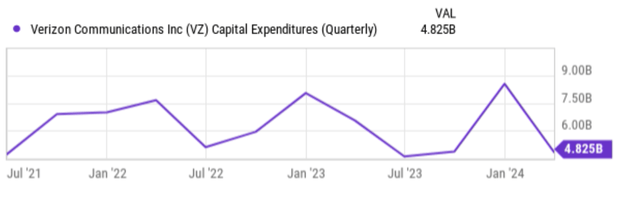

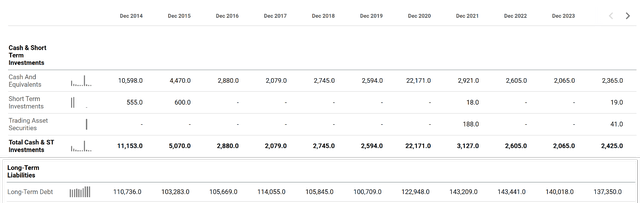

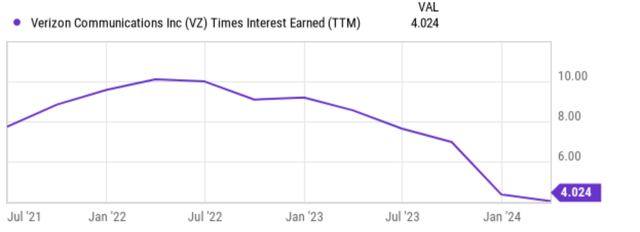

Finally, I need to articulate the risks to my thesis. First and foremost, trading options are more complicated than trading shares directly. As a seller of call options, my gain is limited, but my loss can be unlimited. Secondly, there could be some upside risks in VZ’s business fundamentals too. The capital expenditure (especially for the 5G build out) could have passed its peak already (see the next chart below), thus giving the company more capital allocation flexibility (e.g., to grow dividends). Second, the company has been stabilizing its debt and even paring it recently (see the balance sheet of the second chart below). Notably, its cash position has become stronger (currently at $2.4B compared to about $2.0 billion in December 2023), and its long-term has decreased to the current level of debt of $137 billion (as compared to $141 billion by the end of 2023). However, the effect of the debt reduction was offset by higher borrowing interests and its profitability headings, as you can see from the interest coverage shown in the last chart.

All told, I don’t see anything wrong with holding VZ. It’s the sector leader trading at a reasonable P/E and yielding significantly above its historical average. Such a combination should provide a solid total return even if the EPS growth outlook is not exciting. However, I believe the price appreciation potential I saw when the yield was above 7% has largely materialized already at the current price levels. Given the uninspiring growth outlook and profit uncertainty mentioned, I don’t see a clear alpha from this stock compared to other options anymore.

Seeking Alpha Seeking Alpha Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.