Summary:

- Verizon maintains a strong 6.5% dividend yield, comfortably supported by its free cash flow, despite stagnant financial growth and a declining share price.

- The company is expanding its mobility and fiber businesses, with the Frontier acquisition expected to bolster its fiber segment.

- Verizon’s financials show flat revenue and slight EBITDA growth, but declining cash flow and a heavy $150 billion debt load remain concerns.

- Long-term shareholder returns hinge on Verizon’s ability to manage debt and sustain dividend growth amidst financial pressures and market volatility.

photobyphm

Verizon Communications Inc. (NYSE:VZ), one of the largest telecommunication firms with a market capitalization of around $175 billion, recently announced its earnings. The company continues to have an impressive dividend of more than 6% that it can comfortably afford. We’ve discussed the company before as an investment we’re a huge fan of as a result of its FCF and returns.

However, despite all the company’s discussions about growth, its financials have stagnated, which presents a major risk.

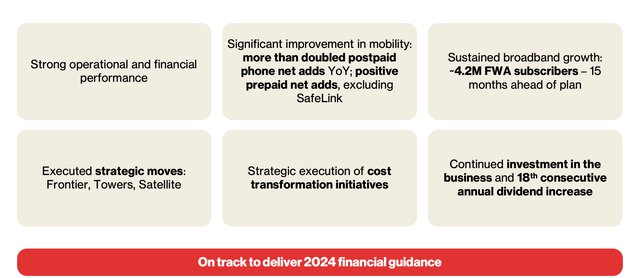

Verizon Business Momentum

Verizon is focused on seeing continued success from its business, with 4.2 million FWA subscribers, its continued goal.

The company’s primary shareholder return is its dividend with a 6.5% yield after the market reacted poorly to the company’s earnings, pushing its share price towards $40 / share. The company can afford that dividend comfortably with its FCF. However, it needs to be able to provide shareholder returns past solely dividends.

The company is working through a number of strategic moves such as its acquisition of Frontier, but that deal will take almost 2 years to close.

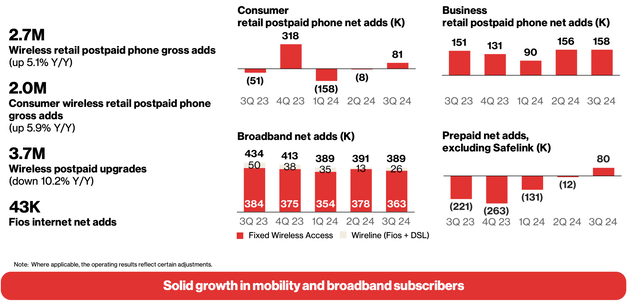

Verizon Operating Metrics

The company’s operating metrics show continued volatility across its business segments with strength in broadband.

The company saw 2.7 million wireless retail postpaid phone gross adds, with net adds much weaker. Consumer retail postpaid phone net adds were less than 100K, however, the company’s retail net adds were stronger. The company’s broadband net adds have been trending downwards, but still hit almost 400K.

The company’s fiber optic segment remains relatively weak, with 43K net adds, however, the company’s acquisition of Frontier should help.

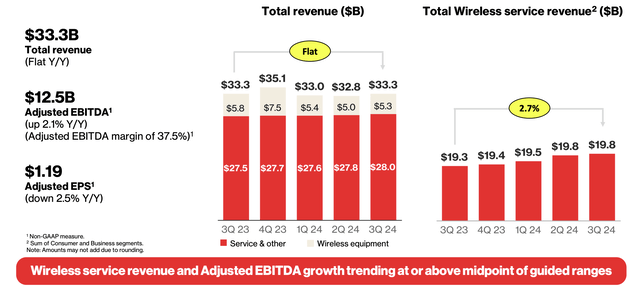

Verizon Financials

Financially, the company’s revenue was roughly flat YoY with $33.3 billion in revenue in both quarters.

The company managed to increase adjusted EBITDA by 2% YoY, roughly in line with inflation and showing an ability to continue performing with stagnant revenue. The company did see a slight decline in its adjusted EPS and the company’s wireless service revenue continues to remain a core of the company’s business at strength.

With weakness in the company’s share price, it’s back to a single-digit P/E based on its adjusted EPS.

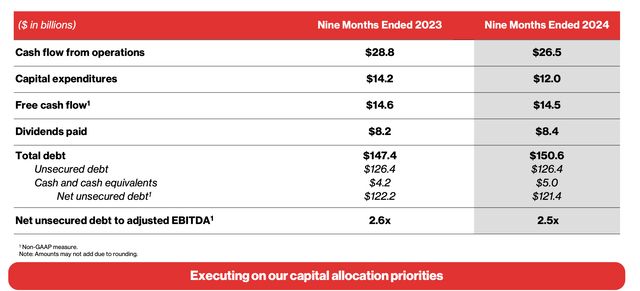

Financially, the company’s CFFO declined by $2.3 billion YoY for the trailing 9-months. That’s incredibly disappointing to see financially. However, the company did manage to cut capital expenditures by $2.2 billion as 5G and associated expenses went down. At the end of the day, the company managed to see $14.5 billion in FCF for the 9M ending 2024, down <1% YoY.

Annualized, the company’s FCF is almost $20 billion, giving the company an FCF of ~11.5%. That’s a relatively lofty FCF yield, that enables the company’s growing dividend of $8.4 billion. The company’s total debt went up YoY with net unsecured debt to adjusted EBITDA down from 2.6x to 2.5x as the company’s EBITDA increased slightly.

The company’s incredibly lofty debt yield costs the company more than $5 billion in annual interest expenditures. While rates have peaked and the company’s financial strength isn’t a concern in terms of handling the debt, it certainly doesn’t have the room to let that debt increase further. At the same time, investor concern has continued to put pressure on the company.

Thesis Risk

The largest risk to our thesis is that Verizon’s financial growth is slowing down. The company has a massive debt load costing it billions in annual interest expenditures and FCF is approximately flat. That will hurt the company’s ability to continue driving long-term shareholder returns, making it a poor investment for shareholders.

Conclusion

Verizon has an impressive portfolio of assets where the company’s cell phone business makes up its core. The company is working to expand this mobility business while expanding its fiber business substantially. The company’s ability to close its acquisition of Frontier will be a major support for the company here.

Going forward the company has a lofty debt load of roughly $150 billion. The company needs to be able to handle that debt load, however, with reducing interest rates, it’s a manageable concern. The biggest aspects for the company are if it can continue increasing its dividend, with 18 years of growth and a 6.5% yield, to generate long-term returns.

Please let us know your thoughts in the comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.