Summary:

- Verizon Communications Inc.’s share price has increased by over 10% since July 2023, but it has underperformed the S&P 500 by roughly 2%.

- Verizon is focused on growing wireless service revenue and has a strong business segment.

- The company’s financial performance remains strong, with improved efficiency and a market cap to EBITDA ratio of just over 3.3x.

hapabapa

jetcityimage

Verizon Communications Inc. (NYSE:VZ) is an investment we recommended July 2023 as a once-in-a-lifetime opportunity. Since then, counting dividends, the company has underperformed the S&P 500 (SP500) by roughly 2%. However, its share price has gone up by more than 10%. Despite that growth, Verizon remains a once-in-a-lifetime opportunity to build a strong cash flow retirement portfolio.

Verizon Positioning

Verizon is focused on positioning itself for a changing future and market dynamic.

The company is focusing on what matters. Specifically, it’s focused on growing wireless service revenue as other businesses stagnate. The company has continued to have strong postpaid net phone adds, and its business segment remains especially strong. At the same time, the company spent a massive amount of C-band 5G, and it’s rolling it out.

That costs the company $10s of billions in late spectrum, and it can help shareholder returns significantly.

Verizon 1Q 2024 Performance

The company’s 1Q 2024 performance shows a continued ability to perform in a tough market.

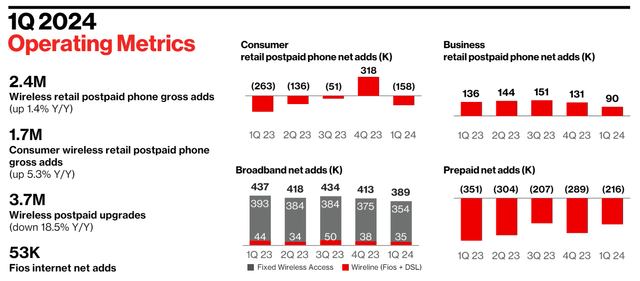

The company had 2.4 million wireless retail postpaid gross adds, although net adds were negative. The company’s 2Q23 to 1Q24 saw roughly flat net adds, showing a volatile environment for the company. The company’s business retail postpaid has continued to do incredibly well, showing the company’s strong business environment.

At the same time, the company’s Fios fiber business remains strong and continues to get additional subscribers and, combined with the company’s broadband business, remains a bright spot. The company’s prepaid business remains weak, but that’s not unexpected given the changing trends in customer tastes.

Verizon 1Q 2024 Financial Performance

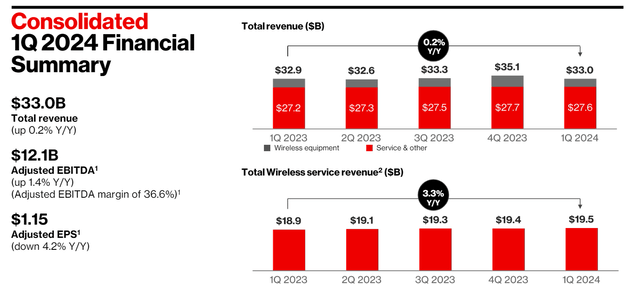

The company is clearly no longer in a business that’s growing rapidly, but its financial performance remains strong.

The company has a market capitalization of roughly $167.5 billion. Total revenue of $33 billion was up a mere 0.2% YoY, losing to inflation, but remaining overall constant. At the same time, the company has improved efficiency, with its EBITDA margin increasing to 36.6% and its $12.1 billion of adjusted EBITDA up $12.1 billion YoY.

That means the company has a market cap to EBITDA ratio of just over 3.3x, showing its overall financial strength.

Verizon Cash Flow Metrics

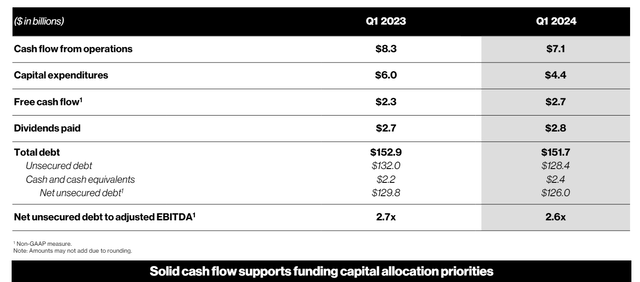

At the end of the day, what matters is cash flow, and despite a scary debt number, the company’s cash flow remains strong.

The company earned $7.1 billion in CFFO, down from $8.3 billion in Q1 2023. Capital expenditures decreased by more, though, resulting in $2.7 billion in free cash flow (“FCF”), up by double-digits versus last year. The company’s almost 7% dividend yield remains its strongest and primary form of shareholder returns, and net unsecured debt to adjusted EBITDA is 2.6x.

There is something worth highlighting here in a higher interest rate environment. The company has a staggering $151.7 billion in total debt, costing it billions in annual interest, and having an enormous impact on FCF. Total 2023 FCF was more than $18 billion, as the company finished the year much stronger than it started.

While we expect the company to have higher 2024 FCF than 2023, with a high single-digit P/E ratio, but we’d like to see the company pay the debt off as it comes due rather than rolling it over at a higher interest rate. Continued weakness in its share price means increased dividends and returns as it pays down expenses.

The company has a double-digit FCF yield. That means it has billions of dollars in FCF after dividends, enough to pay down debt or repurchase shares. Regardless of how the company spends that cash, we expect strong returns. The company’s weak share price remains a once-in-a-lifetime opportunity for investors who are patient enough.

Thesis Risk

The largest risk to our thesis is Verizon’s positioning in an established and expensive market. The company is facing continued competition, and despite attempts with Yahoo and Twitter, has failed to build a suitable alternative business. The company’s business continues to have strong capital requirements. All of this means growth and future performance is tough.

Conclusion

We recommended Verizon as a once-in-a-lifetime investment opportunity when the yield crossed 7%. Since then, the company has raised its dividend by several %, rewarding investors who invested then with even more returns. The company has almost matched the S&P 500 returns, supported by a strong dividend.

Despite the overall market being more expensive, the company remains a valuable investment opportunity. It has an almost 7% dividend yield that it can comfortably and strong FCF. We expect it to use that FCF to pay down debt as it comes due and support overall shareholder returns, making it a valuable long-term investment.

Please let us know your thoughts in the comments below!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.