Summary:

- VICI Properties announced Q3 results, that slightly exceeded expectations with FFO of $0.54 and revenues of $904 million.

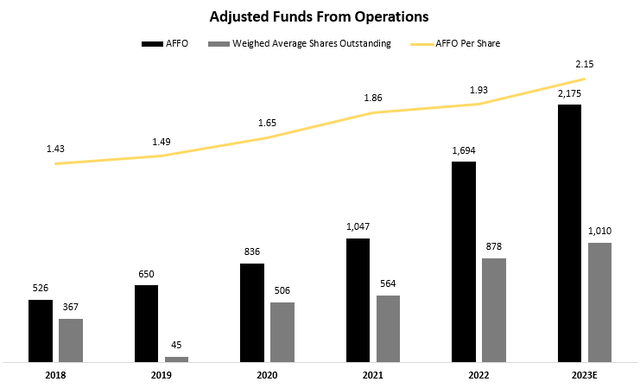

- The company demonstrated resilience with 100% occupancy rates, 100% rent collection, and a 10.2% increase in AFFO.

- VICI is recommended as a buy for dividend investors due to its attractive valuation and steady stream of growing dividends.

Wolterk/iStock Editorial via Getty Images

VICI Properties (NYSE:VICI) announced third-quarter results that slightly exceeded expectations, as FFO amounted to $0.54, a $0.01 beat, and revenues totaled $904 million, a minor beat as well.

It hasn’t been a good year for VICI shareholders, as rising long-term yields and higher interest rates are materially reducing the intrinsic value of the steady stream of growing dividends that VICI provides.

However, the VICI portfolio continued to demonstrate unparalleled resiliency once again in Q3, with 100% occupancy rates, 100% rent collection, and a 10.2% increase in AFFO.

I reiterate VICI as a Buy for dividend investors, as I believe the starting yield as well as the low P/AFFO multiple reflect an attractive valuation.

Background

At the beginning of July, I wrote an article about VICI, claiming ‘Not Many REITs Have Such A Wide Moat’. I urge you to read that article, where I delved into the company’s business model, competitive advantages, and amazing management, as well as analyzed its growth model.

I found that the Ed Pitoniak-led REIT owns non-commoditized, iconic assets like Caesars Palace, The Venetian, The Mirage, Mandalay Bay, and MGM Grand. These are assets that are not only extremely difficult to build, they are located in the most attractive locations in the world, and most of them are right on the Vegas Strip.

As such, I believe that while there could be more attractive opportunistic investments in the REIT landscape, VICI is a great buy-and-hold business.

Q3-23 Financial Review

Created and calculated by the author using data from VICI financial reports and presentations.

The good old business model continued to progress in Q3, as AFFO per share grew 10.2% Y/Y to $0.54. The company upgraded its guidance once again, saying it now expects to drive 11.1% AFFO per share growth for the full year, up from 10.1% in the previous quarter.

VICI 3Q’23 Financial Supplement

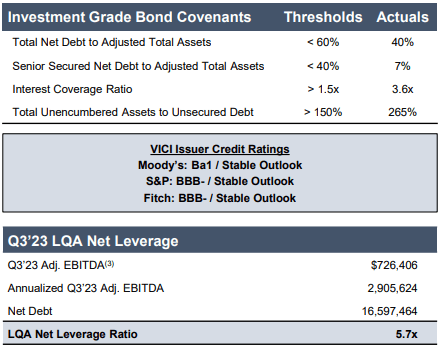

VICI’s balance sheet remained strong, and far above the company’s covenant thresholds, with 40% debt to total assets and a 3.6x interest coverage ratio.

Created and calculated by the author using data from VICI financial reports and presentations.

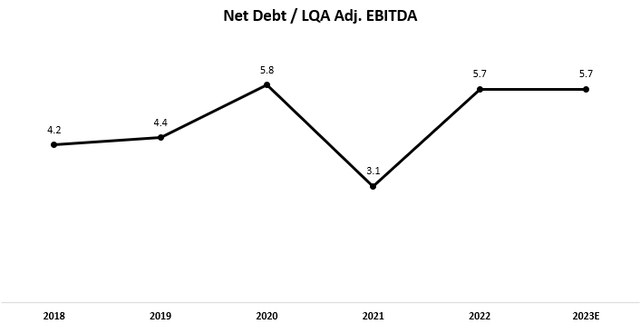

Another important metric to look at is Net Debt / LQA Adj. EBITDA, which is defined as Total Debt less Cash, Cash Equivalents & Short-Term Investments divided by the last quarter’s annualized Adjusted EBITDA.

As we can see, the leverage ratio is currently at the high end of VICI’s range since its IPO, but that is due to a temporary debt spike as a result of the MGM Properties acquisition. I expect that VICI will return to the 4.0-5.0 range shortly.

Growth Prospects Update

VICI already owns the majority of real estate in Las Vegas, which is arguably the most resilient and non-commoditized asset class in experiential real estate. This is a double-edged sword, as on the positive side it reflects the uniqueness and quality of VICI’s portfolio, but on the negative side, it means there aren’t too many opportunities at similar-level quality left.

Still, VICI continues to progress on each of its six growth pillars. Let’s see what’s new.

VICI Properties 2023 Investor Presentation

Let’s begin with the biggest and most recent news, VICI’s sale & leaseback agreement with Bowlero (BOWL). Under the agreement, VICI will purchase 38 bowling entertainment centers for an aggregate amount of $432.9 million. Simultaneously, the parties entered into a lease agreement, under which Bowlero will pay VICI an initial annual rent of $31.6 million, reflecting a 7.3% cap rate. The term of the lease agreement is 25 years, with tenant renewal options for an additional 30 years. Additionally, VICI gained the right of first offer to buy additional Bowlero properties.

This is a clear demonstration of the double-edged sword we were talking about. While VICI can go on with explaining it has entered into a new experiential market in the “Family Entertainment Sector”, this is clearly an asset that isn’t of a similar quality to VICI’s core properties like The Venetian or Caesars Palace. That being said, looking deeper into Bowlero, we can see that this is a company that’s able to generate positive cash flows consistently, and with this sale, its balance sheet will obviously improve. Overall, I see this transaction by itself as immaterial, but the trend of going further away from casinos needs to be closely monitored.

Other highlights were the acquisitions of the Rocky Gap Casino Resort and the real estate of Century Casinos’ four gaming properties in Alberta, Canada.

As we can see, VICI’s management isn’t resting and is continuously working on delivering deals that are immediately accretive to AFFO per share.

Valuation

Based on management’s guidance, VICI currently trades at a forward P/AFFO of 12.9x, which is above Gaming and Leisure Properties (GLPI) and other considerably high-quality REITs like Realty Income (O), and below Iron Mountain (IRM). Before 2022, a year in which VICI significantly outperformed the market, it traded at 15.6x.

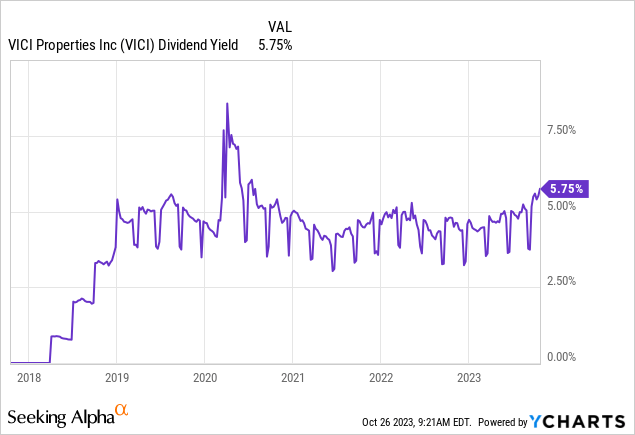

Looking at VICI’s yield, we can see that right around the 5.0% threshold is where it usually trades. Although interest rates and treasury yields are higher, as VICI should continue to grow its dividend and AFFO per share at a high-single-digit pace for the foreseeable future, I believe the current 6% starting yield reflects an attractive valuation.

Conclusion

Not many REITs have as strong of a portfolio as VICI. However, its dominant presence is slowly becoming a double-edged sword, as similar-quality assets are scarce, and VICI is somewhat forced into entering new asset classes, as we saw with the recently announced Bowlero agreement, and the Canyon Ranch deal announced in July.

Still, VICI’s management has demonstrated its relentless focus on accretive deals. With the strength of its core portfolio, even if we assume no multiple expansion, no renegotiated rent agreements, and no new acquisitions, VICI should provide at least a 7% annual return through a combination of dividends and legally binding rent increases.

As such, I reiterate a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.