Summary:

- VICI Properties is a specialized net lease REIT focused on the gaming and entertainment industry.

- The REIT has a strong tenant base and operates in a sector that historically performs well during recessions.

- VICI has a strong balance sheet and trades at an appealing valuation.

Nature, food, landscape, travel

Dear readers,

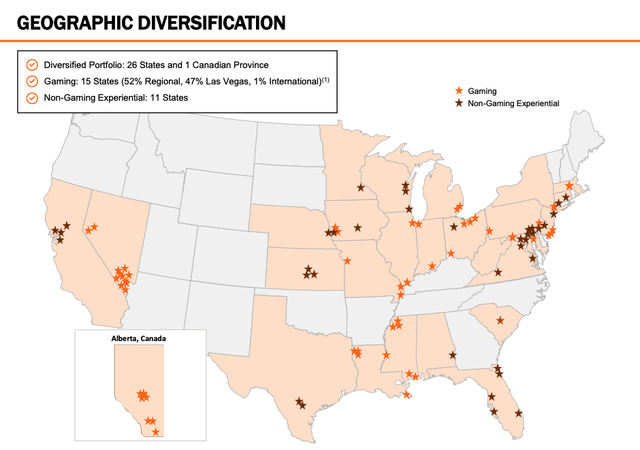

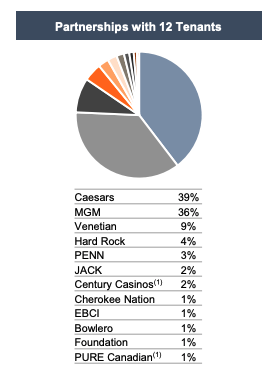

VICI Properties (NYSE:VICI) is a specialized net lease REIT focused on the gaming and entertainment industry. Half of the REIT’s portfolio consist of well-known trophy assets in Las Vegas, such as MGM Grand, Caesar’s Palace or The Venetian, while the other half is spread across the country in regional gambling hubs such as Atlantic City. The company also has a small 1% exposure to Canada, which where it has expanded lately.

VICI is, in my opinion, one of the best positioned REITs in the current high inflation and high interest rate environment.

In particular, there are four reasons why the stock represents one of my largest REIT holding:

- The REIT has a very strong tenant base and operates in a sector that has historically done well during recessions

- It has an unrivalled ability to increase rents in an inflationary environment

- It has a strong balance sheet

- And it trades at an appealing valuation

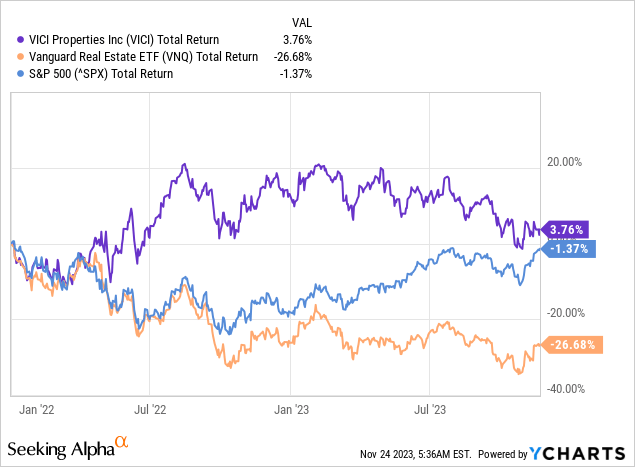

Last time I covered the stock was back in early June when I issued a BUY rating at $31 per share. Since then, VICI has sold off by about 6%, along with the rest of the REIT sector (VNQ).

Over a longer time frame, however, VICI’s performance has been very good, outperforming the S&P 500 (SPX) over the past two years, despite the index’s strong AI-related rally.

VICI is well positioned for a potential recession

The REIT only has 12 tenants and an overwhelming majority of rent comes from just two – Caesars and MGM. Therefore, there is obviously some concentration risk here. But frankly, I’m not too worried about solvency of any of their tenants, much less Caesar’s and MGM, as they’re all very strong investment grade (and mostly publicly traded) companies. Moreover, 81% of rent is covered by a master leases and 91% has parent company guarantees.

VICI Properties

The gambling industry tends to be quite counter-cyclical, which means that even if the economy slips into a recession, casino operators are likely to continue seeing high profits. During a recent gaming conference, one analyst even noted that Caesars is on pace for its best October ever. And consequently, VICI’s revenue which is by definition insulated from the operating performance of its tenants should be very resilient, even in a recessionary scenario.

VICI runs a net lease model, which means that tenants are responsible for maintaining the space at their own expense. And recently many of them have invested significant amounts of capital into VICI’s assets which is a testament to their financial health and also their high conviction of a bright future for the sector. Ceasars invested $400 million into just one asset in New Orleans, The Venetian plans to invest a Billion in Las Vegas, and MGM spends hundreds of Millions in CAPEX each year.

In addition, Las Vegas as a whole is seeing high investment creating nice tailwinds at the moment, despite a tough macroeconomic backdrop. This includes the recently opened Sphere, the Formula 1 and the 2024 Super Bowl.

VICI’s leases are second to none

What sets VICI apart from most of its peers are their lease terms. Most leases have minimum lease terms of 25-30 years and if we account for all renewal options, the average remaining lease term stands at 42 years.

Moreover, the portfolio has average minimum rent escalators of 1.9% and 43% of the portfolio has CPI-linked indexation with no caps. That’s the highest level of inflation protection of any REIT I know of and is extremely valuable in the current inflationary environment.

When combined with a strong balance sheet, CPI-linked indexation serves as a great hedge against the higher for longer scenario, because it ensures rent growth can keep up with interest expense increases and as a result the REIT should growth (or at the very least maintain) its cash flows and dividends even if rates remain high for years to come.

VICI has a strong balance sheet

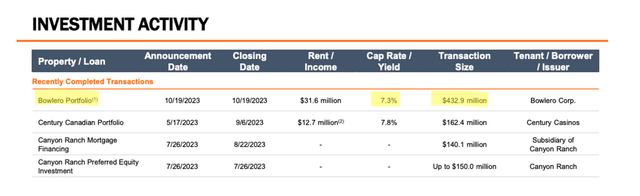

During the third quarter management has played defense and financed virtually all of their new capital commitments in cash (about a $1 Billion) and only $55 Million in debt, demonstrating their commitment to their leverage targets.

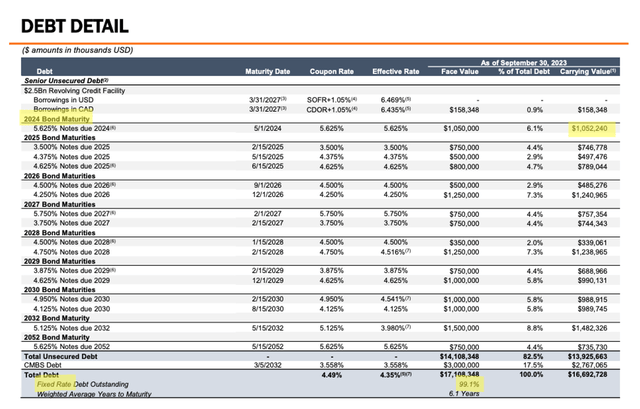

That’s a good sign, because leverage is currently somewhat higher than other net lease peers at a net debt/EBITDA of 5.7x. The weighted average interest rate is also a bit higher at around 4.4% with an average remaining term of 6.1 years.

In short, VICI falls somewhat behind its net lease peers in most balance sheet metrics, which is why its rating is also somewhat lower at BBB-.

But what the REIT lacks in cost of capital it makes up for in hedging as 99.1% of all existing interest rate exposure is hedged. Moreover, the REIT also hold a forward interest rate swap agreement for $450 Million, which is meant to hedge 45% of next year’s refinancing risk.

All things considered, net interest expense is likely to be quite stable in 2024 and would only increase materially in 2025, if interest rates stay high until then. I estimate that refinancing all 2025 maturities at a rate of 6.5% would have about a 2% negative impact on AFFO. Since rates will only stay high if inflation stays high, this increase in interest expense will almost certainly get offset by CPI-related rent increases. Consequently, existing cash flow is poised to be resilient no matter the level interest rates.

The valuation is appealing

With stable cash flow from their existing business, we can focus on external growth prospects. The REIT has done a very good job of growing accretively through acquisitions, with cap rates of 7-8%.

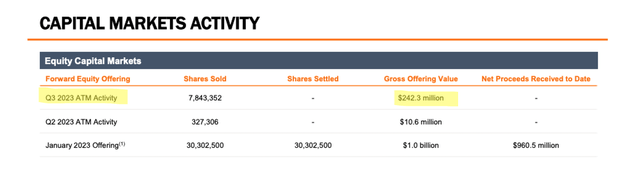

They have financed the majority of these acquisitions through equity issuance as they have raised about $1.3 billion of forward equity in 2023.

As a result, the number of shares has increased drastically, but that’s ok, because per share AFFO also increased significantly. In Q3, AFFO per share reached $0.54, up 10.7% YoY and for the full year management forecast AFFO of $2.14-2.15, up 11% YoY.

That’s extraordinary growth, amongst the highest (if not the highest) in the net lease sector and has enabled VICI to increase its dividend at three times the rate vs. other net lease REITs. The dividend now yields 5.8% and remains very well covered with a payout ratio of <70%. And I fully expect the dividend to grow going forward.

Beyond this year, AFFO growth will most certainly slow. The analyst consensus calls for a 4-5% annual growth driven by rent escalators, CPI-related indexation and some new acquisitions. And I think it’s quite likely that VICI will deliver on this forecast.

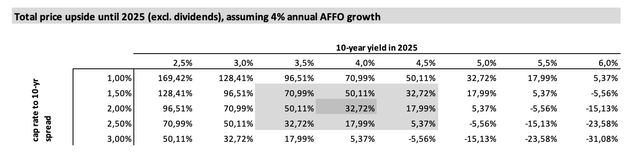

VICI currently trades at an implied cap rate of 6.7%, which is 220 bps above the 10-year treasury yield. I’d argue that a spread of 2-2.5% is fair.

With 4% annual AFFO growth and assuming that the 10-year declines to 4% by 2025 (from 4.5% today), I expect upside of around 25% (midpoint of 17.99% and 32.72% from the sensitivity table below).

That’s about 12% per year, on top of the nearly 6% dividend, for a total expected annual return of about 18%. While this upside will likely only be realized once interest rates and yields decline, investors will get paid a solid dividend to wait and waiting shouldn’t be too painful as VICI’s cash flow should be highly resilient to high interest rates.

Based on the above, I upgrade VICI to a STRONG BUY here at $28.60 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.