Summary:

- VICI Properties is experiencing a sell-off in the REIT sector, causing its stock price to drop to a new 52-week low.

- The price drop is attributed to the increase in the 10-year treasury yield, leading investors to seek safer alternatives.

- Despite the uncertainty in the economy, VICI has raised its dividend and has strong growth potential with its iconic properties in Las Vegas.

- My price target for VICI is $43.50, offering investors double-digit upside and a great margin of safety.

Michael Buckner/Getty Images Entertainment

Introduction

The face Laurence Tureaud, better known as Mr. T, is making in the photo above is the same exact image I have in my head about those running out of the REIT sector (VNQ) right now. VICI Properties (NYSE:VICI) has been on my mind for the past week. And when I logged onto my brokerage account today and saw it was down below my average, I had to buy. VICI is my largest holding and whenever someone asks me what’s my favorite stock to buy, their name comes up quite often. The stock came up in a conversation last week with my sister. She stated that she had heard about how they were a good stock to own from some guy on Seeking Alpha. I told her there’s a military guy who talks about REITs that she should follow since she mentioned them before. That guy turned out to be me. Then the topic of Las Vegas came up in the gym today while speaking with a couple of guys. We talked about the amount of visitors, growth prospects, and cheaper cost of living compared to California. All of this coupled with the sell-off in the sector, and the stock hitting a new 52-week low, has caused me to upgrade the stock to a strong buy.

Why Does VICI Continue to Fall?

I last covered VICI about 3 months ago, and they were trading around $32. Well, today, that price hit below $28. So, I felt compelled to buy a few shares, since my average price is $29. So, what has been causing the drop in price? Treasury yields just topped a level not seen in 16 years, 4.75%. This coupled with the already sour sentiment only caused REITs to drop even further.

The high yield continues to affect them and other sectors as well. Even BDC’s who have done well in this environment are starting to fall. Strong quality stocks like Ares Capital (ARCC) and Capital Southwest (CSWC) are even feeling the pressure. A reader sent me a personal message yesterday and asked what I thought caused the sell-off in the BDC sector (BIZD). I told him I didn’t see anything other than the 10-year treasury yield climbed higher.

BDCs typically perform better in higher interest rate environments, but it’s obvious this is starting to take an effect on the market as a whole. Why? Because every time treasuries go higher, investors look to rotate out of the market into safer alternatives. Essentially, they start to become more and more attractive. Why keep my money in the stock market where it’s risky when I can place it into T-bills where I’m guaranteed not to lose any money?

I understand this sentiment, but I agree with billionaire Ken Fisher:

These pullbacks are just a common feature of young bull markets, and the fact Goldilocks showed up is a sign people can envision a better future. Rather than getting too wrapped up in it, I’d advise you to stay put and keep eating your own porridge.

That’s exactly what I’ve been doing, staying put.

So, What Makes VICI A Strong Buy?

Because Quant, Wall Street, and Seeking Alpha analysts say so, that’s why! Or maybe because Quant strategist Steven Cress also says VICI is a must have when markets dip. Just kidding, but Quant & Wall Street currently rate the stock a strong buy and for good reason. Since my last article, VICI also has raised the dividend by 6.4% to $0.4150 a share. So even with all the uncertainty in the economy right now, they still managed to raise the dividend.

There’s a saying in the investment world, “the safest dividend is the one that’s just been raised.” I don’t necessarily agree with that. I mean, we saw what happened with W. P. Carey (WPC) recently. They had just raised the dividend not long before announcing the spin-off of their office properties. In addition to ratings, I mention next why I think investors should be backing up the truck right now in VICI.

Growth Beyond Belief

Seeking Alpha gives the stock an A+ growth grade. Since going public, it’s the fastest REIT to go from IPO to an investment-grade credit rating. That’s beyond impressive if you ask me. Then there’s the fact that they own some of the most iconic properties in the world on the Las Vegas Strip. And I understand Vegas might not be everyone’s cup of tea as a tourist destination. But the city is destined for growth in the coming years.

Next month, Formula 1 racing is scheduled to start there. Additionally, the REIT is scheduled to serve as a partner in advancing the charitable initiatives that supported bringing the Super Bowl to the city for the first time next year. So, VICI has no shortages of growth there.

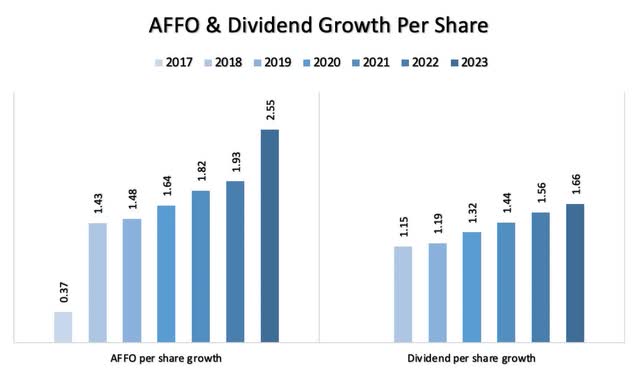

The acquisitions VICI has been making since going public have been reflected in its AFFO per share growth as well. As you can see below, their growth has been astronomical since 2017, and they’ve managed to maintain a lower-than-normal payout ratio while doing so. And this is expected to continue with the recent partnership with Canyon Ranch.

VICI’s Ace In The Hole

Besides owning the real estate of the 6 casinos within and alongside the “Sports Triangle,” they also own 660 acres of undeveloped land across the Las Vegas Strip, and existing call rights on 28 acres related to the Caesar’s Forum Convention Center. I suspect VICI is waiting for the right moment and tenant to enter into a ground lease agreement. This would be a great addition to an already All-Star portfolio and give the REIT more predictable income as these have longer lease terms typically.

Then there’s also talk of bringing the A’s to the city. Completing this successfully would have brought three big-league sports teams to the city in just 7 years. This will make Las Vegas a year-round sports destination going forward. Then there’s the 10-year F1 contract the city has as well. The state has also seen an influx of California residents over the last few years, due to no state income taxes and cheaper living costs. To be honest, these are two reasons I plan on moving there next year.

VICI September investor presentation

Balance Sheet

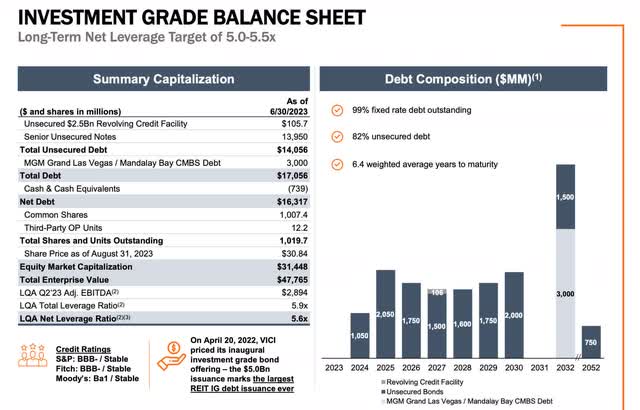

With the stock growing so fast, it’s only fair that their debt would grow also. They currently have about $17 billion in debt, and this has grown from about $4.7 billion to current. They also have a decent amount due next year, which they will most likely have to refinance at a higher rate. The good thing though is the company has an IG-rated balance sheet and 99% of its debt is fixed-rate with 6.4 weighted average years to maturity. In September, the company had $740 million in cash & cash equivalents.

My Valuation & Risks

I like to use the Dividend Discount Model (DDM) when calculating a fair value for REITs. According to Simply Wall Street, analysts are expecting VICI to grow at 9.57% per year going forward. Dividend estimates are also $1.70 for next year, but I disagree and think the dividend will be $1.74. Since 2020, VICI has raised the dividend an average of $0.03. But because of uncertainty, I’m expecting at least a $0.02 increase. Because the sector is expected to experience slower growth going forward, I decided to be a bit more conservative and go with an annual growth rate of 6% for VICI. Expecting a 10% ROR this brought me to a fair value of $43.50 for the stock, slightly above the high price target of $43.

If we do enter into a recession, this could be lowered. Even so, the stock still offers 25% upside to its average price target and almost 43% to its high target. The biggest risk in the near-term for the sector will be Treasury rates. They’ve been creeping up recently, touching new highs not seen in years. If this continues, it will also put pressure on REITs driving their prices lower in the near-term. Although a recession would affect VICI, the major difference is VICI will still collect 100% rent roll from tenants like it did during the pandemic. They will however experience a slow-down in foot traffic as consumer spending becomes tighter.

Bottom Line

VICI is a stellar REIT, offering investors a bargain along with a great margin of safety currently. The stock hit a new 52-week low of $27.70 on Wednesday, and I have continued to add to my largest holding. A looming risk is if treasury rates continue to trend higher, this will put more pressure on the sector going forward. But investors with a long-term outlook should be jumping at the chance to buy VICI at a major discount. They also have undeveloped land that the company can enter into ground leases in the foreseeable future as Las Vegas continues its expansion to bring big-league sports to the city. Due to the current price and projected growth, I now rate VICI a strong buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.