Summary:

- VICI Properties is a strong conviction REIT with a growing portfolio, triple net lease structure, and attractive dividend yield of 6%.

- The casino gaming market is expected to grow, and VICI’s strategic asset portfolio positions it for success.

- Experiential properties, aligned with evolving consumer preferences and Gen X’s inheritance of a great sum of wealth, offer value and potential for sustained growth.

- The dividend yield combined with the estimated FFO CAGR, we are likely to see double digit returns as the REIT market stabilizes over time.

travelview/iStock Editorial via Getty Images

Overview

VICI Properties (NYSE:VICI) has become one of my strongest conviction REITs at this level. I previously started a position at $32/share but now that it has fallen to $27/share, this is the perfect opportunity to lower my position average. I love having the opportunity to buy quality companies on sale and VICI has proven itself to be top tier through their growth, financials, dividend, and portfolio.

VICI was established in 2017 as a result of the separation of real estate assets from Caesars Entertainment Corporation. VICI is a notable REIT that has carved a niche for itself in the realm of gaming, hospitality, and entertainment properties. Operating under the REIT structure, VICI enjoys certain tax advantages while primarily focusing on owning and leasing back real estate assets related to some of the most renowned gaming and entertainment destinations.

The REIT market as a whole has seen downward pressure and has priced VICI at an attractive entry point. The REIT market has seen a downturn for several reasons. Rising interest rates have made other fixed-income investments more appealing which in turn, actively diverts capital away from REITs. Economic uncertainty has led to reduced demand for real estate properties, particularly in sectors such as hospitality, office spaces, and retail which has definitely contributed decline. I believe that VICI’s growing portfolio of properties, the triple net lease structure, and the strategically located portfolio will help them thrive. The growth potential alongside a 6% dividend yield will offer investors double digit returns once the REIT market as a whole stabilizes.

Diverse Portfolio

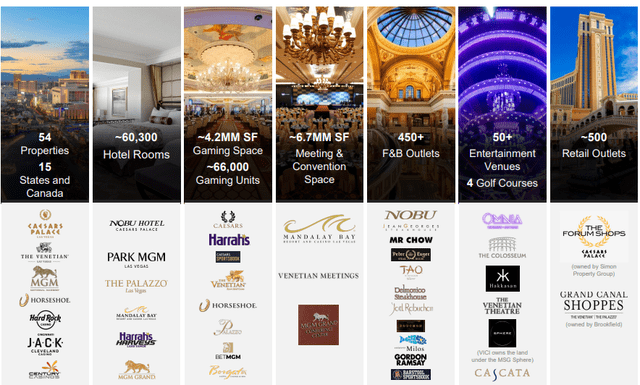

What sets VICI Properties apart is its strategic asset portfolio, which includes a diverse range of properties such as casino resorts, hotels, and convention centers. Through their 54 properties, they gain exposure to over 66,000 gaming units (such as slot machine), 500 retail outlets, 50 entertainment venues, and 4 golf courses. This wide range of properties gives the perfect opportunity to capitalize on each of the age generations and I plan to dig into this next. I believe these properties are strategically positioned in prime markets and are often operated by reputable tenants. The company’s strategy revolves around establishing long-term, triple-net lease agreements with these tenants.

I recently highlighted why I like this triple net lease setup in my article about Realty Income (O). In short, I believe that the triple net lease structure is highly beneficial for VICI and limits the possible liabilities. In such agreements, tenants are responsible for covering most property-related expenses, including taxes, insurance, and maintenance. This arrangement ensures a stable and predictable income stream for VICI Properties and limits exposure to issues that may chew into profitability. This structure makes VICI an appealing option for investors seeking reliable income generation.

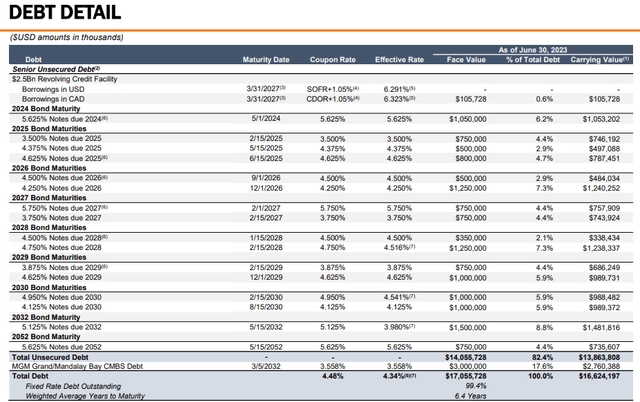

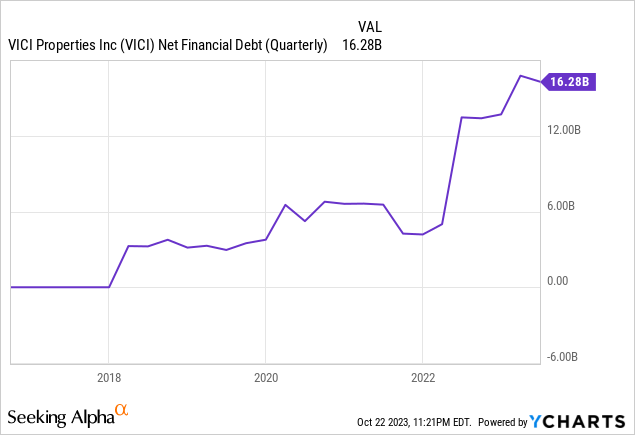

VICI has 99% of its outstanding debt structured as fixed-rate obligations. This means the company benefits from minimized interest rate risk, providing stability and predictability to its financial performance. Moreover, roughly 82% of their debt is unsecured.

Unsecured debt presents a mix of advantages and considerations. On the positive side, unsecured debt offers flexibility by allowing REITs to allocate funds more broadly for purposes like acquisitions and corporate needs. It also allows for diversification in borrowing sources, reducing concentration risks. VICI’s current net debt sits at $16.3B.

At the same time though, unsecured debt often bears higher interest rates than secured debt, increasing the REIT’s overall interest expenses. Lastly, VICI has a weighted average years to maturity of 6.4 years.

Growing Market & Gen X

The casino gaming market as a whole is estimated to grow at a CAGR of 8.1% annually through 2027. VICI’s growth strategy is centered around further expanding its portfolio by acquiring additional properties. They aim to target markets with high barriers to entry and strong tenant relationships, emphasizing quality over quantity in their expansion efforts. This approach not only mitigates risks associated with market fluctuations but also positions the company to offer consistent and growing dividends to shareholders over time.

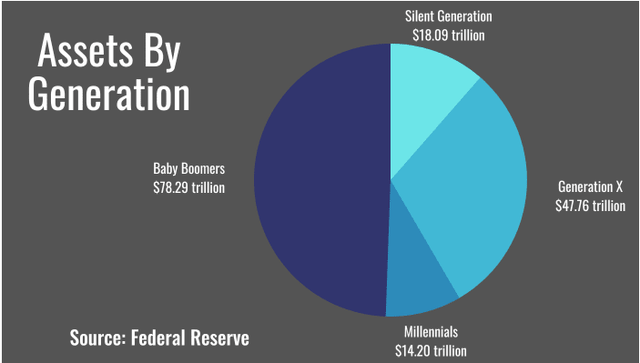

Something that people aren’t giving enough credit to, is the growing number of fresh retirees that will hit the market over the next decade. Gen X, born between 1965 – 1980, will be hitting the retirement bracket soon. There is a rough population of 73 million Gen Xers in the US and they will soon experience a huge wealth transfer from the baby boomers who will slowly phase out of existence. This wealth transfer is estimated to amount to approximately $80 trillion.

I mention this because, unfortunately, humans don’t have the best track record when it comes to managing their finances. Many people struggle with issues like overspending, insufficient savings, and money mismanagement. These financial challenges are often exacerbated during times of economic uncertainty. It’s pretty backwards thinking but luckily for us, we can profit from this. It’s not too far-fetched to believe that a substantial portion of the wealth in the broader economy may find its way into the properties under VICI’s expansive portfolio, and consequently, into the pockets of us, the shareholders.

Moreover, since VICI’s properties encompasses segments like gaming, hospitality, and entertainment, which have historically exhibited resilience, we can expect growth to continue. People tend to continue seeking leisure and entertainment experiences even during economic downturns, further supporting the stability of VICI’s revenue streams. The human mind is an interesting thing and in times of uncertainty, especially when it comes to money, we can try to take shortcuts to increase our liquidity, which is where gambling comes in. It’s a sad reality but let’s not dwell on that for too long. In essence, the challenges people face in managing their finances can indirectly contribute to the success of real estate investments like those held by VICI Properties.

Experiential Properties

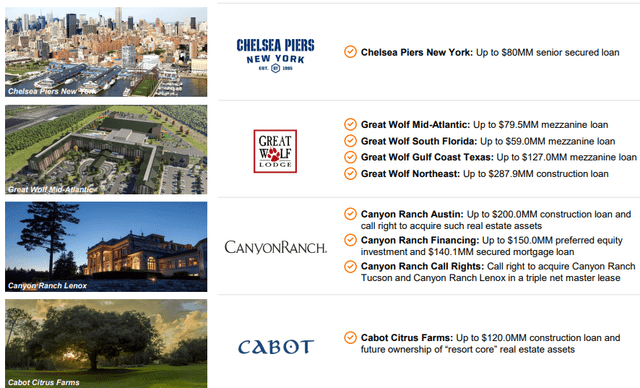

Casinos and gaming aside, VICI still offers value in other aspects. Experiential properties are well-positioned to thrive in the future due to their alignment with evolving consumer spending habits and preferences. We are seeing studies that people are willing to dish out the extra cash on experience based memories. These properties offer a unique value proposition that is increasingly appealing to today’s consumers, a trend that is expected to drive their sustained success.

This cultural shift reflects a growing desire for meaningful and memorable experiences, be it a rejuvenating weekend at a resort, the thrill of a live concert, or the enjoyment of a distinct dining experience. Experiential properties are uniquely equipped to cater to this desire, offering individuals the opportunity to create enduring memories and enrich their lives through immersive experiences. Most importantly, it scratches the itch that people have to post about how cool of an activity they are doing on social media.

The rise of platforms like Instagram and the prevalence of sharing life moments online have heightened the importance of experiences. The modern consumer is not just driven by personal enjoyment but also by the aspiration to share their experiences with their social network. I think these are all important aspects that will contribute to the continued growth of VICI’s revenue. There may not be many studies I can link here for reinforcement, but I am willing to bet that as generations pass, we can see this become more relevant in the dataset.

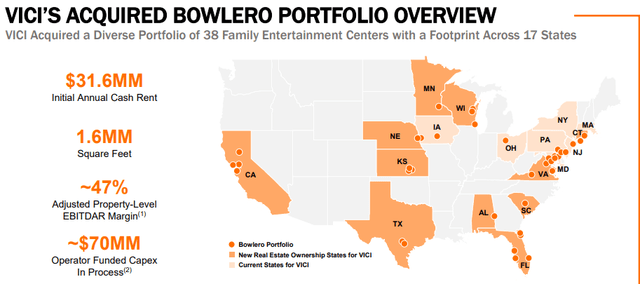

One of these experiential properties can be observed through the recent Bowlero sale-leaseback. Bowlero are bowling alleys and VICI strategically positions those in highly attractive markets across North America. Their business model is highly profitable, generating approximately $200 million in annual cash flow, which is then reinvested back into the business, resulting in returns ranging between 25% to 40%. Furthermore, they excel in the industry with their Corporate FY23 Adj. EBITDA margins reaching an impressive 33.5% and an industry-leading free cash flow conversion rate. This underscores their ability to generate substantial returns and solidify their position as a leader in the sector.

Forward looking, Experiential properties also exhibit a unique characteristic of appealing to diverse demographics. Whether it’s millennials seeking adventure, families led by Gen X parents in search of kid-friendly activities, or baby boomers seeking relaxation, these properties offer versatile experiences that cater to a broad spectrum of age groups and preferences. This diversity in appeal positions experiential properties to gain exposure from a wide demographic of people. This means that VICI will be capable of maintaining a broad customer base and reducing susceptibility to economic downturns or demographic shifts.

Dividend & Valuation

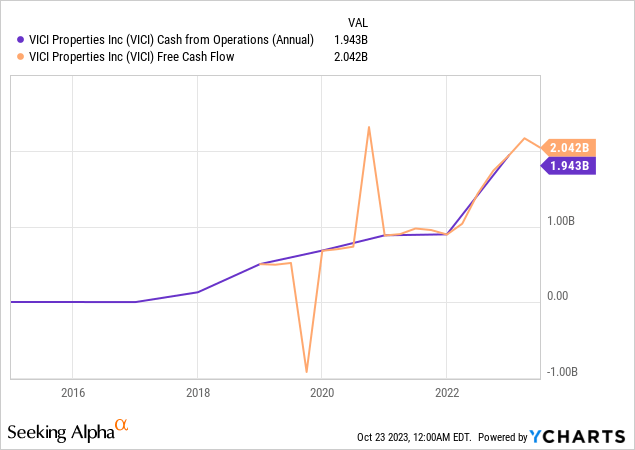

I spent long enough gushing about macro environment aspects that will contribute to VICI’s success so let’s talk about the numbers now. VICI has a strong cash position with $2 billion from operations and an increasing free cash flow. The AFFO payout ratio sits around 75% and as of the latest declared dividend of $0.415/share, the starting yield now comes in around 6% which is above it’s moving average of 5%. This latest dividend declaration represents a dividend raise of 6.4% over its prior payout of $0.39/share.

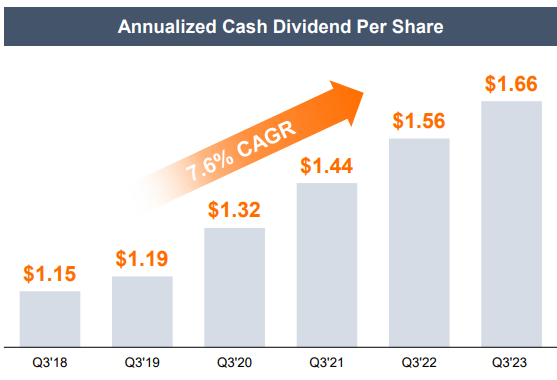

The growth of the dividend has been phenomenal despite the stock’s short history. Since Q3 of 2018, the dividend has seen an annual CAGR of 7.6%. This sort of growth combined with an already high yield of 6%, means you have the ability to create a real income machine here with VICI. The dividend has grown at an average CAGR of 17% over the last 5 year period and profitability supports continued growth going into the future.

VICI Investor Presentation

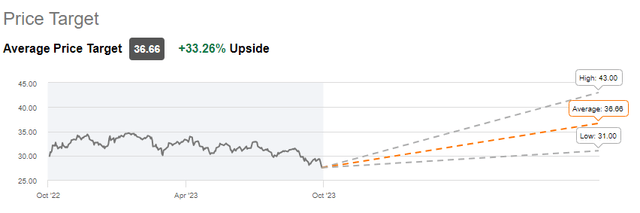

VICI expects to deliver AFFO (adjusted funds from operations) growth of 10% year-over-year. From the latest earnings report, AFFO per share for the quarter came in at $0.54. This represents an impressive increase of nearly 12% compared to the same quarter in the previous year when it was $0.48. Using these metrics, we can come up with an estimated fair value of approximately $34/share that falls close to the Wall St. price target. VICI is currently priced at a 12.6x forward FFO based on the strong growth of 10% per year, strong dividend increases, and investment grade balance sheet, I calculate that a 15.5x forward FFO is a bit more fair. For reference, the average P/FFO for REITs sit around 14.9x.

Right now, Wall St’s average price target of $36.66 per share indicates an upside potential of 33% but being that the REIT market isn’t so hot right now we should have a more conservative outlook.

So far, VICI has proved they are able to achieve this AFFO growth of 10% because their average AFFO growth over the last 3 year period has a CAGR of 9.25%. In addition, their EBITDA growth YoY has excelled at 167%. Something to take into consideration is that the REIT sector is projected to see much slower growth because of the high rate and high inflationary environment we are in. The upside potential combined with a current 6% dividend yield has the strong likeliness of delivering double digit returns to investors over the next decade.

Risk

I think a big portion of VICI’s market share in the gaming and gambling space could be sliced from the online gambling services. Online gambling continues to grow in popularity and ease of access. The mobile market is reshaping the dynamics of online gambling since it is so much more accessible. For example, there are plenty of people in the northeast who have to make a two hour commute to reach one of VICI’s gaming properties. Rather than take the drive, nothing is stopping people from simply downloading an app or getting on their computer to get the same gambling experience from the comfort of their home.

This is exactly why the casino and gambling sector is experiencing substantial growth. Online gambling is estimated to grow at a CAGR of 11.7% through 2030 but the current market value sits around $63B. Cultural shifts and increasing legalization approvals have expanded the market’s reach, making it more accessible to a broader audience. The integration of online gambling into popular culture, further popularized by celebrity endorsements and corporate sponsorships, is playing a pivotal role in normalizing the industry.

Lastly, the influence of celebrities endorsing online gambling platforms and corporate sponsorships cannot be understated. I’m positive that you have likely seen a commercial promoting some form of gambling, voiced over or acted out, by a Hollywood actor. The charming allure of these celebrities have helped reduce the stigma previously attached to the industry, making it a mainstream form of entertainment.

Takeaway

VICI Properties emerges as a compelling investment opportunity, and the recent dip in its stock price to $27/share offers a chance to enhance our position at an attractive entry point. As a REIT with a robust growth trajectory, sound financials, a solid dividend, and a diverse portfolio, VICI has demonstrated its prowess in the gaming, hospitality, and entertainment sectors.

Next, VICI’s triple-net lease structure, 99% fixed-rate debt, and approximately 82% unsecured debt offer stability and predictability to its financial performance. The company’s weighted average 6.4 years to maturity further reinforces its prudent financial management. With the casino gaming market poised for a 8.1% CAGR through 2027 and a growing number of retirees, including the wealth transfer from the baby boomers, VICI is well-positioned for growth.

Lastly, the company’s impressive 6% dividend yield, growing dividend history, and projected AFFO growth of 10% year-over-year make it an attractive income and growth play. While the rise of online gambling presents a potential risk, the cultural shifts, increasing legalization approvals, and celebrity endorsements suggest a promising future.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.