Summary:

- I bought my VICI shares on November 30, 2021, at around $27 per share and the investment was a success.

- After holding it for two years, the position now came up for a review.

- The recent venture into bowling centers and golfing makes sense, but I am not sure if I want to accompany VICI down this path.

- Using a NAV and a more traditional approach, I think VICI is overvalued at the moment.

- I still rate VICI a hold for now because the REIT sector could outperform in 2024 (due to sentiment) and because I think we will keep seeing heightened inflation in 2024.

RandyAndy101

Introduction

In this article, I will review one of my portfolio positions, VICI Properties Inc. (NYSE:VICI). Similar to my Starbucks (SBUX) article a month ago, VICI came up for a portfolio review now that I have been holding it for a bit more than two years.

With 30 published articles in the past six months, VICI is a stock that is seeing quite some coverage on Seeking Alpha. My fellow analysts are rather bullish on VICI, with VICI getting only 2 “Hold” ratings while getting 18 “Buy” or “Strong Buy” ratings (out of the past 20 articles).

VICI is currently the only REIT in my portfolio. The structure of this article will be different from my previous works. I will start with an overview of my 2-year history with VICI, including my initial investment case, the performance since I have been holding it and how everything has played out this far. I will then continue by valuing VICI using two different valuation approaches before finishing with some words on risk and a conclusion.

My history with VICI

I bought my VICI shares on November 30, 2021, at around $27 per share. VICI currently forms around 2.5% of my portfolio. If you are not that familiar with VICI:

VICI is a Real Estate Investment Trust (REIT) and owns gaming, hospitality and entertainment destinations. The majority of VICI’s properties belong to the gaming sector, especially casinos. The properties are subject to long-term triple net leases, meaning that the contract counterpart is responsible for most of the expenses while VICI collects rent. According to VICI’s FY22 10-K filing, 29.2% of VICI’s Casino square feet were located in Las Vegas (at the end of 2022). The next four locations by square feet size were Philadelphia (14.1%), Detroit (6.0%), Cleveland (5.5%) and New Orleans (5.4%).

Now let’s talk about my initial investment case. VICI was able to collect 100% of rent throughout the pandemic, a strong sign of solvent contract counterparts and stability. At the time I bought it, VICI’s AFFO (Adjusted Funds from Operations – a cash flow substitute) for the trailing twelve months (TTM) stood at $1.02 billion. With 628,944,887 shares outstanding at the end of September 2021, AFFO per share stood at $1.62 at that time. So the AFFO yield was around 6% which was not that attractive at first glance. The problem was that VICI already issued new shares for cash proceeds without closing two big deals. VICI bought the Venetian on March 03, 2021, and MGM Growth Properties on August 04, 2021 (more on these two deals later). The dilutive effect of the newly issued shares came into play before the additional cash flows from the new investments, ultimately making VICI look less appealing than it truly was. I assumed that once these deals close, VICI should be able to earn between $1.90 and $2.00 per share in FY22 and clearly above $2.00 per share in FY23. The annual dividend was $1.44 per share for a 5.3% dividend yield back then.

The lease terms VICI had with its contract counterparts were another reason for my investment in VICI. As of today, most of VICI’s leases include an annual escalator of at least 2% (in some cases 2% or CPI if the CPI exceeds 2%). So VICI should be able to increase rents and subsequently AFFO without spending a penny on new objects. This is built-in growth at zero added costs.

Summing it up, I thought VICI was undervalued, had a nice dividend yield of 5.3%, a very stable and predictable business model (casino owner with 100% rent collection) and built-in growth through the annual rent escalators, making it a perfect defensive investment for a time of heightened inflation.

How it played out

VICI was able to report AFFO of $1.93 per share in FY22 (the low end of my estimated range) and currently stands at $2.07 AFFO per share for the TTM (in line with my estimate back then).

VICI was also able to outperform the broader market since my buy:

VICI performance vs. S&P500 since November 30, 2021 (SA Charting)

The dividend was hiked two times over this time and now stands at $1.66 per share, so my yield on cost currently sits at 6.1%.

The investment was a success. So far, so good. Since my initial investment thesis played out, I now have to ask myself if I want to hold onto VICI for the long term or not.

So let’s turn to the negative developments around VICI. As I described earlier, VICI traded at around 7.2% forward AFFO yield as I bought it. Assuming an annual rent escalation of 2% going straight to the bottom line (because extra rent doesn’t incur extra costs), AFFO should have been able to grow around 2.5% from rent escalators alone. So at that valuation, VICI should have been able to generate returns of a bit below 10% in the future, excluding additional property acquisitions.

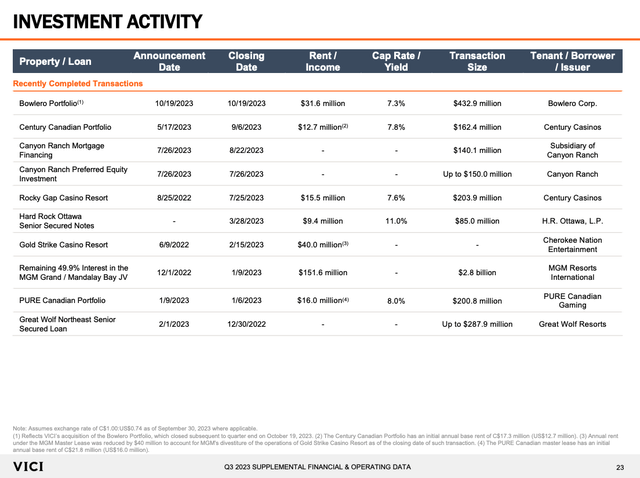

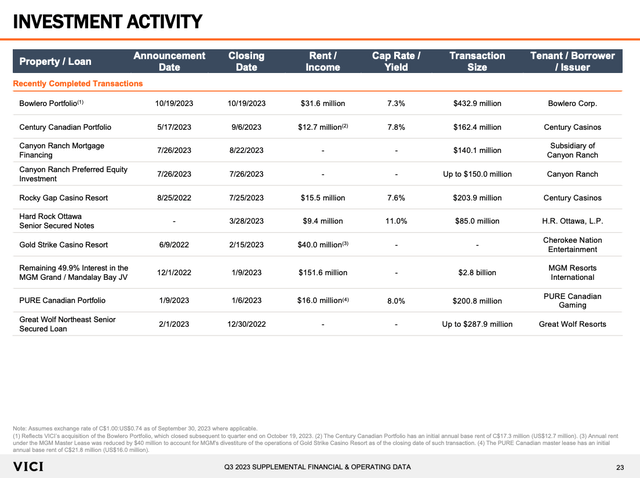

This is where things get a bit problematic. For VICI to be a market-beating investment, it needs to perform accretive property acquisitions. These acquisitions also need to be big enough to “move the needle”. Here is a screenshot of a slide from the Q3 23 Financial Supplement document showing VICI’s recent investment activity:

VICI’s Recent Investment Activity (Q3 23 Financial Supplement Document – Slide 23)

Excluding the MGM Grand /Mandalay Bay JV deal (more on that deal later), recent investment activity amounted to around $1.8 billion (including the mortgage financing and preferred equity investment with Canyon Ranch). Now let’s put this in relation to VICI’s portfolio:

VICI Real Estate Portfolio Q3 23 (Q3 23 Earnings Release – Page 11)

VICI’s real estate portfolio currently amounts to $41.3 billion. So the most recent investments only make up around 4% of VICI’s portfolio. In conclusion, the acquisition activity will most likely not move the needle for VICI.

Another negative point for me is that I invested in VICI as a casino operator. The recent ventures into other areas like the Bowlero deal (sale-leaseback transaction of 38 bowling centers) or the Cabot partnership (golfing) show that VICI has a hard time finding accretive acquisition targets in the casino space. These transactions are still small compared to VICI’s casino operations but I am not sure if I want to accompany VICI down this road.

How to value VICI?

Valuing a REIT is not the same as valuing any other company. I will use two valuation approaches: (1) Net Asset Value (NAV) and (2) A more traditional valuation approach using future growth estimates plus payouts. Let’s go over both approaches separately.

#1 – NAV Approach

This one is pretty straightforward in the beginning and gets more difficult at the end. Let’s start with the easy part. How does the market value VICI’s real estate portfolio?

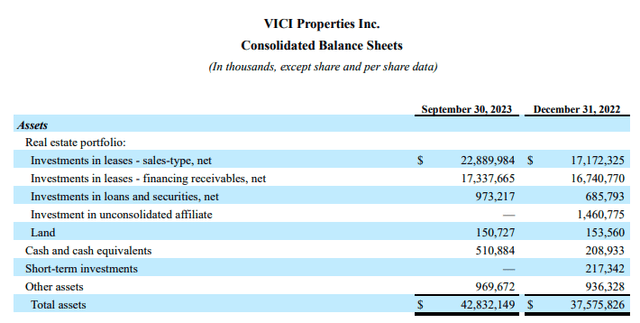

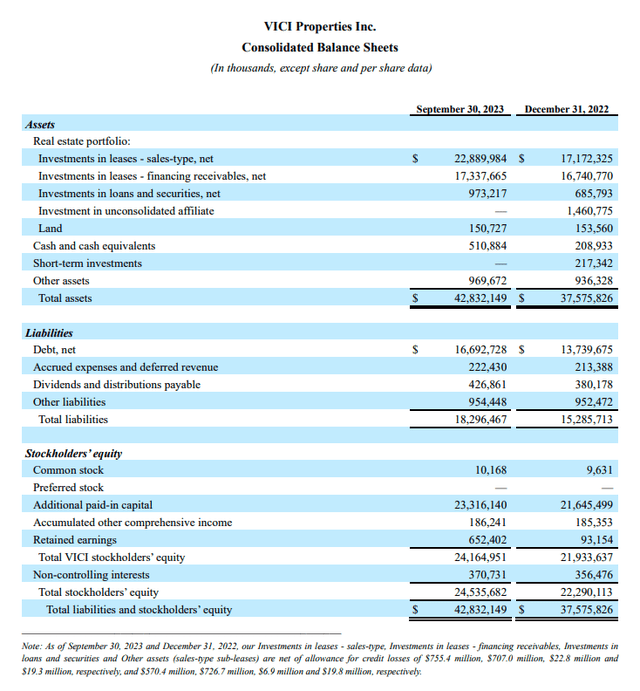

Here is a screenshot of VICI’s Q3 23 balance sheet:

Q3 23 Balance Sheet (Q3 23 Earnings Release – Page 11)

VICI’s cash and other assets amount to $1.5 billion while the total liabilities stand at $18.3 billion. With 1,016,827,883 shares outstanding at the end of Q3 23 and a price per share of $31.92 at the time I am writing this, VICI’s market capitalization currently stands at $32.5 billion. Now let’s sum this up:

| Value in $ billion | |

| VICI market cap | 32.5 |

| + Liabilities | 18.3 |

| – Cash and other Assets | -1.5 |

| = Implied value of the real estate portfolio | 49.3 |

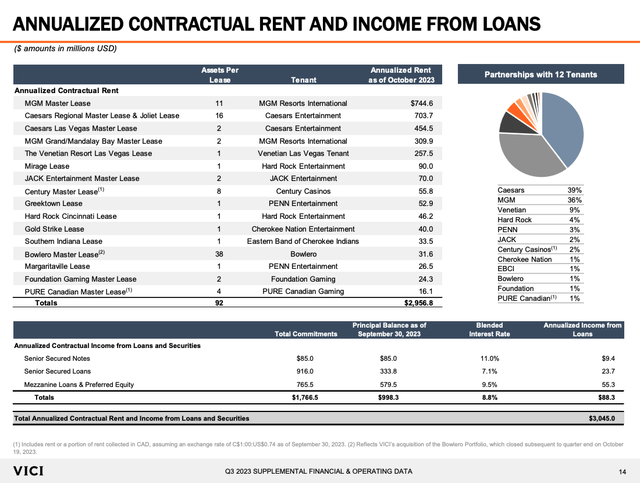

So it seems that the market values VICI’s real estate portfolio at around $49.3 billion. Now we need to look at the annualized rent we would get if we buy VICI’s whole portfolio. Here is another screenshot from the Q3 23 Financial Supplement document:

Annualized Contractual Rent and Income from Loans (Q3 23 Financial Supplement – Slide 14)

The total annualized rent + income from loans currently stands at $3,045 million. So by buying a share of VICI today, we are paying a 6.18% Cap Rate (Annual rent divided by the price we pay) for VICI’s real estate portfolio. This was the easy part.

Now we need to form an opinion if this is cheap or expensive. I will try to answer this question by looking at some of the bigger transactions that we know about:

- VICI announced a deal to buy the Venetian on March 3, 2021. According to VICI’s presentation, this deal was done at a 6.25% cap rate.

- On August 4, 2021, VICI announced the acquisition of MGM Growth Properties. According to the presentation, VICI paid $17.2 billion (total consideration) and got $1,009 million in annual rent in return. So the deal took place at a cap rate of 5.87%.

- VICI then bought the remaining 49.9% interest in the MGM Grand Las Vegas & Mandalay Bay JV from Blackstone on December 1, 2022. The total consideration amounted to $2,767 million for an increase in annual rent of $155 million. The cap rate was 5.60%.

- Lastly, Realty Income bought a stake in the Bellagio at a cap rate of 5.2%.

Let me highlight that all of these transactions took place in Las Vegas.

If we use the average for all of these transactions, VICI’s current valuation at a 6.18% cap rate looks reasonable. However, Blackstone (BX) was the selling party in the last two transactions. Blackstone belongs to the best deal makers in the real estate industry. So when Blackstone is selling, I always consider it a bad deal for the counterpart. In the two cases above, I think that Realty Income (O) made a mediocre deal with the Bellagio while VICI came out “okay” because they already owned 50.1% of the JV before the deal.

But even when we exclude these two transactions, the MGM Growth Properties transaction seems to be the closest comparable to buying VICI’s portfolio and this transaction took place at a 5.87% cap rate.

The problem lies in what I wrote at the very beginning of this article. “Only” 30% of VICI’s portfolio is located in Las Vegas. The aforementioned cap rates are only applicable to Las Vegas properties. I will reuse the slide regarding the investment activity here, this time for another purpose:

VICI’s Recent Investment Activity (Q3 23 Financial Supplement Document – Slide 23)

Here we can see that the cap rates for other casino acquisitions range from 7.6% to 8.0%. Another thing that I want to highlight is that VICI deliberately doesn’t show the “Cap Rate / Yield” for the 49.9% JV deal, probably because it wouldn’t look good to put “5.6%” here (the deal was still okay because VICI assumed the JV’s debt that was priced at a very low rate). In conclusion, the cap rate for the “Non-Vegas” portfolio should be closer to 7% (maybe even higher), Ultimately making VICI overvalued from the NAV standpoint using realistic cap rates for the portfolio.

#2 – “Traditional” Approach

This approach will be closer to how I usually value companies and it will be a lot of numbers crunching, so be warned before reading any further. I always say that the long-term returns of any stock should be the sum of the cash flow yield (what the company could pay out to us) and the cash flow growth rate.

Let’s start with the first part, what VICI could pay out to us. For Q3 23, VICI reported $547.6 million AFFO. So annualized AFFO currently stands at $2.19 billion (in the case of REITs, we need to look at annualized values because once a property is added to the portfolio, it usually stays there and consistently generates AFFO). With the market cap at $32.5 billion, the AFFO yield currently sits at 6.75%. I will assume a payout ratio of 100% to make things easier. So VICI could pay us out 6.75% of our investment per year.

Now let’s turn to the cash flow growth rate. The growth rate consists of two parts and we covered one earlier: (1) AFFO growth through rent escalators and (2) additional AFFO growth through accretive property acquisition.

For (1), I assumed 2% annual rent increases and 2.5% AFFO increases per year because additional rent doesn’t incur additional costs and goes straight to the bottom line.

And here comes an important factor: This assumes a CPI of 2%!

As long as we see heightened inflation, this growth rate will be higher than my assumed numbers because some leases are not capped (the Caesars Master Leases for example have an annual escalator of 2% or CPI, whichever is higher, and are not capped to the upside). Let’s be conservative though and calculate with 2.5% AFFO growth through rent increases.

So now we would sit at 6.75% AFFO yield + 2.5% AFFO growth through rent increases = 9.25% return potential. This makes VICI a sleep-well-at-night (SWAN) investment for dividend investors. If we want a market-beating investment though, we need some more growth. I will just assume a return target of 11%, 100 basis points above the 10% nominal return the broader stock market has delivered over a very long timeframe.

Now we have to turn to (2), additional growth through acquisitions. Earlier, I assumed a 100% payout ratio. So for new investments to be accretive, VICI needs the cap rate of the acquisition to be above the cost of capital. I will start with the cost of capital. I will assume that VICI finances future deals with 40% debt and 60% equity, in line with the recent balance sheet numbers.

The cost of equity is equal to the AFFO yield, so 6.75% (the dilutive effect of new share issuance for existing shareholders). Now we need to assume the cost of debt. Here is a snippet from VICI’s latest 10-Q filing:

April 2022 Notes (Q3 23 10-Q Filing – Note 7 – Debt)

In April 2022, VICI issued several senior notes, with interest rates ranging from 4.375% (due 2025) to 5.625% (due 2052). Now this was back when interest rates were much lower but let’s be very bullish and assume that VICI can borrow debt at 5%. In this scenario, VICI’s cost of capital should be (6.75% x 60%) + (5% x 40%) = 6.05%.

Now how should we calculate cap rates? As I have shown earlier, VICI’s recent casino acquisitions took place at 7.5%+ but they were small. For larger investments that could move the needle, we need to assume lower cap rates (real estate portfolios are usually more expensive than single properties). I will just assume 7% for now.

So now we can sum it up: 7% Cap Rate – 6.05% Cost of Capital = 0.95% Investment Spread. What I call “Investment Spread” is just accretive AFFO per invested Dollar. So if VICI makes a transaction of $1 billion, the accretive AFFO improvement (already taking into account the dilutive effect from the issuance of new shares and added interest expenses) should be by $9.5 million.

And now we can finish this up. To reach 11% returns, we are missing 1.75% because 9.25% already comes from payouts and rent increases. With an annualized AFFO of $2.19 billion, 1.75% growth off of this $2.19 billion means VICI has to add $38.4 million AFFO to reach our target. Knowing that the Investment Spread is 0.95%, VICI needs to add $4 billion to the portfolio per year ($38.4 million divided by 0.0095). With the portfolio currently at $41.3 billion, VICI would need to increase the portfolio by 10% per year.

In my opinion, this seems very unlikely. VICI tries to handle this situation by venturing into other areas like bowling or golfing where the cap rates are higher (7.3% for the Bowlero transaction). The problem is that while these investments have a higher cap rate, they are just too small to move the needle for VICI.

In conclusion, I think that VICI is also overvalued from a traditional valuation point of view. To safely generate market-beating returns, we would need an AFFO yield closer to 7.5%, indicating a price per share of a bit below $29.

So what now?

So what to do with all these numbers? I will start by saying that I personally would not buy VICI today. I don’t see VICI being a market-beating investment at the current prices. At the very least, the possibility of market-beating returns is heavily reliant on VICI performing several BIG transactions and I don’t see that happening (at least not consistently over the next few years).

From the sight of a retired dividend investor though, VICI is still attractive. You get a company with a very stable business model that can handle heightened inflation very well, built-in growth through rent escalators and a safe 5.2% dividend yield that should grow at least in the low to mid-single digits. Total returns will probably be in line with or minimal below the broader market which is fine when you mainly invest for dividend income. If I were a retired dividend investor, VICI might be a bigger part of my portfolio.

But as I have around 20-30 years ahead of me until retirement, I only care about total return potential and don’t have to look at dividend yields. So I have to decide between holding and selling. After thinking about it for quite some time, I decided that I will hold onto my VICI shares for now for the following two reasons:

- REITs had a mediocre year in 2023 because of the rising interest rates and I think REITs could outperform (mainly due to sentiment) on a broader basis once interest rates come down again (which I think is more likely than not).

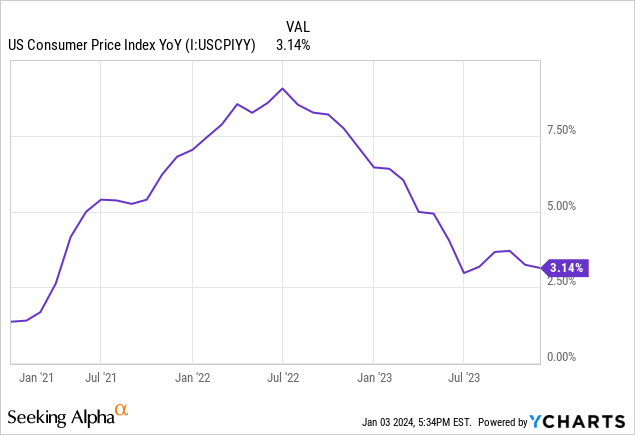

- If we keep seeing heightened inflation as we have seen since the start of 2021 (see chart below), VICI is still set up for better returns (in the near term) than I expect over the longer term because the uncapped rent escalators will push AFFO per share by more than my assumed 2.5% per year.

While inflation has come down, it is still well above the 2% mark that sets the lower end of VICI’s rent escalators.

I will review my VICI position at the end of this year and it is very possible that I could decide to sell my shares then.

Conclusion

In this article, I reviewed my portfolio position VICI. VICI mainly owns casino properties with the biggest part of the portfolio being located in Las Vegas.

Most of VICI’s leases have a built-in rent escalator of at least 2% or CPI (if the CPI is higher than 2%). This is growth at zero added costs. I assume that AFFO per share should grow at a rate of 2.5% per year in a year of “normal” inflation (the U.S. inflation target of 2%). Coupled with the AFFO yield of 6.75%, VICI should be able to generate total returns of about 9.25%, excluding possible accretive effects of additional investments.

However, VICI’s “Investment Spread” (Assumed cap rate of new investments – cost of capital) seems to be around 0.95%. To generate market-beating returns, I think that VICI needs to grow its real estate portfolio by $4 billion next year or 10% per year going forward. I think that this is very unlikely given VICI’s recent investment activity and the size of the portfolio.

VICI tries to keep the added growth through investments high by venturing into other areas like bowling centers and golfing. Since I invested in VICI as a casino operator, I am not sure if I want to accompany VICI down this path.

VICI also seems to be slightly overvalued from the NAV perspective. Using reasonable cap rates for the real estate portfolio, the cap rate of 6.18% we would need to pay to buy VICI’s whole portfolio seems rather expensive.

To generate market-beating returns, I think VICI would need to trade in the range of $29 per share.

However, I decided to hold on to my VICI shares for now because I think that (a) the REIT sector is in a good position to outperform in 2024 due to the possibility of rate cuts and (b) I think we will still see heightened inflation in 2024 which is a tailwind for VICI (due to the rent escalators).

Summing it up, I rate VICI a “hold” at the moment and will probably review my points made in this article sometime at the end of this year.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BX, VICI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.