Summary:

- VICI Properties Inc. stock has underperformed the S&P 500 over the past year, notwithstanding its market leadership as an experiential REIT. Macroeconomic factors matter.

- The recent downward volatility in VICI’s stock demonstrates the market concerns over the overall health of REITs.

- Despite these concerns, VICI’s $26 support level and a forward dividend yield of 5.9% make it an attractive opportunity for long-term buyers.

- I argue why VICI’s improved buying sentiments could help it turn the tide, supported by a much-improved valuation, bolstering its risk/reward profile.

tiero

VICI Properties Inc. (NYSE:VICI) investors have suffered a torrid year since VICI topped out in August 2022. Notwithstanding its position as a market-leading experiential REIT, macroeconomic factors matter, suggesting investors must consider the broader view even when assessing individual REITs.

I last updated my thesis on VICI in mid-September 2023, urging investors to be wary about adding more exposure. I stressed that “a subsequent re-test of the $30 level cannot be ruled out, with momentum increasingly favoring sellers.”

That thesis has panned out accordingly, with VICI falling toward the $26 level before bottoming out in early November 2023. Therefore, I believe it’s timely for me to reassess the current opportunity in VICI on whether dip buyers waiting patiently can finally pounce on it.

VICI has underperformed the S&P 500 (SPX) (SPY) over the past year, registering a 1Y total return of -9.5%. The downward volatility over the past two months hit VICI holders particularly hard, with the stock down 8% on a total return basis since my update, contributing significantly to its underperformance.

Vici delivered its third-quarter or FQ3 earnings release in late October 2023. It was a solid quarter, as management also upgraded its guidance for the year. Despite that, the downward volatility experienced since then demonstrated that market participants remain concerned over the overall health of REITs.

VICI bulls would likely point out the supposed non-cyclical and sticky experiential assets in Vici’s portfolio. The recent sale-and-leaseback transaction with Bowlero Corp. (BOWL) expanded Vici’s exposure to leading non-gaming assets that are expected to be AFFO-accretive.

However, the acquisition cap rate of 7.3% was well below the 9% to 10% rates that would have lifted investors’ confidence further. Accordingly, management accentuated that such opportunities are unlikely in the current market environment. CEO Ed Pitoniak indicated that “there are few opportunities to acquire high-quality real estate occupied by strong operators at 9 and 10 cap rates.”

Pitoniak also cautioned that the volatility in funding costs could implicate transactions “with longer gestation periods.” As a result, investors must remain patient as the company assesses the opportunities in its pipeline that meet its requirements.

I commend management for arranging a substantial forward sale agreement in January 2023, when its shares traded much higher. The company has “completed the physical settlement of all the remaining 17,702,500 shares of common stock under the January 2023 forward sale agreements.” After completion, it delivered net proceeds of about $560.3M, equivalent to about $31.7 per share.

It has provided the company with significant financial flexibility as it deals with a high adjusted EBITDA leverage ratio of 5.7x, well above its long-term target. Coupled with a debt maturity profile comprising more than 18% of its total debt base through 2025, it could hamper Vici’s ability to continue driving acquisitive growth. Furthermore, the lowered cap rates on its most recent transaction could also impact the growth rates on its AFFO per share, justifying the downward de-rating on its valuation over the past year.

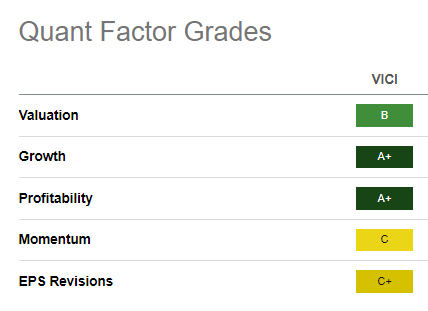

VICI Quant Grades (Seeking Alpha)

VICI’s valuation has improved, assigned a “B” valuation grade by Seeking Alpha Quant. I assessed that the market has likely priced in the headwinds highlighted earlier, suggesting its growth could slow.

Despite that, VICI has dropped to a zone that I believe should proffer robust support for long-term buyers. VICI’s $26 support level has been defended since early 2022 and underpinned by dip buyers in early November 2023.

Also, its forward dividend yield of 5.9% seems reasonable, considering the spread against the United States 10-Year Bond Yield (US10Y), which last printed at 4.46%. I believe the market has likely priced in a resurgent 10Y, which could affect Vici’s cost of capital for its pipeline opportunities.

Investors must remain cautious, using the $26 support zone as a benchmark to assess robust buying sentiments. For now, I believe an upgrade to my thesis is appropriate, considering the recent developments markedly improving the risk/reward in VICI.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!