Summary:

- Virgin Galactic’s potential hinges on achieving ambitious flight goals; execution and early results are crucial before considering a rating upgrade.

- SPCE’s cash reserves are tight, with significant negative FCF expected through FY25.

- The long-term market potential is significant, but I remain cautious, awaiting execution in FY25 and FY26 before revising my rating.

buradaki/iStock via Getty Images

The Virgin Galactic Investment Thesis

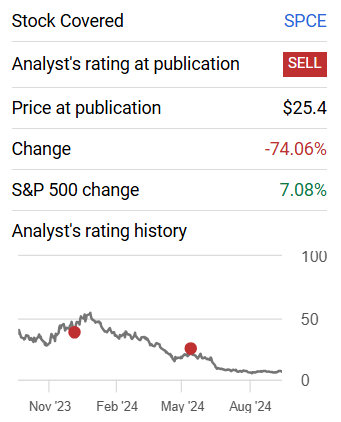

Seeking Alpha

In the chart above, you can see how my rating has performed since I last wrote about Virgin Galactic Holdings, Inc. (NYSE:SPCE) in May of this year. And here we can clearly see that the assessment at that time was the right one, as I felt that the risks outweighed the opportunities.

However, a lot has happened since then, and it is time to take another look at Virgin Galactic, as I still believe that space travel could be an interesting future market in the long run. In the last article, I said that the guidance looked better than I expected, and now they have raised the potential number of flights even further.

If they achieve their goals, it could be a big boost for Virgin Galactic, but execution is key, and I need to see some early results that show the ambitious goals are achievable before I raise my rating. But let us take a closer look at Virgin Galactic to be able to put these things into perspective.

What Has Happened Since My Last Article?

The main events since my last article were the completion of Virgin Galactic’s last flight before taking a break to focus on the development of Delta, and the 20:1 reverse split of the shares. In particular, the reverse stock split was important as the stock was trading below $1, which was the minimum requirement for listing on the NYSE.

The pause to focus on Delta, however, has been known for some time and should come as no surprise to those who follow the company. In addition, they also sent out a press release saying that the facility for the Delta spaceships was ready to go.

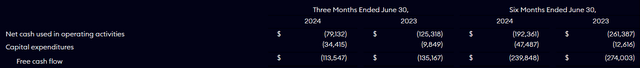

And the most recent Q2 results came in with a double beat in EPS and revenue. But the important fact for Virgin Galactic in the near future, in my opinion, will not be the EPS and revenue numbers, but how high the cash burn will be and whether the shareholders will be diluted.

Virgin Galactic’s Balance Sheet, FCF, And Cash Burn

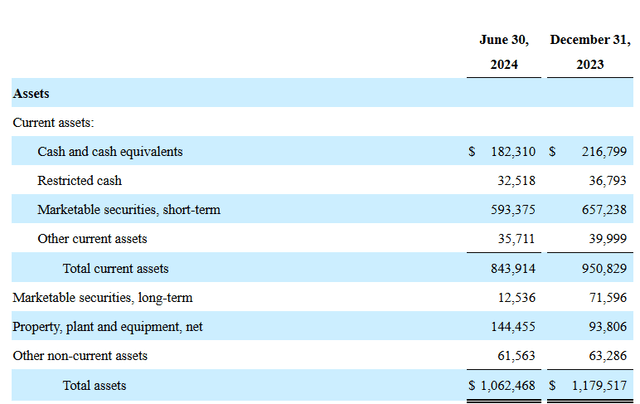

The important part will be knowing how long the cash position will last. And here we have $182 million in cash, $593 million in marketable securities, and other current assets of $35 million. I leave the restricted cash of $32 million out of the calculation. So I am assuming an available cash position of $182 million + $593 million + $35 million = $810 million.

This compares to negative FCF of ($115 million to $125 million) in Q3/24 and possibly ($130 million to $140 million) in Q4/24. Cash and cash equivalents at year-end are therefore expected to be between 565 million and $545 million.

Virgin Galactic Investor Presentation

And for FY24, FCF is expected to be negative (~$484 million to $504 million). So with FY24 likely to be the highest cash burn year, FCF will look a bit better in FY25. However, with approximately $550 million in cash left for FY25, there is not much room for maneuver, as delays in the planned Delta flights could lead to cash shortages if no new funds are raised.

I estimate that negative FCF of $80 million to $100 million per quarter could occur in FY25, meaning that the current cash reserve would last until mid-2026.

The New Improved Guidance

Virgin Galactic Investor Presentation

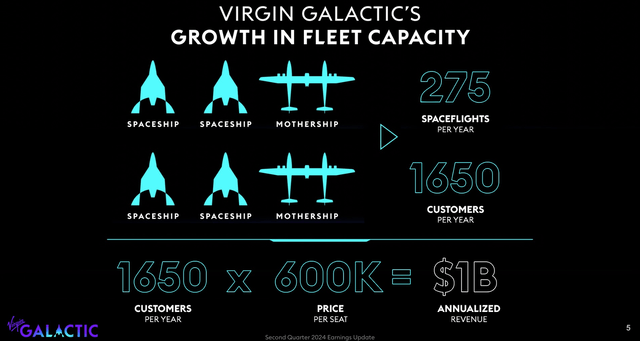

In the Q2 earnings call, it was stated that the design phase of the Delta spacecraft would be completed in Q3. Construction and testing would then begin. In addition, a turnaround time of 3 days is planned, which would allow 2 spacecraft to perform 275 flights per year.

This is a big jump from the 125 flights forecast in Q1. And even with the 125 flights, they were expecting up to 3 flights per week, which is significantly more than the 1 flight per month that has been the norm in the last few months.

Virgin Galactic Investor Presentation

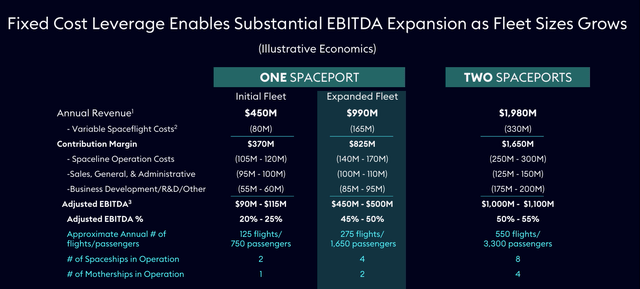

And then there is the chart showing how revenues and Adjusted EBITDA would change if they operated two spaceports instead of one. And here the margins would improve. This is because many costs are fixed, so increasing the number of flights would be beneficial.

However, it will probably take 4 to 5 years to build new spaceports, so I think two spaceports are still in the future and will not be significant until 2030+. But if I knew today with 100% probability that there really will be two spaceports with 550 flights per year in 2031, then today’s share price would be a bargain. Because then the company would probably be back in the tens of billions in market cap, which would be a strong upside to the ~$200 million Virgin Galactic is trading at today.

Unfortunately, there is still a long way to go, and it will be important to see if the implementation really works as planned. The first milestone will be to get the first Delta flights into space and to get by with the existing liquid assets or to raise new capital.

Conclusion

I think that 2025 will be a transition year where we will see if the capital allocation is right, and then it will be interesting to see if the planned flight numbers actually materialize. If Virgin does indeed reach 100 to 200 flights per year, the backlog, which has already dropped from 800 to 700, could potentially be eliminated by 2030. And then you could possibly raise ticket prices as well once the backlog is cleared.

Virgin assumes a TAM of 300,000 people. The potential target audience is defined as people with a net worth of more than $10 million, and a market growth rate of 8% per year is also projected. So the market penetration is still very, very low at the moment.

So in conclusion, I still think Virgin Galactic is interesting and has a lot of potential if the guidance comes in as predicted, but I am staying on the sidelines to see how good the execution is in FY25 and FY26. Therefore, I will stick to my rating for now. However, if the Delta flights go as planned, it would most likely have a major impact and lead to an increase in my rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.