Summary:

- Virgin Galactic Holdings, Inc.’s latest $300 million ATM offering to build 2 additional Delta spaceships may actually be critical for the company to fund its operations until 2026.

- Perfect execution is the only way for Virgin Galactic to survive, in my opinion, ahead of the maturity of the $419.5 million debt in early 2027.

- Virgin Galactic may be behind schedule for Delta spaceships based on its underspending this year compared to the guidance issued in Q3 2023.

- Increasing the flight cadence of VMS Eve to 3 flights per week may not be viable due to its old age and condition.

- Virgin Galactic’s new mothership could be delayed as the company is yet to announce a new manufacturing partner, with Boeing out of the picture.

jroballo/iStock via Getty Images

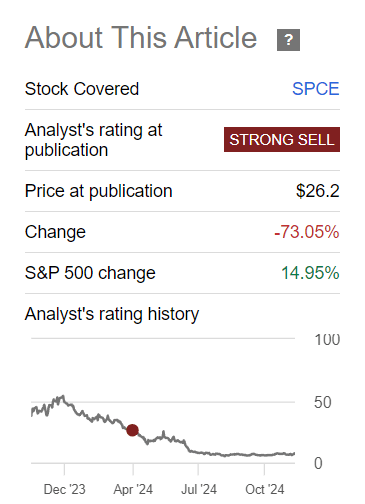

Last April, I was bearish on Virgin Galactic Holdings, Inc. (NYSE:SPCE) after a trade secrets lawsuit was filed against the company by The Boeing Company (BA) as I believed the litigation would delay the launch of its new mothership. While the lawsuit was settled in early October, Virgin Galactic remains down 73% since my last coverage after effecting a 1-for-20 reverse split to maintain its listing on the NYSE. In addition, the company’s plans to introduce the new mothership have taken a hit as it is now expected to be launched in 2028 instead of 2027 as initially expected.

Seeking Alpha

Last week, Virgin Galactic released its Q3 earnings and reiterated its 2026 target for commencing commercial flights of its upcoming spaceship, Delta, and its 2028 target for the new mothership’s debut. At the same time, the company announced an optimistic scenario where it intends to introduce 2 additional Delta spaceships in 2028 to more than double its revenue and adjusted EBITDA opportunity. These plans would be facilitated by a new $300 million ATM offering.

That said, I believe Virgin Galactic must execute its plans and timeline perfectly, as its existing cash balance and the additional $300 million from the ATM offering may only be enough to fund its operations until 2026. This doesn’t even consider the $419.5 million debt maturity in early 2027, which could see the company declare bankruptcy if it’s not ready to commence Delta flights on time.

With that in mind, I believe Virgin Galactic’s expected cadence to reach its revenue and adjusted EBITDA targets may be overly optimistic due to its reliance on VMS Eve to send these flights until the new mothership is ready. In addition, Virgin Galactic may be behind schedule, as shown by its underspending this year compared to the forecast issued in Q3 2023. Given these factors, I’m reiterating my strong sell rating for Virgin Galactic.

Q3 Overview

In Q3, Virgin Galactic reported revenues of $402 thousand compared to $1.7 million a year ago due to its decision to pause commercial flights to focus its resources on the production of the Delta spaceships. Despite this, the company reported a net loss of $74.5 million compared to $104.6 million a year ago due to improved cost efficiencies as operating expenses totaled $82.1 million during the quarter compared to $116 million in the prior year.

Since Virgin Galactic is yet to start generating meaningful revenues from spaceflights ahead of the Delta spaceships, the company’s cash burn is the most important metric that investors look for. In that regard, the company reported a free cash outflow of $118 million, compared to $105 million in the prior year. The company expects cash burn to increase in Q4, as it’s guiding for free cash outflow between $115-125 million.

In addition to these results, Virgin Galactic announced a $300 million ATM offering. To put this in context, the company intends to raise the equivalent of 1.46 times its market cap, at its latest closing price of $7.06 per share. This means that the company can issue about 42.5 million new shares, which would bring its outstanding shares count to 71.4 million shares if the company raised the full amount under the ATM at the current share price.

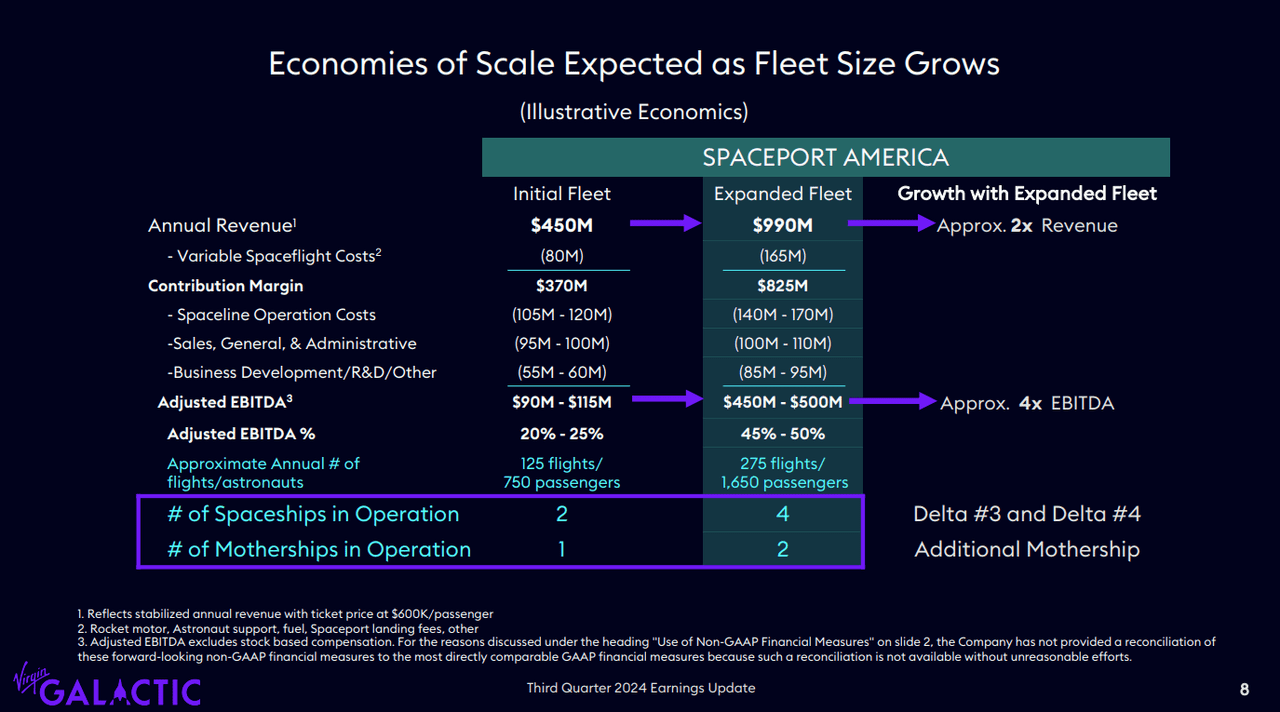

Despite the substantial dilutive impact of this offering, Virgin Galactic believes the $300 million cash injection can help it accelerate its future growth by producing 2 additional Delta spaceships and a new mothership by 2028. Through these actions, the company can operate its spaceport at full capacity as it could send 275 flights carrying 1650 passengers annually. In this way, the company can generate about $1 billion in annual revenues, at the current pricing of $600 thousand per ticket, and generate between $450-500 million in adjusted EBITDA annually at a margin of 45-50%.

Despite management’s plans, I suspect the offering is to support Virgin Galactic’s operations until commercial flights resume in 2026, especially since the press release announcing the offering included the following language.

The Company may also use a portion of any net proceeds for general corporate purposes, including working capital and general and administrative matters.

Latest Capital Raise May Not Be Enough

Virgin Galactic exited Q3 with total liquidity of almost $744 million including cash, equivalents, restricted cash, as well as short and long-term marketable securities. With the injection of the $300 million under the ATM offering, the company has $1.044 billion in liquidity. Given that the company is expected to burn through $120 million in Q4, the midpoint of management’s FCF guidance, it could exit 2024 with around $924 million.

For 2025, Virgin Galactic expects an uptick in spending in Q1. That is when it would reach the peak payments for tools and parts to start constructing and assembling the first Delta spaceships before it starts testing the new spaceships in the second half of the year. The company then expects spending to trend lower and exit 2025 at a cash burn rate below $100 million per quarter.

Assuming Virgin Galactic maintains an average cash burn of $120 million per quarter in 2025, the company would exit 2025 with a total liquidity of $444 million. I believe this is a fair assumption since the company will have to spend cash for the construction, testing, and certification of Delta, as well as designing the new mothership. This is critical for the viability of Virgin Galactic’s plans and prospects. This implies that the only way for the company to survive is to execute its plan of commencing Delta flights in 2026 perfectly in order not to run out of cash before the introduction of its new mothership.

|

Period |

Cash Burn |

Cash (End of Period) |

|

Q4 24 |

$120,000,000 |

$923,891,000 |

|

2025 |

$480,000,000 |

$443,891,000 |

As is, the company still has to deal with $419.5 million of debt maturing on February 1st, 2027, which it is unlikely to be able to repay. These convertible notes have a conversion price of $12.79 per share on a pre-split basis, or $255.8 per share on a post-split, which is a 3523% premium to the stock’s current share price of $7.06. Therefore, the only way for Virgin Galactic to survive is to show a viable path to profitability to refinance its debt mountain.

With that in mind, I believe Virgin Galactic’s timeline may be overly optimistic for several reasons that I will discuss in detail, chief among them is that this timeline doesn’t consider any potential delays. This is especially concerning since delays are common in the space industry in addition to the company’s own history of missing deadlines, as shown by pushing the new mothership from 2027 to 2028.

Delta & New Mothership Timeline: Is It Viable?

Per the latest Q3 earnings call, Virgin Galactic expects to ramp up part fabrication in Q4 this year. It will start assembling the Delta spaceships in Q1 2025, and start testing the spaceships in the second half of 2025, ahead of commercial flights commencing in 2026. The company intends to increase the flight cadence of VMS Eve to 3 flights per week, compared to 2 flights per week for these commercial flights, until the new mothership is ready in 2028.

Virgin Galactic expects to become cash flow positive once the first 2 Delta spaceships start commercial flights, as they’re expected to generate $450 million in annual revenues at a contribution margin of 82.2%. In this way, the company expects to generate between $90-115 million in adjusted EBITDA at a margin between 20-25%.

In my previous coverage of the stock, I was skeptical of the company’s ability to fly Eve twice per week due to its old age and condition. The mothership is 16 years old and has completed more than 330 flights. At the same time, its condition has been the center of a shareholder lawsuit filed in 2021. I also believe that Eve’s condition was a factor for Virgin Galactic to reduce Unity’s flight cadence from once per month to once per quarter.

While the company stated that Unity’s condition was the main reason for the reduced flight cadence in the Q3 2023 earnings call, management also stated that Eve will be a “constraining factor” for Delta flights in the same earnings call.

So our first mothership Eve, as we fly with Eve and Unity, Unity is the bottleneck in the system. We’ll be able to turn Eve as an airplane around quickly, and we feel Eve is able to do two or more flights a week on spaceflights and Unity can’t keep up with that.

At that time, management was planning for a flight cadence of twice per week. Although it is theoretically possible for Eve to fly 3 times per week, there are some factors to consider.

The first factor that could impact this timeline is the expected wear and tear from the more frequent flights. In addition, the more frequent flights may stress the airframe Eve, which can lead to the formation of cracks in the airframe’s structural components and reduce the mothership’s performance. In fact, this might have been the cause of Eve’s alignment pin detaching from the launch pylon during Galactic 06 earlier this year, as I mentioned in my previous coverage.

Another factor to consider is the additional payload of Delta compared to Unity. Unity was designed to carry 2 pilots and 4 passengers, while Delta is expected to carry 2 pilots and 6 passengers. Therefore, it remains to be seen if Eve can carry the additional payload, which can only be known during testing. Considering that Eve has never made more than 1 flight per month in its 15 years in service, it may require more frequent maintenance due to these factors, which could be costly for Virgin Galactic.

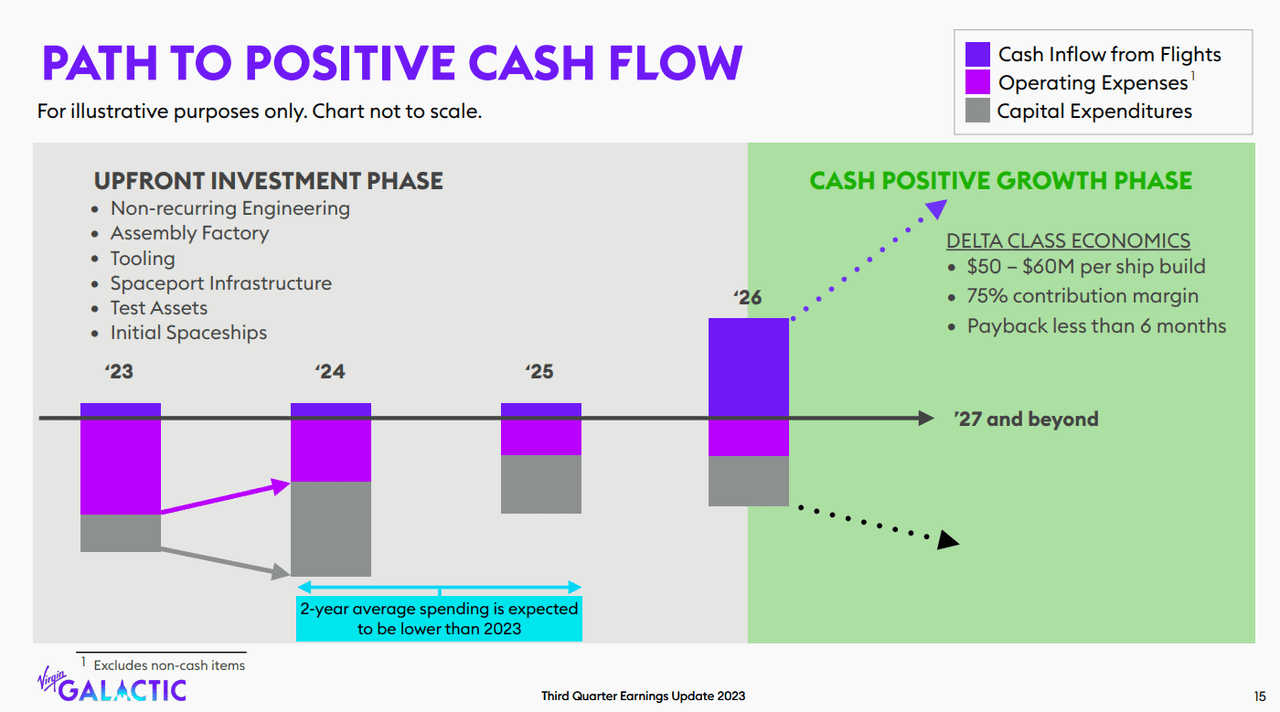

Eve’s condition aside, Virgin Galactic also may be behind schedule. In Q3 2023, the company forecasted an increase in cash burn in 2024 as it was supposed to be the year of peak spending on the Delta program.

According to management’s free cash flow forecast for Q4, the company is on track to spend less this year compared to last year. In 2023, Virgin Galactic’s free cash outflow was $492.5 million, while so far this year, its free cash outflow is $357.8 million, $126.3 million in Q1, $113.5 million in Q2, and $118 million in Q3. At the midpoint of management’s Q4 guidance for free cash outflow, $120 million, Virgin Galactic is expected to burn $477.8 million in total this year.

|

Period |

FCF |

|

2023 |

-$492,502,000 |

|

2024 |

-$477,814,000 |

In my opinion, Virgin Galactic’s underspending this year could be a sign that some expected spending is being pushed for next year, which could mean that the company may not have finished the design of Delta. This can be supported by management’s commentary in the Q3 earnings call where they stated some design bottlenecks which are causing tweaks in the design of the spaceship and the tools that will go into building the spaceship.

You’re like, oh, we’ll just adjust the flange and make that into a different place. But that one little simple thing in the design made a change to the tool that was already in process. And so therefore we have to now rethink through the tool dynamic and you know, it all works out and we had plenty of time to sequence that into how we build it so we don’t lose time off the critical path for that, but that’s what we’re trying to share is just it’s kind of the blocking and tackling of moving through assembly drawings and manufacturing work instructions. We continue to identify elements that need revision.

Sometimes those are pretty straightforward. Sometimes it needs a tweak to the design. Sometimes that’s it. Sometimes those designs ripple back through the toolpath, and then we have to start adjusting schedule sequencing to keep everything on track. So I was just trying to give a little bit of color into — those are the things that our teams are just battling day by day as is typical of a program like this.

Based on this ongoing process, the company’s plan to start assembling the spaceships in Q1 2025 may get delayed. In turn, testing and certifying the spaceships will also get delayed which can be problematic for the company due to its limited liquidity, in my opinion.

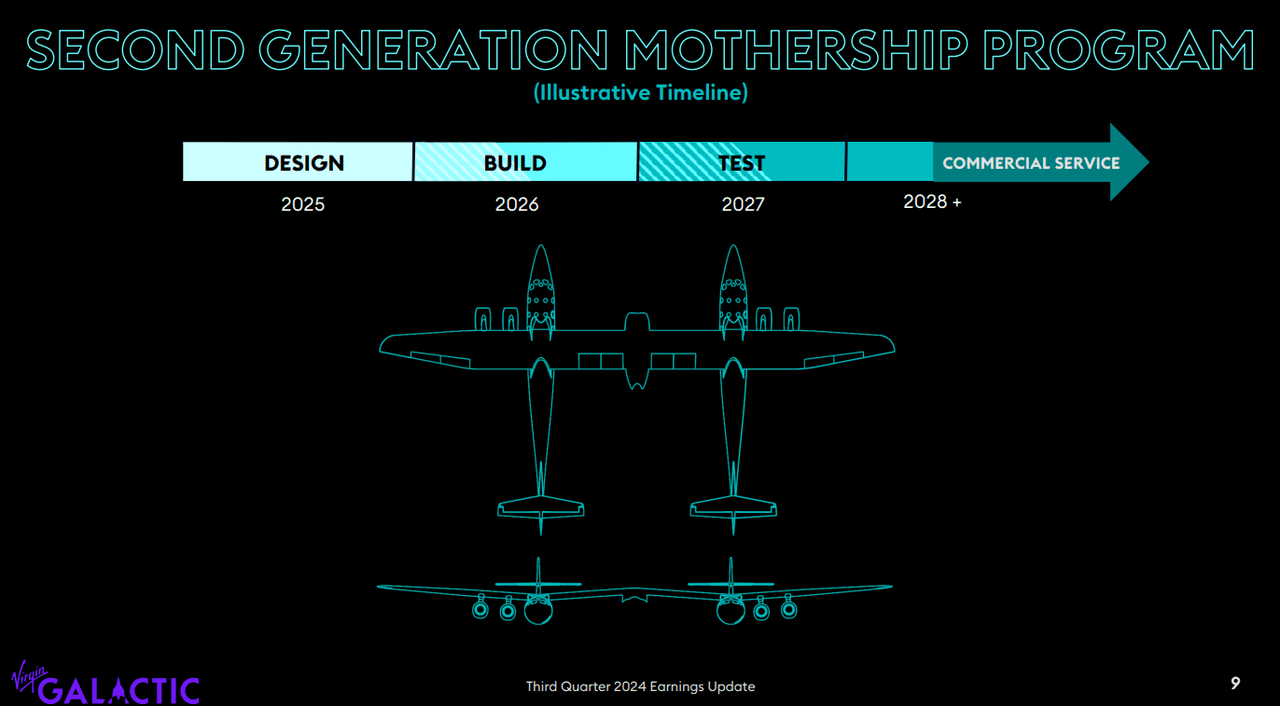

Moving on to the new mothership, Virgin Galactic plans to start the design process in 2025 once enough engineering resources are freed from the Delta program. The company then expects to build and assemble the mothership in 2026 and start testing in 2027 ahead of launching it into commercial service in 2028.

That said, the company is yet to announce its new partner for building the new mothership, with Boeing’s subsidiary Aurora now out of the picture. While Virgin Galactic has the capabilities to design the new mothership in-house, it doesn’t have the manufacturing capabilities to manufacture the mothership, since its manufacturing facility in Arizona is purposely built for the final assembly of the Delta spaceships.

As is, manufacturing a mothership is vastly different from manufacturing spaceships due to the scale, complexity, and customization involved in building a new mothership. Therefore, if Virgin Galactic decides to manufacture the new mothership in-house, it would certainly need to invest heavily in manufacturing facilities and equipment. In my opinion, this could be detrimental to the company’s future since it may not have enough liquidity to achieve this endeavor. Meanwhile, further delays in announcing a new manufacturing partner for the new mothership could extend this timeline, a luxury Virgin Galactic doesn’t have if it is to exist in the future.

Upside Risks

The main upside risk to my bearish thesis on Virgin Galactic is the company perfectly executing its plans and timeline without any delays. The company is already trading at a low valuation with a market cap of only $204 million, which could be a sign that the market is pricing in the company’s failure to execute its plans. Therefore, timely announcements regarding the completion of each stage in the company’s timeline could improve market sentiment around the stock, since that would increase the company’s chances of existing in the long term. As is, if the company achieves its revenue and adjusted EBITDA forecasts, it could have an extremely profitable future.

Conclusion

In summary, I’m still bearish on Virgin Galactic despite its depressed valuation. The company is in a make-or-break stage as its existence hinges on its ability to execute its timeline for both Delta and the new mothership perfectly. Although the company stated that its latest $300 million ATM offering is to develop 2 additional Delta spaceships, I believe these funds are critical for the company to reach 2026, the date it set to commence commercial flights of Delta spaceships.

That said, I don’t believe the company can achieve a flight cadence of 3 flights per week due to Eve’s old age, that may impact its ability to fly more frequently than ever for 2 years at least. Moreover, Virgin Galactic’s spending pattern this year could be a sign that the company is behind schedule in the design phase of Delta, especially when taking management’s commentary in the Q3 earnings call into consideration.

The company is also yet to announce a partner to manufacture the new mothership, which could delay the launch of the mothership over the expected timeline. Given the uncertainty surrounding the company’s execution of its plans and the debt wall it has to deal with in early 2027, I’m reiterating my strong sell for Virgin Galactic.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.