Summary:

- The rise in interest rates has shifted market sentiment, making it more difficult for companies reliant on external financing to offset negative cash flows.

- Virgin Galactic’s business model, which relies on space tourism for wealthy individuals, is unrealistic given its operating costs per customer are at least 30X its ticket price, excluding R&D.

- The company’s high operating costs and negative cash flows raise doubts about its ability to continue without significant changes or restructuring, given its annual losses are above its market capitalization.

- The one positive factor for SPCE is that its working capital is likely above its market capitalization, giving it potentially positive liquidation value, particularly if its intellectual property has value.

- Virgin Galactic may succeed more in supersonic air travel, a more realistic intermediate between air and space travel. An immediate shift in that direction could improve its market cap enough to prolong its life.

David McNew

The sharp rise in interest rates has led to a decisive shift in market and economic sentiment. The cost of money was virtually free over the period, extending from the initial QE and bailout responses in 2009 to the end of 2021. With interest rates at or near zero and the government rapidly increasing the money supply via waves of QE, the financial system had a significant excess of liquidity. Venture capital rose to fame as “Unicorn” companies dominated growth stock speculation. With money having so little intrinsic value, investors could afford companies to operate at negative cash flows for long periods, only promising some eventual ascent into long-term profitability. Over this period, many such “Unicorns” such as Snapchat (SNAP), Airbnb (ABNB), Uber (UBER), and others successfully transitioned from money vacuums to cash-generating machines.

However, the financial market regime changed dramatically at the onset of 2022. As inflation rose to the highest levels in decades, the Federal Reserve and its global counterparts began to hike interest rates and reverse their QE policies aggressively. Today, each day, around $2B to $3B is effectively “deleted” from the financial system due to quantitative tightening. The cost of money is the highest in decades, with money markets now offering 5%+ interest rates. Further, interest rates compared to inflation expectations are very high, with the 5-year breakeven rate (inflation expectation rate) at 2.3%, meaning 5-year bonds are expected to deliver a 2.6% return above the CPI. Accordingly, cash has been roughly at its peak investment value since the early 2000s.

This sharp change is great news for investors because lower-risk assets have much higher returns. However, it is potentially a death sentence for those companies still totally reliant on external financing. Companies that seek external money today through equity and debt financing are now paying far more because investors (and banks) have far superior risk-reward avenues. Further, for those seeing their stock price decline due to increased financing risks, bankruptcy is an increasingly likely occurrence when equity-dilution financing becomes untenable.

I believe Virgin Galactic (NYSE:SPCE) is an excellent case of this issue. The stock has lost around half of its value this year and has lost over 90% of its value since the 2020-2021 “free money” era. Its market capitalization has sunk to an abysmal $630M while its short interest has risen to an alarming 23%, signaling immense speculative bets against the company. Its forward EPS is -$1.80, but its share price is $1.75, so it cannot offset losses with equity sales unless the stock has another strong “dead cat bounce.” Of course, Virgin Galactic continues to float the dream of space tourism, with speculative outlooks suggesting profitability around 2027, though that date has long been delayed. I think the company will either need to prove itself soon or will never meet this goal.

The Decade of Realism over Idealism

Virgin Galactic’s business plan hinges upon a highly idealistic view. As investors, it is critical to balance the idealistic potential of creative dreams with realistic needs, limits, and trends. Personally, as an analyst, I am biased toward realism, but that may not always serve, considering companies like Tesla (TSLA) lost money for around fifteen years while focusing on idealistic goals until very recently achieving those dreams on a large scale. That said, I believe Virgin Galactic is a far more idealistic dream than Tesla, considering the path to middle-class use of EVs is far more realistic than middle-class use of space travel. Fundamentally, Virgin Galactic is a business catered solely to wealthy people with $450K seats. It will likely be some decades before that price comes down to a more reasonable level.

Furthermore, a fundamental basis for my view regarding Virgin Galactic stems from the shift in social sentiment around and following 2020. Since then, it seems there has been less public interest in idealistic dreams and more public interest in meeting the immediate challenges facing most people. Companies that can make inventions to lower living costs have a significant edge in this environment, while those producing inventions only accessible to a few people do not. An interesting 2021 survey showed that over three-quarters of UK people believed wealthy people such as Richard Branson (Virgin Galactic’s founder) “should focus their resources on problems facing Earth, like climate change, before space travel.” Companies make money both by selling dreams and solving real-world issues. In eras of abundance, the “long-term” dreamers have an advantage, while in more challenging economic periods, those solving real-world problems seem to.

Of course, while there are surveys that show the shift in public sentiment, it is not entirely provable. That said, it is critical regarding Virgin Galactic because the company can only exist if investors are willing to subsidize its immense losses. Investors give money to the company, and the company uses that money to offset losses on tourism flights for ultra-wealthy people. Thus, to an extent, many middle-class investors are essentially funding the whimsical desires of extremely wealthy people. To me, there is nothing wrong with wealthy people going to space as that is usually the first step in broader use, only that SPCE investors should understand how their money is being used.

How Long Can Virgin Galactic Fly Without Fuel

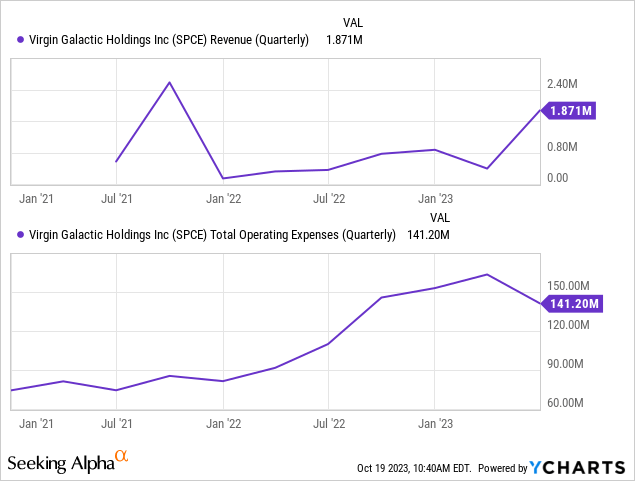

Virgin Galactic has had excellent revenue growth of 400% YoY from Q2 2023 to Q2 2022. However, its overall sum of revenue is ~$1.9M compared to around $400K last year, equating to three paying tourists. That compared to a total operating cost of $141M, or roughly $47M per customer. Thus, investors effectively subsidized ~99.5% of the cost of each ticket. Interestingly, the company’s operating costs are also rising quickly, potentially due to inflationary pressures on fuel and other items. See below:

Had Virgin Galactic charged the total price of ~$47M, I do not believe it would have many customers. I emphasize that point to illustrate how long the timeline will be before the company can break even, as even its high $450K ticket price is nothing compared to the actual flight cost. Of course, it is likely reasonable to add back R&D and depreciation, totaling about $90M last quarter. Ideally, its high R&D efforts will add value to the company, like capital investments. Excluding that figure, the cost of the three-customer flight would be ~$51.6M or $17.3M per person. The investor subsidization level falls to ~97.5% of the cost. Of course, we could try to account for less-scalable cost factors like management pay, but even then, the overwhelming majority of flight costs will rest on financiers, not customers.

The company currently aims to produce its next “Delta Class” ship around the end of 2027, which ideally will be more cost-effective. Of course, the actual date of commercial service remains very speculative, not to mention the high capital expenses the firm will likely face in building it between now and then. As it stands, the company almost certainly does not have adequate solvency and liquidity to offset these cash costs.

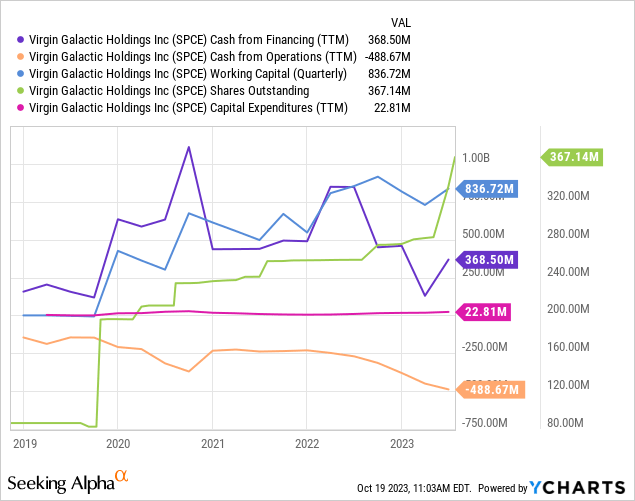

Over the past twelve months, Virgin Galactic has had -$488M in negative operating cash flows and $22.8M in capital expenditures. The line between R&D and CapEx is likely very vague in its situation, but they’re effectively the same given how few operating assets it owns. As such, I expect it to need at least ~$511M on a forward basis. The company also has ~$416M in debt from convertible notes. Still, I do not believe it will maintain that financing avenue in the future because of the heavy losses likely incurred on its existing notes due to its share price decline. Thus, all future cash needs will probably come from continued equity dilution.

Since 2020, SPCE has diluted its equity by around 46%. Initially, this worked well because its market capitalization was so high that only small equity sales were needed to raise enough cash to offset losses. One positive outcome is that Virgin Galactic has $838M in positive working capital today, predominantly cash and short-term investments. Indeed, its interest income of $8.4M last quarter was over four times as high as its revenue – one benefit of higher interest rates. See the key figures below:

At the end of Q2, the company had a working capital of $751M after removing inventories, prepaid expenses, and restricted cash. That adjusted figure is vital because it determines its capacity to operate at negative cash flows. That figure and its ~$511M needs give the firm ~1.5 years of life expectancy without external financing or sharp declines in overhead. However, the company aggressively diluted during Q3, potentially raising $400M and increasing its life expectancy to 2.2 years. Of course, about four months have passed since these data, and its operating overhead costs have consistently risen, so I believe its life expectancy from today is still likely to be close to 1.5 years.

That is not necessarily a poor figure, as its working capital today is likely the highest it has ever been and is above its market capitalization by potentially around 50% to 100%. If it is liquidated today, investors may come out ahead, potentially if its intellectual property has considerable value. However, its ability to survive is extremely questionable. If it wished to raise one year of expected cash needs, ~$500M, it would need to sell an additional 300M shares, causing its dilution level to double. Of course, should SPCE announce share sales, its price would almost certainly crash again, so the true dilution level would likely be much higher.

As we’ve seen with companies like AMC Entertainment (AMC) and GameStop (GME), there is always the possibility that a wave in retail speculator interest will push a failing company’s share price up so much that it can sell equity at a more reasonable cost. To me, that is one major deterrent to short-selling the stock. However, that probability seems relatively low given the decline in “meme stock” activity since interest rates increased.

The Bottom Line

I am firmly bearish on SPCE and do not believe it will survive beyond 2024 without extreme changes. That said, there are some potential reasons to be bullish on it. Further, I would not bet against it despite its poor prospects.

In any realistic outlook, Virgin Galactic’s business model is, to me, entirely unreasonable. The way I see it, the company depends upon idealistic dreams of (primarily) retail investors to offset the immense costs of space tourism for very wealthy people. While space tourism may someday be available to more people, that may require tremendous investment, likely needing scientific breakthroughs that solve the immense energy cost issues. Thus, this dream is still likely decades away from coming to reality. Although possible, I believe the route will not be by Virgin Galactic’s model because even its $450K ticket prices are nowhere near its actual operating costs.

Without immediate change to Virgin Galactic’s business plan, I do not see how the company can continue to offset losses via equity dilution without losing its existing market capitalization. However, if it were to alter its course to a more reasonable one, the company could attract a resurgence in investment that dramatically improves its potential. Its negative cash flows are very high compared to its market capitalization today. Still, if it were worth $20B as it was in 2021, then it could operate via dilutions for a sufficiently long time to make its dreams a reality.

To me, the intermediate link between air travel and above-atmosphere travel will most likely be supersonic plane travel. This was initially performed around three decades ago with the Concorde, which was retired due to costs. However, with modern technology, some companies believe supersonic plane travel may be profitable for middle-class people. Should supersonic jet travel return, then the expansion of that technology could eventually give way to Virgin Galactic’s ultimate aims. I can imagine Virgin Galactic may have relevant intellectual property for that endeavor. However, the company recently canceled orders for supersonic jets, likely due to the company’s weakened financial position.

While its poor business model makes Virgin Galactic’s failure seem inevitable and somewhat imminent, I would not bet against it due to the combined potential value of its working capital and intellectual property. I could be slightly bullish on the firm if it were keen on making a more reasonable transition today because its market capitalization is below its working capital. However, since it has not done so thus far, I feel it is more likely that SPCE has walked down the wrong path for too long that it will not alter its course. Therefore, I am bearish on SPCE and would be surprised if it avoids restructuring by 2025.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.