Summary:

- Visa continues to execute against a rough macroeconomic backdrop.

- Margins and growth remain strong, and share count continues to decrease.

- The stock’s attractive valuation vs. historical multiples is compelling and should entice GARP-style investors to begin/continue building a position.

- The ‘mounting competition’ narrative is overblown, and FedNow should impact P2P payment processors like PayPal much more than card processors like Visa.

Justin Sullivan

Currently, in the United States, there are roughly 4,646 public companies that are listed on the New York Stock Exchange and NASDAQ. Of these companies, however, only a few firms have the distinction of being “compounders”, or stocks that offer the unique prospect of compounding an investment’s value at a higher-than-average rate for long periods of time. Investing in a compounder at the right moment can offer tremendous relative and total returns vs. the market, and today we’re going to look at one of our favorites: Visa (NYSE:V).

This powerhouse has demonstrated that it shares the characteristics that all compounders have, including highly favorable supply and demand dynamics for company shares. As the stock has recently fallen into a range we find attractive, we think it’s time to take a closer look at Visa and determine whether or not it’s time to begin buying.

What Makes A Compounder?

So, what exactly defines a compounder? It depends on who you ask. Some analysts look at return on invested capital for clues, and some look at management / moat. Some investors measure IRR. Here at PropNotes, we take a slightly different view.

The important thing to remember is that compounding doesn’t happen automatically – it requires buyers and sellers in the market to agree that an asset’s value has increased vs. the year before. Thus, when it comes to finding an asset that will compound its value over time, there are only two factors that matter in our opinion: supply and demand.

How can we measure supply and demand? We’ve simplified it down into three variables. First – diluted shares outstanding. This is simply the amount of shares that currently exists, plus potential ownership interest as a result of warrants, employee options, convertible debt, etc. This is how we track supply, and ideally, we want to see it decreasing over time. If a company is retiring shares from the market, it means that investors will see a larger share of the pie over time without doing anything!

For demand, we look for growing revenue and free cash flow. These are great proxies for the scope, size, and ‘real’ profitability of a business, which are the key metrics investors care about in any investment.

Thus, when you add it all up, at its core, a compounder is a company that consistently increases its revenue and free cash flow, while simultaneously reducing its share count. This potent combination creates a wealth-building engine for investors.

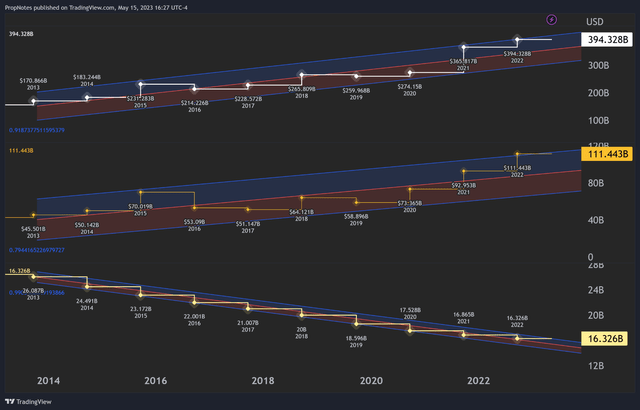

Take Apple (AAPL), for instance. Over the past decade, Apple has displayed the quintessential traits of a compounder. Its revenue and free cash flow have consistently grown, and the company has continually retired shares from the open market:

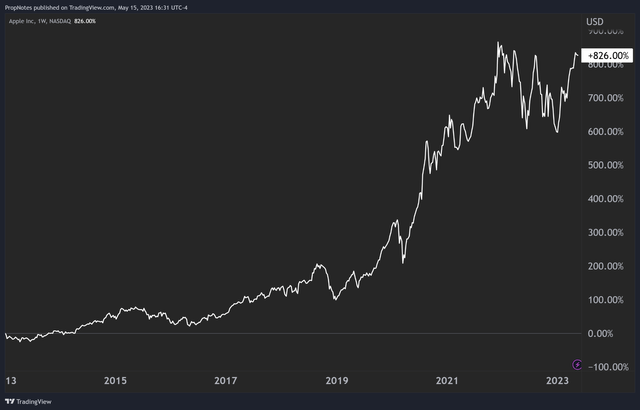

As a result, the stock price has increased more than 8-fold:

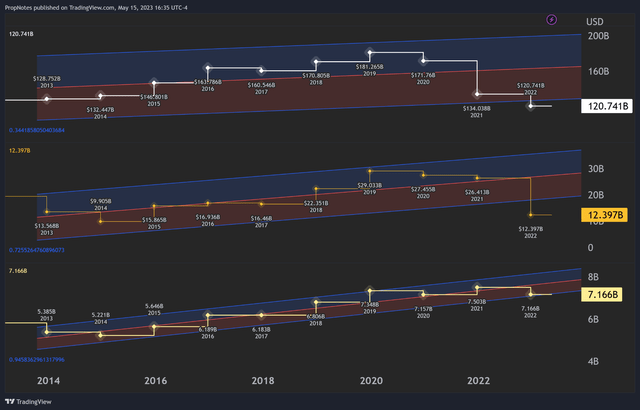

This example stands in stark contrast to a company like AT&T (T), where revenue has been flat, free cash flow hasn’t seen any growth, and shares outstanding have increased significantly:

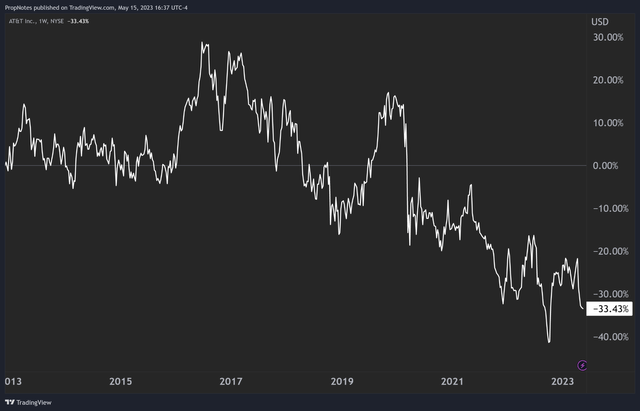

Even though AT&T is a highly profitable company, shares haven’t gone anywhere. In fact, if you don’t adjust the data for dividends, the stock is down by more than one-third in that time:

Remember: in the market, actions speak louder than words. No matter what investors, analysts, or executives say, it’s difficult to argue with a proven track record of a company built over a meaningful period of time.

Why Visa Is A Compounder

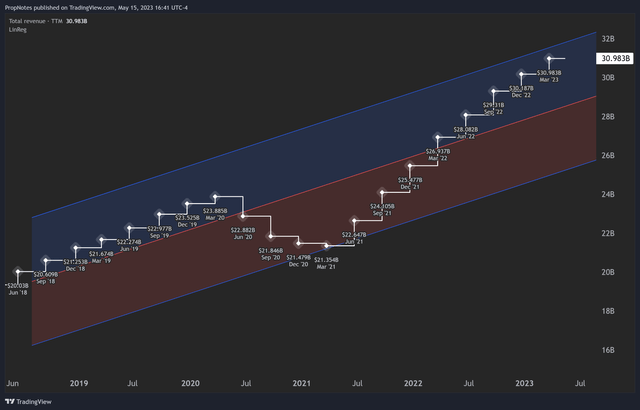

Shifting our lens to Visa, it’s clear the company has all the traits we look for in a compounder. Over the past five years, Visa’s revenue has steadily grown from $20 billion in 2018, to an impressive $30 billion today, reflecting a compound annual growth rate (CAGR) of 8.4%:

On a scale as large as the one Visa operates on, a 50% increase over 5 years is highly impressive.

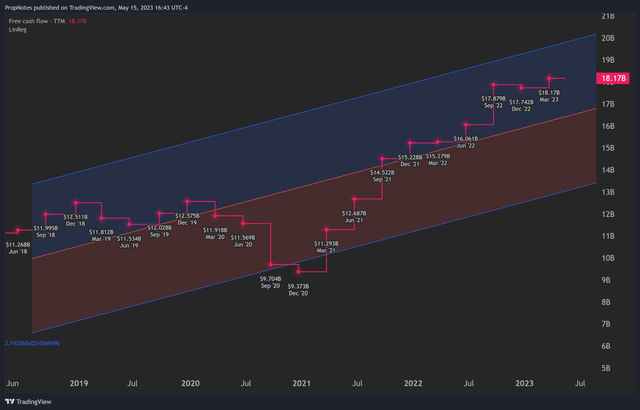

Simultaneously, Visa’s free cash flow has soared from $11.2 billion to $18.1 billion over the same period of time, which is a result of Visa’s solid business model and efficient cash conversion:

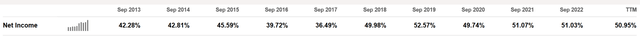

The growth in FCF (a CAGR of more than 9.5%) is also highly impressive – doubly so given the scale and margins, which are also market-beating:

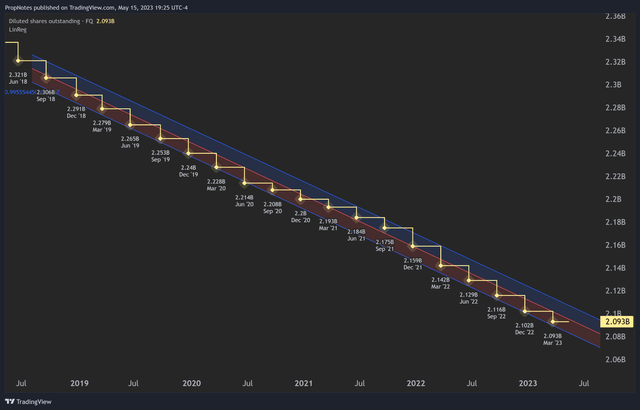

However, again, the magic of compounders lies not only in expanding financials (and demand for shares!) but also in a shrinking share count.

During the same period, Visa has diligently bought back shares, reducing the outstanding count from 2.32 billion to 2.09 billion:

This reduction, coupled with strong financial growth, has enhanced the value of remaining shares, thus benefiting long-term investors.

While the market obsesses over quarter-to-quarter speculation, Visa continues to deliver consistent, robust performance, affirming its status as a true compounder.

Why Now?

With a clear understanding of Visa’s compounder characteristics, the question arises: Why is now the right time to get involved?

Basically, now is a great time to build a position because the current valuation presents a compelling entry point.

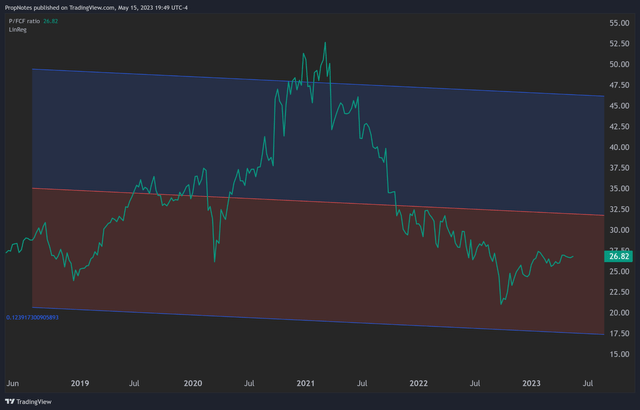

Visa stock currently trades at a 26x multiple of free cash flow, significantly lower than its five-year average of ~33x:

Additionally, the range of multiples over the last 5 years spans 21x to 52x, so 26x is clearly on the lower end of the spectrum here. It’s also trading below the long-term linear regression, which places the stock firmly in the ‘attractive’ camp.

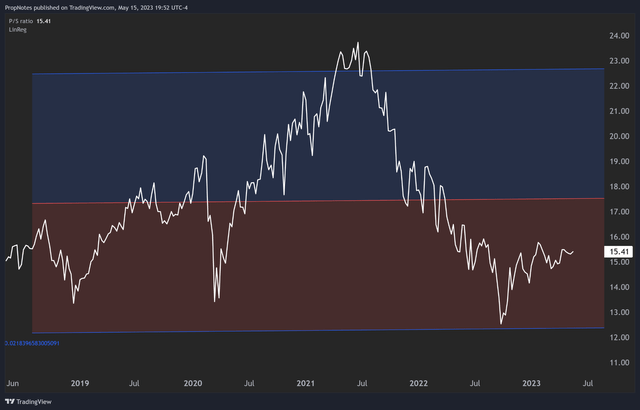

The stock looks similarly priced when evaluating the price-to-sales ratio, which sits at 15x:

This is vs. a 5-year historical range between 13x and 23x, which can be seen above. Normally a 15x price/sales ratio would be extremely high for such a mature company, but in this case, it only looks so high because the company’s margins are so large (~50%).

In sum, while picking exact bottoms and tops can be a tricky game, investing in companies with a proven compounder track record at attractive historical valuations is a great way to stack the deck in your favor. We think accumulating shares while the stock remains at this level is a great opportunity to get involved in Visa, if you haven’t already.

Risks

While the trade idea seems attractive, it’s crucial to be aware of the potential risks associated with Visa’s long-term thesis. Some of the key risks to consider include:

Business Execution: Visa’s ability to grow earnings may be hampered by market saturation, and raising fees may not be feasible, as we saw last year with the UK Amazon (AMZN) standoff. If the company can’t find ways to further monetize its network, then the company’s growth will slow to the rate of GDP growth, which will likely demand a lower premium and thus cause a dip in the stock price.

Competitors: While Visa currently forms one-half of a duopoly co-inhabited by Mastercard (MA), competition is coming from all sides for Visa’s fat margins. Cryptocurrencies are in their early stages of development but will likely eventually boast a network both cheaper and faster than Visa for P2P, B2B, and B2C payments. Neobanks and competitor networks are always innovating and undercutting costs, and FedNow promises to shake up the world of payments with instant, or near instant payments from bank account to bank account. We view these risks as widely overblown. FedNow should eat into PayPal’s margins, not Visa’s. That said, Visa has a target on its back, which should not be taken lightly in the world of business.

Macro: Visa is subject to broader macroeconomic risks, including interest rate fluctuations, economic downturns, and changes in government policies that could impact the consumer credit / financial sector. If the economy slows, then revenues and margins should decline in kind as the velocity of money, and thus fees, are reduced. This happened in 2020, and is one of the key reasons that the valuation is attractive right now – the market is expecting a recession.

Technical Sentiment: Visa’s stock has outperformed in this recent bear market, but there’s always a risk that negative sentiment or the recent period of choppiness could persist longer than anticipated, impacting the trade’s opportunity cost.

Summary

In conclusion, the investment thesis for Visa is compelling and straightforward. As a proven compounder, it has consistently demonstrated robust financial growth and efficient capital allocation. Its track record of increasing revenue and free cash flow, coupled with a decreasing share count, underscores the company’s commitment to delivering shareholder value. Despite the bleak macro outlook, Visa’s strong fundamentals remain intact. Now is the time for savvy investors to tap into this undervalued gem, poised to continue along its trajectory of success.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in V over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.