Summary:

- Visa and Mastercard exhibit astronomical returns on equity. They have a history of exponential growth via profit reinvestment and a history of aggressive share buybacks.

- Both companies faced class action antitrust lawsuits over swipe fees, settling for billions of dollars and facing ongoing legal battles. Whether they will ultimately be regulated is an open question.

- Market valuation shows similarities between Visa and Mastercard, with their pricing reflecting that of a growth company with an asset-light business model. They are currently at relative low valuations.

Jacob Wackerhausen/iStock via Getty Images

Exponential Growth & Business Model

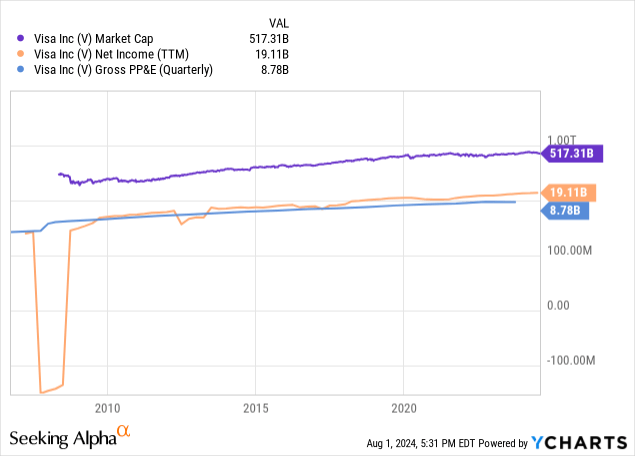

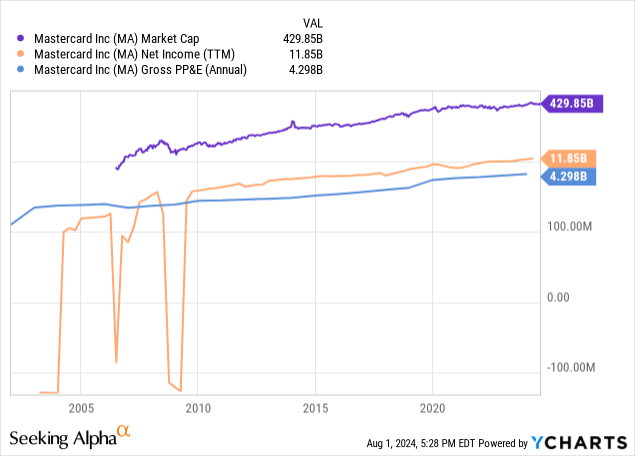

Visa (NYSE:V) and Mastercard (NYSE:MA) are masterful at compounding their profits by reinvesting them: ever since their IPOs, they have exhibited exponential growth. I will plot their gross PP&E account, net income account, and market capitalization on the same logarithmic plots:

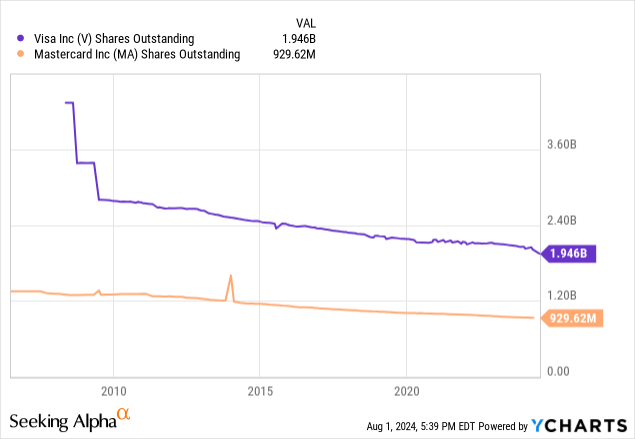

There are some quirks with using log plots like this. A straight trend line on a log plot actually implies exponential growth, which is exactly what the fabled “compound growth” is. A vertical gap that is about the same size wherever you look on the graph between two lines expresses a multiple. So actually, for both companies since 2010, their TTM net income is a multiple of their gross property, plant & equipment. This is a very rare sight indeed. Anyway, the point I want to make is that both companies have been doing rapid organic growth. They are so profitable that they have been recently returning substantial amounts of capital via aggressive share buybacks:

How do these companies make money? Visa and Mastercard are the technological muscle behind card transactions: they are the intermediary between the customer, the merchant, and the customer’s bank that facilitates transactions by transmitting data and moving money. In every card transaction, a “swipe fee” is charged by the customer’s bank to the merchant, equal to about 150-350 basis points worth of the transaction. Generally, the payment processor earns about 25 of those basis points as revenue (source video here), while the rest generally funds the rewards program the customer is participating in. It will be important to note that the majority of the “swipe fee” actually funds the rewards – only a small fraction of it goes to the payment processor.

In effect, payment processors are a toll booth on a payment highway, charging a fee for every transaction on that highway. This “highway” is very busy indeed. A Nilson report stated that worldwide, payment cards (including credit, debit, and prepaid cards) reached $40.645 trillion USD in 2022, for a total of 684.26 billion transactions. These figures include cards from Visa, UnionPay, Mastercard, American Express, JCB, and Diners Club/Discover. UnionPay, Visa, and Mastercard represented 40%, 35%, and 20% of global volume. For those who don’t know, UnionPay is a Chinese state-owned enterprise that provides payment processing services; its market is almost entirely just composed of mainland China.

Market Power & Antitrust Lawsuits

Visa started out as the BankAmericard by Bank of America, and it was first introduced to the market by mass mailing credit cards and saturating the mailboxes of entire US cities with them in the late 1950s and 1960s. Additionally, the BankAmericard system was licensed to other banks around the world. This firmly established a network of merchants and banks that all accepted the same payment processor. By 1970, Bank of America gave up control of the program, forming a cooperative with other BankAmericard issuer banks to form a new management for it. In 1976, it was renamed as Visa, and the IPO was in 2008. Mastercard’s story is similar: it too started out as a cooperative owned by various banks and financial institutions, with its IPO in 2006.

As a result of how both companies were built, Visa has the first mover advantage, incumbency advantage, and network effect intrinsically built in its favor, and Mastercard has the incumbency advantage and network effect in its favor too. One key to note is that the consumer is not the one who picks what payment processor that gets used in a transaction. When a consumer is issued a credit card, the payment processor is bundled along with the card. When was the last time that your credit card payment was sent to the wrong merchant? Regardless of whether you use Visa, Mastercard, UnionPay, or some other processor, the answer is likely never. This means you’ve probably never thought about switching between Visa, Mastercard, or some other payment processor. Additionally, Visa and Mastercard are nearly ubiquitously accepted, further cementing the network effect: there’s no need to fix what isn’t broken, so why swap payment processing providers?

The flip side is true for merchants; now that Visa and Mastercard are ubiquitously carried by consumers, choosing to not join the Visa / Mastercard network would severely crimp the possibilities for performing transactions with customers. So there is pressure for merchants to accept both Visa and Mastercard. It goes further by locking merchants into paying the swipe fees. And yes, Visa and Mastercard have a LOT of market power. Just look at the trail of lawsuits and settlements (this is not an exhaustive list).

Antitrust Lawsuits & Settlements

Dec 13, 2013 – Visa and Mastercard reach a $5.7 billion settlement with retailers over swipe fees. The original settlement was reached in July 2012 and was worth $7.2 billion, but many merchants bowed out of the deal because accepting the deal would waive the right to sue Visa and Mastercard individually. Up to then, this was the largest private antitrust settlement in US history. After this deal, there was still significant discontent among retailers, and the National Retail Federation, National Association of Convenience Stores, and the National Community Pharmacists Association were considering appealing the settlement, saying that “the deal will not change the fighting between merchants and card companies”.

June 30, 2016 – The above-mentioned settlement was thrown out by a federal appeals court, on the grounds that it would be unfair to many retailers that would not receive any payments and receive little to no benefit. The suit was decertified as a class action. The general counsel to the National Retail Federation said that the settlement “would have forever shielded card networks from a variety of litigation while giving retailers “at best” three cents on the dollar in damages.”

Sept 18, 2018 – Visa and Mastercard agreed to pay $6.2 billion to settle a lawsuit brought by merchants over swipe fees. Visa said it would pay $4.1 billion and Mastercard would pay about $900 million. The original lawsuit dates to 2005, when both companies were still privately owned by the banks. The allegation by merchants was that Visa and Mastercard used their dominant position in the market to impose artificially high swipe fees that totaled billions of dollars. There had originally been a settlement in 2012, but it was thrown out by a federal appeals court.

March 15, 2023 – The Court of Appeals for the Second Circuit upheld the district court’s order on a $5.54 billion settlement between Visa and Mastercard and about 18 million businesses that accepted Visa or Mastercard for a 15-year period ending Jan 25, 2019. The merchants allege that they paid excessive swipe fees in order to accept Visa and Mastercard cards.

March 26, 2024 – Visa and Mastercard reach an antitrust settlement with US merchants over a two-decade-long series of litigation about swipe fees. The result of the deal was to lower and cap swipe fees for 3 to 5 years, and let small businesses collectively bargain for rates. The value of the saved swipe fees is calculated to be close to $30 billion dollars. For a comparison, Visa’s 2023 revenue was $32.7 billion, and Mastercard’s revenue was $25.1 billion – this settlement is big enough to move the needle on their financial results.

The exact terms of this settlement were that Visa and Mastercard would reduce swipe fee rates by at least 4 basis points (out of an average of 219 basis points that is the typical swipe fee), and ensure an average rate that is seven basis points below the current average for a period of 5 years. Additionally, rates would be capped for 5 years and remove anti-steering rules.

June 26, 2024 – A federal judge rejects the $30 billion settlement as mentioned above. Many merchants and trade groups opposed the settlement because they argued that card fees would remain too high. Visa and Mastercard could be forced to negotiate a deal that is even more favorable to merchants, or go to trial and expose themselves to legal risk again.

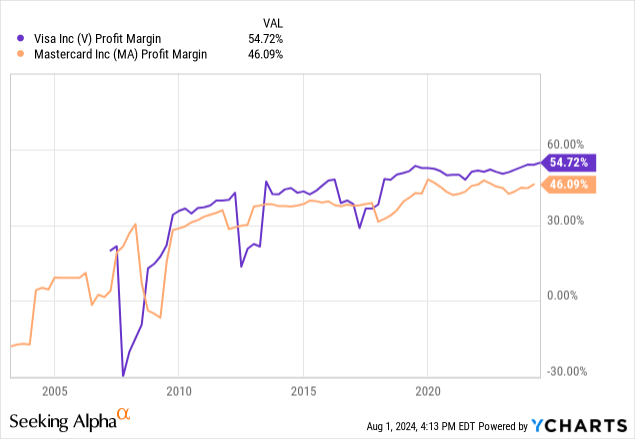

A quick Google search for “price war between Mastercard and Visa” turns up nothing substantial. Indeed, if we look at Mastercard and Visa’s net profit margins, I highly doubt whether Mastercard and Visa ever competed with each other on price (swipe fees); both companies’ net profit margins have been in the 30-60% range over the past decade.

The fact is that both Visa and Mastercard are, economically speaking, “natural monopolies”, where customers are best served by a monopolist in the market because of network effects and economies of scale. The difference between payment processors and public utilities though is that payment processors are “asset light” while public utilities are capital intensive; hence payment processors, if unregulated, tend towards oligopoly or monopoly and have high profit margins.

The single biggest long-term risk I see in investing in Visa or Mastercard is the chance that one day, they will become regulated in some way, the worst way being as though they were public utilities. Looking at the results of the past decade’s worth of litigation results, that still seems far off, as the notion of Visa and Mastercard as public utilities hasn’t seemed to show up yet. Such regulation would easily cut their share prices in half at least, by making the swipe fee pricing depend on a cap on returns to equity – their current return on equity is almost 50% while electric utilities are generally capped at 10%. To be clear, I’m not the only person who can see how payment processors might be public utilities; this Forbes article from March 2023 expresses this sentiment without naming Visa or Mastercard. Given the recent development of the $30 billion settlement being rejected for being too small, how big can a settlement get? How much do Visa and Mastercard ultimately need to give up in order to end this litigation? That question will hang in the air for the next few years.

As my personal remark, the target of these lawsuits seems somewhat confused. The main complaint of the plaintiffs is the overall size of swipe fees as a fraction of the total value of a transaction. Given that on average only 25 basis points of the 150-350 basis point swipe fee on the total value of any transaction goes to the payment processor (source video here), with the bulk of the rest going back to the consumer in the form of card rewards programs, the banks’ credit card rewards are the root cause of the majority of their complaint. I would regard these lawsuits just as an expression of misdirected frustration on the part of the merchants. Whatever the case, they are a risk that an investor in Visa or Mastercard must bear.

Market Valuation & Growth Prospects

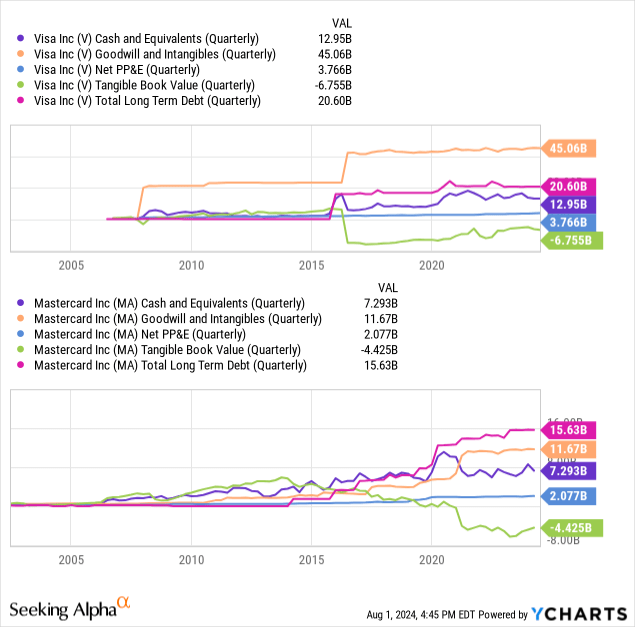

Let’s start by peeking at the financial statements – it turns out that they have some similarities. Their balance sheets have a LOT of goodwill and intangibles on the asset side, so as a result, Visa and Mastercard’s tangible book values are both large negative numbers. They both hold a lot of cash and cash equivalents too, so they have plenty of liquidity. And their net PPE accounts are very small – they are both very asset-light businesses.

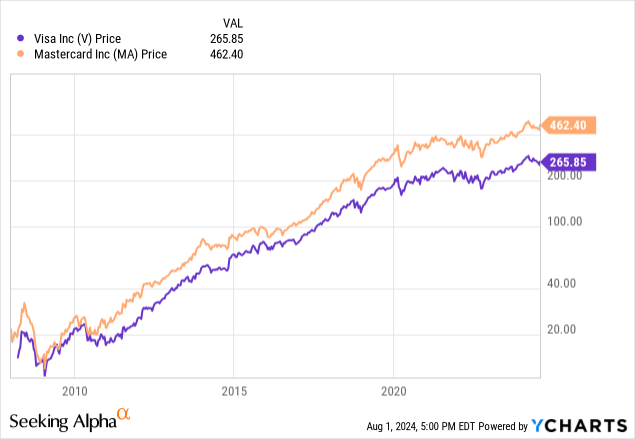

Their similarity extends beyond just the balance sheet; obviously, their business models are the same: be a toll booth operator that charges a fee in exchange for processing a payment. They’re so similar that even their share price volatility looks similar if we zoom out and look at the big picture on a log scale:

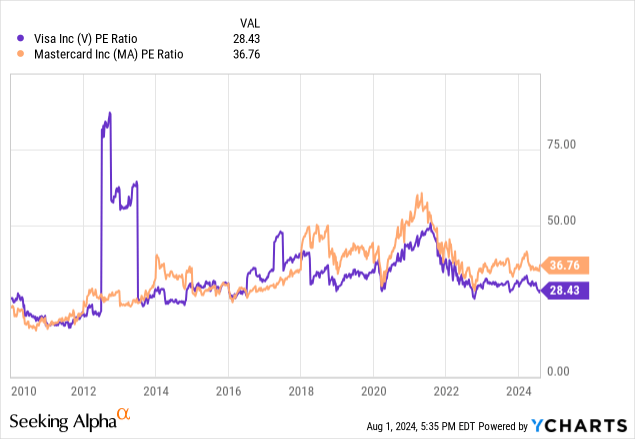

This suggests that the market sees Visa and Mastercard as almost interchangeable companies for portfolio management purposes. Hence, I think it makes sense to discuss their valuation together. Both companies have traded at substantial P/E multiples, as would befit growth companies:

As it happens, despite both companies being near their all-time high share prices, are currently trading at the lower end of their historical P/E market valuations, with Visa being the somewhat better deal of the two. There was a bump in their P/E ratios in 2020-2022, likely because of the lowered interest rates. With both Visa and Mastercard trading at relative lows of their historic P/E ratios, now would seem like a good time to start a position in them. But as I said before, the single biggest risk to their business model is regulation and lawsuits – so that should be in the back of your mind if you do choose to invest in Visa or Mastercard.

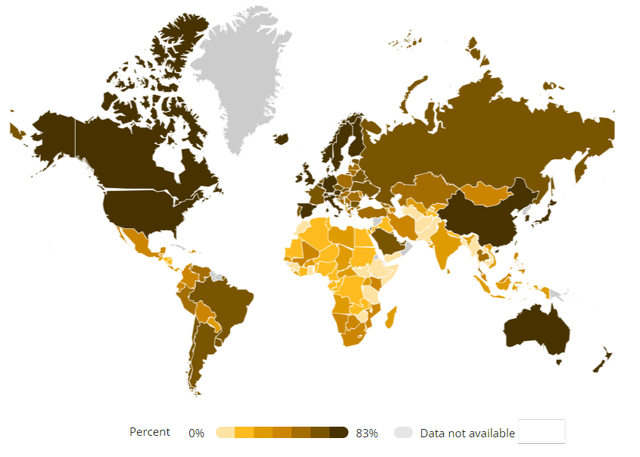

Let’s look at their growth prospects next. The map I display below shows the % market saturation of credit cards in the age 15+ population of various countries around the world (source here):

World Bank Group

Most of the developed countries’ markets are nearly totally saturated, though not at 100% level yet, indicating there is relatively less room to grow there via growing market share. There is still room for growth via GDP growth in places such as the USA, Canada, UK, Germany, Spain, Scandinavia, Italy, Japan, and Australia via per capita GDP growth: as GDP grows, so does spending too.

Next, let’s look at the developing countries. The Chinese market is nearly monopolized by the state-owned enterprise UnionPay, which basically takes China out of consideration. The next largest market is India. Here, the Indian government is promoting its own RuPay payment processor, but not at the exclusion of others. While there is room for market share growth here for both Visa and Mastercard, like with other developing economies because the per capita income is smaller, the average size of each transaction is smaller, and so there is less revenue to be had per % of market share.

The two points above suggest to me that going forward, Visa and Mastercard’s growth will not be nearly as explosive in the future as it has been in the past, when they were largely working to saturate the developed markets. Overall, there is nearly nothing that differentiates Visa and Mastercard here in terms of growth prospects. They are nearly ubiquitously accepted worldwide and are the two hegemons of payment processing worldwide. This means that they can be valued at approximately the same P/E, albeit perhaps with a slightly lower P/E multiple for the future (say 25-30) because they have largely used up their explosive growth possibilities in the developed markets.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.