Summary:

- Visa Inc. is likely to continue to perform in line with the large cap growth stocks, and this is not necessarily good news.

- An upward multiple repricing appears limited once we consider the drivers behind it.

- As growth slows down, market-wide forces should be in the driver’s seat for Visa’s returns going forward.

Thomas Cooper

Visa Inc. (NYSE:V) is among my favorite picks in the electronic payments space, but as an investor looking to outperform the market, I have a hard time considering the stock as a high conviction idea.

In spite of its highly profitable business model, competitive positioning within the industry, and iconic brand, Visa has become a company that more likely to perform in line with large cap growth stock as a whole, as opposed to delivering superior returns.

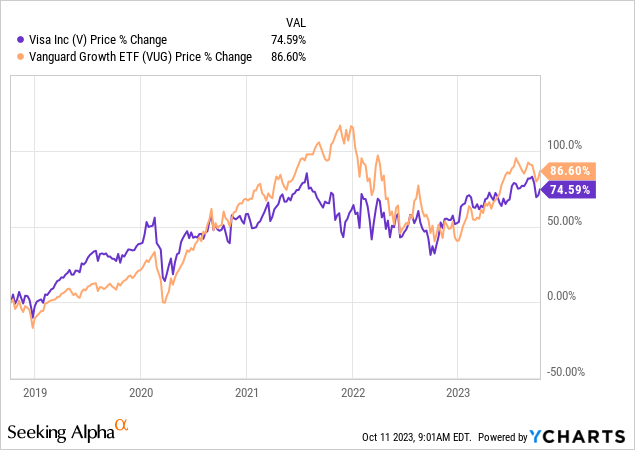

When I say growth stocks, I mean the Vanguard Growth Index Fund ETF Shares (VUG), which is an area of the market that I don’t see to be as attractive as it used to be over the past decade.

In spite of Visa being massively different from the big tech names in the VUG, the company’s share price has performed largely in-line with the aforementioned exchange-traded fund (“ETF”).

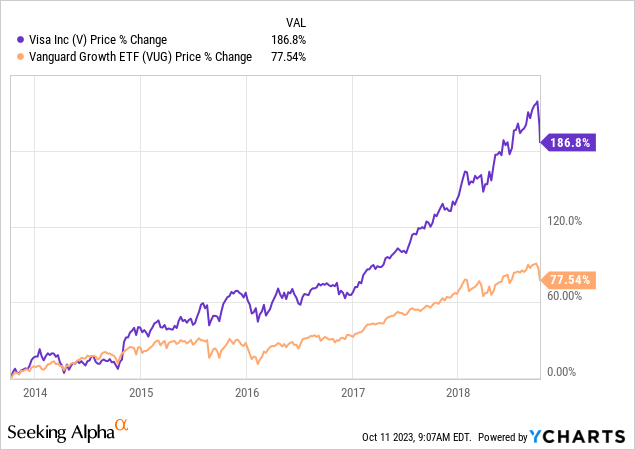

The prior 5-year period, however, was vastly different for Visa, which outperformed the VUG by a very wide margin.

This clearly illustrates that something fundamental must have changed for Visa and even though the company continues to grow and solidify its competitive advantages, its upside relative to the VUG appears limited.

What Happened?

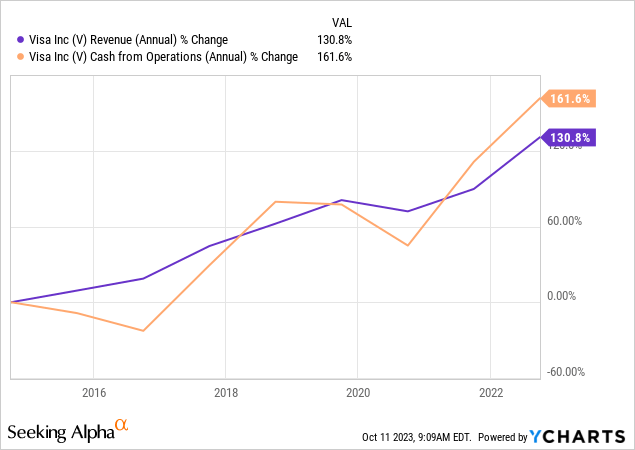

Visa’s net revenue and cash flow growth over the past 10-year period has been fairly consistent. At a glance, nothing distinguishing could be spotted between the first and the second 5-year period.

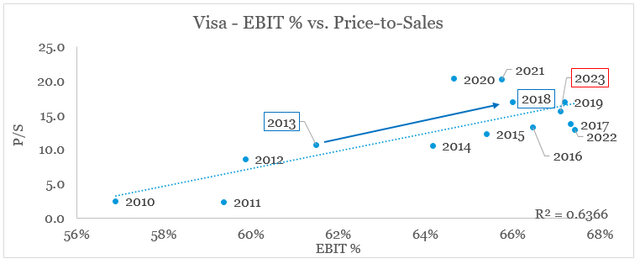

But once we map Visa’s operating margin against its price-to-sales multiple on a historical basis, we observe the following:

- there is a relatively strong relationship between the two variables;

- and at the moment, Visa’s exceptionally high operating margin is supporting the company’s sales multiple.

prepared by the author, using data from Seeking Alpha and SEC Filings

More importantly, however, the graph above could help us explain why the two 5-year periods we observed above were so different when it comes to Visa’s share price return.

At the starting point of the first 5-year period (around the end of FY 2013), Visa’s operating margin of around 61% has resulted in a sales multiple of around 10. As margins improved, however, and reached the 66% – 67% range, the P/S also expanded. But as we note, even though there are fluctuations in recent years, a consistent upside from here appears limited.

Furthermore, Visa’s operating margin seems to have peaked at around 67% which leaves multiple expansion out of the equitation.

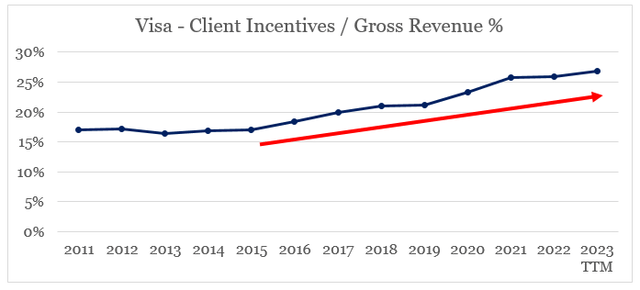

Recent revenue growth for Visa has also allowed the company to keep its margins stable, in spite of the growing share of client incentives as a share of Visa’s gross revenue. This ratio has increased from 17% in FY 2015 to 27% during the past 12-month period.

prepared by the author, using data from Seeking Alpha and SEC Filings

During the latest quarter, this ratio stood at above 28% and is expected to come at the high end of the range for the whole fiscal year.

Client incentives were 28.1% of gross revenues, in line with our expectations. (…)

Source: Visa Q3 2023 Earnings Transcript.

This high level of client incentives has also allowed Visa to retain its revenue growth in recent years as competition intensifies and growth in electronic payments accelerated.

And incentives, everybody focuses on the percentage. If you look at what really counts, which is net revenue growth, we had healthy net revenue growth in the quarter.

Source: Visa Q3 2023 Earnings Transcript (emphasis added).

Should top line growth experience a slowdown, Visa will be in a good position to reduce the level of incentives and thus balance the net revenue figure, but this is unlikely to provide a tailwind for margins.

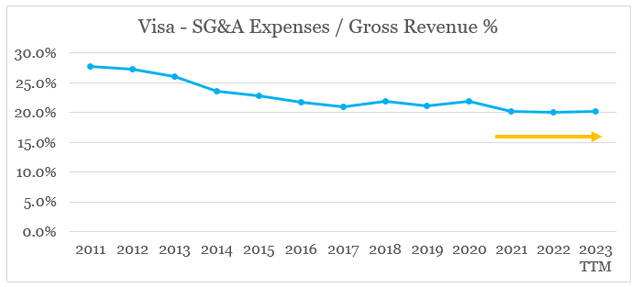

At the same time, economies of scale as far as fixed costs are concerned are reaching their limits. After nearly a decade of falling SG&A expenses (selling general and administrative expenses) relative to gross revenue, the ratio has now become stable at around 20%.

prepared by the author, using data from Seeking Alpha and SEC Filings

What Now?

Even though Visa has significant moat and is one of the highest quality businesses in the sector, future returns are now heavily influenced by outside factors that have little to do with Visa’s operational performance.

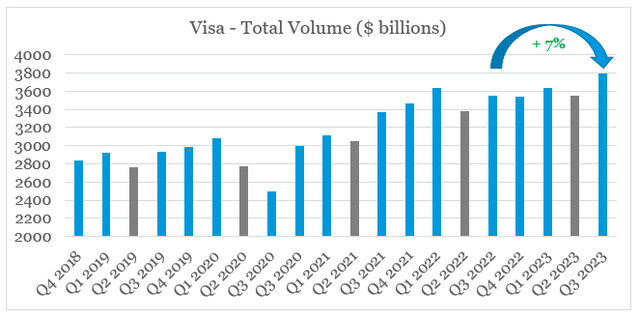

After a seasonally low second quarter, total volume during the 3rd quarter of the current year stood at 7% on year-on-year basis, which is not significantly higher than the current rate of inflation.

prepared by the author, using data from quarterly operational updates

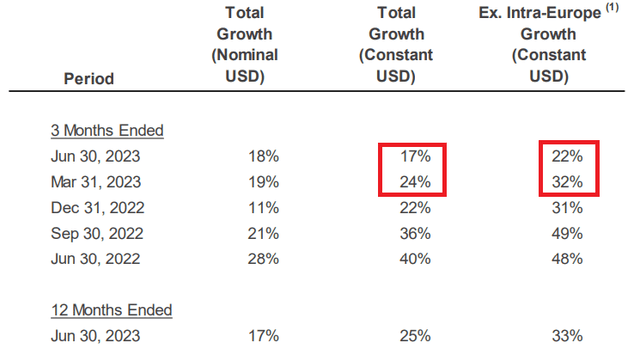

Growth in the lucrative cross-border volumes is also slowing down after recovering from the pandemic lockdowns in 2020-21 period.

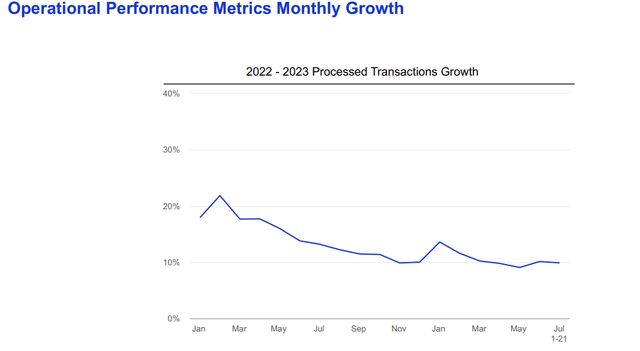

The nearly 20% transaction growth in 2022 is also coming down to around 10%, which is a notable decline in an inflationary environment.

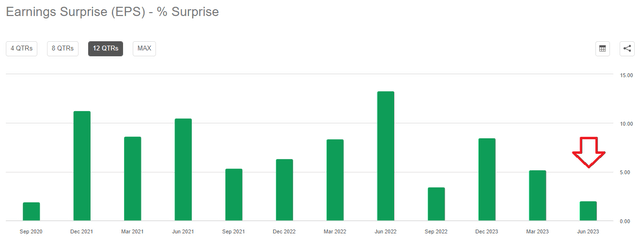

With the outside tailwinds slowly dissipating, we also note a meaningful drop in Visa’s quarterly EPS surprises above the consensus estimates.

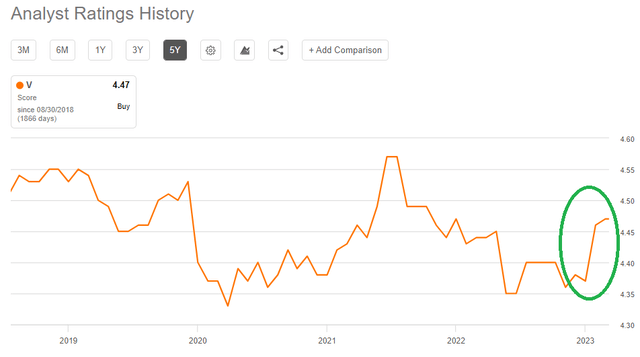

Although this is not troubling on itself, analysts are very bullish on the stock and are still rushing to upgrade their ratings which provided a short-term support for Visa’s stock on top of the broader market forces.

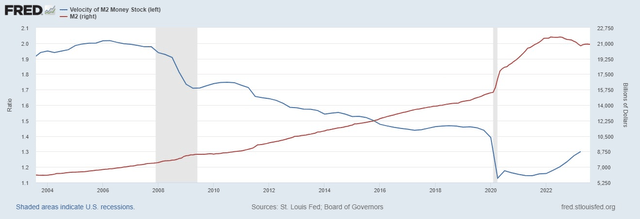

This is largely driven by the narrative that the U.S. will be avoiding a recession and that a ‘soft landing’ is now the base case scenario. So far, the higher velocity of money stock has been enough to offset the slight fall in M2, but the dynamic between these two variables will be of paramount importance for Visa’s operational performance going forward.

Investor Takeaway

With a limited opportunity for multiple repricing and a high likelihood of slowed topline growth ahead, Visa’s future upside is not something to be excited about. Having said that, however, the high quality business model and industry positioning offer a meaningful downside protection which makes V attractive for risk-averse investors.

It also makes the stock a good fit for a well-diversified portfolio with significant exposure to more defensive areas of the market. The reason being that Visa Inc. stock is highly likely to continue to perform in line with growth stocks, but at the same time is offering more downside protection to other peers in the sector.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for similarly well-positioned high quality businesses in the electronic payments space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

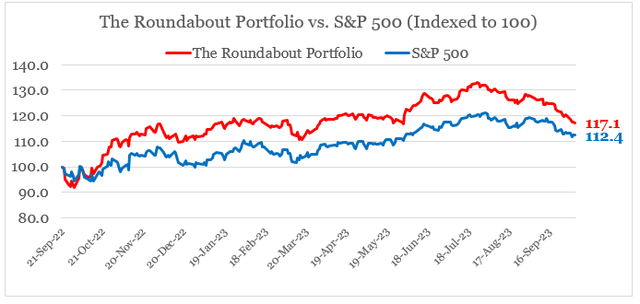

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.