Summary:

- Visa’s growth slowed a bit sequentially in fiscal Q3, but remains healthy.

- The payment processor’s net investment income was much greater than interest expenses through the first three quarters of FY 2024.

- Shares of Visa are priced 20% below my fair value estimate.

- The payment processor could generate 40% cumulative returns through September 2026.

FinkAvenue

This article was coproduced with Kody Kester.

Long-time readers are probably familiar with my dividend growth investing story. But for those who aren’t or are new readers, my interest in this discipline began from a theoretical standpoint at the age of 12 (that was 15 years ago).

However, I didn’t begin investing with real money until I finished my first two years of undergrad in 2017. At that time, I also started my first full-time job in a paralegal setting.

After all of my time learning about investing theory, I certainly made some mistakes along the way. Theoretical learning is great and all. But as the expression goes, experience is the greatest teacher.

When I first began real money investing, I fell into the same trap that so many investors have over the years: I was too laser-focused on my current passive income. In other words, I lost track of my future passive income.

This is understandable. All humans seek immediate gratification to some extent. And let’s be honest: The fruits of dividend growth investing to beginners are about as far from immediate as possible.

My dividend stock purchases threw off two or three dollars of dividends here and two or three dollars of dividends there. In the earlier stages of my investing career, I had some great picks, like Williams-Sonoma (WSM).

But in my retrospective opinion, I was all too often focusing on the immediate income story of my portfolio (you know, the stagnant/slower-growing dividend stocks). To be clear, there’s a place for those in my portfolio. But being in my early to mid-20s, I was overallocated to such picks.

In practice, I had lost much of the dividend growth investing theory that I embraced in my adolescence.

Well, I’m happy to report that I’m taking a more balanced approach to dividend growth investing. As of late, I have been leaning more heavily into world-class dividend growers than in the past.

For my money, Visa (NYSE:V) (NEOE:VISA:CA) is the textbook definition of a dividend compounder. When I last covered it with a buy rating in April, there was a lot to like. Long-term tailwinds were intact. The company’s corporate credit rating was AA- from S&P on a stable outlook. Shares were also moderately undervalued at the time.

Today, I’m upgrading shares to a strong buy rating.

Despite the slowdown in sequential growth, Visa’s business model is still advantageously positioned to cash in on secular growth trends over the long haul. The company’s balance sheet remains a financial fortress. Not to mention that the recent pullback in share price represents the best buying opportunity since last fall.

Even A “Bad” Quarter From Visa Is Impressive

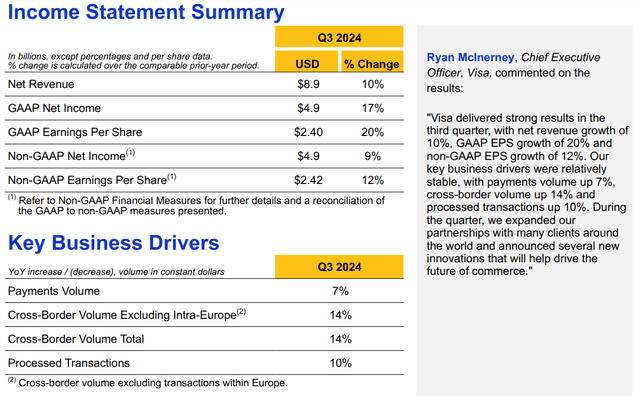

Visa Q3 2024 Earnings Press Release

In my opinion, a trademark of a high-quality business is its ability to consistently beat analysts’ expectations. This is one of the most obvious signs of a business with significant competitive advantages and growth catalysts.

Well, Visa has been one of the most reliable performers in earnings season for many years now. In 19 quarters leading up to its fiscal third quarter, the payments processing leader topped the analyst consensus for net revenue in 17 of those quarters.

The story was similar with adjusted diluted EPS, with Visa exceeding the analyst consensus in all but one of those quarters.

When the company shared its fiscal third quarter results yesterday (July 23), it wasn’t the strongest quarter, at least not by Visa’s exceptionally high standards.

Net revenue came in $20 million shy of Seeking Alpha’s analyst consensus – just Visa’s third net revenue miss in the past five years.

However, most companies can only dream of even their “good” quarters matching one of Visa’s “bad” quarters. This is because the company’s net revenue surged 9.9% higher year-over-year to $8.9 billion during the quarter.

Visa’s topline growth was made possible by all-around contributions throughout the business.

For starters, the company’s payment volume grew by 7% in constant currency over the year-ago period. This was slightly slower than the 8% constant currency payment volume growth in Q2 2024.

As Visa added more merchant locations, that continued to feed the virtuous cycle of cardholder growth. This resulted in an 8% year-over-year growth rate in cardholders heading into Q3 2024.

According to CFO Chris Suh’s opening remarks during the Q3 2024 Earnings Call, this growth was partially offset by moderation in the lower-spend consumer segment. Put another way, some consumers are cutting back on spending.

This tightening of some consumers’ financial belts also trickled down to Visa’s cross-border volume growth. That dipped sequentially from 16% in Q2 to 14% in Q3.

Due to slowing spending, Visa’s processed transactions growth decelerated as well, from 11% in Q2 to 10% in Q3.

Moving to the bottom line, the company’s adjusted diluted EPS climbed by 12% over the year-ago period to $2.42 in the fiscal third quarter. That was in line with Seeking Alpha’s analyst consensus for the quarter. Just as Visa’s key operating metrics experienced a modest dip, its adjusted diluted EPS also did from $2.51 in Q2.

Looking beyond the near-term where growth may continue to slightly moderate, the medium-term to long-term picture is still very encouraging for the company.

CEO Ryan McInerney noted in his opening remarks that Visa has more than $20 trillion in opportunities remaining with consumer payments. That’s via the ongoing transition from cash and checks to the company’s payment network.

This isn’t just a pie-in-the-sky figure that may never materialize for Visa, either. The company is working on multiple fronts to capture these opportunities. One way that Visa is doing so lately is through working with businesses to expand acceptance of its network.

A more recent example that McInerney pointed to was rent collection. Alongside property management software company Entrata, Visa is now helping to process rent payments. Visa isn’t the only one winning from such an arrangement: Data from Entrata shows that properties using online payment technology spend 65% less time processing rent and decrease rent delinquencies by 50%. This is why I believe that further penetration in this space is likely in the years to come.

Additionally, Visa is working to make it easier to drive e-commerce growth and e-commerce transactions. The more that it succeeds in this front, the higher the penetration rate of e-commerce to overall retail sales can go over time.

This isn’t even mentioning the beneficial impact that inflation has on driving Visa’s total payment volumes higher. Nor is it noting the B2B program that is penetrating new verticals like healthcare.

For these reasons, the analyst consensus is that Visa’s adjusted diluted EPS will rise by 13.5% in FY 2024 to $9.95. In FY 2025, another 12.5% growth in adjusted diluted EPS to $11.19 is anticipated. For FY 2026, adjusted diluted EPS is projected to grow by 13.4% to $12.69.

Finally, a discussion of Visa wouldn’t be complete without praising its balance sheet.

As of June 30, the company had a net debt balance of $7.7 billion. Its cash position is enjoying rates of around 5%. Yet, much of its debt is well below these rates. That’s how Visa’s net investment income through the first three quarters of FY 2024 was $298 million. This earns the company an AA- credit rating from S&P on a stable outlook.

(Unless otherwise sourced or hyperlinked, all details in this subhead were according to Visa’s Q3 2024 Earnings Press Release, Visa’s Q2 2024 Earnings Press Release, Visa’s Q3 2024 Operational Data PDF, and Visa’s Q2 2024 Operational Data PDF.)

Fair Value Has Reached $320 A Share

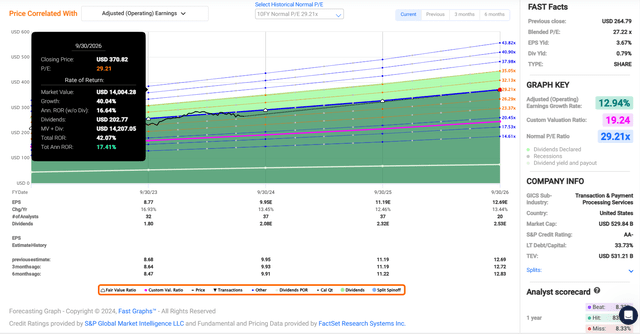

FAST Graphs, FactSet

The 7% decline in Visa’s stock since my previous article is a stark contrast to the 7% gains of the S&P 500 index (SP500) in that time. To me, this spells a buying opportunity.

Visa’s current-year P/E ratio of 25.7 is moderately below its 10-year normal P/E ratio of 29.2. The company’s forward annual adjusted diluted EPS growth outlook remains in the teens. This confirms that the investment thesis remains intact. So, I believe that a reversion to a valuation multiple of around 29 will be justified when sentiment around the stock improves.

Visa’s current fiscal year is approximately 81% complete. That means another 19% of FY 2024 remains and 81% of FY 2025 is yet to come in the next 12 months. That yields a 12-month forward adjusted diluted EPS input of $10.96.

Plugging that into my fair value multiple, I get a fair value of $320 a share. Compared to the $256 share price (as of July 24, 2024), this represents a 20% discount to fair value.

If Visa returned to my fair value multiple and matched the growth consensus, it could have a 40%-plus cumulative upside ahead by the end of FY 2026.

Dividend Aristocracy Is Just A Matter Of Time

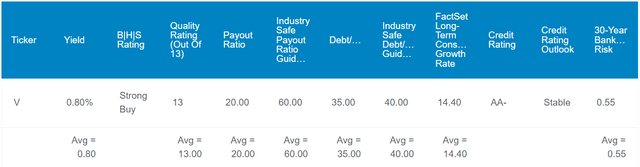

Dividend Kings’ Zen Research Terminal

Visa’s 0.8% forward dividend yield probably isn’t going to win any favor with income investors. This forward yield is below the financial sector median of 3.1%. That’s why Seeking Alpha’s Quant System grades it an F for forward dividend yield.

Everywhere else, Visa is an amazing dividend payer, though. The company’s has hiked its dividend for 15 consecutive years, which is much better than the sector median of 2.2 years. That’s enough for an A- grade for consecutive years of dividend growth from the Quant System.

Visa’s 10-year dividend growth rate of 18.1% is also substantially better than the sector median of 7.7%. That justifies an A grade for the metric from the Quant System.

Best of all, I expect dividend growth in the teens annually to persist well into the future. This is because Visa’s adjusted diluted EPS payout ratio is on pace to be around 21% in FY 2024. That’s a fraction of the 60% that rating agencies desire from their industry, per our research terminal. Along with its financial strength, this leaves the company with plenty of room to hand out generous dividend boosts.

Risks To Consider

Visa is a remarkable business, but it still faces risks that are worth pointing out.

The company’s 50%-plus non-GAAP net profit margins have always attracted negative attention from regulators and merchants. Last month, the $30 billion antitrust settlement in the U.S. between Visa and Mastercard (MA) and U.S. merchants was rejected by a federal judge in Brooklyn, New York.

Now, it’s back to the drawing board. If a reasonable deal can’t be worked out, Visa’s profit margins could suffer. This could weigh on the company’s growth prospects.

Just as I noted in my previous article, another risk to Visa is that it must keep a healthy brand reputation to maintain its success. If a cyber breach compromised tons of sensitive data, that could result in lawsuits against the company. More importantly, it could jeopardize Visa’s brand with consumers. This could cause it to lose market share and harm the investment thesis.

Summary: I’ll Soon Be Buying More Visa

Visa already accounts for 1.3% of my portfolio and is my 25th biggest holding. I’m a firm believer in putting my money where my keyboard is, which is why I’m going to back up my Strong Buy rating and bump my position up by almost 30% in the next week. This will move Visa up to around my 15th biggest holding.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed to assist in research while providing a forum for second-level thinking.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For A FREE 2-Week Trial

Join iREIT® on Alpha today… for more in-depth research on REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. You’ll get more articles throughout the week, and access to our Ratings Tracker with buy/sell recommendations on all the stocks we cover. Plus unlimited access to our multi-year Archive of articles.

Here are more of the features available to you. And there’s nothing to lose with our FREE 2-week trial. Just click this link.

And this offer includes a FREE copy of my new book, REITs for Dummies!