Summary:

- To state the obvious, Visa is a remarkable company with a wide moat.

- Almost all numbers look better than they did 10 years ago.

- Stock is still at a reasonable relative valuation.

Justin Sullivan

As I’ve mentioned in the past, it is fun to look back at my own past recommendations on Seeking Alpha. Obviously, no one is right all the time but when something you said 10 years ago turned out to be true, you feel good as an author. I wrote this article 10 years ago on Visa, Inc. (NYSE:V), touting the company’s dividend growth potential when the company had a dividend growth streak of 5 years. Fast forward 10 years, Visa is still firing on all cylinders on this front and is well on track to announce a 15th consecutive dividend increase later this year.

To make things easier for comparison, this article retains the same template used 10 years ago. Let us get into the details.

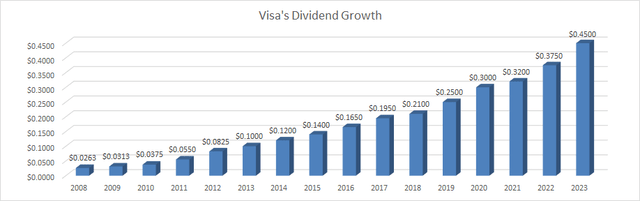

Dividend History: Visa’s dividend has now grown for 14 consecutive years since 2008 as shown below. Please note the dividend information below is adjusted for the 1:4 stock split in 2015.

Visa Dividend Growth (Compiled by Author with data from Seeking Alpha)

Payout Ratio: Visa’s current annual dividend payout of $1.80/share pales in comparison to its forward EPS of $8.48. That gives the stock a payout ratio of 21%. It is remarkable that despite 9 more dividend increases since my 2013 article, Visa’s payout ratio based on EPS has shrunk from 28% to 21%.

Over the years, I’ve started using Free Cash Flow (“FCF”) as a better indicator of dividend strength. Let’s see how Visa fares in this regard.

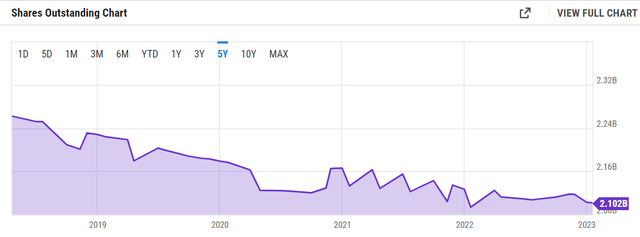

- Total shares outstanding: 2.102 Billion

- Current quarterly dividend: 45 cents a share

- Quarterly FCF required to cover dividends: $0.9459 Billion (That is, 2.102 Billion shares times 45 cents a share)

- Visa’s average quarterly FCF over the last 5 years: $3.416 Billion, which gives Visa a payout ratio of 27.70% based on this metric. Once again, a remarkably low (strong) number.

- Even Visa’s lowest quarterly FCF of $1.251 Billion (during COVID lows) over the last five years is sufficient to cover the current dividend commitment.

In short, the dividend coverage is extremely strong.

Dividend Growth Rate [DGR]: In the 14 years since dividend initiation in 2008, Visa’s dividend has grown more than 17 folds. The average 5-year DGR now stands at about 18%, which has fallen from the 31% during the 2013 review. This is understandable and I expect the dividend growth rate to gradually go down over the years as the dividend grows.

Buybacks: Visa has continued rewarding shareholders with monstrous buyback programs as covered here by Seeking Alpha. Shares outstanding have dropped by 7% over the last five years as a result.

Visa Shares Outstanding (YCharts.com)

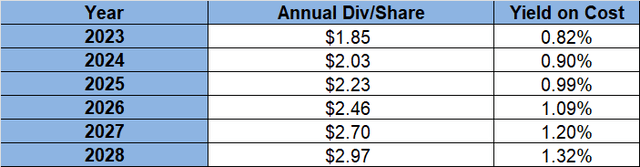

Extrapolation: In the 2013 article, I assumed an annual dividend growth rate of 12% for the first five years and 8% for the next five. Visa handily outdid my expectations here. I love to err on the side of caution and hence, I am using an average of 10% for the next five years although Visa’s current 5 year average is almost double that. The yield on cost is very likely to double in less than 5 years.

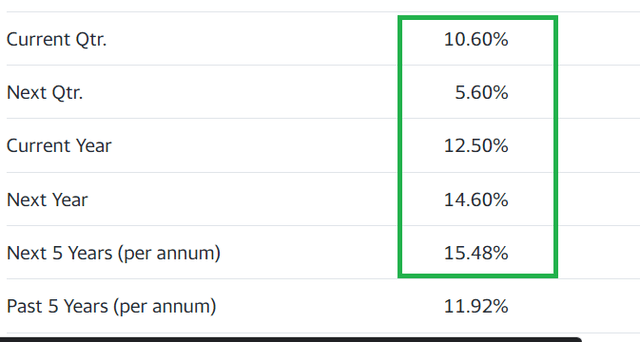

Earnings Potential: Visa is now a 65 year old company and it may still not be an overstatement to say this is a growth stock. Take a look at the growth projections (and the past) below and you will believe it. Trading at a forward multiple of 27 with an expected earnings growth of 15%, Visa is still relatively cheap as it is hard to find strong companies trading at a price-earnings/growth (“PEG”) < 2 these days.

Visa Earnings Growth (Yahoo Finance)

Conclusion:

This stock has all the features Warren Buffett looks for in a life-long investment:

Wide-Moat: Check

Dividend: Check

Buybacks: Check

Shareholder Focus: Check

Integrity: Check

I owned Visa in the past but do not hold it right now and I sometimes regret the decision. One reason may be that American Express (AXP) has been a part of my portfolio for a long time. Visa stock was always a little bit pricey for me and while I tend to pay attention to the advices from the likes of Buffett and Peter Lynch, I did not follow one particular Buffett and Munger axiom: it is okay to pay up for quality. And quality doesn’t come better than Visa. I am fairly confident in predicting that in 10 years’ time, Visa will still hold these same attributes. The one thing I hope will be different is owning Visa at that point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AXP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.