Summary:

- Visa faces a DOJ antitrust lawsuit over alleged anticompetitive practices in the debit card market, but the long-term impact is expected to be minimal.

- Visa’s extensive network, financial strength, and adaptability suggest it can withstand regulatory scrutiny without significant damage to its competitive standing.

- Historical precedents, like Mastercard’s FTC settlement, indicate Visa can adjust practices without undermining its core business model.

- Despite DOJ headwinds, Visa remains a high-quality business with strong financial performance, rendering the recent share dip a potential buying opportunity.

FinkAvenue

Visa (NYSE:V) (NEOE:VISA:CA) finds itself under the spotlight as the U.S. Department of Justice (DOJ) files an antitrust lawsuit alleging anticompetitive practices in the debit card market. While I understand that regulatory actions of this nature can unsettle investors, my view is that Visa’s competitive standing and formidable business moat are unlikely to suffer significant long-term damage from the investigation/ lawsuit. In fact, according to my expectations, the DOJ investigation will likely result in a non-event for shareholders; and accordingly, I suggest that any dip resulting from the DOJ newsflow may result in an attractive buying opportunity.

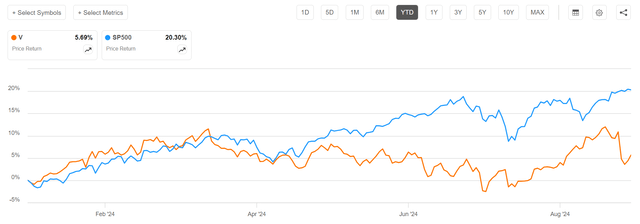

To provide some context on share price momentum, Visa stock has lagged behind the broader market this year. While V shares have risen around 6%, the S&P 500 has gained roughly 20%.

Seeking Alpha

Understanding the DOJ’s Allegations …

On September 24th, the DOJ “sued Visa for monopolizing debit markets”, focusing on Visa’s incentive agreements and contractual terms that allegedly hinder competition in debit transaction routing:

Visa’s Exclusionary and Anticompetitive Conduct Undermines Choice and Innovation in Payments and Imposes Enormous Costs on Consumers, Merchants, and the American Economy

According to my understanding, there are 3 key allegations relating to the DOJ investigation: Firstly, the DOJ addresses concerns surrounding incentive agreements with merchants and fintechs: According to the complaint, Visa has over 180 agreements with merchants and acquirers that cover at least 75% of its U.S. debit volume and 80% of card-not-present (CNP) debit volume. For context, these agreements provide financial incentives to route transactions through Visa’s network, potentially limiting merchants’ ability to choose alternative, potentially less costly networks. Secondly, the DOJ takes issue with Visa’s strategy relating to “noncontestable” transaction: approximately 45% of Visa’s CNP debit transactions are deemed “noncontestable,” meaning they cannot be routed over alternative networks. Factors contributing to “noncontestability” include high transaction amounts (above certain thresholds), the use of tokenization (encryption methods), and the absence of PIN authentication options. This situation undermines the intent of the Durbin Amendment, which was designed to ensure that merchants have at least two unaffiliated networks to choose from for debit transactions, promoting competitive pricing. By effectively locking in nearly half of CNP debit transactions, Visa strengthens its market dominance, restricts merchant choice, and could be contributing to higher costs for both merchants and consumers, raising concerns about anticompetitive practices. Thirdly, the investigation tries to address non-competitive agreements with major tech and payment competitors like Apple, PayPal, and Block.

As Visa’s internal documents make clear, Visa feared that some technology companies and fintech startups with “network ambitions” would cut Visa out as the middleman between merchants, consumers, and their banks by offering a better or cheaper payment product. Visa aimed to stop that development by entering into agreements to pay potential competitors to partner instead of innovating. As Visa’s then-CFO put it: “Everybody is a friend and partner. Nobody is a competitor.”

Visa’s agreements with tech/ payment companies allegedly include clauses that restrict these companies from developing or deploying payment solutions that could compete directly with Visa’s services. For example, if Visa has an agreement with Apple that prevents Apple from creating payment functionalities relying primarily on non-Visa payment processes or products, it effectively stifles innovation and limits the entry of alternative payment methods into the market. This is problematic for several reasons. Firstly, it inhibits competition by blocking significant players who have the capability and resources to challenge Visa’s dominance from offering alternative solutions. Such restrictions can lead to a lack of innovation in the payments industry, as potential competitors are barred from introducing new technologies or services that could benefit consumers. Secondly, these practices can harm consumers and merchants by limiting their choices and potentially keeping transaction fees higher than they would be in a more competitive environment. Lastly, these agreements may violate antitrust laws designed to promote fair competition and prevent monopolistic behavior. By contractually restricting companies like Apple, PayPal, and Block from competing, Visa may be undermining the competitive landscape that encourages efficiency, innovation, and fair pricing in the payments sector.

… And Why They May Imply A “Non-Event”

Despite the DOJ’s allegations against Visa for anticompetitive practices in the U.S. debit card market, the impact on Visa’s business could ultimately be minimal, in my view. As a starting point for the discussion, I highlight that Visa’s dominant market position is supported by an extensive network of over 100 million merchant locations and partnerships with nearly 15,000 financial institutions worldwide. This vast network creates significant network effects and economies of scale that are difficult for competitors to replicate quickly. Even if Visa is compelled to modify certain incentive agreements or routing practices, the core value proposition of a secure, reliable, and widely accepted payment network remains largely unaffected. Merchants and consumers continue to favor Visa for its convenience and trustworthiness, factors that are not easily swayed by regulatory changes.

Furthermore, historical precedents indicate that regulatory interventions often result in companies making operational adjustments rather than experiencing fundamental disruptions to their business models. A salient example is Mastercard’s situation in 2023 when it faced allegations from the FTC regarding its debit card routing practices. The FTC accused Mastercard of violating the Durbin Amendment by effectively blocking merchants from routing electronic wallet (e-wallet) debit transactions over alternative networks, thereby limiting competition. In response to these allegations, Mastercard reached a settlement with the FTC. The agreement required Mastercard to modify certain business practices, specifically to stop inhibiting merchants’ ability to route transactions over other debit networks. Despite initial concerns, the settlement did not materially affect Mastercard’s operations or profitability. In fact, I point out that since the settlement, Mastercard has continued to perform with strong financial results and stable market share. Accordingly, I suggest that even when faced with significant regulatory scrutiny, payment giants like Mastercard—and by extension, Visa—can adapt their practices to comply with legal requirements without undermining their core business models or competitive positions. This, in my view, reinforces the notion that Visa’s situation with the DOJ could similarly be a manageable event that necessitates adjustments but does not threaten its fundamental business moat.

Lastly, I highlight that the DOJ is only addressing a part of Visa’s business model. As of 2023, debit transactions account for approximately 25% of Visa’s total purchase volume. The company also generates significant revenue from credit transactions ($2.77 trillion in U.S. credit purchase volume in fiscal 2022), cross-border transactions, and value-added services (VAS), which includes offerings like fraud management, cybersecurity solutions, and data analytics. In fiscal 2023, VAS contributed over $3 billion to net revenues, growing at a double-digit rate.

High-Quality Business With Fat Margins, Solid Growth

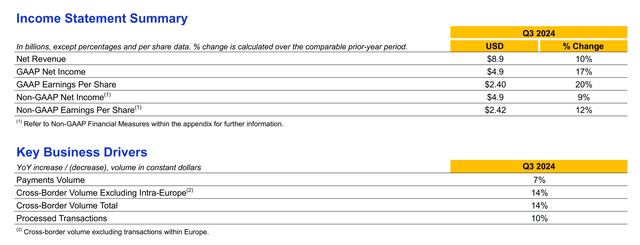

Looking beyond the DOJ headwinds, I highlight that Visa looks to be an “ultra” high-quality business, demonstrating the characteristics of fat margins and solid growth. In the fiscal third quarter of 2024, Visa reported a 10% YoY increase in net revenue, amounting to $8.9 billion, at a 98% gross margin and a 67% EBIT margin.

Visa Q3 FY 2024

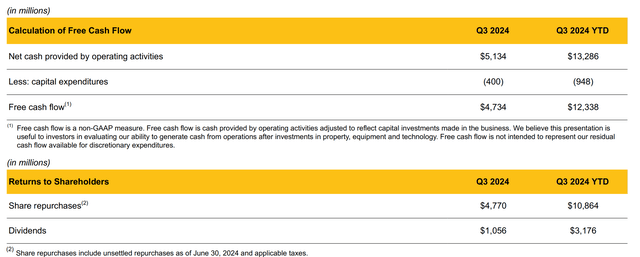

Visa’s GAAP net income grew by 17% to $4.9 billion. Visa’s strong financial performance is supported by robust operating metrics, including a 7% rise in payments volume and a 10% increase in processed transactions. Free cash flow generation was reported at $4.7 billion in the quarter, while Visa repurchased 4.8 billion of stock and distributed about $1.1 billion of dividends.

Visa Q3 FY 2024

Investor Takeaway

Shares of payment network giant Visa dropped approximately 5.5% on Tuesday following a lawsuit filed by the U.S. Department of Justice, accusing the company of unlawfully maintaining a monopoly in the debit card market. However, Visa’s extensive network, financial strength, and proven adaptability position it well to withstand the DOJ’s antitrust lawsuit without significant damage to its competitive standing, in my view. Accordingly, I suggest that the current situation may represent a buying opportunity for long-term focused investors, buying one of the world’s best businesses at 22x FWD EBIT.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.