Summary:

- A portfolio of world-beating dividend growers is like having an ATM at your disposal.

- Visa continues to throw off absurd amounts of net income and free cash flow, implying it possesses the moatiest of moats.

- The payments processor is unbelievably financially sound, with an AA- credit rating from S&P.

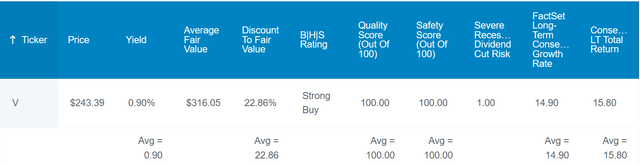

- Visa is valued at a substantial discount to fair value, offering an attractive margin of safety to investors.

- The payments giant could generate 400%+ cumulative total returns over the next 10 years, which would almost triple the S&P.

An ATM machine dispenses $100 U.S. banknotes. selensergen/iStock via Getty Images

In dividend investing, my opinion is that free cash flow is generally the ultimate measure of whether or not a company is worth owning (utilities and REITs are notable exceptions). Earnings are a great starting place, but free cash flow often provides a more telling narrative on how a business is doing.

I like to think of corporate earnings like a pay stub. Sure, that will tell me how much I’m taking home. But looking at my checking account would be more useful because I can get a clear understanding of how much money is coming in and going out, and what is left over.

Unsurprisingly, c-corps that are producing loads of free cash flow are going to be more giving with dividend growth because they can afford it. One such company that is the cornerstone of my dividend growth portfolio is Visa (NYSE:V).

For the first time since September, let’s reexamine the company. I’ll highlight the company’s recent operating results and its valuation to explain why I am maintaining a buy rating.

Visa’s 0.9% dividend yield clearly distinguishes it as more of a growth company than a pure-play dividend company. But for those who are patient and don’t mind holding over the long haul, Visa could be a great pick. This is because the EPS payout ratio of 21% is just a fraction of the 60% payout ratio that is considered to be safe by rating agencies for Visa’s industry.

Aside from its very low payout ratio, the company also has an amazing balance sheet. Visa’s 35% debt-to-capital ratio comes in below the 40% that rating agencies prefer from its industry. For these reasons, S&P has awarded an upper investment-grade credit rating of AA- on a stable outlook to the company. That implies the risk of Visa closing its doors by 2053 is just 0.55%.

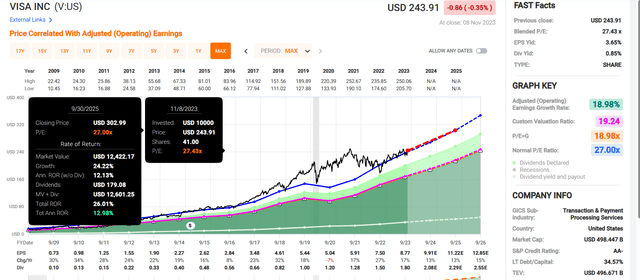

As if these impressive fundamentals weren’t enough, the stock also looks to be cheap. If historical fair value metrics like dividend yield and P/E ratio are any indication, shares of Visa are worth $316 per Dividend Kings.

My fair value estimate using the discounted cash flows model is $285 a share. For context, I used $8.77 in trailing 12-months adjusted diluted EPS, a 10% discount rate, and assumed a 5-year annual adjusted diluted EPS growth rate of 8%, and 6.5% thereafter.

Averaging my fair value estimate and Dividend Kings’ fair value together, I get a $301 fair value. If Visa grows as expected and returns to this fair value, here is what total returns could resemble for the next 10 years from the current $242 share price (as of November 10, 2023):

- 0.9% yield + 14.9% annual earnings growth + 2.2% annual valuation multiple upside = 18% annual total return potential or a cumulative total return of 423% versus the 10% annual total return profile of the S&P 500 (SP500) or a cumulative total return of 160%

A Strong Finish To Fiscal Year 2023

Visa Q4 2023 Earnings Press Release

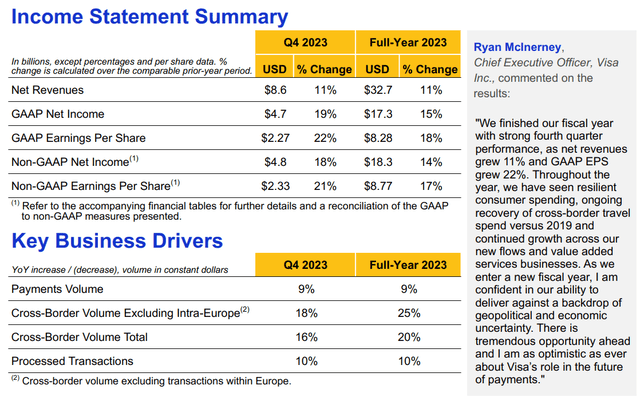

World-class businesses tend to consistently grow and outpace analysts’ expectations. To perhaps nobody’s shock that has been following Visa for a while, the company exceeded expectations in its fourth quarter to close out its fiscal year 2023.

Visa’s net revenue during the fiscal fourth quarter grew by 10.6% over the year-ago period to $8.6 billion. This narrowly beat the analyst net revenue consensus by $50 million.

Solid results across the board are what led to this outperformance. As was the case for the fiscal year overall, the company’s payments volume (e.g., the total dollar amount of transactions processed on Visa’s network) increased by 9% for the quarter. This was aided by steady consumer spending and revenge travel spurred by when the COVID-19 pandemic forced consumers to defer travel arrangements.

Speaking of the latter, a 16% uptick in cross-border volume in the fourth quarter (situations where the issuing country of a card isn’t the same as the merchant country) supports this assertion.

Finally, Visa’s processed transactions increased by 10% during the fourth quarter. Aside from the variables we already discussed, the continued growth of the company’s card base contributed to these results.

Visa’s non-GAAP EPS surged higher by 20.7% year-over-year to $2.33. Higher net revenue and a 340 basis point improvement in non-GAAP net margin to 55.9% were the primary contributors to this vigorous earnings growth.

Looking ahead, Visa’s operating fundamentals should continue to be promising as more merchants accept the company’s payment methods to draw its massive customer base. This will keep propelling net revenue and earnings growth, which is why FactSet Research expects 14.9% annual earnings growth from Visa moving forward.

Moving to the balance sheet, the company also shines in this department. In subtracting Visa’s $20.1 billion in cash and cash equivalents and investment securities as of September 30 from its $20.5 billion in long-term debt, its net debt is just $335 million. Against the $22 billion in EBITDA that the company generated in fiscal year 2023, this net debt load is practically zero (all details sourced from Visa Q4 2023 earnings press release).

The Safest Dividend Is The One Just Hiked By 16%

Visa’s 15.6% raise in its quarterly dividend per share to $0.52 and new $25 billion share repurchase program emphasize just how much the company cares about shareholders.

In even more good news, the company can easily afford to provide its shareholders with these goodies. Visa’s 10-K filing for fiscal year 2023 won’t be out for at least a few more days. But in the first nine months of the fiscal year, the company generated $13.1 billion in free cash flow. Putting this into perspective, that means Visa converted 54.4% of its net revenue into free cash flow. This free cash flow margin is unmatched by any business of which I am aware, which speaks to the moat that it possesses.

Even with $2.8 billion of dividends paid in the first nine months of the fiscal year 2023 and $8.4 billion in share repurchases, the company still had excess cash (info in this section sourced from pages 11 and 5 of 171 of Visa 10-Q filing). This is why there will almost certainly be plenty more mid- to high-teens dividend hikes left in Visa’s future.

Risks To Consider

Even as a 13/13 ultra SWAN per Dividend Kings, Visa has its risks as all businesses do.

As I indicated in my previous article, the biggest risk is probably regulatory. Visa’s profit margins are out of this world, which could eventually make the company a victim of its success. In the U.S., the Credit Card Competition Act of 2023 was put back onto the table this summer. Although it looks to have stalled out as of now, the bill could theoretically lead to more competition for the likes of Visa. This could weigh on the company’s profit margins if it were ever passed.

Another risk to Visa is that with the sensitive information of billions of cardholders, it is a frequent target of cyber breaches. If the company ever experienced a major cyber breach, trust in the brand could be diminished and its fundamentals could be harmed.

Summary: A Buffett Stock With High Total Return Potential

Visa’s immense profitability, healthy growth prospects, and ironclad balance sheet explain why Berkshire Hathaway (BRK.A)(BRK.B) owns a $2 billion stake.

Looking at FAST Graphs, we can see that the company’s valuation is reasonable. Visa’s 27.4 blended P/E is in line with its normal P/E ratio of 27. Thus, the company is expected to generate 13% annual total returns over the next two years for shareholders if the valuation returns to its normal P/E ratio.

Looking out over the long term, Visa can offer nearly triple the returns of the S&P. Therefore, I’m affirming my buy rating on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.