Summary:

- Visa is the leading payment processor with a global reach and competitive advantage in credit card transactions.

- The company’s financial success is evident with impressive revenue and profits, driven by its investments in network development.

- Visa has significant room for growth, and the shift towards digital payments, making it an attractive long-term investment.

- The stock price is presently trading at the breakout point, and any upward break from this level will set off another vigorous rally.

Thomas Cooper

Visa Inc. (NYSE:V), with its commanding stature in the financial world, stands as the unparalleled leader in payment processing, defining itself as the epitome of success and innovation in the sector. Its omnipresence in countless merchant locations worldwide emphasizes a brand that’s become synonymous with credit card transactions, a brand dominance further accentuated by the well-known refusal to accept non-Visa cards in many establishments. Beyond its current ubiquity, the company’s strategic focus on network development and expansion has laid a robust foundation for a profitable future. This article offers a technical analysis of Visa’s stock price, aimed at determining future trends and pinpointing investment opportunities. The examination reveals that the stock is trading at a critical juncture, a strong key point. A breakout from this specific point could signal the commencement of a robust rally, potentially driving the stock to significantly higher levels.

A Deep Dive into the World’s Leading Payment Processor

Visa’s standing in the world of financial transactions is unparalleled, backed by a global reach and a competitive edge that promises enduring value. As Visa has cemented itself as a cornerstone in the financial sector, boasting a competitive advantage that is unlikely to be challenged in the foreseeable future. The company’s ubiquity in millions of merchant locations worldwide ensures that its brand is synonymous with credit card transactions.

Visa’s financial success is equally impressive, with recent figures showcasing an enviable track record. In its third quarter of 2023, Visa recorded $8.12 billion in revenue, up 12% year-over-year, beating both GAAP and non-GAAP analysts’ expectations. But what stands out is Visa’s profits, with an impressive $4.2 billion for the quarter. The company’s unique ability to operate with high margins is due to its significant investments in network development over the years. With minimal additional costs for processing payments, Visa stands to gain even more as transaction volumes rise, resulting in decreased costs per transaction.

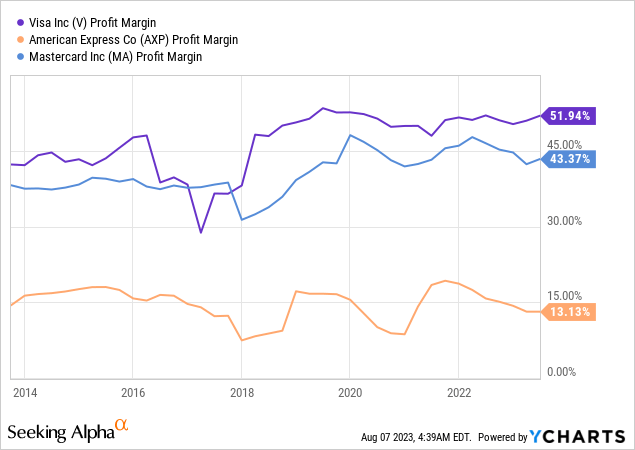

Looking beyond the current scenario, I think there’s still considerable room for growth. A recent study revealed that Visa’s market share was the largest at 48% with 753 million open credit cards in circulation at the end of 2021, leading its nearest competitor Mastercard Incorporated (MA) and American Express Company (AXP) by a significant margin as seen in the chart below. Globally, the scales tip further in Visa’s favor, operating in over 200 countries with over 4.2 billion cards in circulation. Even more exciting is Visa’s growth in cross-border transactions, which fuels international revenue and provide promising prospects.

While Visa’s reach is undeniably extensive, the potential for growth remains vast. Many parts of the world still rely on cash and remain underbanked. Although Visa may not immediately change this scenario, it is well-positioned to benefit as the world gradually shifts toward digital payments. With $15.6 billion in cash and cash equivalents, Visa also has the financial strength to explore growth through acquisitions, though organic growth seems highly likely as well.

Although its valuation may appear expensive, marked by a price-to-earnings ratio hovering near 30, I think the stock holds a promise of stability and enduring prosperity, notably in contrast to rivals such as Mastercard. While a bullish market could propel Visa’s price further upwards, the real allure lies in the long-term perspective. With characteristics that make it a dependable hold, coupled with a well-earned reputation and strategic positioning, Visa seems cemented as a dominant force in the global financial terrain, a status it is poised to maintain for the foreseeable future.

Understanding Key Breakout Points and Emerging Investment Prospects

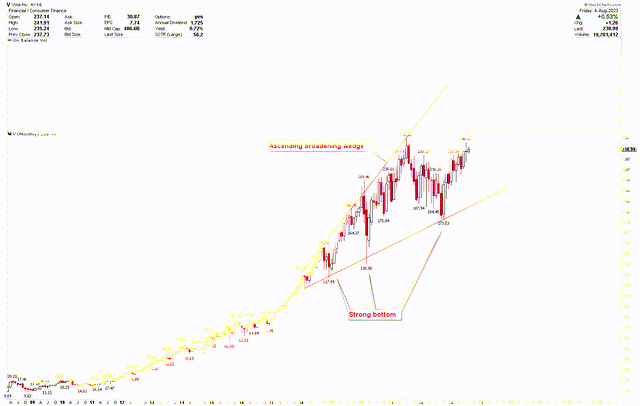

The monthly chart below provides a strong bullish perspective on Visa’s long-term outlook. It reveals that there has been no considerable correction in Visa’s stock price over the past 14 years, with the stock price consistently climbing within a pronounced bullish trend. However, there has been an escalating volatility in the stock price over time. This uptick in volatility has led to the development of an ascending broadening wedge pattern from 2018 to 2023.

This pattern highlights growing market uncertainty, marked by expanding higher highs and higher lows as the trend advances, often mirroring mixed investor sentiments about the asset’s future direction. The drop in price from the 2021 highs of $249.02 to the 2022 lows of $173.53 remained within the trend lines of the ascending broadening wedge. A potent rally, underscored by the key reversal monthly candle of October 2022, emphasizes Visa’s strength and supports a bullish outlook.

Visa Monthly Chart (stockcharts.com)

Currently, the stock price is nearing all-time highs and exhibiting signs of consolidation, which bolsters Visa’s bullish stance. This consolidation points to price compression and hints that the market is gearing up for the next rally to break from this region. Additionally, there is ample room for price growth since the ascending broadening wedge line is distant from the current region. Furthermore, the RSI is trading above the mid-level of 50, signaling positive developments.

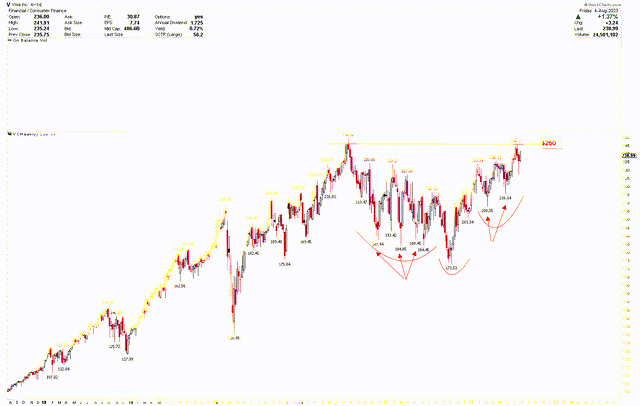

The weekly chart below further clarifies Visa’s bullish picture, spotlighting the formation of an inverted head and shoulders pattern delineated by the red arcs. With a neckline at $250, any break above this threshold should trigger a vigorous market rally. This pattern is inherently bullish, as both the left and right shoulders of the pattern are defined by multiple bottoms. Each price pullback has been swiftly reversed by a strong upward move, indicating bullish momentum in the market.

Visa Weekly Chart (stockcharts.com)

The left shoulder identifies strong support levels at $187.94, $193.42, $184.85, $188.45, and $184.45, where the market rebounded quickly. Meanwhile, the right shoulder reveals $208.35 and $216.14 as robust levels where the market swiftly turned higher. The market is currently contending at the pattern’s key point of $250. If this level is breached, a rapid rally could propel Visa’s stock price to much loftier levels.

Investors could consider buying Visa’s stock during a pullback or at the notable breakout point of $250, aiming to capitalize on potential further gains.

Market Risk

As the technical analysis points out, Visa’s stock price has experienced escalating volatility in recent years. The formation of an ascending broadening wedge pattern from 2018 to 2023 indicates growing market uncertainty and can reflect conflicting investor sentiments, potentially leading to unexpected fluctuations in the stock price. Moreover, Visa’s global reach and dominance in the financial transaction world mean it’s highly sensitive to macroeconomic factors. Any negative shifts in the global economy, such as recessions, regulatory changes, or geopolitical tensions, could affect transaction volumes and consequently Visa’s revenues.

Although Visa holds a strong market position, the evolution of digital payment technologies and the entry of tech giants into the payment processing sphere could pose threats to its competitive edge. Operating in the financial sector, Visa must consistently maintain top-notch security measures. Any failure in its cybersecurity could severely harm its reputation and lead to financial losses.

Bottom Line

Visa’s commanding presence in the credit card transaction world, underpinned by unrivaled efficiency and reach, positions it as an epitome of stability and success. The company’s remarkable financial performance, extensive global operation, and growth potential in emerging markets demonstrate a promising path for sustained success. While acknowledging market risks and volatility, the positive technical outlook and Visa’s adaptability to the digital shift further solidify its appeal. The blend of innovative strategies, financial acumen, and a dominant market presence ensures Visa’s continued role as a leading player, making it an attractive investment opportunity for years to come.

From a technical standpoint, the long-term perspective for the stock appears firmly positive, with the price nearing the significant long-term breakout point at $250. This approach is characterized by the formation of a robust base, manifesting in inverted head and shoulder patterns. Investors may consider buying during a pullback or if the price breaks through the $250 mark, in expectation of ascending values.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.