Summary:

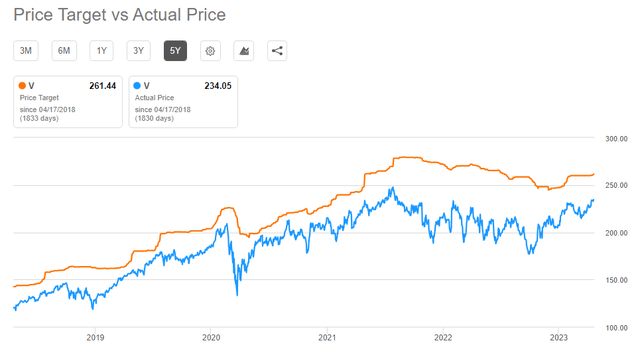

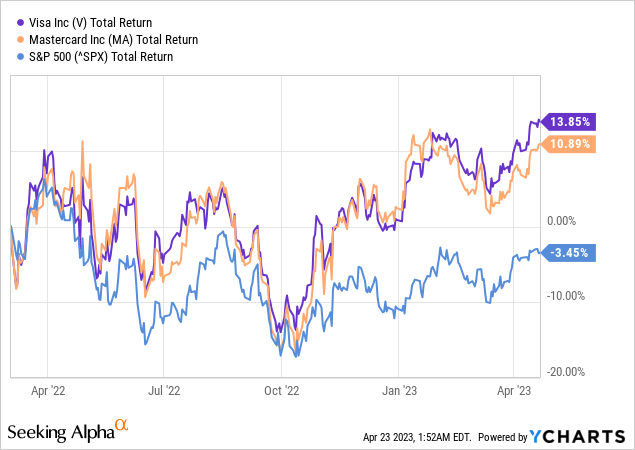

- At odds with the predominant narrative, Visa has become one of the best-performing stocks within its peer group.

- The risk of a recession is still casting a shadow over Visa, but implications from the inflationary environment should not be ignored.

- The business continues to perform better than expected, and investors should keep a close eye on the upcoming earnings report.

Justin Sullivan

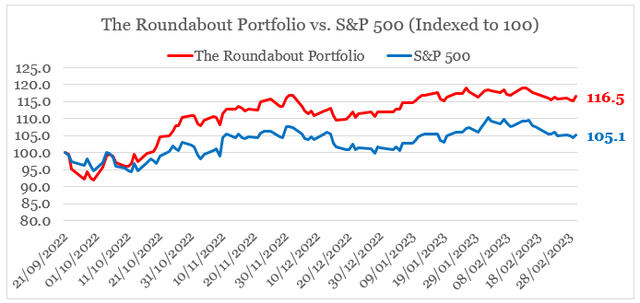

Even after considering its premium valuation and size, Visa (NYSE:V) has become one of the best-performing stocks within the payments sector over the past year, outperforming even its main rival – Mastercard (MA).

At the same time, the broader equity market has declined by nearly 4% since I first laid out my investment thesis on Visa.

With the company scheduled to report quarterly results this week, investors should be mindful of Visa’s positioning and all the risks associated with the pending recession at a time when inflation could prove to be stickier than most economists expect.

Don’t Follow Simple Narratives

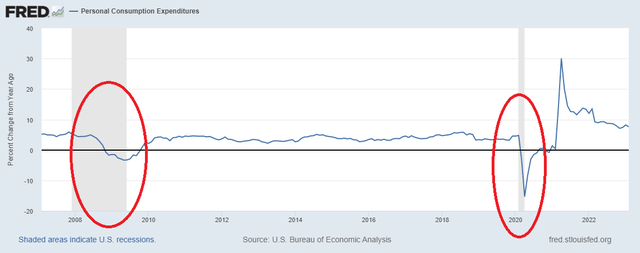

Needless to say, the macroeconomic environment plays a major role for Visa as the health of its business is closely related to consumer spending and a potential economic slowdown could have severe implications for Visa revenues and profitability.

At the same time, the rate of inflation is no less important since Visa’s service, processing, and transaction revenues depend heavily on changes in the consumer price index.

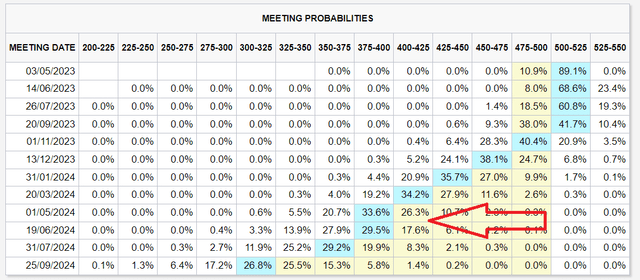

At present, the base case appears to be that of a soft landing and lower inflation ahead, which largely depends on the Federal Reserve being accommodative.

The validity of these assumptions would play a major role not only in Visa’s share price performance but also in the underlying business as well.

It’s also important to steer clear of simple narratives that associate the risk of a recession with Visa underperforming the broader market.

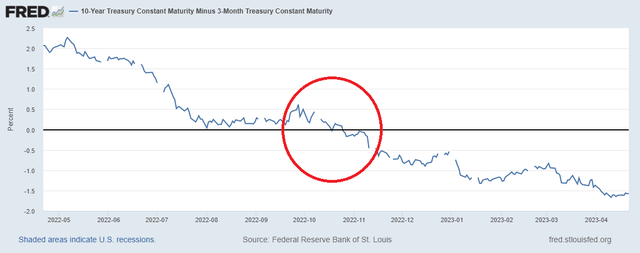

To illustrate why this is, consider that the 3-month – 10-year yield curve has become inverted back in October of last year, thus raising a red flag of an upcoming recession.

As we saw in the first graph of this article, this was the exact moment when the performance gap between Visa and the S&P 500 opened and has been widening ever since just as the probability of a recession continued to increase.

While I kept recommending Visa, Wall Street analysts also were caught in this narrative and have been reducing their price targets just as the stock price begun to recover.

Although the risk of a severe economic slowdown is present, Visa continues to benefit from the current environment. With that in mind, investors should keep a close eye on revenue and volumes.

Better Than Expected Revenue Growth

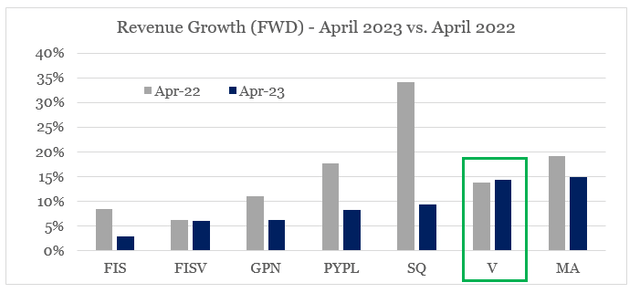

As rhetoric of an economic slowdown accelerated, Visa has quietly become one of the stocks with the highest forward revenue growth rate within the electronic payments space.

Not only that, but V is the only stock within the wider peer group shown below that currently has higher expected revenue growth from a year ago.

Prepared by the author, using data from Seeking Alpha

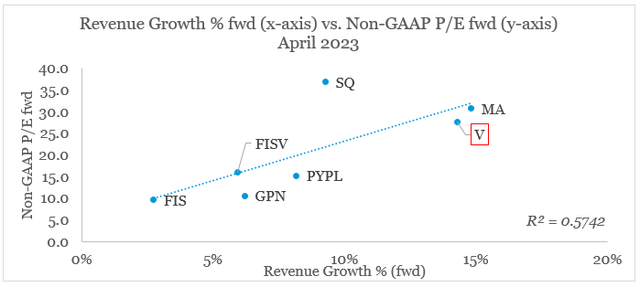

The reason why this is so important for investors is that as long as margins remain stable (more on that in the last section), price-to-earnings ratios within the sector remain closely related to the expected revenue growth.

Prepared by the author, using data from Seeking Alpha

While Russia will continue to be a headwind for overall revenue growth, the other major short-term factor is the dollar.

Two variables will have a significant impact on our reported revenue growth in fiscal year 2023, Russia and the dollar, which has strengthened to extraordinary levels through fiscal year 2022. Since we discontinued operations in late March, Russia will reduce first half fiscal year 2023 revenue growth by over 4 points, with 4 points in the first quarter and as much as 5 points in the second quarter.

Source: Visa Q4 2022 Earnings Transcript

These comments, however, were made back in October of last year, when the U.S. dollar index was hovering at record highs for the past 20 years. In the following months, exchange rate movements have turned in the other direction and Visa’s revenue would now benefit over the first half of fiscal 2023.

Thus, adjusting the initial assumption of mid-teens constant dollar revenue growth for the impact of Russia, it appears highly likely that Visa would deliver topline growth in double digits.

When you pull all this together, our planning assumptions get us to mid-teens constant dollar net revenue growth on a run rate basis, i.e., adjusted for Russia. With a 2-point Russia impact and a 4-point exchange rate headwind, reported nominal dollar fiscal year 2023 net revenue growth would be in the high-single digits.

Source: Visa Q4 2022 Earnings Transcript

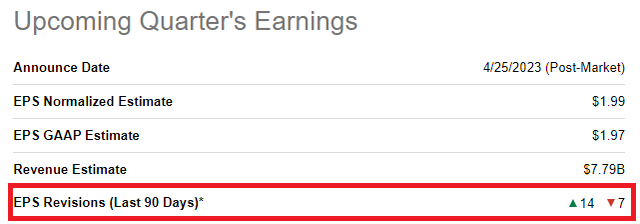

So far this is largely in line with expectations, but given that analysts are once again playing catch-up with their recent EPS revisions and the FX tailwind, it won’t come as a surprise if Visa beats expectations.

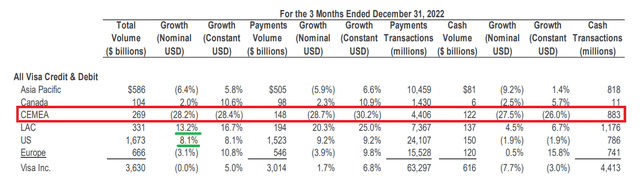

On a regional basis, Visa continues to do exceptionally well in the U.S. and Latin America, with Russia having a large negative impact on total volume in Central Europe, Middle East and Africa (CEMEA).

The 2022 FIFA World Cup in Qatar played a major role during the past quarter which makes it less indicative of future results, hence the upcoming results will provide important information on what growth rate could investors expect from the new client wins, ongoing cash digitalization, and acceptance expansion in the region.

Our CEMEA region, excluding Russia, grew 25% year-over-year and was 108% higher than 2019 as we saw, all through FY ’22, growth in both regions was fueled by client wins, cash digitization and acceptance expansion.

Source: Visa Q1 2023 Earnings Transcript

What About Profitability?

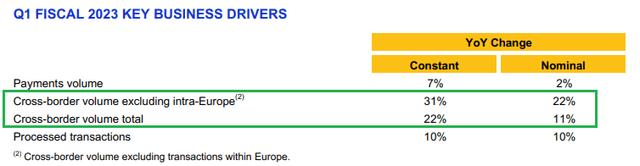

Over the past year, improving cross-border volumes played an important role in stabilizing Visa’s operating profitability.

This trend has continued during the past three-month period, with cross-border transactions noting yet another large increase on both a constant and nominal currency basis.

Although growth has slowed down notably in Q1 2023 when compared to the prior quarter, the results shown above were still a major improvement since three years ago.

Q4 cross-border volumes, excluding intra-Europe were up 49% year-over-year and 130% versus three years ago, up 7 points from Q3. Excluding Russia, cross-border year-over-year growth was higher by about 5 points.

Source: Q4 2022 Earnings Transcript

In addition to the tailwind from higher cross-border volumes, margins also would benefit from lower growth in operating expenses through fiscal 2023.

I also gave you fairly clear operating expense expectations. We were about 15% growth in the first quarter. We said growth will be 2 points to 3 points lower in nominal dollar terms in the second quarter, another 2 points to 3 points lower in the third quarter and another 2 points to 3 points lower in the fourth quarter.

And that reflects what we had said last quarter that is expense growth will moderate through the year, both as we moderate the rate of increase when also as we lap higher levels of expenses from last year.

Source: Visa Q1 2023 Earnings Transcript

Investors, however, should expect an update from the management regarding expense assumptions for the rest of the fiscal year during this week’s results.

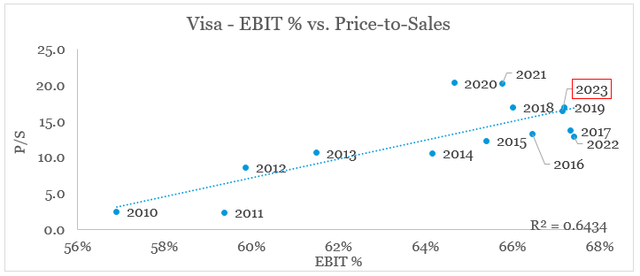

Overall, margins are likely to remain elevated in 2023 and Visa now appears to be trading near fair value on a historical basis.

Prepared by the author, using data from SEC Filings and Seeking Alpha

Having said that, better-than-expected margins could have a double-whammy effect on returns as higher revenue in 2023 will get priced at higher P/S multiples in such an event.

Conclusion

At odds with the predominant narrative, Visa has become one of the best-performing stocks within its peer group. Even though the risk of a severe recession should not be ignored, the company benefits from the current inflationary environment and a potentially higher velocity of money. At the same time, Visa is exceptionally well positioned to deliver on its revenue growth targets, while keeping its margins at record highs which could drive the share price even higher through the rest of the calendar 2023. Having said all that, there are certain areas that investors should follow closely over the coming months.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FISV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the electronic payments space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.