Summary:

- Visa’s high valuation multiples may deter some investors, but historical data shows that waiting for a crash to invest may not be the best strategy.

- Conventional valuation methods like the P/E ratio may not accurately reflect Visa’s true value due to its high profitability, dominant market share, and long-term growth potential.

- Visa’s strong competitive advantage, secular growth trend towards a cashless society, and continuous buybacks justify its premium valuation multiple and make it a potentially good long-term investment.

ahlobystov/E+ via Getty Images

No one doubts that Visa (NYSE:V) is a great company. However, I often hear about overvaluation. Many people prefer not to invest in it because they believe its valuation multiples are excessive, so it is better to wait for a crash first.

Buying a company as large as Visa and growing less than 15% per year may seem like a gamble given the NTM P/E of 24.58x, but in my opinion, it is not. In order to value Visa, I think it is rather misleading to use conventional valuation methods, such as P/E ratio, and in this article, I will show you why.

A company with a high P/E is not always overvalued, as well as the opposite. There are many other factors to consider that lead to multiple distortions.

How to interpret Visa’s P/E ratio

In general, when we want to buy a company, we hope that the P/E is as low as possible since it is synonymous with undervaluation. While this is potentially true, there can be valid reasons of why a P/E is lower than average. Often things are cheap for a reason, as well as the other way around.

In Visa’s case, we can say that it was never really cheap. If you had waited for the P/E to fall in the 10-15x range, I guarantee you would have never bought it.

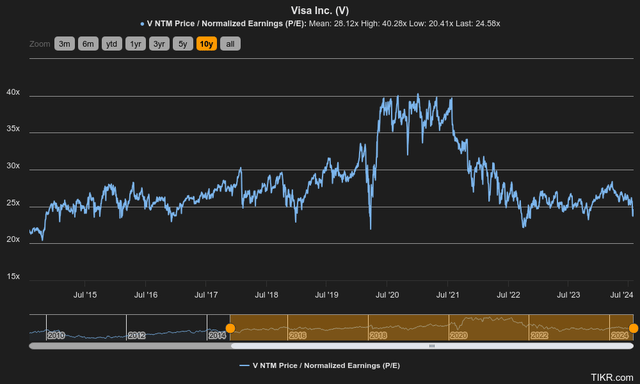

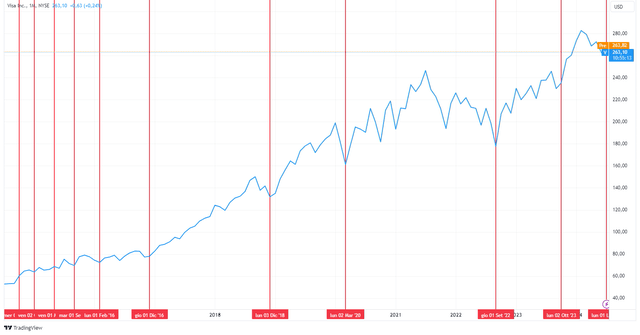

Actually, you would have never bought it even if you had waited for the NTM P/E ratio to touch 20x: in the last 10 years, the all-time low has been 20.41x. Following this logic, you would not have bought it in the last 10 years, even though Visa has since then experienced a price return of +400% versus +181% for the S&P 500.

Looking at the history of the NTM P/E, it is not common for this multiple to fall below the 25x threshold, which is currently happening. In the past, when this occurred, it has always been a good buying opportunity.

In this chart, I have drawn a red line whenever the NTM P/E has fallen below 25x. Sometimes moments of multiples contraction can last as long as 2-3 months, but eventually, there has always been a major recovery. In addition, another aspect we can note is that a value below 25x does not occur as frequently as it did 10 years ago. In the past, it was more common for Visa to trade at lower multiples; since 2018 it has happened only 5 times. This means that the market now prices Visa at a higher premium because it is aware of its well above-average soundness.

We would all like to buy it at an NTM P/E of 15x or 20x at most, but it has not been possible so far and, in my opinion, may not be possible in the future either. It may take years if not decades before that moment comes, but by that time you will have already lost a huge capital gain.

In other words, there are some companies that are so dominant that they warrant a higher P/E ratio than the market, even if their growth rate is not that exciting. There are not many companies in the world that exhibit such a characteristic, but I think Visa fits perfectly into this category. The reasons that lead me to think so are mainly three.

First reason: profitability among the best in the world

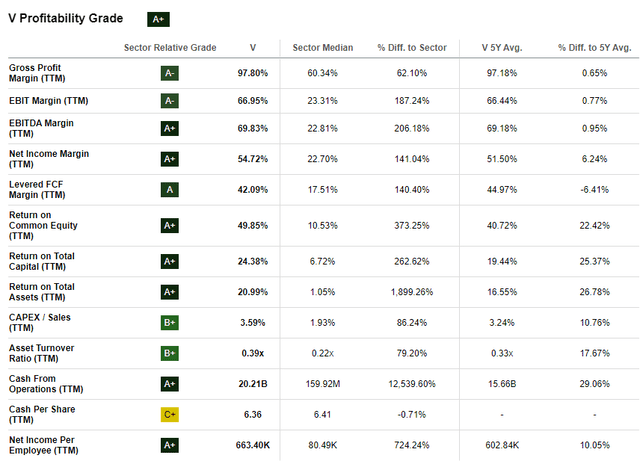

Visa is one of the best companies in the world in terms of profitability. Out of $100 of revenue, $54.72 is net income, which is insane. Only a few companies can have such high profitability for so long, and Visa is one of them.

The main reason is that it has a strong competitive advantage, and its business model is mainly based on fixed costs. In fact, Gross Profit is 97.80%, so there is a very low incidence of variable costs.

Having a high incidence of fixed costs allows the company to take advantage of high operating leverage and generate economies of scale. This reduces the cost of each individual transaction to process and increases the final profit. ROE, ROA, and Return on Total Capital are also very high compared to peers, so management knows how to invest its money.

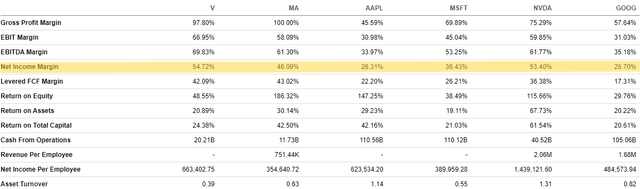

Finally, albeit minimally, it is impressive to note that marginality is continuing to improve. Gross profit is increasing faster than operating costs, and this could lead to a net income margin of up to 60% in the future. To give you an impression of how crazy these numbers are, I attach a table in which I compare Visa with the current top companies.

In terms of Net Income Margin, Apple is two times less profitable; Microsoft and not even Mastercard, the main competitor, can keep up. What is more, even Nvidia in its golden period could not do better than Visa.

In light of these considerations, it is obvious to me that an investor should pay a premium to have such a company in his or her portfolio. Quality must be paid for, which is why Visa deserves to trade at higher multiples than the market.

Second reason: competitive advantage

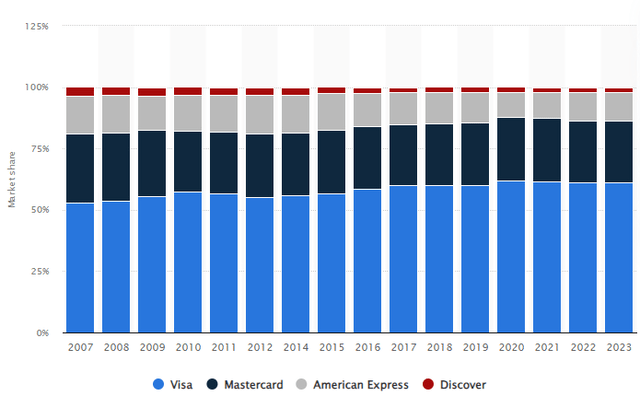

As you are well aware, Visa in the United States has a dominant market share in terms of transaction value.

At the end of 2023 its position was worth about 61% of the total market; for Mastercard and American Express it stood at about 25% and 11%, respectively. If we look on a larger scale, even globally, Visa’s importance remains considerable: together with Mastercard (MA), it controls about 90% of all payment processing (excluding China, where UnionPay prevails).

All in all, these two giants are immovable and have dominated this market for decades. The barriers to entry in this type of market are massive, which is why there are no new competitors that can break this oligopoly. Creating a new payment system that can process so many transactions per second is almost a mission impossible, as it requires several tens of billions of dollars and decades of industry knowledge. Just think that Visa can process more than 65,000 transactions per second, so we can consider it one of the best tech companies even if it is little talked about. The fact that we do not hear much about AI does not make it any less technologically advanced; in its field it is the best and its results speak for themselves.

Moreover, assuming a new competitor has better technologies than Visa, it would have to enter into tens of thousands of agreements with banks and merchants to make its payment system globally accepted. Why would a merchant decide to replace Visa since its service is flawless? At the same time, why should a buyer replace his Visa card, accepted by virtually any merchant?

Beyond the technology, Visa’s competitive advantage lies primarily in having created a network within which millions of users operate. None of them have an incentive to change things since the service works smoothly and within seconds.

For all these reasons, Visa’s competitive advantage is a huge reason why it deserves a premium on its multiples.

Third reason: secular trend in its favor

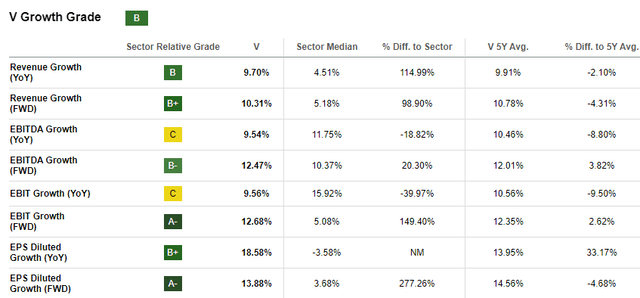

For a company with an NTM P/E of 25x, we might expect revenue growth of 15%-20% per year, something we do not find in Visa. The 5-year revenue CAGR was only 9.91%, while the 5-year EBIT CAGR was 10.56%, slightly higher due to improved profitability.

At first glance, a novice investor might think it is not worth it, but there are two aspects to consider:

- The first is that Visa is taking advantage of a secular growth trend that is still going on.

- The second is that Visa tends to constantly make buybacks.

In the first case, the secular trend I am talking about is the transition to a cashless society. Cash is being used less and less because of the many related problems (tax evasion, theft, convenience) and debit/credit cards are being used more and more. As the number of users within the network increases, Visa will benefit from this trend for decades to come.

Consider that even some developed economies are far from being cashless, let alone undeveloped economies. I live in Italy (the world’s ninth largest economy by GDP) and I assure you that cash payments are still widespread, especially for purchases under €50. Supporting my opinion is this study by the Bank of Italy.

Before the “cashless” trend can be widely spread on a global scale, it will still take several decades. So, while growth of 10% per year may not impress with an NTM P/E of 25x, the length of this growth must also be taken into account. Personally, I think Visa has the potential to grow 10% even in a very long-term perspective, and that makes all the difference. In 20 years we don’t know where Alphabet or Nvidia will be, a new competitor with better technologies may take over, but I’m confident that Visa will still be there and will still be exploiting this trend.

Based on this last statement, conventional methods of evaluation are broken. Assuming Visa continues to grow at this rate for the next 20 years, it changes little if bought at an NTM P/E of 20x,25x or even 30x. Certainly better to buy it at a low multiple, but even those who did so at 30x will probably not regret their choice.

Second, another factor that justifies buying Visa at a high multiple is the continuous buyback.

As you can see from this table, the 5-year EBIT growth was 10.56%, while the 5-year EPS diluted growth was 13.95%. This differential is mainly due to the reduction of shares outstanding, a typical practice used to increase EPS, the most important factor for the price per share from a long-term perspective. If we were to consider this, combined with improving profitability, Visa’s annual growth would be well over double digits.

Overall, if you want to get in your portfolio a company that takes advantage of a secular growth trend and does buybacks, you need to pay higher multiples.

Valuation and risks

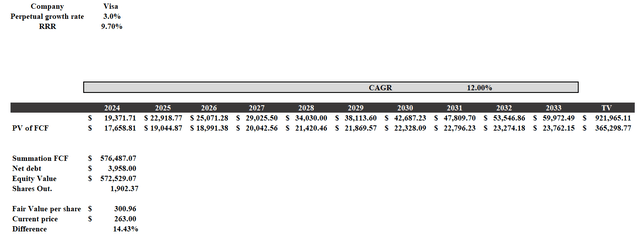

As for the valuation of Visa, I will use a DCF model whose inputs are as follows:

- RRR of 9.70%, equal to cost of equity. To calculate the latter, I used a risk-free rate of 4.13% (10-year Treasury yield), a beta of 0.95, and an expected market return of 10%.

- Free cash flow 2024-2028 based on street estimates, from 2029 to 2033 I considered a CAGR of 12%, slightly above 5-year EBIT growth. The reason is that I wanted to consider an increase in profitability as well as the benefits of a potential buyback. Since outstanding shares remain fixed in the model, I preferred to discount buybacks by adjusting upward the free cash flow growth.

Based on these assumptions, the fair value amounts to about $300 per share, a difference of 14% from the current level. So, Visa is undervalued, which is why I revise my previous hold rating upward. I still don’t consider it a strong buy because I don’t think there is a very marked difference between fair value and the current price. Potentially, it could be a strong buy if the price falls around $210-$220.

By buying Visa at the current price, I think there is a basis for a great long-term investment, but it is wise not to get too caught up in the hype. This is by no means a risk-free investment, it should be made clear.

While Visa’s competitive advantage is considerable, it is not insurmountable; Mastercard and American Express are always ready to gain market share. At the same time, other threats come from new technologies that bypass Visa’s payments system.

Although Visa is trying to enter the cryptocurrency market, to date, it is unclear what its role will be in this regard. If cryptocurrency payments are the order of the day in the future, Visa’s role may take a back seat.

In addition, another threat from Visa may come from the ECB, since it is working on a digital euro. The decision on its adoption will be coming in 2026-2027 and could potentially be a game changer. In a sense, European lawmakers believe that Europe does not have its own “payments champion” and there is too much dependence on Visa, Mastercard and PayPal. Just as with crypto, a digital euro could bypass certain steps when any economic transaction takes place.

Overall, Visa’s threats come primarily from new solutions that could disrupt the payments system in the future, and secondarily from the competitors with whom it shares its addressable market.

Conclusion

The average investor looks first at the P/E ratio to figure out whether a company is undervalued or not, but in Visa’s case, this method has proven completely wrong over the past decade. The P/E will most likely continue to be high in the coming years for the following reasons:

- Profitability among the best in the world and improving.

- Double-digit growth supported by a secular trend still in its early stages.

- Stable competitive advantage created over the decades.

Waiting for the P/E to touch 20x or even 15x is a losing strategy for a company like Visa, as you will miss out on much of the capital gain by not investing in it. From a long-term perspective, only by buying it at a P/E of 35x or 40x the performance could be significantly downgraded. Historically, when the ratio has fallen below 25x it has always been a good opportunity to buy and today we are at that point in my opinion.

Finally, I did not mention Visa’s huge dividend potential, which is growing strongly and largely sustainable. Since recently there have been a number of articles about it on Seeking Alpha, I prefer not to argue this topic. My advice is to read them to get a full understanding of the potential of an investment in Visa.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.