Summary:

- Visa is expected to remain the market leader in the global payment processor market in 2024, with growing market share on a YoY basis.

- With robust YTD results, we believe that the fintech is well positioned to deliver on the FY2024 net revenue guidance with richer bottom-lines.

- As the market prices in a pivot in the upcoming FOMC meeting in September 2024, we may see the Consumer Confidence Index improve nearer to 2019 levels.

- Assuming a consistent intermediate term execution, V is likely to offer double-digit capital appreciation prospects, despite the expensive PEG non-GAAP valuation.

- Investors may also look forward to a rich dividend hike in the upcoming earnings call, building upon the 5Y Dividend Growth Rate at +15.77%.

DNY59/E+ via Getty Images

V’s Investment Thesis Remains Promising As The Payment Processor Market Leader

We previously covered Visa (NYSE:V) (NEOE:VISA:CA) in April 2024, discussing why we had reiterated our Buy rating, thanks to its robust performance metrics and expanding profit margins, with it demonstrating why the stock deserved its premium valuations over the sector median.

Combined with the management’s promising commentary surrounding consumer spending and the raised consensus forward estimates, we believed that it remained a compelling Buy at every pullback.

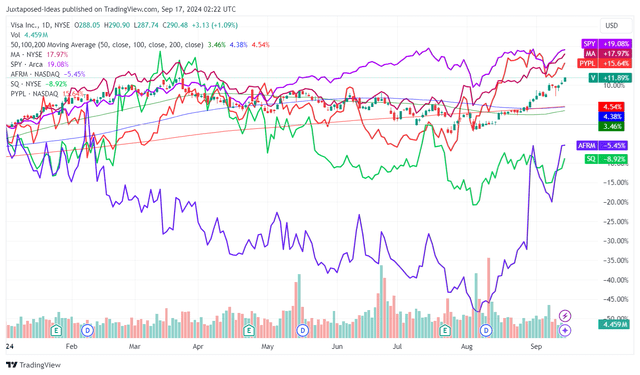

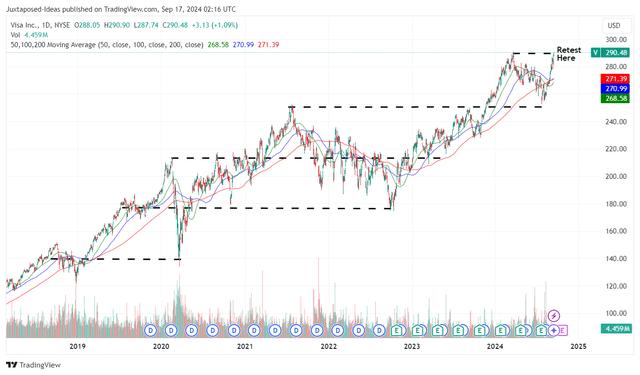

V YTD Stock Price

TradingView

Since then, V has already retraced by -6.6% during the worst of the July 2024 market rotation, while rapidly recovering by +14.4% to retest the March 2024 peaks of $290s.

Part of the recovery tailwinds are attributed to the higher likelihood of soft landing, as the Fed has signaled their willingness “to kick off a series of interest rate cuts at the U.S. central bank’s meeting in two weeks,” attributed to the cooling inflation and the relatively healthy labor market.

If anything, the latter has already contributed to the relatively healthy consumer spending trends by August 2024, with retail sales still rising by +0.4% YoY albeit decelerating from June 2024 levels of +0.8% YoY.

While the average credit card delinquencies have been rising to 2.98% by July 2024 (+0.08 points MoM/ +0.53 YoY/ +0.32 from August 2019 averages), we are not overly concerned indeed.

This is because the lenders’ average net charge-off rates have been moderating to 4.24% (down by -1.08 points from the peak April 2024 levels of 5.32%) while nearing the 3.55% observed in July 2019.

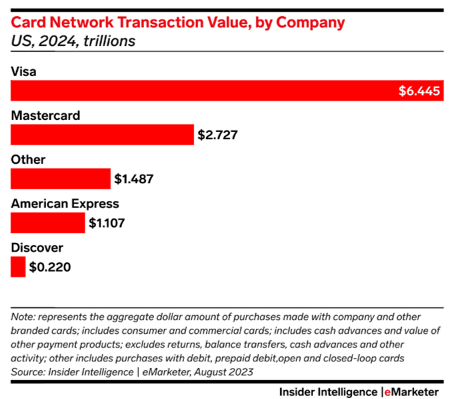

V’s Projected Transaction Value In The US By 2024

eMarketer

These developments further highlight why V’s intermediate term prospects remain bright, as observed in its robust total credit/ debit card volume of $15.47T over the last twelve months (+7.3% sequentially at constant currency) and growing total transactions of 279.71B (+10.5% sequentially).

It is unsurprising then, that eMarketer already expects V to remain the market leader in the global payment processor market with $6.44T in transaction volume in the US by 2024 (+3.8% YoY), with a projected expansion in market share to 61.3% (+0.2 points YoY).

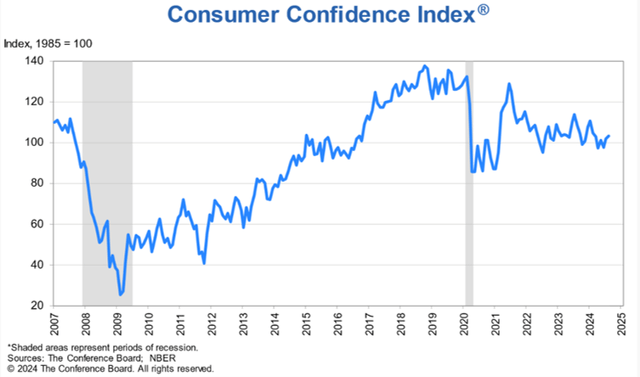

Improving Consumer Confidence Index

Conference Board

At the same time, with the market already pricing in a 50 basis point cut in the upcoming September 2024 FOMC meeting, we may see borrowing costs moderate with it triggering improved consumer spending trends and improved consumer confidence surrounding the state of the macroeconomy.

By August 2024, the Consumer Confidence Index has already risen to 103.3x, up from 101.9x in July 2024. While still a distance away from the ~120x observed in 2018 and 2019, we believe that sentiments may drastically improve upon the Fed’s upcoming rate cut, no matter by 25 or 50 basis point.

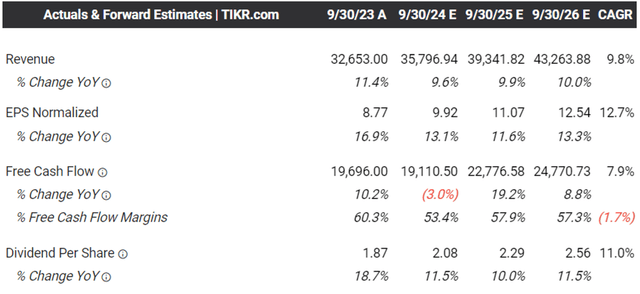

The Consensus Forward Estimates

TIKR Terminal

With V already generating a robust YTD net revenue growth by +10% YoY on a constant currency basis, excellent expansion in YTD operating margins to 65.5% (+1.3 points YoY) while nearing the FY2019 levels of 66.9%, and YTD adj EPS generation at +14.5% YoY, we believe that it remains well positioned to achieve the FY2024 guidance of low-double digit net revenue growth and low-teens EPS growth on a YoY basis.

And this is also why the consensus forward estimates remain promising, with V expected to generate a robust top/ bottom line growth at a CAGR of +9.8%/ +12.7% through FY2026, building upon the normalized levels of +11.7%/ +17.5% between FY2016 and FY2023, respectively.

So, Is V Stock A Buy, Sell, or Hold?

V 6Y Stock Price

TradingView

For now, V is already on its way to retest the all-time heights of $290s while running away from its 50/ 100/ 200 day moving averages.

For context, we had offered a fair value estimate of $261.20 in our last article, based on the LTM adj EPS of $9.41 ending FQ2’24 and the FWD P/E non-GAAP valuations of 27.76x.

Based on the LTM adj EPS of $9.67 ending FQ3’24 and the upgraded FWD P/E non-GAAP valuations of 28.97x, we are looking at an updated fair value estimate of $280.10, with there remaining an excellent upside potential of +21.3% to our reiterated long-term price target of $352.50.

If anything, V has also been returning great value to long-term shareholders at $14.03B on a YTD basis (+26.5% YoY), with 2.8% of its float retired over the LTM/ 9.8% since FY2019.

This is on top of the upcoming dividend hike in the next earnings call, based on the +15.5% raise announced in October 2023 and the 5Y Dividend Growth Rate at +15.77%.

As a result of the robust dual pronged prospective returns through capital appreciation and dividend incomes, we are reiterating our Buy rating for the V stock.

Risk Warning

With V now likely to enter new stock price territories, readers may want to temper their near-term expectations, since part of the embedded optimism is attributed to the Fed’s upcoming pivot.

It goes without saying that the next two years of macroeconomic normalization may bring forth some uncertainty in the fintech’s prospects and stock prices, depending on the CPI’s return to the Fed’s target rate of 2% and the health of the labor market/ consumer spending during the normalization process.

While the market has temporarily priced in a soft landing, readers may want to closely monitor the developing situation, since a prolonged process may potentially put a damper on V’s stock price recovery thus far.

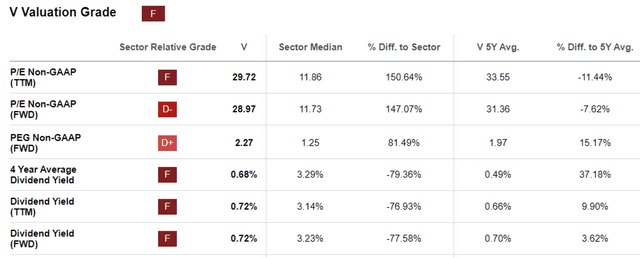

V Valuations

Seeking Alpha

At the same time, the V stock is also relatively expensive at a FWD PEG non-GAAP ratio of 2.27x, compared to its 5Y average of 1.97x and the sector median of 1.25x.

Even when compared to its direct peers, including Mastercard (MA) at 2.13x, Block (SQ) at 0.49x, PayPal (PYPL) at 1.29x, V’s somewhat premium valuations cannot be ignored indeed.

Therefore, while we remain optimistic about V’s long-term prospects, investors may want to time their entry point, preferably after a moderate pullback to its intermediate support levels of $265s for an improved margin of safety.

Do not chase this rally over the cliff.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.