Summary:

- Visa is scheduled to report its Q3 2024 results early next week, and the market does not seem to expect any surprises.

- The company is in a good position to report better-than-expected revenue growth, albeit the share price response is likely to be muted.

- Investors should also pay close attention to any one-off items when it comes to earnings, as Visa’s operating margins have likely peaked already.

2Ban

Visa Q3 Earnings Preview

Visa (NYSE:V) is about to report its third quarter earnings for fiscal year 2024 next week, and by the looks of it, the market is prepared for yet another uneventful quarter and results that are mostly in-line with estimates.

Although this appears to be the most likely scenario, investors should be aware of the risks ahead and why the stock’s response is likely to be muted even in the case of better-than-expected quarter.

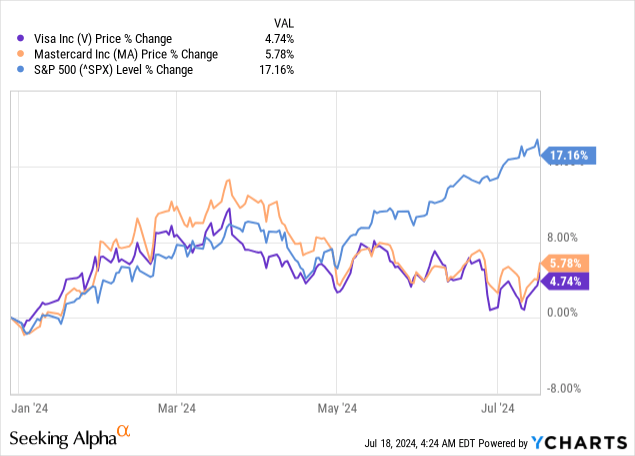

After a spectacular performance for Visa in calendar year 2023, I warned that 2024 is likely to be more challenging as certain tailwinds are dissipating, and the macroeconomic environment becomes more uncertain. So far, this year hasn’t offered any meaningful challenges for consumer spending and with that, Visa’s stock has remained relatively flat (see below). The same could be said for its major peer – Mastercard (MA) with both stocks mostly trailing the S&P 500, up to May when certain cloud players with large share within the index got all the attention of investors.

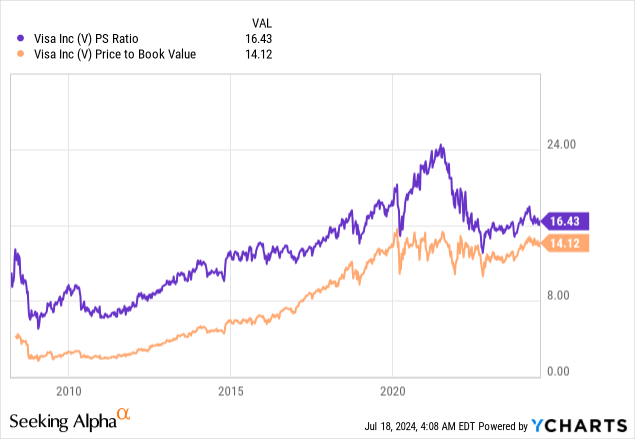

Thus, if we ignore certain mega cap stocks and their unprecedented performance in recent months, Visa appears to be mostly trailing the state of the U.S. and global economy. The stock’s sales and equity multiples also seem to have settled at mid-teen levels.

With all that in mind, it isn’t a surprise why Visa’s upcoming results are expected to be mostly in-line with expectations. When it comes to volumes and revenue, however, Visa is in a good spot to deliver better-than-expected figures.

Sustained Revenue Tailwinds

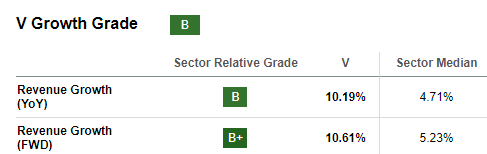

At the beginning of this year, I wrote a detailed review of Visa and why I expect a more challenging year for the company and consequently for the stock. Back then, the company’s forward revenue growth rate stood at 10.5%, which remained unchanged for the past 6-month period.

Seeking Alpha

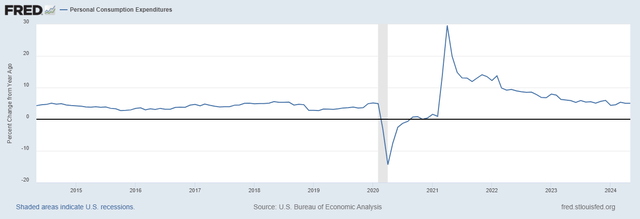

To an extent, these sustained high expectations about Visa’s revenue growth have come as a result of the resilient global economy in the first half of 2024. For example, the U.S. consumer remained healthy over the period, with year-on-year growth in personal consumption expenditures remaining at around 5%.

FRED

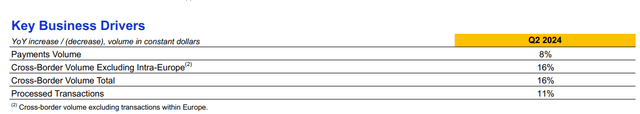

Growth in the high-margin cross-border volumes has also remained elevated, coming at 16% during the last reported quarter.

Visa Q2 2024 Investor Presentation

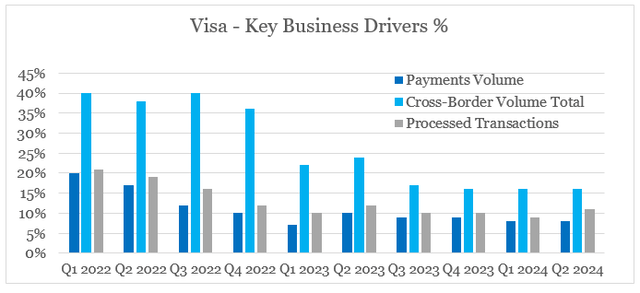

To put things into perspective, this is far lower from the growth registered during the post-pandemic recovery in 2022 (see the graph below).

prepared by the author, using data from Earnings Releases

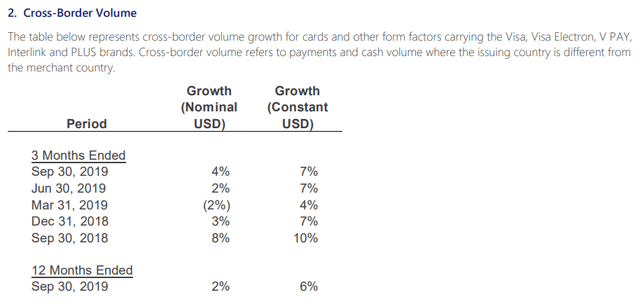

But at the same time, is significantly higher to the pre-pandemic growth rates of mid to high single digits.

Visa Operational Data Q4 2019

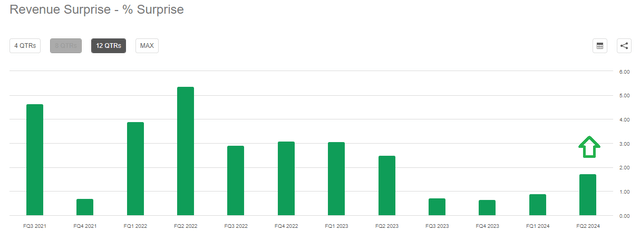

As we saw on the graph above, quarterly growth in payments volume and processed transactions have also held strong over the past year, which seems to have caught sell-side analysts off guard during the last quarter when we saw a jump in Visa’s quarterly revenue surprise.

Seeking Alpha

The management even made a small adjustment to its total payments volume outlook during the last reported quarter, and expects growth in cross-border volumes to be sustained at current levels.

(…) we are making a small adjustment to our outlook for total payments volume growth to the high-single-digits from the low-double-digits. Total cross-border volume, excluding Intra-Europe is expected to continue to grow strongly in the mid-teens with the strength in e-commerce generally offsetting weakness in Asia travel.

Source: Visa Q2 2024 Earnings Transcript

All that increases the odds of Visa reporting better-than-expected results on its topline next week and even upgrading its outlook for the rest of fiscal year 2024. However, given Visa’s current valuation relative to its margins and the muted share price response during the latest reported quarter, I remain skeptical that such an outcome would translate into much higher returns for shareholders in the short-run.

Muted Share Price Response

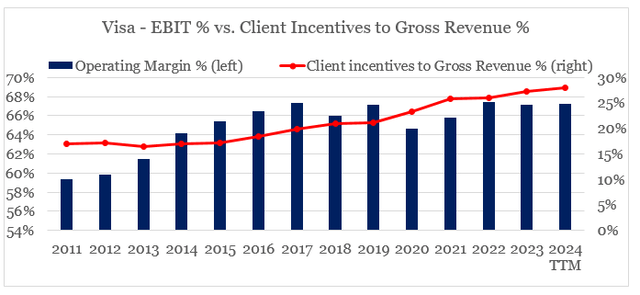

Another major reason why Visa’s stock price is unlikely to outperform the equity market going forward is the fact that operating margins have peaked in recent years at around 67%, while client incentives have been increasing as a share of gross revenue.

prepared by the author, using data from SEC Filings and Seeking Alpha

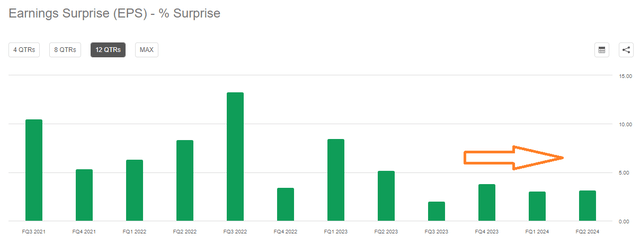

That is why we didn’t see a jump in the quarterly earnings per share surprise to the same extent we saw with revenues above.

Seeking Alpha

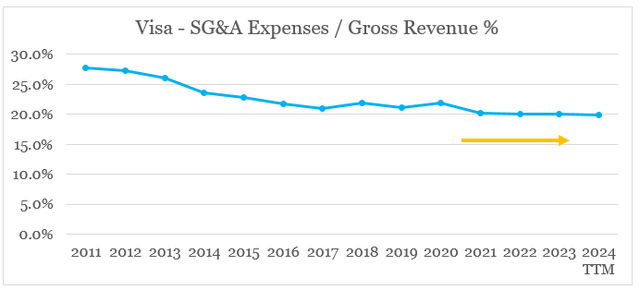

In recent years, I have also been emphasizing the limiting factor of Visa’s enormous size on its margins, as economies of scale seem to have been exhausted when it comes to fixed costs. As we see on the graph below, in the 2011-2017 period, Visa has expanded its operating profitability as it grew in size and fixed costs as a share of revenue fell. This, however, is no longer the case and a reason why margins have peaked.

prepared by the author, using data from Seeking Alpha

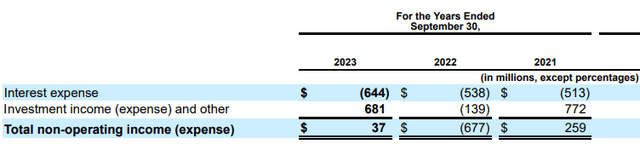

And yet, we could still see Visa delivering better-than-expected results even on its bottom line over the coming quarter. This, however, is more likely to be related to non-operational items, such as investment income, which came in at $681m in fiscal year 2023 – a notable improvement from the $139m expense during the prior year.

Visa 10-K SEC Filing

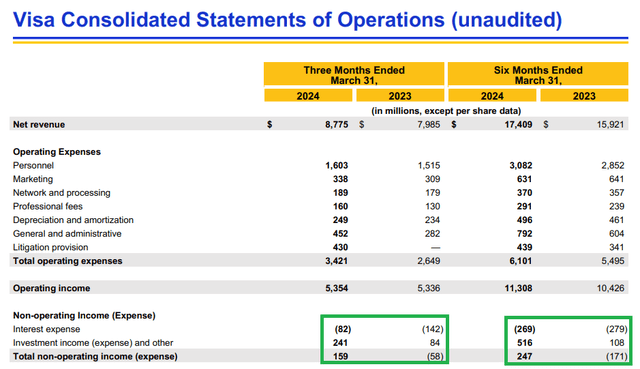

In the first half of fiscal year 2024, we saw this trend continuing with investment income increasing from $108m during H1 2023 to $516m during H1 2024.

Visa Q2 2024 Earnings Release

As interest rates are likely to remain higher for longer, Visa’s bottom line would continue to benefit from its investment income, related to interest on investments in money market funds, U.S. Treasuries and other interest-bearing securities.

Investor Takeaway

As Visa is about to release its third quarter results for FY 2024, investors and sell-side analysts do not seem to expect any surprises. In my view, the company is in a very good position to deliver better-than-expected volume and revenue figures, but that is unlikely to move the needle unless the management provides a more optimistic outlook for the rest of 2024 and beyond. Margins, on the other hand, have peaked already, and any increase is likely to be temporary and less relevant for the share price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the electronic payments space?

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.