Summary:

- Visa has underperformed the market by nearly 20 points over the past five years, primarily due to multiple contractions, and despite strong EPS growth.

- The company’s transition to a diversified three-legged business, including Value-Added Services and New Flows, positions it for future market-beating performance.

- Visa’s consumer payments segment still offers significant growth opportunities, especially in developing markets and untapped transaction categories like rent and transit.

- With a more inviting valuation and strong growth pillars, I expect Visa to outperform the market over the next five years and reiterate a ‘Buy’ rating.

TanjalaGica

Visa (NYSE:V) is the center of many high-quality investor portfolios, showcasing one of the most resilient, consistent, and highly profitable growth stories of the 2000s.

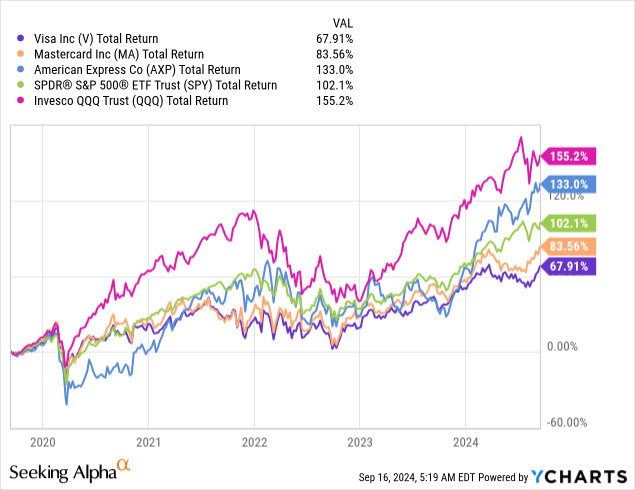

Although Visa is typically perceived as an impeccable market-beating investment, this hasn’t been the case for the past five years. In fact, Visa is lagging the market by nearly 20 points.

As I expect 2025 to mark a tipping point for the company, this is the perfect time to recap Visa’s 5-year underperformance, explain why I view the same reasons for the underperformance as the drivers for its future market-beating trajectory, and emphasize the three-pillar growth story.

Introduction

I started covering Visa here on Seeking Alpha in April of last year. In a series of articles, I went through Visa’s complex business model and its growth trajectory. I also published quarterly updates diving into the competition with Mastercard (MA) and explained why I prefer Visa as an investment.

Although Visa has performed well since I initiated coverage, it did underperform the market, by about 10 percentage points, albeit with much less volatility.

In this article, I thought it would be valuable to do something a bit different, zoom out a little, and look at the longer-term opportunity.

But first, we should briefly take a look at the past.

Let’s dive in.

Putting Five Years Of Underperformance Into Context

Past performance isn’t an indicator of future results. Although it’s a commonly cited phrase in the investing world, I think that in many cases it turns out to be incorrect.

Just like you would generally expect a winning athlete to continue winning and a losing athlete to continue to lose, I think the same is true for both investors and companies.

For every investment of mine, whether it has a history of outperformance or underperformance, I ask myself this simple question – “What lies in its future that can lead to a different outcome going forward?”

Of course, if it has a history of market-beating, I want nothing to change. If it doesn’t, I need to clearly explain to myself like a three-year-old – “This is why X led to underperformance, and why it won’t in the future.”

I’m sure many of you may have recently encountered this graph across social media or the financial news landscape:

It probably came with a statement that said something like, “I didn’t have Visa underperforming American Express (AXP) in my scoreboard.” Well, even if it’s counterintuitive, it’s true.

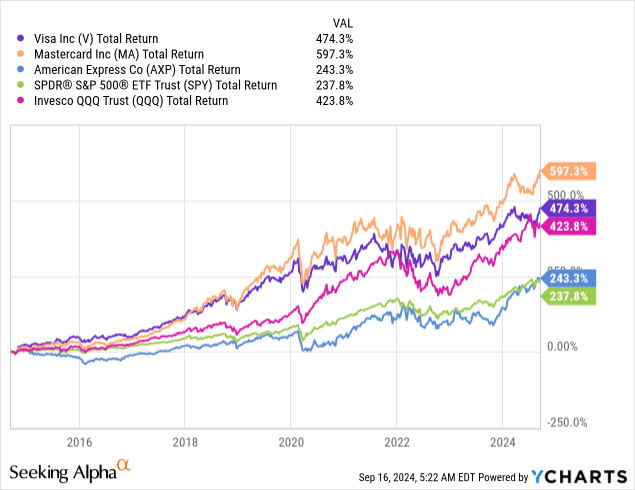

Importantly, Visa is a big outperformer in a longer timeframe:

Still, there’s no denying that Visa has been a laggard over the past five years. And, to stay true to my process, we need to go through the reasons for the underperformance.

The Reasons For Visa’s Underperformance

Visa is first and foremost a consumer payments company. This is what made the company the empire it is today. Cynical people might argue that Visa was at the right place at the right time to ride the digitalization of payments worldwide, but in reality, Visa and its frenemy Mastercard should get a lot of the credit.

The two payment giants drove and accelerated the adoption of digital payments, which enabled the buildout of entirely new industries like e-commerce, reduced fraud, and improved global GDP.

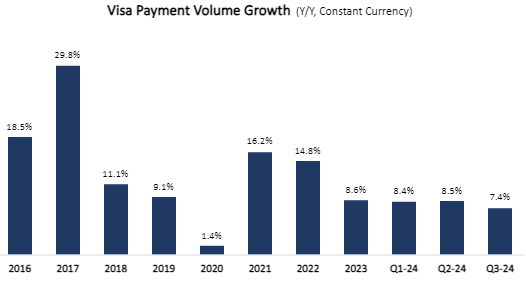

All this is the basis of what I’m about to say now – this extremely lucrative secular trend had to reach deceleration at some point.

As digital payments become the norm, the tailwinds of cash-to-card are declining. They are very far from reaching saturation, but also very far from peak growth.

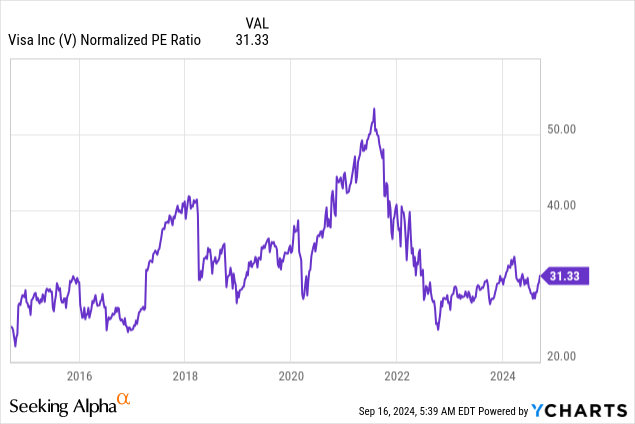

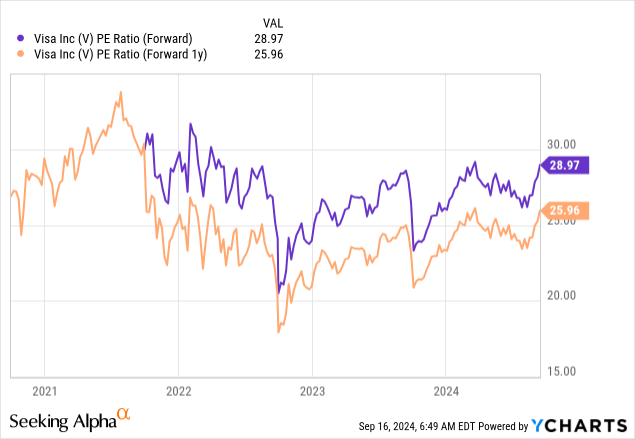

Both Visa and Mastercard reached elevated valuations around the end of calendar 2019, still reflecting outsized growth:

At a nearly 40x multiple, the market was underwriting a future that couldn’t materialize. Then, came the pandemic, which, combined with stimulus, ZIRP, and post-Covid consumer mania, drove growth rates very high very fast, but also led to a sharp deceleration thereafter.

All in all, Visa’s underperformance is almost entirely a multiple-contraction story, as its five-year EPS CAGR of 12.5%, materially outpaced shares at 10%. Notably, Visa’s EPS and revenue growth over this period is much higher than the market.

In addition to the growth deceleration in consumer payments causing the contraction, a meaningful portion of Visa’s growth in recent years is derived from new business lines in Value-Added Services and New Flows.

Those are still relatively new, and the market isn’t willing to pay the historical consumer payments multiple (30x-35x) for them.

So, this is why Visa underperformed. Let’s switch gears to the next question.

What Can Lead To A Different Outcome In The Future? Visa’s Three Growth Pillars

Setting aside the much more “inviting” valuation today compared to five years ago, which we’ll discuss in the next section, Visa has three primary growth pillars that I believe the market is yet to fully grasp.

Legacy Consumer Payments

Consumer payments are no longer the blue-ocean space they were two decades ago. Today, there’s a clear distinction between developed markets like the U.S. or the UK, where digital payments have very high penetration, and emerging or developing markets, like Indonesia and Latin America, where there’s still a lot more runway for core digitalization tailwinds.

In developed markets, Visa estimates there’s still a $20tn volume opportunity, primarily coming from transactions that are still made by cash and check. The U.S. represents 25% of that number. To drive the migration of these more stubborn segments, Visa is working on convenience (for example tap-to-pay and tokenization), and tailored solutions for traditionally non-carded categories like rent, large buys, or utilities.

In developing and emerging markets, it’s the same historical playbook. Working on educating consumers and merchants on the benefits of digitalization, working with regulators, increasing acceptance, and more. One example is Japan, which is still a big cash country, where regulators have set goals to cut the use of cash.

Created by the author using data from Visa reports.

Twist it anyway you’d like, consumer payments is still a high-single-digit growth story and remains one of the best businesses in the world.

Value-Added Services

I described the Value-Added Services (VAS) segment in my previous article. Just to briefly remind everyone, it has five divisions across issuance, acceptance, risk, consulting & marketing, and open banking.

What they all share in common is that they leverage the existing capabilities, know-how, and relationships of Visa, in order to cross-sell and add value to clients.

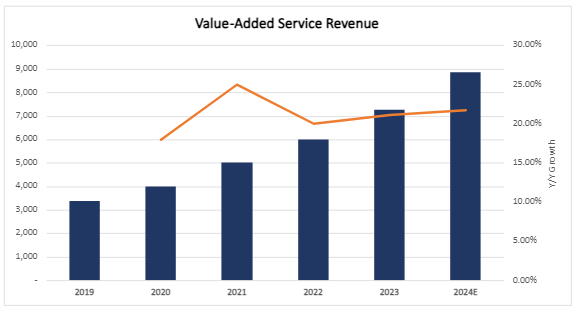

Created by the author using data from Visa earnings calls.

VAS is approaching a $9 billion run rate, growing comfortably in the low twenties. This is also a line of business where Visa is outgrowing Mastercard, which is a big factor in my preferring of the former.

This is essentially a fintech-producing machine, as the CFO describes it:

Why value-added services is so strategically important for us is, A, when we do a good job of providing value to our clients through innovative products and services, it really deepens and strengthens those client engagements, and it helps them grow and protect their business.

And B, it’s a great pipeline for innovation. So, it’s our innovation pipe, new products, new services. It lets us reach new addressable TAM. It also gives us the opportunity to expand geographically in a much more expansive way. And when we do both of those things right, it ensures that Visa remains the best way to pay and be paid.

— Chris Suh, CFO, Goldman Sachs Communacopia 2024

I expect this segment to continue to grow in the high teens to low twenties. Today, it’s 25% of total revenues, and as it increases in size, it’ll drive up the consolidated growth profile as well.

New Flows

Similar to VAS, this is also a relatively new line of business. Here, Visa is tapping into new payment verticals, primarily in the commercial space. Things like accounts payable, accounts receivable, procurement, insurance, and more.

Visa sees these verticals as places where there’s still a lot of manual work and real pain points. I remember that when I was in charge of inventories at a bar I worked for, we had to file everything into a binder, and the owners would go sit with the accountant at the end of every month to file every invoice.

This is a space Visa wants to disrupt, just like it did for consumers.

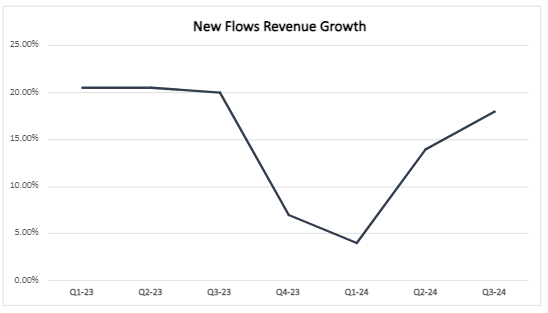

Created by the author using data from Visa earnings calls.

After some non-recurring hiccups in Q4 ’23 and Q1 ’24, New Flows is back to mid-teens growth, where I expect it to stay for the foreseeable future.

Valuation

The valuation question for Visa is fairly easy and simple.

Considering Visa’s extraordinary free cash flow margins, high-quality business model, strong competitive advantages, and long-term growth prospects, I believe Visa should trade at around 2.5x PEG, in line with similar high-quality names.

With a ~12% EPS growth trajectory, that brings us to a 30x P/E, roughly 15% higher than the current FY multiple of 26x.

Importantly, Visa’s fiscal year starts in September, which means that the 26x multiple you’re seeing above is a bit higher than the calendar 2025 multiple, which is at 25x.

Conclusion

Visa has been underperforming the market for the past five years, as it goes through a transition period from a fast-growing consumer payments company to a diversified three-legged business.

The new segments in Value-Added Services and New Flows should accelerate growth, and showcase Visa’s advantages over competitors, including Mastercard.

Over time, the market will learn to appreciate these new categories, and push Visa back to its historical premium.

I expect Visa to outperform the market over the next five years, and reiterate a ‘Buy’ rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.