Summary:

- Visa is the leading global card network, benefiting from the shift towards card-based and electronic payments.

- Visa has delivered steady revenue growth and value accumulation over the past decade, with impressive margins.

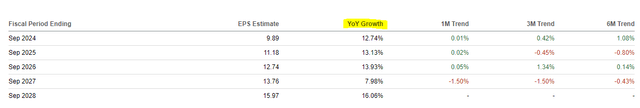

- Analysts project continued double-digit earnings growth for Visa, driven by a supportive industry growth backdrop, as well as strong margins.

- I value Visa stock based on a residual earnings model and I calculate a fair implied share price equal to $282.

Justin Sullivan

My investment thesis for Visa (NYSE:V) emphasizes the company’s position as the leading global card network, benefiting from the secular shift towards card-based and electronic payments. In addition, the attractiveness of Visa’s solid growth outlook is compounded by high incremental margins, low capital expenditures, and an exceptional ability to generates substantial free cash flow, most of which is directed to shareholders. On that note, Visa stock looks quite cheap at an EV/EBIT of 21x; And in line with my valuation model based on analyst consensus estimates, I estimate that Visa stock may reasonably be valued about 10% higher. Buy.

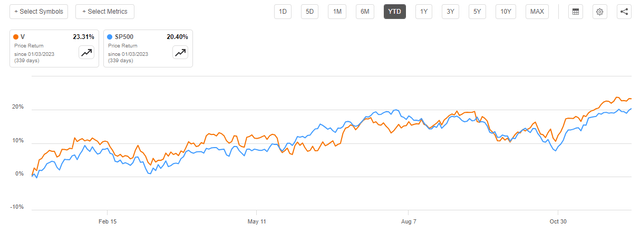

For reference, since the start of the year Visa stock is up about 23.3%, compared to a gain of approximately 20.4% for the broad market, S&P 500 (SP500)

For the past 10 years, Visa shares are up almost 400%, compared to about 160% for the S&P 500.

Revenue Growth And Value Accumulation Is Impressive

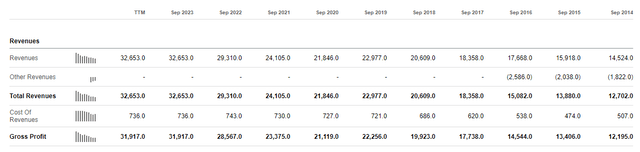

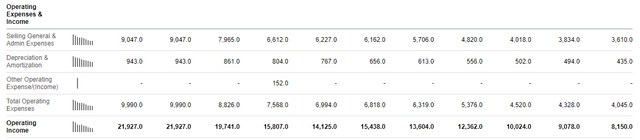

There are few companies that have delivered similarly steady revenue growth and value accumulation over such a long period like Visa. For context, during the most recent twelve months, Visa generated approximately $32.7 billion in sales, achieving a compounded annual growth of about 9.5% compared to the company’s sales a decade ago. Similarly, the company’s gross profit almost tripled, to about $32 billion, outpacing top line growth by approximately 100 basis points.

Also the company’s operating income delivered solid expansion: a CAGR of about 12% from 2014 through 2023 TTM, growing to $22 billion.

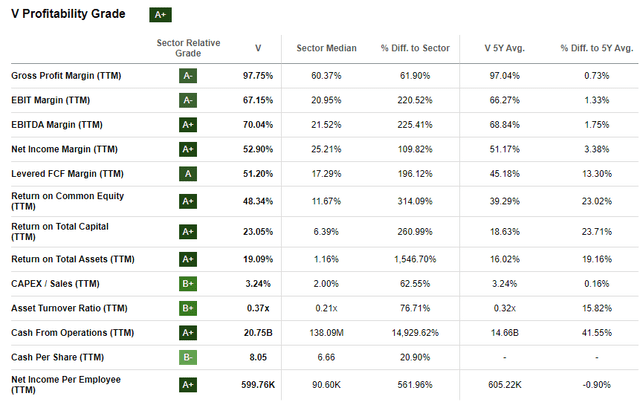

Commenting on Visa’s profitability, I would also like to point out that the company’s margins are unmatched, even by blue chip tech giants such as Google (GOOG) and Microsoft (MSFT). As of September 2023, Visa’s gross profit margin and EBIT margin stood at 98% and 67%, respectively.

More Growth Ahead …

There are reasons to believe that Visa’s potential of delivering revenue growth and value accumulation may not yet have been fully exhausted. In fact, according to analysts from BusinessResearchInsights, the global cards and payment market is projected to grow at a 15.9% CAGR through 2031, to about $202 billion. Notably, this would be about 5x the projected nominal GDP growth for the respective period, implying investors may quite certainly find alpha-rich growth in Visa shares. Underlying drivers of this growth are e-commerce, mobile technology, software-driven payment systems, as well as the evolution of modern digital banking.

That said, analyst consensus currently projects that Visa’s earnings may continue to grow at a double-digit CAGR through 2028, broadly in line with the company’s historical growth.

Referencing growth, I view Visa’s expansion outlook as well-protected, with payment processing clearly being anchored on network effects. As of FY 2023, Visa’s network extends across over 200 countries and territories, linking approximately 14,500 financial institutions, over 130 million merchant locations, while managing a total annual payment volume of $15 trillion over 276 billion transactions.

… Setting Up For Attractive Shareholder Distributions

One major aspect to like about Visa’s growth is related to the company’s exceptional ability to leverage top line expansion into higher shareholder payouts.

In that context, investors should consider that Visa operates within an incredibly asset-light business framework, deeply rooted in its payment-focused value proposition. Virtually every facet of Visa’s operations, spanning its payment networks, processing systems, and financial services, revolves around reliance on digital transactions and services. This software-driven and asset-light business model empowers Visa to efficiently monetize its offerings, swiftly expand its reach, and maintain competitiveness. Moreover, by emphasizing asset light software infrastructure and digital services, Visa can dedicate resources to innovation and agile responsiveness to customer needs while minimizing risks and costs linked to physical assets. This approach also allows Visa to reduce its dependence on significant capital expenditures associated with asset depreciation, liberating substantial resources to be channeled back to shareholders.

That said, Visa’s financial and commercial success almost 1:1 translates into appealing returns for shareholders through dividends and share buybacks. Over the recent year, Visa’s operations generated approximately $20.8 billion in cash, of which a significant portion (almost 80%) was distributed to equity holders, approximately $3.8 billion in form of dividends and $12.2 billion in form of stock buybacks. Notably, only about 5% of the operating cash was directed to CAPEX.

Valuing Visa

At first glance, Visa does screen somewhat expensive on a relative basis, trading at an EV/EBIT of 21x compared to a sector median of about 12x for “Financials”. However, I point out that Visa’s business model and growth profile is clearly not comparable to “Banks” and similar businesses. In fact, compared to traditional banking, Visa’s business model enjoys higher operating margin, lower capital expenditure, a less severe competitive backdrop and a stronger long-term growth outlook.

That said, I view a multiples comparison as very superficial. In my opinion, companies with steady, and relatively predictable business fundamentals are quite easily and precisely valued with a residual earnings model, which anchors on the idea that a valuation should equal a business’ discounted future earnings after capital charge. As per the CFA Institute:

Conceptually, residual income is net income less a charge (deduction) for common shareholders’ opportunity cost in generating net income. It is the residual or remaining income after considering the costs of all of a company’s capital.

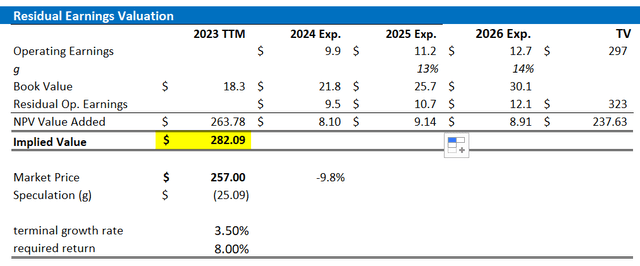

With regard to my Visa stock valuation model, I make the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2026. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2–3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on Visa’s cost of equity at 8%. Although this rate may be set to high, given the company’s competitive standing and business stability, I prefer to be conservative in my assumptions.

- For the terminal growth rate after 2025, I apply 3.5%, which is about one percentage point higher than estimated nominal global GDP growth. Again, I believe this rate reflects a conservative base case scenario.

Given these assumptions, I calculate a base-case target price for Visa stock of about $282/share.

Analyst Consensus; Company Financials; Author’s Calculations

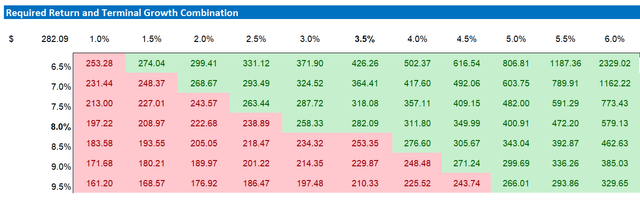

As I argued that may estimates for growth and equity charge may be conservative, I acknowledge that investors may hold varying assumptions regarding these rates. Therefore, I’ve included a sensitivity table to test different scenarios and assumptions. See below.

Analyst Consensus; Company Financials; Author’s Calculations

A Note On Risks

No stock is without risk, and neither is Visa. Most notably, I point out that payment/ financial services companies are frequently exposed to regulatory changes relating to transaction fees or privacy laws. Additionally, technological advancements present a double-edged sword. While innovation drives Visa’s industry position forward, it also invites heightened competition and disrupts traditional payment systems. Emerging fintech firms and evolving consumer preferences might challenge Visa’s market dominance, or may necessitate substantial investments to stay competitive. Lastly, I argue that economic downturns may challenge Visa’s revenue due to lower consumer spending.

Conclusion

Visa is a highly attractive “compounder”, having delivered a historic track record of steady revenue growth and value accumulation, with impressive margins. Going forward, this trend is projected to continue: Visa’s fundamentals are likely to continue to benefit from the shift towards card-based and electronic payments. On that note, my projection for Visa agrees with analysts consensus that the company may deliver double-digit earnings growth through the next 3-5 years. That said, I value Visa stock based on a residual earnings model and I calculate a fair implied share price equal to $282.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.