Summary:

- Increased position in Visa due to outstanding dividend growth and potential for multiple expansion.

- Visa operates on high margins and remains a cash flow machine, regardless of the market consensus regarding revenue growth.

- V’s management expects the revenue growth to fall in line with its previously announced outlook.

- Visa remains the industry leader with outstanding, long-term ability to generate cash flows and reward shareholders. However, after recent pullbacks V became undervalued and holds strong upside potential.

- Welcome to Cash Flow Venue, where we discuss dividend investing opportunities. I am a finance professional with broad M&A and valuation expertise. Enjoy the read!

imaginima/E+ via Getty Images

Introduction and Investment Thesis

In our ever-changing world, change is the only constant. Therefore, it’s always worth considering cutting-edge businesses operating within modern-world industries accompanied by secular tailwinds. At Cash Flow Venue, we build a resilient, dividend-oriented portfolio generating steady and growing income.

Accordingly, I’ve recently increased my position in Visa (NYSE:V). Although its dividend yield is not something to be impressed with, Visa delivered outstanding dividend growth, and I don’t believe there’s any reason for that to change as the Company:

- still has plenty of room to grow its business in our increasingly digitized world

- operates on high margins

- can be considered a cash flow machine with not only solid dividends but also significant share repurchases

- has a safe financing structure with no debt maturities upcoming until year-end 2025

- has a low payout ratio

Moreover, after recent pullbacks, Visa has meaningful upside potential resulting just from multiple expansion, which I believe to be a realistic scenario. Therefore, Visa is a ‘strong buy’ for me. As mentioned, I’ve increased my position and believe V is a solid addition to a well-structured portfolio with a place for a reliable tech player.

Business Model Supported By Secular Trends

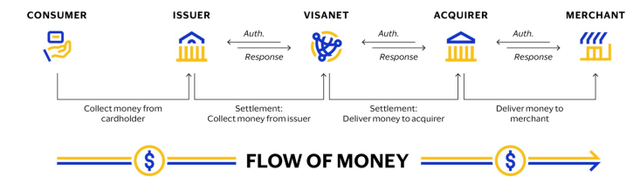

Visa is one of those businesses that are accompanied by secular trends, have high growth potential, and can easily be considered cash flow machines. The Company operates a global payment network, facilitating payment processes and funds flow. Visa distinguishes three main operational segments followed by ‘other revenues‘:

- Service: The main growth driver of this segment is payment volumes, as revenue is related to supporting the usage of the Visa payment network

- Data processing: This segment is driven primarily by the number of processed transactions, as the revenue is earned for (inter alia) clearing, authorizing, and settling the transactions

- International transaction: Revenues are earned when cross-border transactions or currency conversion settlements are involved

Visa’s 2023 10-K

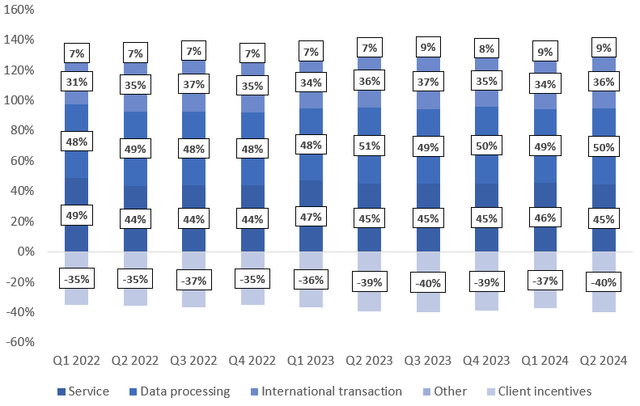

Visa’s revenue stream is well-diversified across the above segments. For details regarding the revenue structure, please refer to the chart below. However, please remember that this is not a typical structure, as the net revenues are cleared for customer incentives (negative share). Nevertheless, that provides a high-level understanding of Visa’s revenue sources.

Visa’s 10-Qs

Visa’s further development will be supported by major trends and business activities, including:

- continuous movement from cash payments to digital payments

- e-commerce development with non-present, usually digital settlements

- increasing activity outside of the US with double-digit revenue growth rates recorded (on a year-over-year basis) in V’s International segment

- further innovations increasing the security, UX, and convenience of digital payments

Visa’s 2023 10-K

Visa Missed The Revenue Expectations – So What?

As we can read in Seeking Alpha’s news section regarding V:

Q3 net revenue of $8.90B, lagging the $8.92B consensus, increased from $8.80B in Q2 and $8.12B in Q3 2023.

Any readers of Benjamin Graham’s Intelligent Investor? One of the most important lessons he embedded within this classic was to be aware of Mr Market’s mood swings, as he is highly emotional. That’s what we can observe on V’s stock price chart, with a noticeable decrease in V’s stock price. We are ~10% below its ATH recorded in March 2024.

Yes, the Q3 2024 results were not the best by V’s standards or according to the market consensus; however, revenue growth still amounted to a solid 9.6% on a year-over-year basis, and high margins were upheld. Numerous businesses may wish to deliver such results during a ‘bad’ quarter. Also, what’s the business-wise impact of meeting/exceeding/falling short of the analysts’ expectations? Apart from the short-term increase in volatility, I don’t believe that has any meaningful impact – as long as one keeps a long-term perspective. In many cases, such events create opportunities to accumulate or start building positions at more favourable entry prices with more solid safety margins. I believe that’s exactly the case for Visa.

The business remains intact, and during the Q3 2024 Earnings Call, the management pointed out the expectations to meet its previously announced 2024 guidance:

With three quarters now complete, our expectations for full year adjusted net revenue growth remains unchanged from what we shared at the start of the year. Whilst absorbing the impact of lower currency volatility and the macroeconomic challenges in Asia, which have affected volumes, we still expect to reach low double-digit adjusted net revenue growth for the full year.

Visa Is a Cash Flow Machine

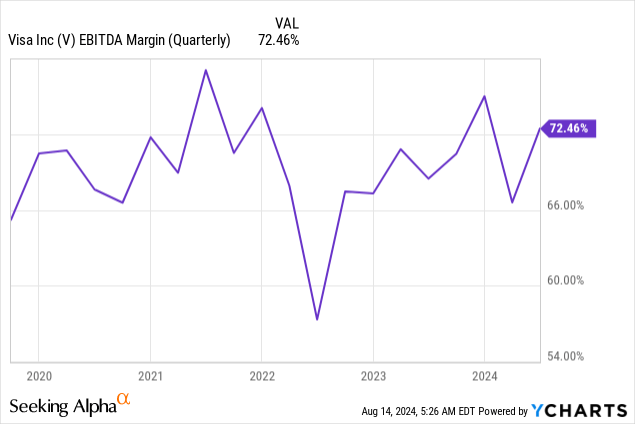

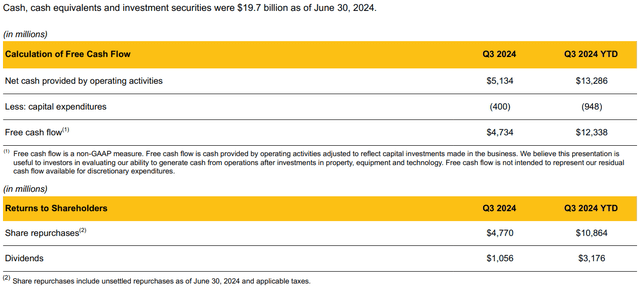

V generates a sustainable EBITDA margin often exceeding 70%. As a result, the Company generated $13,286m of net cash by operating activities in 2024 YTD. As Visa suggested in its presentation, adjusting the above value for capital expenditures (PP&E), the Company generated $12,338m of free cash flow, which supported the rewards for Visa’s shareholders, including:

- share repurchases amounting to $10,864m YTD

- dividends amounting to $3,176m YTD

Visa’s Investor Presentation

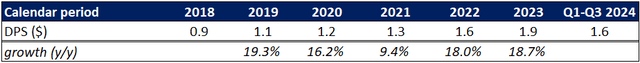

Let’s examine the dividends per share, looking at the class A common stock. Please remember that for this segment, I examined calendar periods, not fiscal ones. With that said, please review the DPS of V in the table below.

Visa – dividend summary

V delivered an outstanding compound annual growth rate of its DPS, amounting to 16.3% during 2019 – 2023 (with 2018 as a base year). Moreover, I expect another dividend increase to be announced for Q4 2024.

Therefore, despite a modest yield of 0.8%, V’s dividend is a strong factor to consider while analysing the Company. There’s no reason for this significant growth to seize, which will drive the yield-on-cost upwards. Moreover, let’s remember the significant share repurchases amounting to ~3x the value of dividends paid.

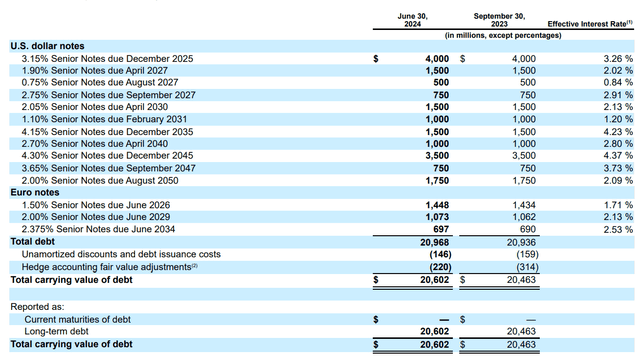

From the balance sheet point of view, shareholders’ returns are well-supported as there are no upcoming debt maturities until December 2025, when V’s 3.15% senior notes are due. Should the high-interest rate environment be upheld, V may face a higher debt cost related to refinancing, but that’s a negligible factor regarding its ability to uphold and further increase shareholders’ rewards.

Visa’s Q3 2024 10-Q

Quick Peek At The Competition

It’s difficult, and probably not very effective, to discuss V without considering its peer, Mastercard (MA). MA is V’s close competitor that distinguished (for reporting purposes) two operating segments:

- payment network

- value-added services and solutions

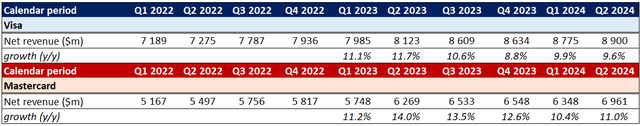

MA’s net revenue stood at ~$7B, so it has a smaller scale of business than V. Also, according to its revenue structure, MA has a smaller share of the US market than V.

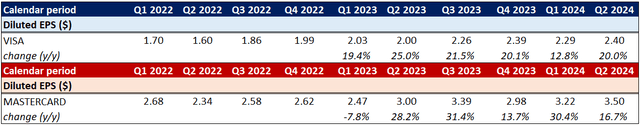

A positive factor vouching well for MA over V is its revenue growth. Please refer to the table below, which summarises the quarterly revenue development with year-over-year growth dynamics. Please keep in mind that for comparability, I’ve presented the results on a calendar basis – not a fiscal basis. There’s no financial impact; it’s just a presentational aspect.

Visa and Mastercard – 10-Qs

During recent quarters, MA outperformed V in terms of revenue growth. However, V’s quarterly diluted EPS recorded a higher compound ‘quarterly’ growth rate during the Q2 2022 – Q2 2024 period, amounting to 3.9%, while MA’s stood at 3%. For details, please refer to the table below.

Visa and Mastercard – 10-Qs

The outperformance regarding the revenue growth in recent quarters, combined with still solid dil. EPS growth may make investors wonder whether MA is not a better choice. That is a fair question; however, that comes with a price – there are no free lunches. MA is noticeably more pricey than V, which leads us to the next point.

Valuation Outlook

As an M&A advisor, I usually rely on a multiple valuation method, a leading tool in transaction processes. This method allows for accessible and market-driven benchmarking. Numerous metrics are available for valuing a company, with EV/EBITDA being a rule of thumb for most sectors and transactions.

With that said, the forward-looking EV/EBITDA multiple stood at:

For some P/E advocates, the forward-looking GAAP P/E stood at:

- 26.9x for Visa

- 32.7x for Mastercard

The above data reflects my previously mentioned point – Vica trades at a significant discount compared to Mastercard. To some degree, it may be attributable to the slower revenue growth it recorded in recent quarters. Nevertheless, I believe that the valuation gap is too wide and expect V to narrow it. Once again, referring to Benjamin Graham, once the Mr Markets’ mood swings weaken and the market will seize to underestimate Visa’s long-term ability to generate cash flows and shareholder returns, Visa will experience the multiple expansion.

Considering the strength of its business, the secular trends supporting it, and the Company’s financial stance, I consider reaching the EV/EBITDA multiple of ~23x as a realistic and quite conservative scenario. That alone would unlock over ~15% upside with a solid base for the yield-on-cost to appreciate.

The Bottom Line

Visa is well-established to further capitalize on our ever-changing, continuously digitizing world. V is a reliable tech player operating crucial infrastructure that has proven its stability as a leading provider of payment facilitation solutions. The Company:

- still has plenty of room to grow its business

- operates on high margins

- can be considered a cash flow machine with not only solid dividends but also significant share repurchases

- has a safe financing structure with no debt maturities upcoming until year-end 2025

- has a low payout ratio

- trades at a discount, and thus, holds potential for meaningful upside resulting just from the multiple expansion

Nevertheless, there are some risk factors worth considering:

- the potential recession and geopolitical tensions may limit the number of processed transactions and payment volumes, which are the main drivers of V’s revenue growth

- should the high interest rate environment be upheld, V may face higher debt costs related to refinancing

- V is a technological business supporting crucial infrastructure in the modern world. Should it be subject to major cyber attacks, data leakages, or payment network blackouts, its brand would be hurt by that, leading to increased stock price volatility and possible worse growth prospects

- any other material adverse changes impacting its financial stance or the market sentiment. That’s why it’s important to build that margin of safety, which V certainly provides.

All in all, Visa is a ‘strong buy’ for me – I am bullish on V.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.