Summary:

- Visa, a multinational financial services corporation, is now a $554 billion (by market cap) digital payments monstrosity.

- Visa is processing around $15 trillion in total volume annually.

- With inflation running hot over the last few years and causing the cost of almost everything to go up rather materially, Visa’s fee base is rising in kind.

- The 10-year dividend growth rate is 18.3% with the stock’s yield of 0.8%.

- Visa moved its revenue from $12.7 billion in FY 2014 to $32.7 billion in FY 2023 with a compound annual growth rate of 11.1%.

hatchapong

Visa Inc. (NYSE:V) is a multinational financial services corporation. Founded in 1958, Visa is now a $554 billion (by market cap) digital payments monstrosity that employs more than 28,000 people.

FY 2023 net revenue breaks down across the following four segments: Data processing revenues, 49%; Service revenues, 45%; International transaction revenues, 35%; and Other revenues, 8%. Client incentives, a contra-revenue segment, which reduced gross revenue by 27%, reconciles the difference.

Visa has a simple business model. But there’s beauty and power in the simplicity. Essentially, Visa operates a global open-looped network that enables electronic payments for consumers, merchants, and governments.

Visa facilities easy digital payments. In return for doing so, the company collects a small fee from every digital payment it processes. This is a “toll booth” model, which can be very lucrative. In lieu of cash, payments are able to easily and safely be handled on Visa’s payment network – by way of a Visa card. Visa has been so successful at this, it now operates the largest such digital payments network in the world.

To put this in perspective, the company’s processing infrastructure, VisaNet, processes more than 700 million transactions per day. The company is processing around $15 trillion in total volume annually. With over 4.5 billion Visa cards in global circulation, there appears to be no stopping this train.

On the contrary, in some ways, Visa might be just getting started. Up until somewhat recently, cash was still the dominant form of payment for global transactions. Morningstar notes this: “Digital payments, on a global basis, surpassed cash payments just a few years ago, suggesting this trend still has a lot of room to run.”

Since digital payments are superior to cash payments in almost every single way, it makes sense that cash is slowly being phased out. This means there’s still a huge growth runway ahead. And yet, Visa dominates this expanding landscape. Morningstar states this about Visa’s share of market: “According to the Nilson Report, Visa holds over 50% market share (by purchase volume) in the U.S., Europe, Latin America, and the Middle East/Africa.”

It’s estimated that Visa processes twice as many transactions as its nearest competition. The ongoing conversion from cash to cards bodes incredibly well for Visa – it gets the lion’s share of a pie that continues to grow in size.

Furthermore, with inflation running hot over the last few years and causing the cost of almost everything to go up rather materially, Visa’s fee base is rising in kind. That’s because Visa earns a steady percentage of the amount of purchases made across its network. The annual rate of inflation in percentage terms has been slowing of late, but the new, higher cost base of almost everything is firmly entrenched, which boosts Visa’s fees in absolute terms.

Outside of outright deflation, these higher prices are very sticky. It’s a permanent “step up” for Visa’s fee base. Visa has many levers to pull. That’s why the company’s revenue, profit, and dividend should all continue to grow briskly over the coming years.

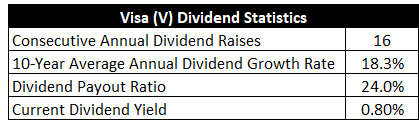

Dividend Growth, Growth Rate, Payout Ratio and Yield

Already, Visa has increased its dividend for 16 consecutive years. Remarkably, that dates back to Visa’s 2008 IPO. So the company has been paying a dividend right out of the gate, and it’s been increasing the dividend for as long as it possibly could be.

The 10-year dividend growth rate is 18.3%. That is quite impressive. Moreover, there hasn’t been a marked slowdown here – even the most recent dividend raise was over 15%. Visa has been a consistent double-digit dividend grower throughout its public history.

Now, the stock’s yield of 0.8% is the trade-off one has to make in order to access that high growth. That said, this is a trade-off that’s been made for years, and this yield is actually 10 basis points higher than its own five-year average.

Seeing how much performance and total return shareholders have gotten out of Visa over the years, it’s been a very wise trade-off to make. And with a payout ratio of only 24%, the dividend is easily covered.

With the business growing as fast as it is (which I’ll delve into soon) and with the payout ratio being this low, Visa is pretty much a lock for double-digit dividend growth for years to come. For long-term dividend growth investors who prioritize growth and lean toward high-quality compounders, these dividend metrics have to pop out and make you smile.

Revenue and Earnings Growth

As much as one may smile at these numbers, though, they’re largely looking into the past. However, investors must always be looking toward the future, as today’s capital gets risked for tomorrow’s rewards. That’s why I’ll now build out a forward-looking growth trajectory for the business, which will be of aid when it comes time to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth. And I’ll then reveal a professional prognostication for near-term profit growth. Lining up the proven past with a future forecast in this way should give us what we need to make an informed judgment on where the business may be going from here.

Visa moved its revenue from $12.7 billion in FY 2014 to $32.7 billion in FY 2023. That’s a compound annual growth rate of 11.1%. I’m usually looking for a mid-single-digit top-line growth rate from a mature business, although I’m happy with more.

Visa clearly knocked it out of the park here, especially considering its size. Meantime, earnings per share grew from $2.16 to $8.28 over this period, which is a CAGR of 16.1%. Very nice. This is a strong result.

Visa has been growing the business at a brisk pace, which explains the low payout ratio in the face of such high dividend growth. There’s been no “faking” of dividend growth through pure payout ratio expansion.

A combination of sharp margin expansion and extensive share buybacks helped to fuel excess bottom-line growth. For perspective on the latter, the outstanding share count is down by approximately 17% over the last decade. Visa has been both a growth and buyback machine.

Looking forward, CFRA is projecting a 15% CAGR for Visa’s EPS over the next three years. This is roughly in line with what Visa has done over the last decade. It would be a continuation of the status quo. CFRA states: “We expect growth to be driven by durable payment volumes as key growth engines (consumer payments, new flows, and value-added services) allow for sustained gains. Importantly, secular catalysts (i.e., displacement of cash through higher usage of digital payments) related to adjacent payment flows have compounded solidly.” This secular change in the way payments are made and processed is key for Visa, and there’s still a very long runway ahead on this.

Another key aspect of the business model is near-infinite scalability at a fixed cost. CFRA touches on this: “Of note, when revenues grow, operating leverage is relatively easy as Visa’s network costs are largely fixed (have risen just 2% since 2019).” There’s a big runway for network growth without a matching cost runway. That bodes extremely well for Visa and its ability to compound over the coming decades.

The inflation that’s played out over the last few years is a good example of how this works for Visa. If, for example, something that would have cost $20 a few years ago now costs $30, Visa now collects a fee for a $30 transaction rather than a $20 transaction. That’s automatically more fee revenue, and Visa did nothing for it.

Yet, Visa also incurs no additional costs for the facilitation of the transaction. The scalability is incredible, and the business model is about as good as it gets when it comes to hedging inflation. Again, this is basically a money machine, which opens up many avenues to reward shareholders. This passage by CFRA sums it up well: “Visa remains a top-tier capital allocator, as its cash generative business allows for healthy returns via buybacks, dividends, and M&A.” If we take this 15% number as our near-term base case – I see no reason why not – that easily sets the dividend up for similar growth. That’s right there with Visa’s most recent dividend raise.

Assuming no major change in valuation, the sum of yield and growth should roughly approximate total return. Putting it all together, Visa’s shareholders could be in for a double-digit annualized total return over the next decade. If one is just hungry for yield, maybe it’s sour milk. But for younger investors who understand the importance of compounding and total return over long stretches of time, this setup is highly, highly appealing.

Financial Position

Moving over to the balance sheet, Visa has a fantastic financial position. The long-term debt/equity ratio is 0.5, while the interest coverage ratio is over 32. On their own, these are very good numbers. However, they believe in Visa’s true financial prowess.

Visa has almost no net debt, as cash nearly offsets all long-term debt. Profitability is outstanding. Return on equity has averaged 40.6% over the last five years, while net margin has averaged 51.2%.

Visa is consistently generating extremely high returns on capital, which is what unleashes a lot of the enterprise’s compounding ability. Margins are also outrageously great, and there’s been a nice expansion here – net margin was regularly in the 40% area at the start of the last decade.

Fundamentally speaking, Visa is one of the best businesses on the planet. And the company does benefit from durable competitive advantages that include brand power, a huge network effect, built-out global digital infrastructure, global market share leadership, easy and infinite scalability on industry-leading scale, and barriers to entry.

Of course, there are risks to consider. Regulation, litigation, and competition are omnipresent risks in every industry. Seeing as how Visa operates within the favorable confines of a global oligopoly – there are only four large global payment networks – competition is limited. However, regulation is a major concern, especially with the oligopolistic nature of the industry inviting regulator ire.

Visa is exposed to broader economic trends, as its fee base is directly tied to global spending. Any kind of large-scale recession would likely impact Visa. Being a global payments processor, Visa has built-in exposure to geopolitics and different currencies.

The company’s large size is a risk, as the law of large numbers could start to be a drag on relative growth. Any major change in the way payments are handled would be a threat to Visa’s business model, and there are technological disruption risks present. There are definitely some risks to consider here, but even a world-class business like Visa has some risks. And the valuation doesn’t seem to fully account for the quality and growth of the business.

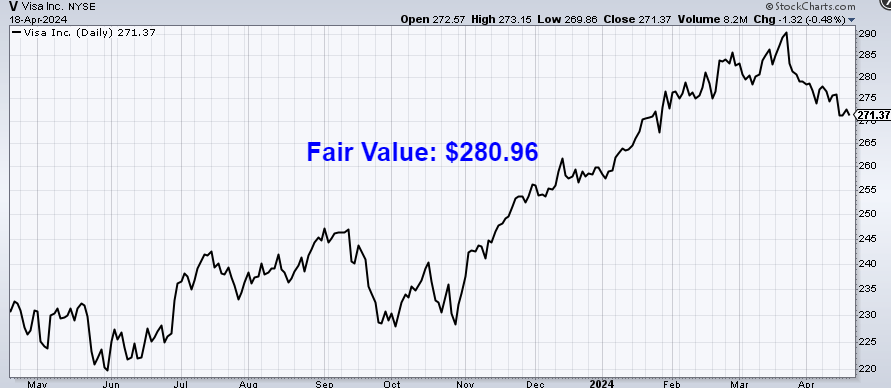

Valuation

The stock’s P/E ratio is sitting at 31.4. That’s high, yes, but not overly so for a business like this. Keep in mind, its own five-year average P/E ratio is 34.8. And I’d argue that 35 times earnings for a business like this isn’t all that bad.

The cash flow multiple of 17.5 is also below its own five-year average of 20.2 And the yield, as noted earlier, is slightly higher than its own recent historical average. So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a two-stage dividend discount model analysis. I factored in a 10% discount rate, a 10-year dividend growth rate of 18%, and a long-term dividend growth rate of 8%. This model is more aggressive than what I’m typically using, but Visa is exactly the kind of business to warrant aggressiveness.

My near-term base case assumes a continuation of the demonstrated 10-year dividend growth rate. It’s more of the same. And the same has been great. This is a business that’s been compounding EPS at a mid-teens rate and the dividend at a high-teens rate for years. Furthermore, the near-term expectation for EPS growth is in the mid-teens area.

With the payout ratio being as low as it is, along with the stellar balance sheet, Visa should be more than able to grow the dividend at a high-teens rate over the coming years, although I would (and did) assume a moderation of that growth beyond the next decade.

The DDM analysis gives me a fair value of $257.88. The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide. The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth. It then discounts those future dividends back to the present day, to account for the time value of money, since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks. I see a wonderful business trading at something close to a fair price. But we’ll now compare that valuation with where two professional stock analysis firms have come out at. This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system. 1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value. Morningstar rates V as a 3-star stock, with a fair value estimate of $260.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line. They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold. CFRA rates V as a 4-star “buy”, with a 12-month target price of $325.00.

I’m very close to Morningstar’s number on this one. Averaging the three numbers out gives us a final valuation of $280.96, which would indicate the stock is possibly 3% undervalued.

Bottom line: Visa Inc. is a world-class business that’s perfectly positioned for the secular trend that’s transitioning the world away from cash and toward digital payments. It has sky-high returns on capital, fat margins, a stellar balance sheet, and infinite scalability at minimal costs. With a higher-than-average yield, high-teens dividend growth, a low payout ratio, more than 15 consecutive years of dividend increases, and the potential that shares are 3% undervalued, this could be a great opportunity to buy shares in one of the world’s best businesses at a reasonable valuation.

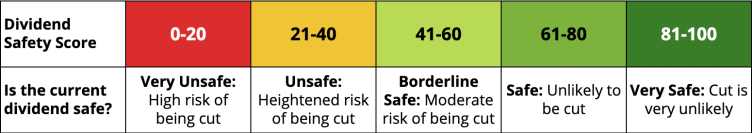

Note from D&I: How safe is V’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 99. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, V’s dividend appears Very Safe with a very unlikely risk of being cut.

Disclosure: I’m long V.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.