Summary:

- The US Dollar Index has been bullish for 8 weeks, which may pressure earnings for companies with significant ex-USA operations.

- Visa, the largest global credit network, has a stable operating environment and robust EPS growth outlook.

- Risks to Visa’s stock include a weakening consumer environment, regulatory changes, and the potential impact of a rising dollar on earnings.

- Ahead of earnings next month, I outline key price levels to watch.

Justin Sullivan

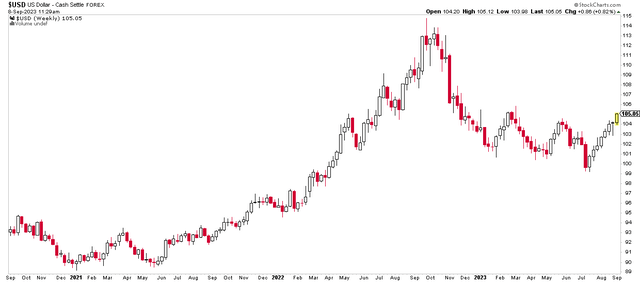

The US Dollar Index’s bullish run has reached 8 weeks. The greenback will undoubtedly pressure earnings for companies with significant ex-USA operations. The DXY’s rally to 6-month highs may not be seen so quickly but expect companies to cite adverse FX moves as dinging profitability trends perhaps next month when Q3 earnings reports roll in and beyond.

I have a buy rating on one of the largest global payment processors, Visa (NYSE:V). I see the company executing well, and its EPS growth outlook is robust. With a new CFO taking the helm, Visa has a relatively stable operating environment with ample free cash flow.

Dollar, A Rising Earnings Risk For Large Multinationals

According to Bank of America Global Research, Visa operates the world’s largest retail electronic payments network. The company provides processing services and payment product platforms, including consumer credit, debit, prepaid and commercial payments, that are offered under Visa and related brands. According to Nilson estimates, V is the largest global credit network (as measured by volume) and the second-largest global debit network.

The San Francisco-based $501 billion market cap Transaction & Payment Processing Services industry company within the Financials sector trades at a high 31.2 trailing 12-month GAAP price-to-earnings ratio and pays a low 0.7% forward dividend yield. Ahead of earnings next month and a pair of industry conferences next week, shares feature a low implied volatility percentage of just 15% while its short interest is also low at 1.9%.

Back in July, Visa reported a modest bottom-line beat in its Q3 with 12% year-on-year revenue growth, though the quarter as a whole was not far from consensus expectations. The management team’s Q4 outlook also featured few surprises, though improvements in US volume growth and bullish signs for cross-border travel volumes helped the stock after a bearish initial share price reaction.

On a more real-time basis, July metrics were generally stable to modestly accelerating compared to the previous month, with growth in US payment volumes and total processed transactions. The firm expects Q4 net revenue growth of 10% as it continues to execute well in an ebbing consumer landscape.

Then in late August, Visa issued its mid-quarter update. Key metrics, such as travel-related cross-border volume growth and US payments volume, appeared on track in line with the longer-term earnings growth trajectory. US payment growth, specifically, accelerated to 7% on a year-on-year basis. Card-not-present volume increased by 9% as consumer payment preferences shift. Still, all eyes remain on how new potential rules on credit card late fees and ebbing spending trends in care of the reinstatement of student loan repayments get underway.

Key risks to further upside to the stock include the apparent weakening consumer environment, higher customer concentration, adverse regulatory changes along with unfavorable litigation outcomes, and the threat of losing key customer contracts due to rising industry competition. Being a multinational, a jumping dollar could pressure near-term earnings, too.

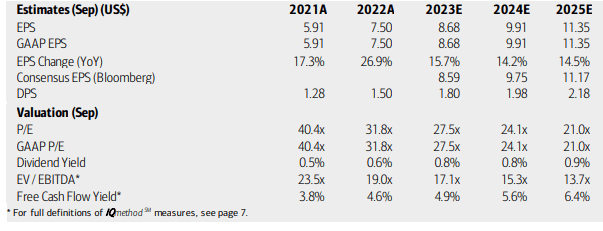

On valuation, analysts at BofA see earnings rising at a robust mid-double-digit rate over the next two years. Per-share profits are seen as nearing $10 in 2024 with further gains in 2025. The Bloomberg consensus forecast is about on par with what BofA projects. Dividends, meanwhile, are expected to rise commensurate with earnings growth while the stock’s P/E remains lofty. Shares feature an EV/EBITDA rate slightly above that of the broad market, so you are paying a premium for this stable business today. But Visa is also a solid generator of free cash flow – with $9.05 of free cash flow per share on a trailing 12-month basis.

Visa: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

BofA Global Research

If we assume normalized EPS of $9.50 over the coming 12 months and apply the stock’s 5-year historical P/E of 31.8 then the stock should be just north of $300. But with higher interest rates, we should trim the earnings multiple slightly, but the firm also has better execution today and more diversification compared to earlier years, so slicing the P/E materially is unwarranted in my view.

A 28 multiple on $9.50 of earnings yields a valuation of $266 – with the potential for the stock to be worth $310 by the end of next year based on EPS estimates and the same P/E.

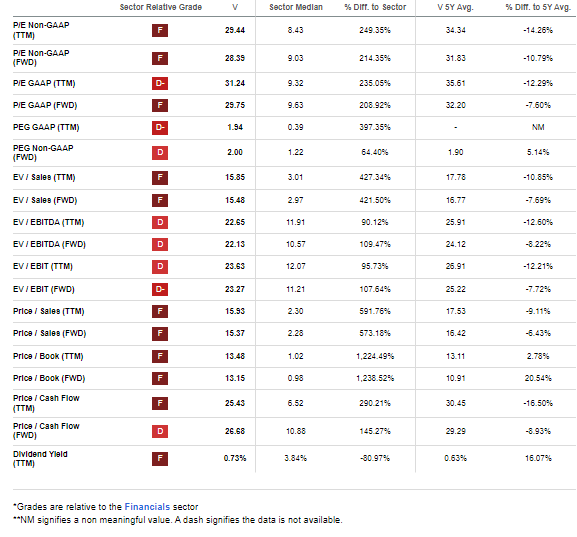

Visa: A Premium Valuation Deserved

Seeking Alpha

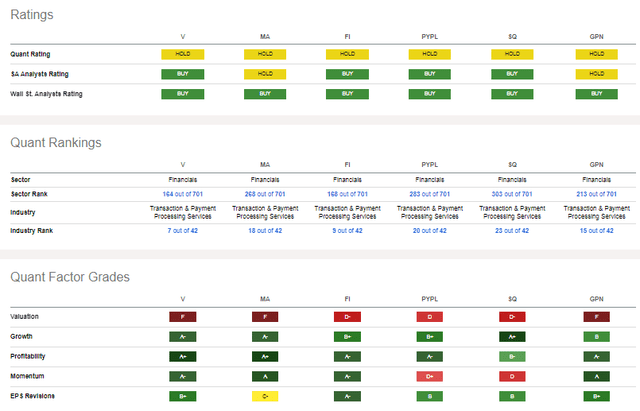

Compared to its peers, Visa has similar rankings. The group sports a valuation premium in a low-P/E sector with growth that most other Financials long for. Both Visa and Mastercard (MA) have impressive and consistent profitability trends and very strong stock price momentum in recent months. Visa, however, stands out compared to Mastercard in that its earnings revisions are much more sanguine.

Competitor Analysis

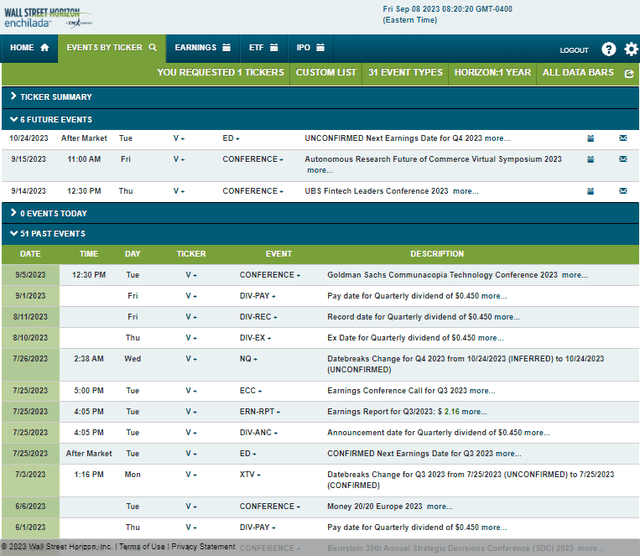

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q4 2023 earnings date of Tuesday, October 24 AMC. Before that, however, the company’s management team is slated to present at the UBS Fintech Leaders Conference 2023 and the Autonomous Research Future of Commerce Virtual Symposium next week. So, we could see new industry news at those events which could stir up some share price volatility.

Corporate Event Risk Calendar

The Technical Take

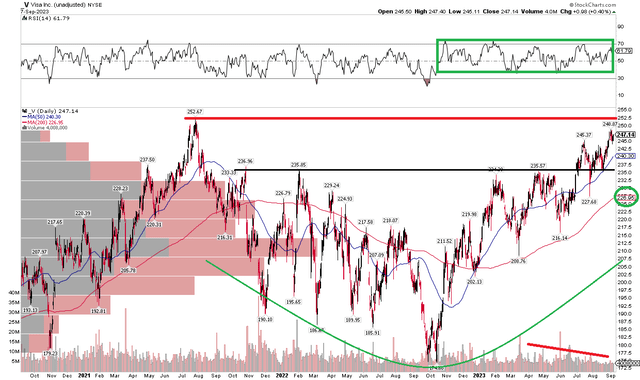

With a robust growth trajectory and reasonable valuation, how does the chart look? Notice in the graph below that shares are near their all-time high that was notched in the middle of 2021. Following a tough 30% bear market stretch that played out over more than a year, the stock has rallied more than 40%, outpacing both the Financials sector and the S&P 500 in that span.

What’s encouraging here is that Visa’s long-term 200-day moving average is upward-sloped, with the 50dma above that – both signs of a sustained bullish trend. I see support near $235 while $253 is the obvious point of potential selling pressure, though the 2021 peak might not bring about too much bearish activity since there were few shares traded hands then. There is, though, a high amount of volume by price starting at $230 all the way down to $190 – so deeper pullbacks should be met with buyers.

Overall, while volume has been on the decline during the latest thrust higher, the chart appears constructive, and a buy here while adding to a position on a breakout to new highs appears favorable.

Visa: Bullish RSI Momentum Range, Shares Approach All-Time High

The Bottom Line

I have a buy rating on Visa. This is a steady earnings grower with solid free cash flow, and its chart features a powerful uptrend today. The valuation is reasonable given its defensive nature and diversified business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.