Summary:

- Visa continues to show strong financial and operating performance, with steady revenue and total volume growth.

- The company is expanding its partnerships and exposure to developing markets, supporting medium-term growth rates.

- Visa’s costs remain stable, and the company is expected to generate strong free cash flow. However, the current valuation suggests limited price growth potential.

Justin Sullivan

Investment Thesis

Visa (NYSE:V) continues to show great financial & operating performance, growing TPV & revenue at steady rates. The company has well-positioned cost-structure, so the margins and free cash flow generation are also safe. Anyway, current valuation supposes very limited price growth potential, so we’re remaining HOLD status despite that in the long-term Visa may be a perfect choice for conservative value investors due to improving financials and market leadership.

Revenue growth is supported both by stable digitalization trend & product mix

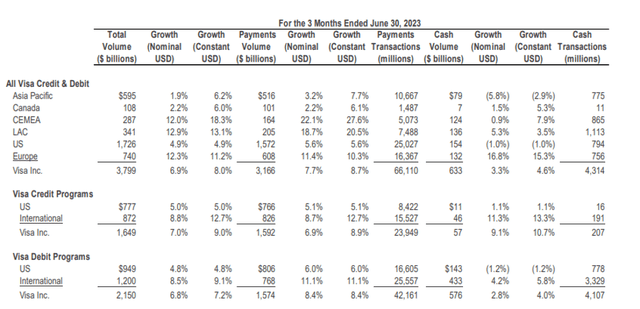

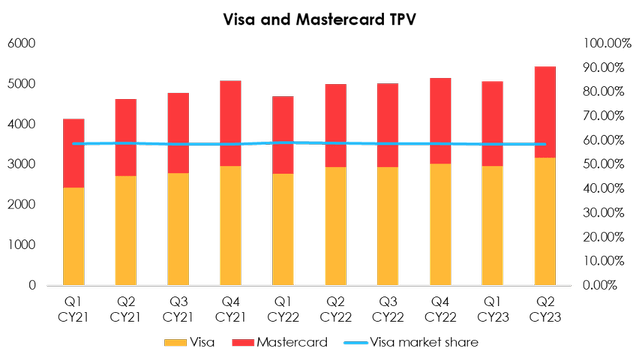

Visa’s total payment volume reached $3 166 bln (+7.8% y/y) in the third quarter, in line with our forecast for $3 133 bln. The macro trend for the digitalization of payment systems remains sustainable, while Visa continues to expand the number of its partnerships and boost exposure to developing markets.

In Q3, the company signed a contract with SAP to provide infrastructure for B2B payments in Asia, entered the P2P payment market in Bolivia with the help of the YellowPepper app, and signed several other deals. Although these are all small steps and are unlikely to have a significant impact on revenue in 2023, diversifying the business in developing markets will help support medium-term growth rates from 2024-2026.

With regard to TPV, we are maintaining our key expectations and slightly increasing the forecast for the metric from $12 272 bln (+5.8% y/y) to $12 305 bln (+6.1% y/y) for 2023 and from $13 427 bln (+9.41% y/y) to $13 462 bln (+9.4% y/y) for 2024 amid the weakening dollar.

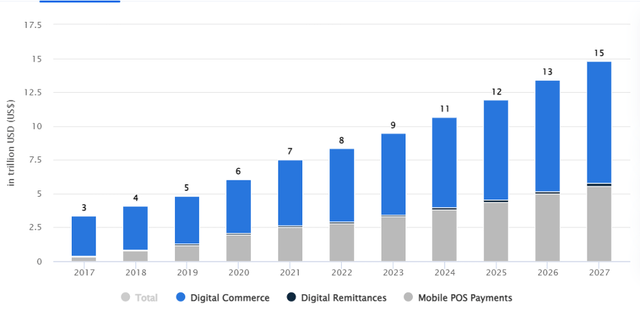

According to Statista, worldwide digital payment volume should increase to $9 tn in 2023 and to $11 tn 2024. Anyway, we believe that industry is mature enough to support 20+% annual growth rates, hence providing more moderate assumptions for Visa’s TPV forecasting.

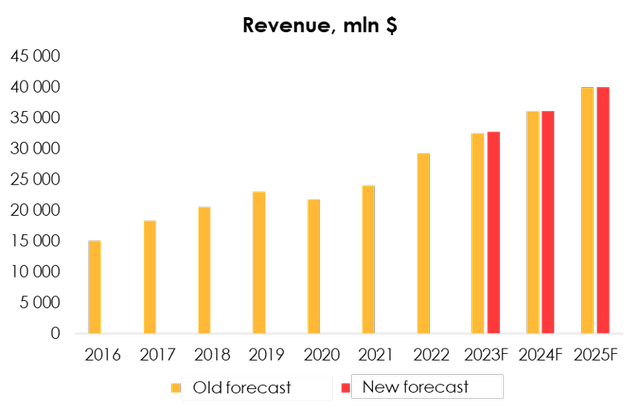

Furthermore, monetization of transactions is rising faster than we expected due to the growing proportion of more expensive services, so we are raising Visa’s revenue forecast from $32 528 mln (+11.0% y/y) to $32 728 mln (+11.7% y/y) for 2023 and from $36 085 mln (+10.9% y/y) to $36 096 mln (+10.3% y/y) for 2024.

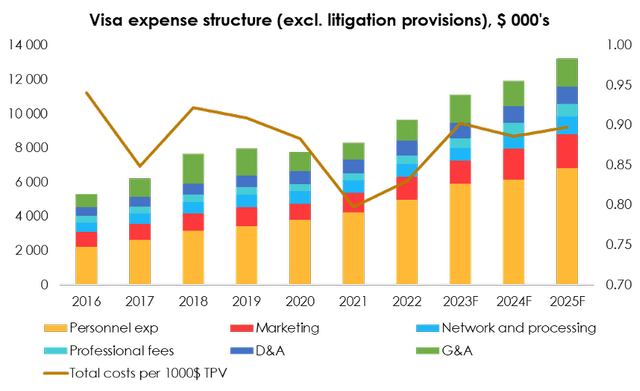

No pressure on cost side

Visa’s costs remain highly stable, and we aren’t changing the assumptions for operating costs for the period from 2023-2024. Since 2015, company shown great performance in terms of cost management, steadily decreasing OPEX per $ transaction. Anyway, rising wages may slightly affect company’s margins in short-term.

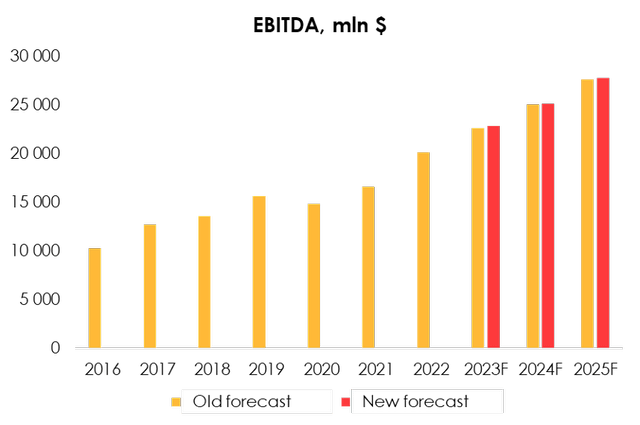

Given the increased revenue forecast, we are raising the forecast for adjusted EBITDA from $22 617 mln (+10.1% y/y) to $22 899 mln (+10.1% y/y) for 2023 and from $25 059 mln (+10.8% y/y) to $25 140 mln (+9.8% y/y) for 2024.

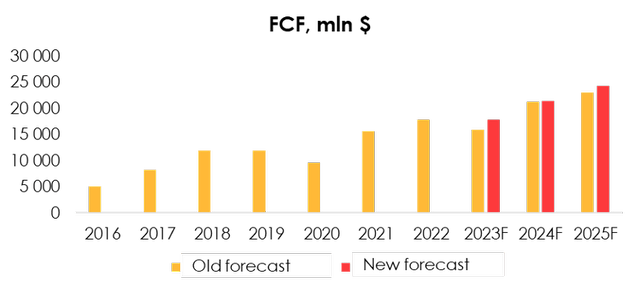

At the same time, historically unsignificant contributions to both capital & working capital investments are favorable for free cash flow generation.

Following the company’s report, we have also raised the forecast for free cash flow from $16 003 mln (-10.5% y/y) to $17 916 mln (+11.5% y/y) for 2023 and from $21 286 mln (+33.0% y/y) to $21 388 mln (+19.4% y/y) for 2024 due to moderated investment in working capital and a revision of interest revenue earned from securities and cash on the company’s balance sheet.

We previously published an article on Visa in December and since there the performance didn’t change much. Visa’s results in Q2 and Q3 were generally in line with our expectiaions, sometimes slightly exceeding them on revenue & EBITDA due to positive production mix effect. Since that, we don’t change our base assumptions and only slightly adjust them for the production mix and thereafter monetization effect.

Relative valuation

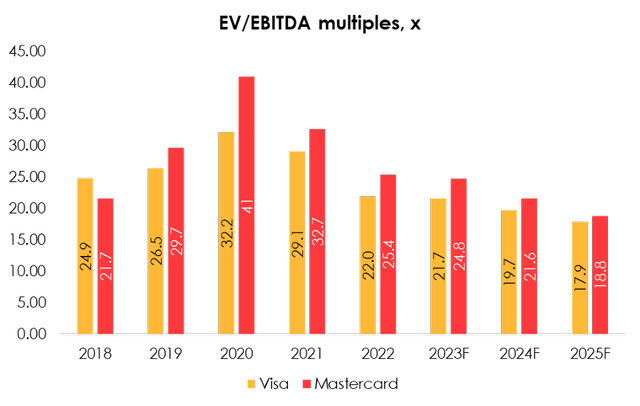

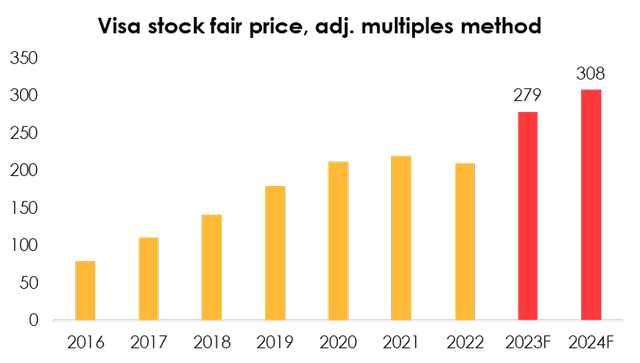

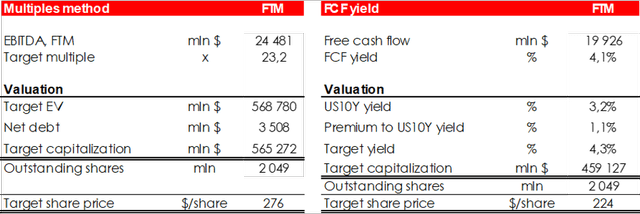

Visa has only one comparable peer, Mastercard, and is trading with almost 10% discount compared to MA. In FY16-FY22 Visa had an average multiple of 25.2x and adjusted for growth rates of 22.9x. We prefer Visa compared to $MA, as financials growth rates and market shares are identical, while Visa costs less.

Under base case scenario (adj. multiple of 22.8x and our projections EBITDA), we believe that Visa share prices may rise to $308 by the end of FY2024.

Risk section

Compared to other industries, Visa seems much less vulnerable to both systematic and unsystematic risks.

The unsystematic risk, which is generally related to losing competition, doesn’t seem significant for Visa. For the last 2 years Visa’s relative market share to Mastercard was rather stable, fluctuating at about 58.6%.

Strategic partnerships with banks and transaction systems are established with the same pace by both companies, and are likely to not be terminated in favor of the competitors due to customer habits.

Systematic risk, which now seems more reasonable due to potential economic slowdown, is more significant for Visa, but we believe Visa won’t likely face all these difficulties.

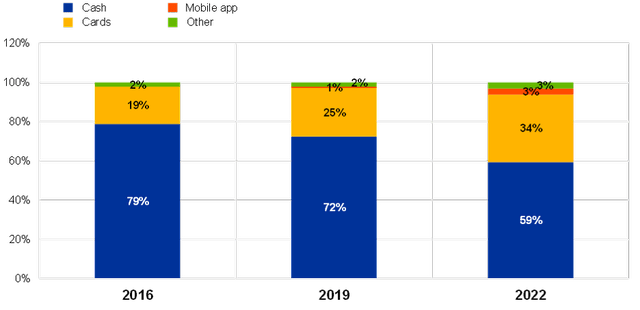

Payments are steadily shifting to digital space. According to ECB data, even in EU, where banking is less developed than in US, share of card payments almost doubled since 2016.

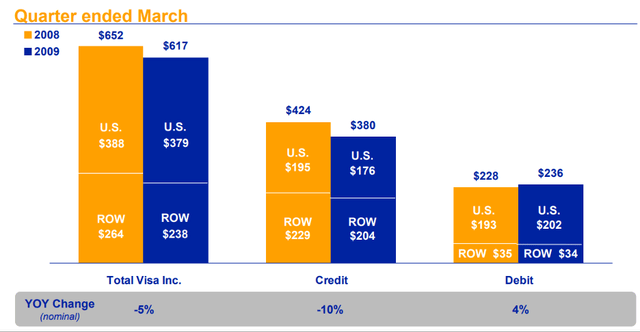

Even though discretionary spending may decrease, when we refer to the most critical scenario (2008 financial crisis), Visa’s TPV only decreased by 5% at its peak. Of course, currently Visa may have more significant impact on its operations due to higher base and economic penetration, but we don’t assume crisis of the same level in the near term.

Valuation

We are evaluating Visa target price based on FTM EV/EBITDA multiple & FCF Yield. The fair value price for the stock is $250. Previously, we estimated that fair value price for the stock is $220. We raised our target with the rise of EBITDA forecast for 2023 and 2024.

Conclusion

Visa may be good choice for conservative investors, as company financials will only increase. Anyway, we don’t see short-term triggers for the company to rise as valuation remains fair, so in general we recommend investors to search for a better buying point (for example, on S&P correction). To manage your position, we suggest keeping an eye on Visa’s & Mastercard’s financial statements, economic indicators (for example, consumer spending & labor market condition).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.