Summary:

- Visa’s quarterly results showed reasonable growth, with a 9% increase in revenue and a 6% decline in operating expenses.

- The company’s key performance metrics indicate stronger growth in debit cards and international payment volume, posing potential risks.

- Visa faces threats from the growth of non-card transactions, Capital One’s acquisition of Discover, and ongoing legal issues regarding fees with Mastercard.

Dilok Klaisataporn/iStock via Getty Images

Visa (NYSE:V) is an almost $600 billion company, making the payment processing company one of the largest companies in the world. The company is also recently working to pay out an almost $6 billion payout with Mastercard (MA) about illegally setting fees charged to businesses. As we’ll see throughout this article, as competition expands, we expect the company to face threats.

Visa Quarterly Results

Visa had reasonable quarterly results, with continued growth.

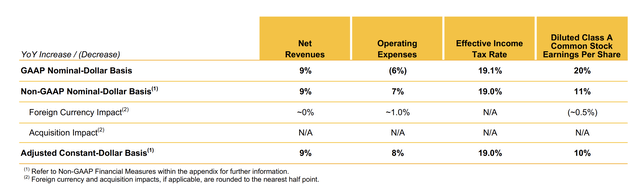

Visa Investor Presentation

The company saw a 9% increase in nominal dollar revenue and a 6% decline in operating expenses. That resulted in 11% non-GAAP EPS growth. The company’s net income was just under $5 billion, with annualized profit at $20 billion. The company’s current P/E of 32x isn’t particularly high for a company growing at double-digits.

However, it does undervalue some of the risks. For example, the company’s effective tax rate is 19%, and President Biden has recently proposed raising corporate taxes by 6%. That alone could wipe out a year of growth for the company. Still, it’s worth noting that the company’s portfolio and results do remain strong.

Visa Performance Metrics

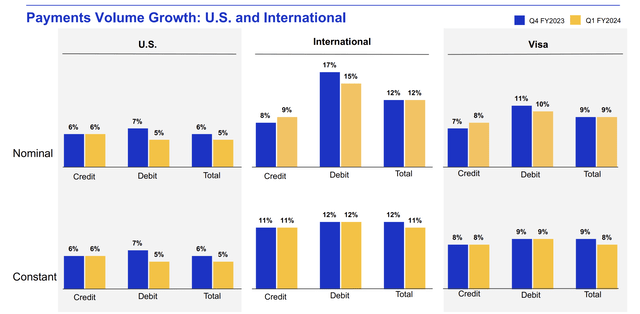

The company’s key performance metrics have been strong, but interestingly, debit is much stronger than credit.

Visa Investor Presentation

In general, credit cards have higher fees than debit cards, so consistent faster growth for the debit card business is a potential risk for the company over the long term. Also important is the much faster growth of international payment volume. International payment fees are lower and the company faces much more international payment competition.

That means the contribution to growth internationally will be weaker. Putting all of the above together, the company’s constant currency post inflation YoY growth was ~2%. This is a much less impressive performance figure, worth paying close attention to.

Visa Core Business

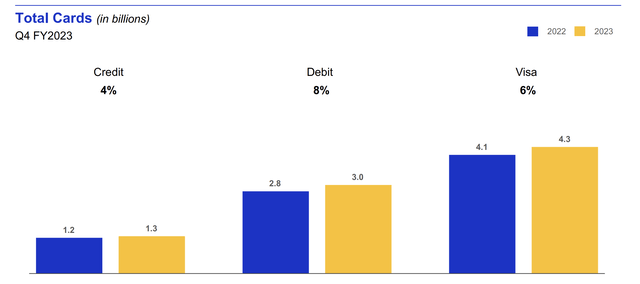

The end of the day result is visible in growth of total cards.

Visa Investor Presentation

The company is up to 4.3 billion cards, up 6% from 4.1 billion cards. That 6% growth in cards is likely the company’s long-term non-inflationary growth. That’s still an impressive growth rate, but it’s not as much for a company currently trading with a P/E in the low-30s. The company needs to double its profits just to hit a 5-6% shareholder return.

At 6% that’s more than a decade to hit that point. That’s for shareholders who invest today, and it shows the lower returns for an expensive company. Shareholders who invest today need to be truly confident about the company’s growth potential.

Visa Threats

At the same time, the company has a number of threats worth paying close attention to.

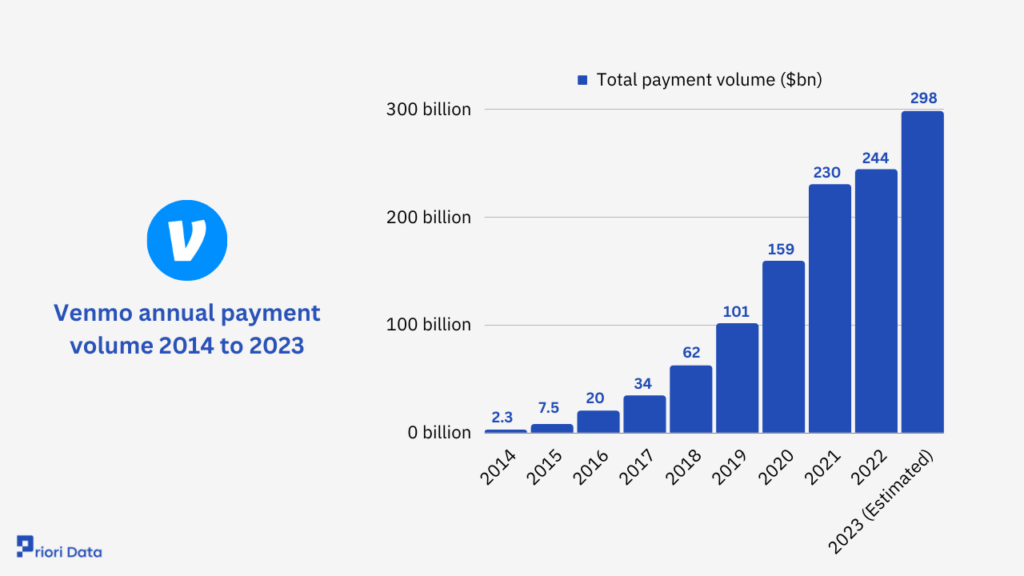

Visa Investor Presentation

The first is the growth in non-card transactions, especially among people paying money back and forth to each other, or even at smaller stores etc. The above shows Venmo, one of the largest competitors in the United States, that has seen payment volume increase by more than $50 billion YoY (20% estimated).

That massive growth comes from an app that was effectively non-existent a decade ago.

Visa Investor Presentation

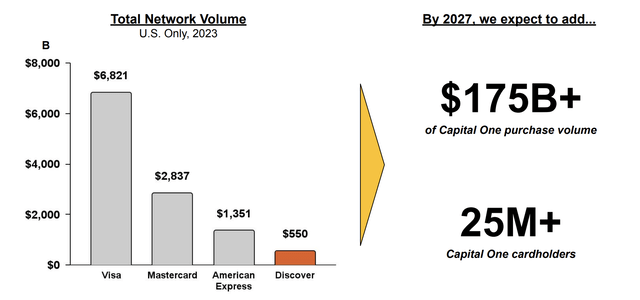

Another massive source of competition is Capital One’s proposed acquisition of Discover, the smallest of the 4 payment networks. Capital One is a fairly large purchaser, and by 2027 it expects to move $175+ billion of purchase volume to Discover. Over the subsequent years, we expect this number to increase as the company moves past debit cards moving to Discover.

That shift, along with a renewed focus on Discover, could put significant pressure on Visa and Mastercard.

Lastly, the strength of the company’s consolidation with Mastercard, together processing almost $10 trillion in annual volumes, has led to anti-trust lawsuits. Central to many lawsuits are accusations that Mastercard and Visa have banded together to keep fees higher. How this pans out remains to be seen, but the almost $6 billion in fines already announced indicates a weak position.

This could put pressure on Visa to at least limit future payment network growth or fee growth. It could also open the door for new competitors like Discover to have an easier time expanding.

Conclusion

These three risks above, in our view, will slow down the company over the long term. The above risks don’t even count completely new risks such as Apple building technology to become a payment processor with its massive iPhone network. At the end of the day, Visa has a moat in acceptance but no moat with consumers, which is risky if you don’t own the hardware.

The company’s growth rate already slowed down into 1Q 2024 from the end of 2023. The company is trading at an incredibly lofty valuation, at a mere 3% yield. Its current growth rate means it could need towards the end of the decade to even hit a yield of ~6%. This will make it harder for the company to drive long-term returns, making it a poor investment.

We expect slowing growth to result in the market assigning the company a lower multiple, hurting long-term returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.