Summary:

- Visa is the world’s largest payment network operator, with robust top and bottom-line growth and high returns on shareholder capital.

- V stock consistently generates returns on capital well above its cost of capital, creating value for shareholders.

- The Company’s capital-light business model allows for high returns on capital and a steady reduction in shares outstanding.

belterz/E+ via Getty Images

Introduction

Visa (NYSE:V) is the world’s largest payment network operator, ahead of Mastercard (MA) in second place. I believe Visa has the much sought after combination of a robust top and bottom-line growth, a capital-light business model, a clean balance sheet, a steady reduction in shares outstanding, and high returns on shareholder capital, which are well in excess of the firm’s cost of capital.

Visa is what we might refer to as a “set-and-forget” or “Coffee Can” investment. In a recent article I published on MA, I referenced the great Charlie Munger’s wisdom on buying exceptional businesses. Today, I refer to the British legendary investor Terry Smith. He said, in his 2023 annual letter, that his fund applies a simple three-step approach to investing: 1) Buy good companies; 2) Don’t overpay; 3) Do nothing. This approach exemplifies the simplicity of good investing. I intend to detail in this report why Visa provides us the opportunity to exercise this simplicity.

The Case for Visa

I believe that Visa, like its peer MA, is a true sustainable compounder. Visa has shown the ability to consistently generate returns on capital well in excess of its WACC. When a company generates returns above its WACC, it is creating value for shareholders. This is an important concept to understand, as many publicly traded companies grow revenues and earnings, but in doing so, they fail to generate a return in excess of the capital inputs into the business. In effect, these firms are gradually destroying shareholder value over time. I refer readers to an excellent paper by Morgan Stanley on the topic of return on capital and value creation. The below quote summarises the core message:

A company creates value when the present value of the cash flows from its investments are greater than the cost of the investments. In other words, one dollar invested in the business becomes worth more than one dollar in the market. Discounting future cash flows makes sure the investment is attractive relative to the capital’s opportunity cost, the return on the next best alternative.” (Morgan Stanley)

A true compounder, such as V, is capable of consistently achieving suitable returns. The firm’s capital-light business model naturally lends itself to low input capital costs and high returns on those inputs. In order to illustrate this sustainable value creation engine, I have estimated the WACC for Visa using both its cost of debt and equity.

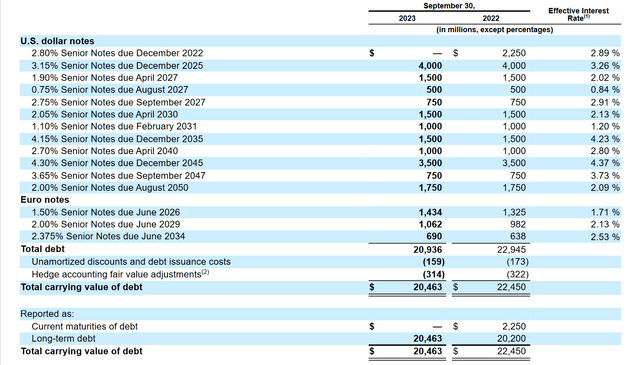

As can be seen in Visa’s 10-K, the firm pays an extremely low rate of interest on its outstanding debt. Given we are potentially entering a period of structurally higher inflation and higher interest rates, I think it prudent to estimate Visa’s ongoing cost of debt to be 4%. Readers may contend that 4% is too low, I admit it is merely an estimate, and I am happy to concede the real number could be closer to 6%. As I will display below, Visa’s ability to create value in excess of its capital costs has a tremendous margin of safety.

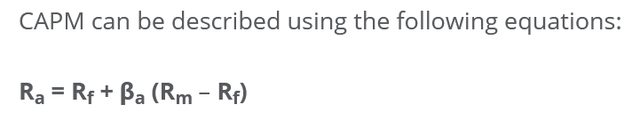

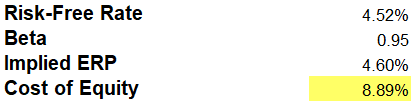

A firm’s cost of equity is not directly observable like the cost of debt. Thus, to estimate for Visa, I apply the CAPM method. For the equity risk premium (ERP) portion of CAPM, I use the year-end 2023 estimate provided by Professor Aswath Damodaran. The real risk-free rate I use is the latest available yield on the US ten-year treasury. I provide a description of the CAPM formula as a refresher. My estimates conclude the cost of equity to be in the region of 8.9%. As with the cost of debt, my figure is merely a ballpark estimate to help ground our understanding.

Authors Calculation

Visa’s capital structure is roughly 65% equity and 35% debt. So, taken together, we arrive at a WACC of around (0.65 * 8.89%) + (0.35 * 4%) = 7.2%. We can debate over the exact inputs, but I think 7-8% is a good ballpark figure for Visa’s WACC. Where we surely cannot disagree, is when we set the WACC against Visa’s Return on Capital. We see steady, consistent growth in excess of the cost of capital over time, and thus the creation of shareholder value. As seen below, V has been consistently generating high-teens and low-20s returns on capital for the last decade. A number that greatly exceeds WACC and does so like clockwork.

The ability to generate high returns on capital is a function of running a capital-light business. Intuitively, if we think about a capital intensive business such as mining or energy, these businesses require continuous investment to buy items like machines, do repairs, etc. The constant need to provide more capital to run the business naturally makes it more difficult to generate high returns on that capital, due to a higher denominator effect. A payment network business such as V (or MA) requires minimal additional capital once scale is achieved in the business.

Hence, Visa has the ability to deliver high returns on its capital base, by growing revenue and earnings consistently, while simultaneously reducing its outstanding share count. It achieves this while having net debt of around $2B, which for a firm valued at close to $450B is essentially no debt.

I refer again to Terry Smith, for an eloquent description of why a high return on capital is important.

Earnings per share is not the same as cash, but more importantly it takes no account of the capital employed to generate those earnings or the return which is earned on it. If all you want from your investments is earnings per share growth, we can provide as much as you need providing you supply us with unlimited capital and turn a blind eye to the returns we are able to generate” (Terry Smith)

Looking ahead, we see V is expected to growth earnings by over 13% over the next number of years. I note, V has beaten earnings estimates in 19 of the last 20 quarters, so don’t be surprised if growth exceeds 13%. Thus, I am confident we will see yet more shareholder value being created, which supports a purchase recommendation.

Valuation

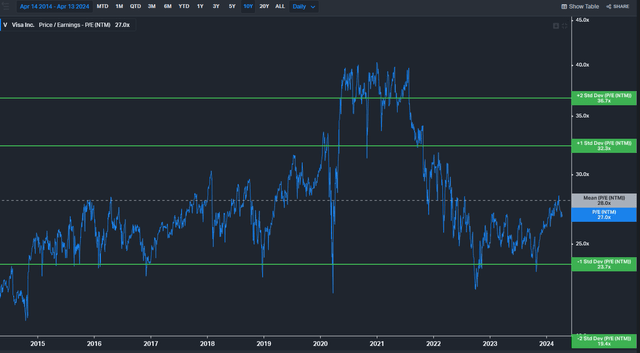

Turning to valuation, I think Visa looks relatively attractive at current levels. The forward P/E of 27x is less than the ten-year average. When we set that average valuation against both higher returns on capital and higher profit margins vs recent history, I think Visa looks undemanding at this price.

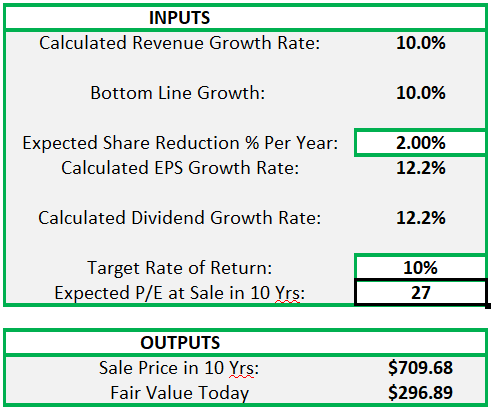

For my DCF valuation, I forecast 10% top-line growth, in line with analyst forecasts and the ten-year history. I model for no expansion of net margin, but I do anticipate the continuation of a 2% share count reduction, in keeping with the past decade of buybacks. I use a 27x P/E at sale, which is the current P/E and broadly in line with the ten-year average. For the discount rate, I use a 10% figure. As illustrated above, this is likely to be well in excess of the WACC. As always, I model in a prudent manner, with a view to building a margin of safety into my estimates. Hence, I am comfortable using a 10% discount rate.

I arrive at a fair value just shy of $297, which is about an 8% upside from the last close. At this price, I think one could start to build a position, with the real opportunities presented by pullbacks in the market.

Author

Upcoming Earnings

Visa reports their fiscal Q2 earnings on April 23rd. Investors will be keenly watching spending volumes trends at the firm. On its fiscal Q1 earnings, call management noted that spend trends had weakened in January. The reason cited for January weakness was one-off impacts from extreme weather in the US. Markets were sufficiently concerned to send the stock tumbling close to 2% on the day, as investors worried that weak consumer spending was due to more than just the weather.

Consensus expects Visa to post EPS growth of 16% and revenue growth of 8%. On Friday, JPMorgan delivered their Q1 earnings, which showed card spending trends remaining strong and consumer credit stress remained minimal. Given this, I would be surprised if Visa failed to deliver its typical earnings beat on April 23rd.

Risks

As I wrote in my previous article on MA, the most pertinent risk facing the two card giants, is the risk of regulatory change. As recently as last month, MA & V agreed to a settlement that ended a long-running legal saga. Bloomberg reported that the deal could save US merchants $30B over five years. The lawsuit related to the charging of “swipe fees” on card transactions. Fees are paid by merchants, with the proceeds going to the card networks and the merchant bank and acquiring bank. The settlement has agreed to cap swipe fees for five years. The ruling allows merchants to alter that price a customer pays at the checkout based on the type of card used.

Fortunately for V, the biggest losers from the settlement are likely to be the card issuing banks, as customers will be steered away from pricier premium issue cards like those offered by Chase Bank. For payment networks, the ruling is not expected to materially alter the long-term trajectory of their businesses. Due to the scale of their network dominance, and the universal acceptance of cards at merchants, the card firms can remain strong despite the regulatory change. One could even view it as a positive that a decade-long regulatory overhang has been put to bed with a relatively trivial impact.

Conclusion

Visa is a quintessential compounding stock. I think it is a stock that every investor should have as part of their portfolio. As I have illustrated, Visa has a long history of generating value in excess of the cost of capital. Per Morgan Stanley, this is the essence of value creation, and it is the combination of a capital-light business model, reasonable valuation, clean balance sheet and strong forecast earnings growth that lead me to recommend a BUY on Visa.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.