Summary:

- Visa processes nearly $15 trillion in payments annually, but its future growth will come from new drivers such as New Flows and Value Added Services.

- New Flows, which include business-to-business and government-to-consumer transactions, present a $200 trillion volume opportunity for Visa.

- Value Added Services, which make up nearly 25% of Visa’s revenues, are growing at an above-20% pace and could surpass Mastercard in the near future.

- Investors should learn about client incentives and yields before picking their horse in the race.

FinkAvenue

Visa (NYSE:V) is one of the most recognizable brands in the world, processing nearly $15 trillion in payments annually, or almost 15% of global GDP.

The company’s rise has been overlooked by many investors, despite it being right under their noses, with the stock up more than 17x since its IPO.

Looking at the company today, Visa’s future performance will be determined by drivers that are different from the ones that made the company what it is today, namely, Value Added Services, and New Flows.

The company is set to report its third-quarter earnings next Tuesday, and those drivers will be key to monitor.

Let’s dive in.

Introduction

I’ve been covering Visa on Seeking Alpha since April of last year, maintaining a bullish rating throughout the period. In my first article, I delved into the company’s unstoppable revenue streams and focused on its legacy consumer payments business.

In the following articles, I compared it to Mastercard (MA) and repeatedly claimed both are a great investment, although Visa is more attractive based on both valuation and prospects.

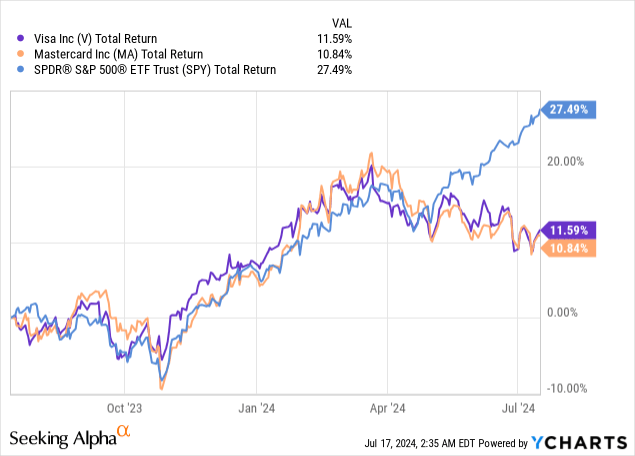

Both companies have been trailing the market in the past year, while Visa slightly outperformed Mastercard. Year-to-date, the S&P 500 is up nearly 20%, whereas Visa is at 4.0%, and Mastercard at 5.1%, reflecting continued underperformance.

Today’s Visa Is Not The Simple Company Everybody Knows

Visa is known by the average Joe as a credit card company, or the company that charges a hefty fee for non-cash payments. Most investors should already know that Visa is not a credit company, but rather a technology provider to issuers, acquirers, payers, and merchants. Secondly, the majority of the fee, which is called an interchange fee, goes to the issuers, not to Visa.

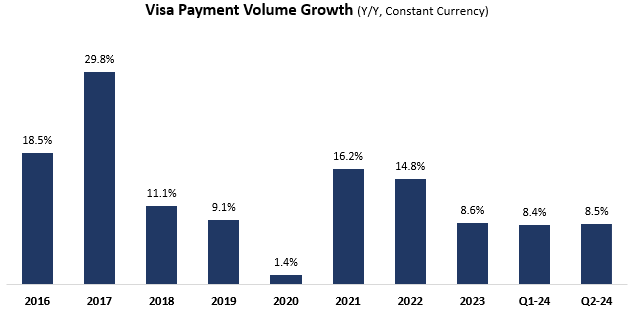

This line of business, which we’ll call consumer payments, is still the primary source of revenues for the company. As the shift from cash to digital payments in most developed markets is maturing, the future growth of the legacy payment business should be in the high single-digit range.

We can see that reflected in the company’s payment volume growth numbers:

Created by the author using data from Visa reports.

This is still a fast-growing, highly profitable, top-quality line of business. However, Visa’s future is becoming increasingly more reliant on other businesses. And just like the company’s prospects in consumer payments went overlooked by many, I believe we’re seeing something similar today in New Flows, and Value Added Services.

New Flows

The company defines New Flows as all transactions that are not between a consumer and a merchant. For context, they quantify their consumer payments volume market at $40 trillion, while New Flows are a $200 trillion opportunity. New Flows include business-to-business, business-to-consumer, government-to-consumer, and many more.

In the recent quarter, revenue from New Flows grew 14%, while Visa Direct transactions grew 31%, both accelerating from the previous quarter.

Value Added Services

The company aggregates all its ancillary services under VAS. There are five main pillars for those services.

First, issuing solutions, including card benefits, account controls, buy now pay later, card processing, issuing processor, and more.

Second, acceptance, things like cyber protection and dispute management.

Third, risk. Visa helps with fraud detection, authorization, and risk management.

Fourth, advisory and consulting, primarily in marketing. Visa helps its clients with campaigns, rewards, and other ways to drive growth.

Five, banking. Visa is a leader in open-banking solutions and cloud-based banking platforms.

VAS is already a large part of the Visa pie, representing nearly 25% of total revenues in the recent quarter, and growing at an above-20% pace for several quarters in a row. Visa is close to surpassing Mastercard on that front, which offers similar services but started a little earlier.

Two Important Metrics Investors Need To Know

When it comes to Visa, the revenue metric has a lot of complexity behind it. There are two key metrics investors need to be familiar with, especially when comparing Visa to Mastercard.

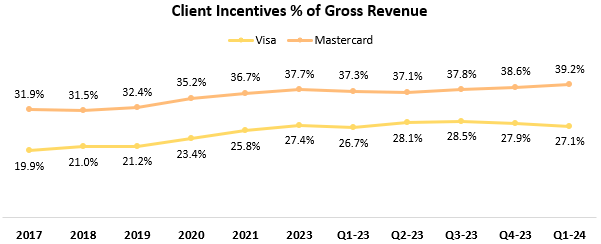

Created by the author based on data from Visa and Mastercard financial reports; Periods are on a calendar basis.

Let’s start with client incentives. These are incentive arrangements made between Mastercard or Visa and their clients.

Generally speaking, Visa and Mastercard offer similar solutions. As a result, much of the competition over clients comes down to financial terms.

As we can see, Mastercard’s client incentives are rising and approaching the 40% mark, while Visa’s are in decline, closing in on 27%.

This goes to show you how much more Mastercard needs to give back to its clients to acquire them. It’s also the main reason why Mastercard’s operating margins are almost 9 points lower than Visa’s.

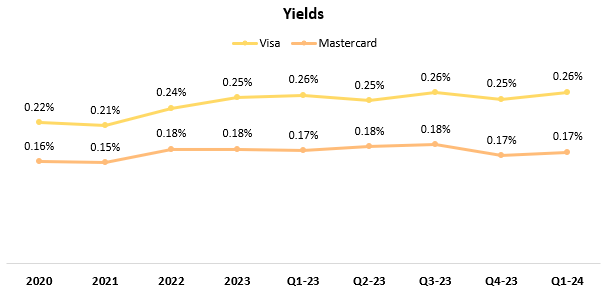

Created by the author based on data from Visa and Mastercard financial reports; Periods are on a calendar basis.

Another key metric to look at is yields. This is essentially the other side of the client incentive calculation. I calculate yields by dividing the companies’ payments revenue (total revenue minus Value Added Services) by their total volume.

As we can see, Visa’s yield is growing, while Mastercard’s is declining somewhat, which is another piece of evidence that the companies’ volume growth wasn’t created equal.

Valuation & Growth Trajectory

Investing in Visa today means you’re investing in the legacy consumer payments business, which should continue to grow at an above-market pace. It also means you’re investing in its New Flows and Value Added Services, which are both growing rapidly and faster than consumer payments.

Together, these should result in double-digit growth for the foreseeable future, with extraordinary profitability.

More importantly, with Visa’s unparalleled scale, being ~65% bigger than Mastercard in terms of volume, Visa should benefit from a significant network effect as it penetrates these new opportunities. Visa caters to more issuers, acquirers, and merchants, which means it has a larger pool of customers to offer its new services.

This is starting to materialize, as Visa is now outgrowing Mastercard’s VAS, and it’s also much more efficient in terms of yields and client incentives.

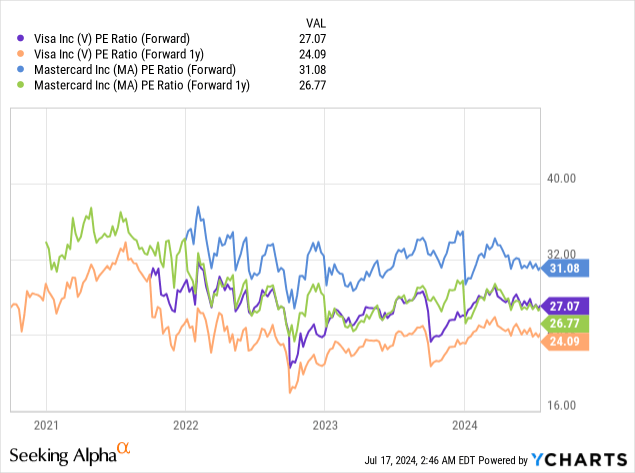

Both Visa and Mastercard trade at historically low valuations, as the market seems to react (overreact in my view) to growth deceleration amid a tougher economic environment, as well as extremely strong comps. It is also important to note that this is happening at a time when the market itself is trading at historically high valuations.

Mastercard is still trading around its historical premium over Visa, despite the increasing amount of evidence Visa has many advantages entering this new stage in the companies’ lives.

In my view, Visa should revert closer to its historical valuation as it continues to capitalize on its new opportunities, while its legacy business normalizes.

That means a 27.5x multiple on CY25 EPS, which brings me to a price target of $320 a share, reflecting close to 20% upside.

Conclusion

Visa is trading at a historically low valuation. In my view, just like the company’s rise in consumer payments went overlooked by many, Visa’s new opportunities in New Flows and Value Added Services are again being underappreciated.

Visa’s future isn’t similar to Visa’s past, and it makes sense that the market is discounting those prospects, as they naturally come with some uncertainty.

That said, those opportunities are huge, and so far, it seems Visa is well on track to capitalize on them.

I expect that as these new lines of business continue to grow stronger, and the legacy business normalizes, Visa’s multiple will expand.

Therefore, I reiterate a Buy rating ahead of Q3, expecting 20% upside by early 2025.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.