Summary:

- Visa is set to release its financial results on July 25.

- Going into earnings, the company looks fairly valued compared to its historical metrics, its peer, and according to a Discounted Cash Flow Analysis.

- A possible decline after earnings might therefore be an attractive entry point.

Justin Sullivan

Today, on July 25, Visa (NYSE:V) is expected to release its financial results. As the earnings near, I’m examining if a possible decline in the stock price resulting from or brought on by the results would represent a good time to buy.

SWOT Analysis

I have conducted a small SWOT analysis that summarizes the important components in order to understand the current key issues affecting Visa’s company and to determine the parts we should focus on in the forthcoming earnings call on Tuesday.

Strengths

-

Global Presence: With a network that links millions of retailers, thousands of financial institutions, and billions of customers worldwide, Visa has a significant global footprint.

-

Strong Brand Recognition: One of the most well-known brands in the world is Visa. Its recognizable blue, white, and gold emblem stands for a trustworthy and dependable payment provider.

-

Advanced Technology Infrastructure: The infrastructure of Visa is one of the most sophisticated and reliable financial networks in the world, with the capacity to process over 65,000 transactions per second.

-

Extensive Merchant Acceptance: Visa cards are a practical payment option for customers since businesses accept them in more than 200 nations and territories globally.

-

Innovative Solutions: Visa is a cutting-edge technology corporation that regularly makes investments in cutting-edge technologies like blockchain, digital wallets, and AI in addition to being a card processing business.

Weaknesses

-

Dependence on Banks: The banks and other financial institutions that issue Visa-branded cards are crucial to Visa’s business strategy. The revenues generated by Visa might be impacted by any substantial changes in this industry, such as tighter restrictions or a change in business strategies.

-

Lack of Diversification: Visa is primarily focused on the payment processing sector while having a worldwide footprint. Due to this lack of diversity, it is more vulnerable to an economic downturn.

-

Legal and Regulatory Challenges: Like many other financial institutions, Visa is faced with major legal and regulatory obstacles, such as antitrust inquiries and merchant fee litigation.

Opportunities

-

Increase in Cashless Transactions: A global trend toward cashless transactions already exists and is most likely to continue. Visa now has a tremendous potential to boost its transaction volumes.

-

Growth in Emerging Markets: Emerging markets, where many consumers and organizations still largely rely on cash, provide enormous development potential.

-

Technological Innovations: Visa may benefit from developments in fields like mobile payments, contactless payments, blockchain, and AI as a tech firm.

-

Expansion into Related Business Areas: There are chances to grow in allied industries including financial services, cross-border remittances, and business-to-business payments.

Threats

-

Competitive Pressure: Other payment processors like American Express, MasterCard, and up-and-coming fintech firms compete with Visa fiercely.

-

Technological Disruptions: The business model of Visa might be impacted by new technology. Blockchain-based payment systems, for instance, might eschew conventional payment processors.

-

Regulatory Risks: Regulatory modifications can be a danger to Visa. Governments could, for instance, pass laws restricting transaction costs or encouraging competition.

-

Cybersecurity Risks: As a supplier of online financial services, Visa is exposed to cybersecurity risks. Any serious breach might be detrimental to the company’s finances and image.

Valuation

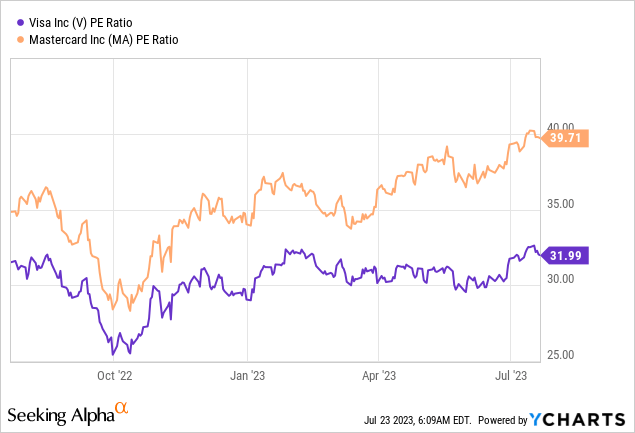

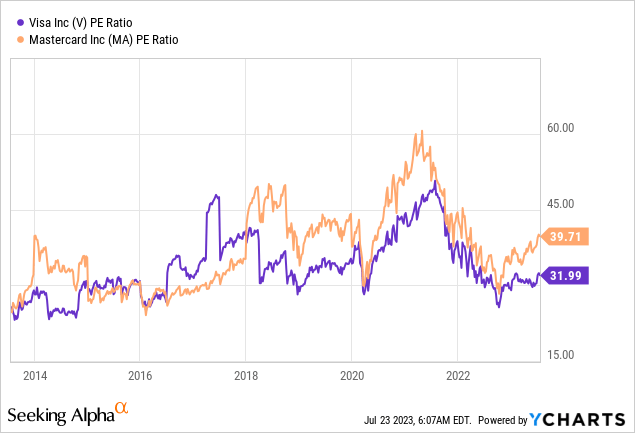

Visa is currently trading at a PE-ratio of 32. While this seems high at first, considering its average 5-year PE-ratio of 35.5 the company seems to be trading at an attractive valuation right now.

Comparing the PE Ratio to Mastercard (MA) – Visa’s major competitor – V also looks cheaper.

Over the last 10 years, MA was trading at a higher valuation most of the time, however the difference between the two companies is pretty large right now, as can be seen below.

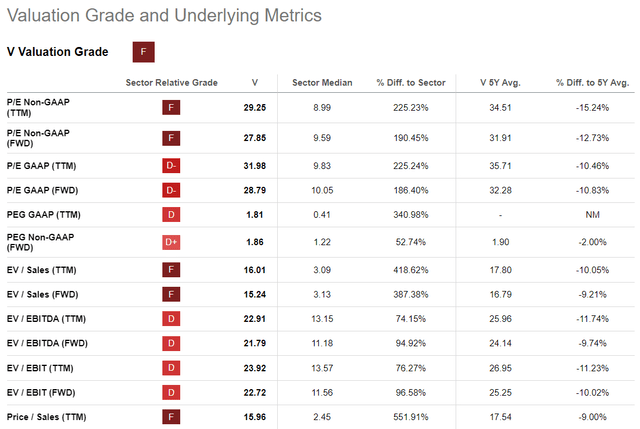

The Seeking Alpha Quant rating system is currently rating Visa with a valuation grade of “F”, suggesting the company is heavily overvalued. While the valuation metric here on Seeking Alpha is always a good first indication, I think SA is wrong here, since they compare Visa to the whole Financials sector and therefore to general cheaper companies like banks etc.

SA Valuation Grade of Visa (seekingalpha.com)

What I’m looking for in today’s earnings

I now want to focus on some key points and financial metrics that have largely impacted Visa’s business positively over the last few years. On the earnings today, I am keeping a close look at these factors and if the general trends stay intact here.

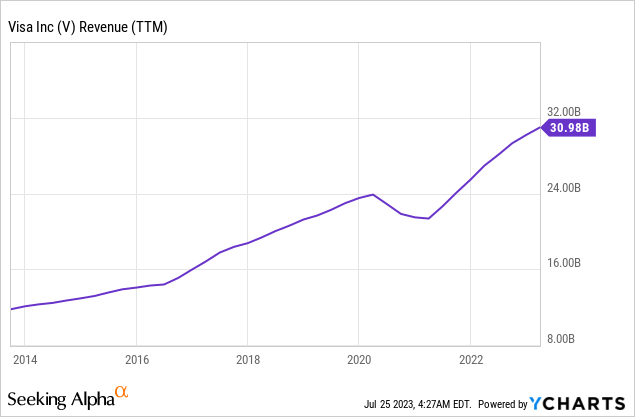

First off, we have the revenue growth of Visa. Over the last 10 years, the company managed to achieve a revenue growth rate of around 11% p.a. Another revenue decline – like in 2020 due to Covid-19 – might be a first negative signal for potential investors in Visa.

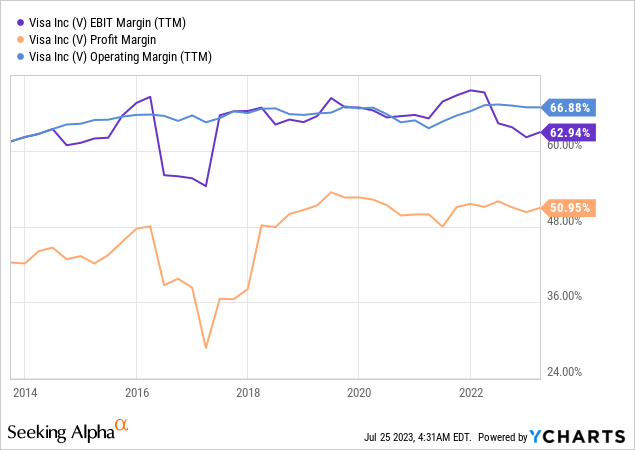

The second big thing, which I observe very closely today, is the margin development of the company. Due to its almost “Duopoly” with Mastercard, the company was able to constantly improve its already pretty high margins over the last 10 years.

Discounted Cash Flow Analysis

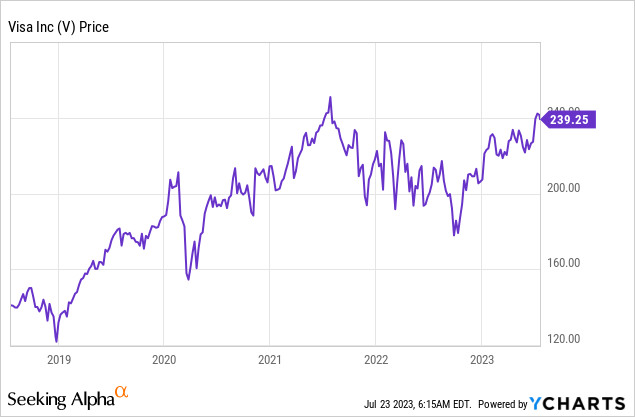

For such a top-tier company like Visa, it’s quite unusual to trade pretty much “flat” for several years, which is why there might be a lot of uncertainty going into earnings.

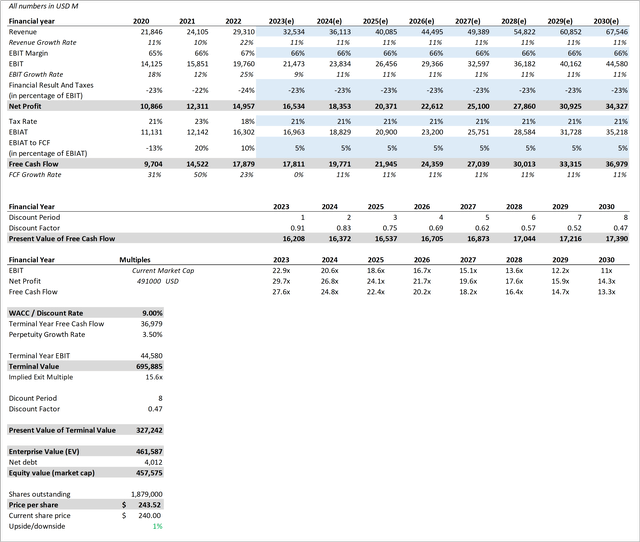

The valuation methods used above however are just look at the present numbers and at the past average metrics. At the stock market we however play for the future of a company. Therefore, I conducted a Discounted Cash Flow Analysis (DCF), to evaluate Visa independently from its peer and from past valuation metrics. Blue cells are the assumptions I took.

- Revenue: I predicted an annual revenue growth rate of 11% for the next 8 years. This is in line with Visa’s historical ten-year growth rate and with analyst’s expectations for the next years.

- EBIT Margin: For the EBIT margin, I used the average of the last 3 years and anticipated that it will stay flat at 66% for the next 8 years.

- Financial Result And Taxes: I averaged the values of the last three years and therefore used -23% to calculate the Net Profit for the years 2023 to 2030.

- Tax Rate: For the tax rate, my calculations were pretty much the same. I averaged out the last three years and then anticipated that it’ll stay flat at 21% over the next years.

- Free Cash Flow: With the metrics for 2020 to 2022, I averaged out the EBIAT to FCF ratio and assumed it’ll stay flat over the next years.

- WACC: I used the current WACC of Visa, which currently sits at around 9%.

- Perpetuity Growth Rate: The perpetuity growth rate assumed for the analysis is 3.5%.

DCF for Visa (seekingalpha.com; investor.visa.com/)

Risks

The DCF assumes a revenue growth rate of 11% and the margins to stay flat at the average of the last three years. If one of the above mentioned threats (Competitive Pressure, Technological Disruptions, Regulatory Risks, Cybersecurity Risks) or a weakness (Dependence on Banks, Lack of Diversification, Legal and Regulatory Challenges) comes into play, one or both of the metrics could decrease significantly.

If however the general trend of the revenue growth and the margin expansion – or at least keeping them at the present level – remains intact, the company seems to be fairly valued right now.

Conclusion

Based on our reasonable conservative Discounted Cash Flow analysis, we arrive at a price target of $243, which indicates the company is pretty much trading at a fair valuation going into earnings.

It is rare that you get the opportunity to buy such a high quality company for a fair price. My personal position in Visa is currently up around 10% and I am planning to expand my existing position at these prices , which is why I rate the company as a ‘Buy’. If the earnings on Tuesday disappoint and the general business case for Visa remains intact, I will add without hesitation to my existing position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.