Summary:

- Visa’s strong capital allocation strategy and focus on free cash flow contribute to its success in the market.

- The company’s solid balance sheet and valuation make it an attractive investment option in my opinion.

- Despite facing threats in the industry, Visa’s barriers to entry and strategic positioning continue to drive its growth and profitability.

TanjalaGica

The Visa Investment Thesis

I think Visa Inc. (NYSE:V) is one of the companies with one of the strongest business models, which is also very well protected by barriers to entry and competitive advantages. And the current multiple is an attractive entry point with nice upside potential should there be even a modest multiple expansion.

V’s Business

Most readers are probably familiar with Visa because the product is an integral part of their daily lives, with millions of cards bearing the Visa symbol being used to make payments every day. But what I have noticed over and over again is that many people think that Visa because it is often referred to as a credit card company, is liable for these credit card debts. But this is not the case, the issuing banks are liable for the debts of their customers if they default.

As a payment processing network, Visa is often referred to as the railroad of financial flows. Visa’s role is to authorize and settle payment transactions, cross-border payments and, most importantly, fraud detection.

And in return, Visa receives what is called an interchange fee. And depending on the country, these fees are capped at different levels, giving Visa pricing power up to that cap. With more than 4 billion cardholders and more than 130 million merchants accepting Visa, almost every business must offer Visa to avoid losing customers who prefer the superior Visa payment experience.

In fact, even when Visa raises its fees, it tends not to lose customers because consumers still want to pay with their Visa cards. That is a huge competitive advantage.

Barriers To Entry

I think this is an industry with enormous barriers to entry, one is the point that was made about the number of cardholders and merchants that all rely on the Visa system. These people trust Visa that they will get paid when someone pays with a Visa card, and the customer also trusts Visa that their security and fraud detection is up-to-date so that no one steals their money. Just building that network of billions of people who trust the system is a huge competitive advantage because Visa is so good at the little things that happen unnoticed. On top of that, the consumer experience is flawless because it’s easy and fast to pay with your card, and most stores accept Visa, whether in Europe or America.

And the tremendous fraud detection combined with the high regulatory requirements is something that, I think, is underestimated. I think that even with a few billion dollars, it is almost impossible to build a fraud detection system that is equivalent to Visa’s, because you just lack the massive amount of data that Visa has been collecting every day for decades.

Visa has not just one competitive advantage, but several. A trusted brand, network effects, a superior security system, plus they also control the payment rails on which many fintechs then build their products.

VISA’s Capital Allocation

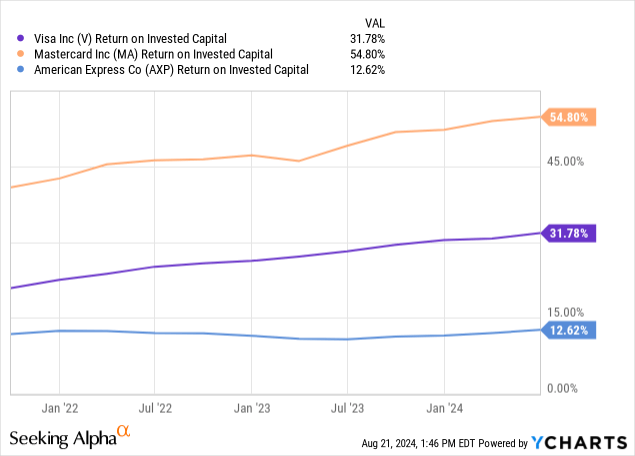

These huge competitive advantages are also reflected in the ROICs of Visa and Mastercard (MA), while American Express (AXP) lags behind. Also, Visa’s ROIC-WACC spread is 31.78% – 8.2% = 23.58%. This is an incredibly strong number that shows the strength of this company and its business model. Other very strong companies have a ROIC of about 23%. For Visa, that is the ROIC-WACC spread, and I think that speaks for itself.

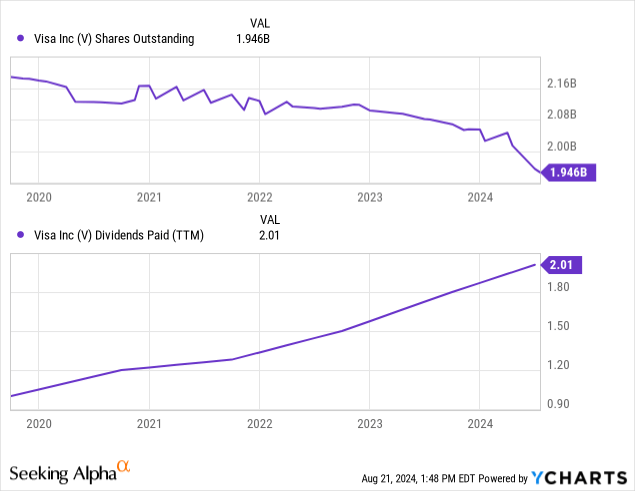

Visa, in my opinion, is very shareholder-friendly, as we can see by the fact that they use their FCF to consistently increase their dividend and aggressively buy back shares. In fact, over the last 12 months, $14,810 million was used to buy back shares and $4,104 million was used for dividends. This means that $18,960 million has been returned to shareholders. This means that Visa is in a position to return almost all of its FCF to its shareholders and still be able to continue to grow.

And I mean, when we look at Visa’s 10-year growth rates by various metrics, they just look fantastic.

- FCF: ~ 22%

- EPS: ~ 15%

- Revenue: ~ 10% (This relatively low revenue growth translated into fantastic FCF and EPS growth.)

- Dividend per Share: ~17%

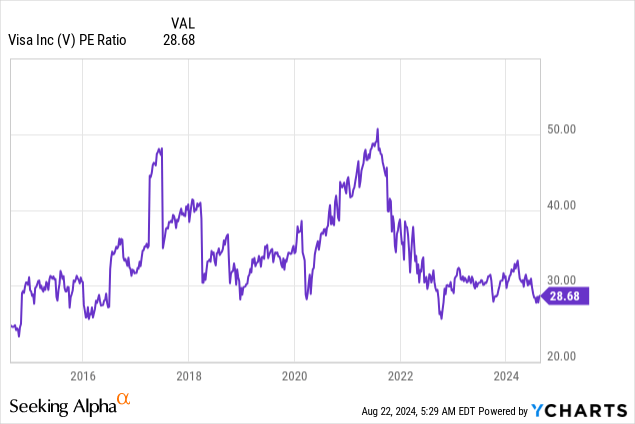

Plus, if we look at the P/E history, we see that there were some spikes that definitely made the company expensive, but in the big picture, over the 10-year period, it was not the P/E multiple but the strong EPS growth that drove the stock. In fact, the multiple is only slightly higher today than it was 10 years ago.

Balance Sheet Of Visa

Visa has long-term debt of $20,602 million, but if you generate net income of about $19,107 million TTM, you could pay off all long-term debt within 1 year if we add the cash position of $12,947 million and the ST investments of $3,697 million. This is a healthy balance sheet.

And Visa is also paying down the debt, because they have paid down $3,000 million in 2021, $1,000 million in 2022 and $2,500 million in 2023. So I expect the balance sheet to be even better in the coming years.

Furthermore, the interest expense is easily covered, as the EBIT/Interest multiple is around 36x. The average for the S&P 500 excluding banks is ~10x. So Visa is clearly ahead of the pack.

VISA’s Valuation

I think the likelihood that revenues and EPS will be higher in 5 years than they are now is relatively high because the competitive advantages are in place to protect earnings. And I also think that the margins are somewhat safe, so I would use a 51% net income margin, which is the 5-year average, and a 10% revenue growth rate as the basis for my EPS calculation.

In addition, I think they can reduce the outstanding shares to about 1,700 million over the next 5 years if they continue to buy back shares, which is my current expectation. In addition, I am assuming a multiple of 28x, which is conservative to have a margin of safety.

Revenue starting point: $34,918 million TTM

| Revenue in 5 Years | $56,235 |

| Net Income Margin | 51% |

| Net Income in 5 Years | $28,679 |

| Shares Outstanding | 1,700 |

| EPS | $16.87 |

| Multiple | 28x |

| Price | $472 |

| Upside | ~76% |

From my point of view, this is sort of the base case, and then of course you add the dividends to the total return. If the net income margin were closer to the 54% we have now, and the multiple was back in the 30x+ range, then of course the upside would be much higher. But I always like to be conservative to have a safety margin.

For example, if the multiple were to rise to 32x over the period, the upside would be ~100% or 15% per year. This is not unrealistic, nor is the possibility that buybacks could be even higher.

Threats

When companies have such fantastic margins as Visa, then of course, there are very often companies that try to attack those margins in order to get a piece of the pie. Examples are RuPay in India, China Union Pay and MIR in Russia. And I really believe that India is going to be a huge opportunity and one of the growth drivers for many companies over the next 10 years and beyond. So I think it will be very important to be successful in that market.

And RuPay, which has a 60% market share in India, has now signed a strategic agreement with the Emirates. And in Singapore, RuPay is already active, but they are also noticing that it is not so easy, for example, in Sri Lanka there were problems agreeing on a payment fee.

It will be interesting to see how business develops in Asia and the Arab countries, and who will have the edge there in the future. I believe that the rapidly increasing prosperity in this region will create many opportunities.

But even without these countries, I believe that Europe and the Americas will be sufficient for Visa to grow sales in line with its long-term average over the next 5 years+.

Conclusion

Visa is one of the few companies where I can say with a relatively high degree of confidence that revenues will be higher in five years than they are today. This, together with the shareholder-friendly use of FCF, means that I believe the probability of outperforming the S&P 500 over the long term is relatively high. Earnings are relatively secure and the business model is so mature that growth will continue to be stable even without major investments.

The downside is also relatively protected by the balance sheet and high barriers to entry. Nevertheless, RuPay should be watched closely as it could be very interesting if it goes public one day.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.