Summary:

- Visa and Mastercard share a lot of similarities.

- Several things differentiate Visa and Mastercard, and investors can pick accordingly based on their investment philosophies.

- There are risks that Visa and Mastercard both face in the long run.

2Ban

Visa (NYSE: V) and Mastercard (NYSE: MA), duopoly in the global payment network, share a lot of similarities.

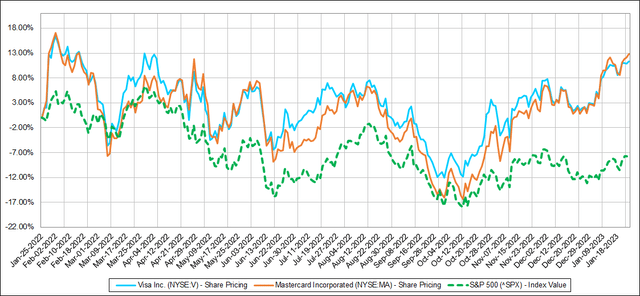

1. Stock Price: as shown in the following chart, Visa and Mastercard stocks have very similar growth trajectories in the last 12 months, Visa (+11.34%), Mastercard (+12.88%), as opposed to SP500 (-7.99%).

2. Business Model: The value proposition of V and MA is to enable banks to issue credit and debit cards to consumers (V – Services revenue, MA – Domestic assessments ), to help merchant acquirers facilitate payments between banks and merchants (V – Data Processing revenue, MA – Transaction processing), and to enable cross-border transactions (V – International transaction revenue, MA – Cross-border volume fees).

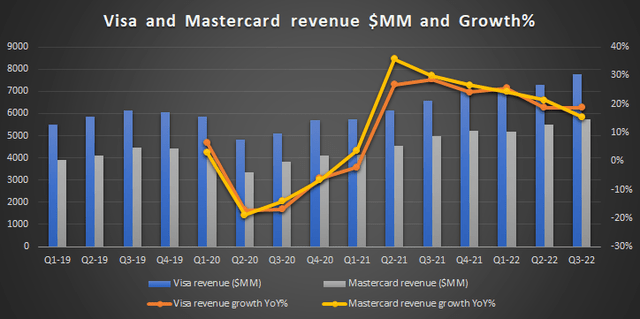

3. Quality of business: V and MA are probably the best way for investors to gain exposure to FinTech growth. Both businesses enjoy 15%-25% growth rates in topline, and 60%-70% in op margin.

Several things differentiate Visa and Mastercard, and investors can pick accordingly based on their investment philosophies.

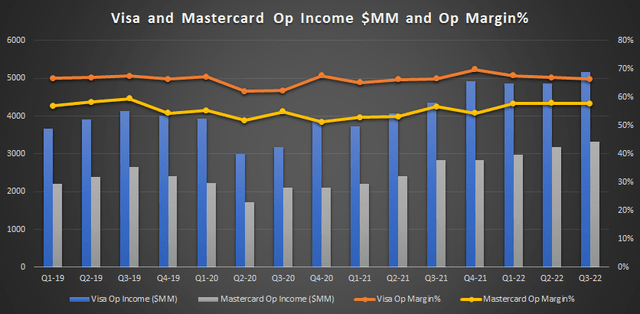

1. Operating Leverage Difference

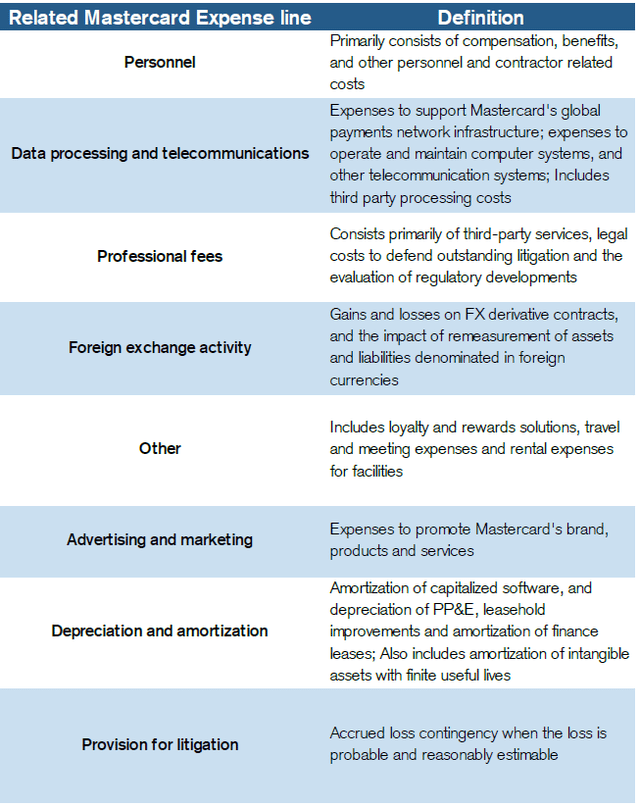

As shown in the above table, MA is lagging Visa by 10-15 ppts in Operating Margin. The following chart shows what categories of expenses V and MA generally incur. According to Credit Suisse analysis, the main difference comes from Personnel cost. As of Q3-22 (Visa’s FY22), V had 26.5k employees. As of Q4-22 (Mastercard’s FY21), MA had 24.0k employees, and 3.9k contractors. V generates $1.06MM per head, and MA generates $0.79MM per head (or $0.68MM per head incl. contractors). This could potentially mean a few things: 1) different levels of operating efficiencies – how are their tech infrastructures and AI technologies; 2) different levels of investments in innovation; 3) different locale mix of their businesses (presumably we think US market generates higher margins than INTL markets, and MA has a higher mix in INTL markets).

company, and Credit Suisse consolidation

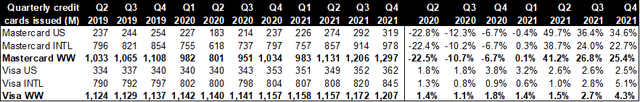

2. International Growth Difference

As shown in the following chart, MasterCard actually issued more cards than Visa did, and also had a higher mix of issued cards in INTL markets. Cards issued also grew at different rates (4% for V vs 25% for Mastercard).

Investors may want to think about a few things when deciding which is a better investment.

First, how would you expect the future growth of US market vs INTL markets?

Second, will Mastercard be able to grow more loyal card users with some differentiated services? It’s common that one has both Visa and Mastercard credit cards in hand, but one becomes the “primary” card and the other is used occasionally.

Third, although international markets generate mean lower margins. For businesses generating over 50% in Op Margin, are you happy with that? (I am, as 50% is the watermark rarely other businesses can reach).

There are risks that Visa and Mastercard both face in the long run

V and MA are facing the threats from Crypto, Digital Wallets, and any other innovations that can bypass the payment network. The impact won’t be pronounced in its growth for the next couple of years. It would be more about how the payment industry evolves in the long run.

In my opinion, V and MA are taking the right approach of embracing the ‘new money’. For instance, V is working with crypto exchanges like Coinbase Global (COIN) to facilitate transactions, and partnering with more than 50 crypto wallet providers to develop “native digital currency” settlement on its card networks. MA is enabling mainstream banks to offer crypto trading to their customers. Being able to test and learn in the midst of payment evolution, I am positive that V and MA can appropriately shape their business strategies in a timely manner. Therefore, admittedly there are risks V and MA face in the long run, nothing is going to materially pressure its growth or stock price in the next couple of years.

Conclusion

Both V and MA are excellent investments for investors who hope to have exposure to FinTech. Relative to MA, V represents a more mature and stabilized business. Relative to V, MA stands out with bigger investments and higher growth outlook.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.