Summary:

- Visa is the largest player in the payment services industry with a strong market share.

- Despite a low valuation, Visa’s exceptional margins and revenue growth make it a must-have investment.

- Operational considerations, revenue and profitability, valuation, risks, and peer comparisons are important factors to consider when investing in Visa.

- My analyst rating for Visa is Buy, based on the effective business model far outweighing the valuation risks.

Justin Sullivan

Visa (NYSE:V) is an exceptionally large organization in the payment services industry. My analysis shows me it is the biggest player in terms of market share. The valuation of the company is not its strongest point (Quant Factor Grade F), but I believe it remains a must-have investment in my portfolio due to exceptional margins and revenue growth rates.

Operations

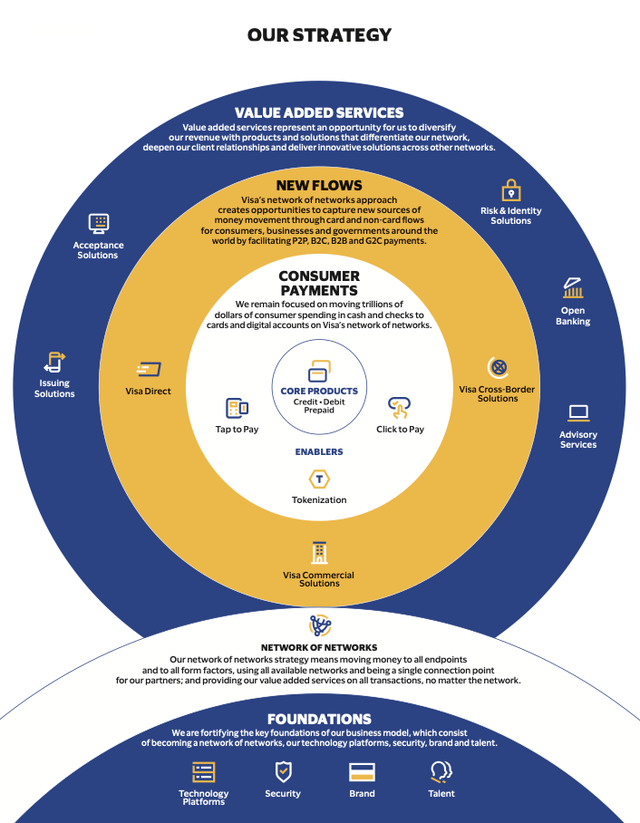

Visa’s core products are credit and debit cards, and they also offer pre-paid cards. This is the part of the business that most people know. Yet, it has an extensive payment network including not only ‘Consumer Payments’ but three distinct divisions, also including ‘New Flows’ and ‘Value-Added Services.’

The three core elements that enable Visa’s core products are Tap to Pay, Click to Pay, and Tokenization, which are vital to its revenue generation. Most important, in my opinion, is the implementation and advancement of Tokenization, which enhances the security of digital transactions by hiding sensitive information related to users. I think this is particularly vital in an age of growing threats from advanced technology, including AI and machine learning, in its relationship to payment and identity fraud.

Visa is facilitating P2P (Peer-to-Peer), B2C (Business-to-Consumer), B2B (Business-to-Business), and G2C (Governmet-to-Citizen) transactions at a growing rate under its ‘New Flows’ segment. Visa Direct, for example, leads the strategy further than C2B (Consumer-to-Business) transactions, allowing for payments to cards, accounts, and digital wallets in more than 190 countries. Commercial Solutions is the company’s solution portfolio for ‘small business, corporate cards, virtual cards and digital credentials, non-card cross-border B2B payment options, and disbursement accounts’ in almost all major industries globally. Cross-Border Solutions collaborates with Currencycloud and aims to advance its capabilities in international money transfers. Some of the core features of these services, targeting banks, fintech companies, and FX brokers, among others, are the ability to receive in multiple currencies, access real-time FX rates, and multi-currency wallet functionality facilitating payments to more than 180 countries.

Visa’s ‘Value-Added Services’ include a range of other services that further strengthen the firm’s brand. Some of the most significant, in my opinion, are Buy Now, Pay Later (BNPL) capabilities, loyalty and benefit services, Visa Acceptance Solutions (a collaborative SMB payment network to facilitate ease of payment), further security solutions to prevent fraud and identity threats, and advisory services (harnessing Visa data to consult on business decisions).

Revenue & Profitability

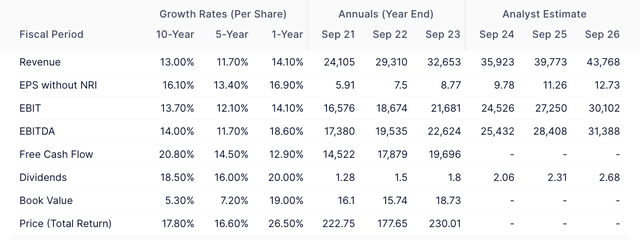

Visa is undoubtedly strongest on revenue growth and margins. The company has a 13.00% 10-year average annual revenue growth rate, which reduces to 11.70% on a 5-year basis and up to 14.10% on a 1-year basis.

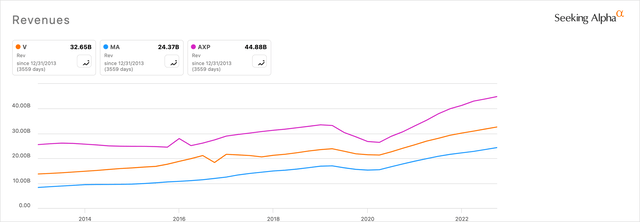

To compare the revenue growth rate to peers, I have placed it alongside its greatest competitor, Mastercard (MA), and American Express (AXP), another popular payment provider investment. While I know Amex is not a direct competitor to Visa, in my view, it does place as a contender in portfolio allocation for the ‘payment services’ industry:

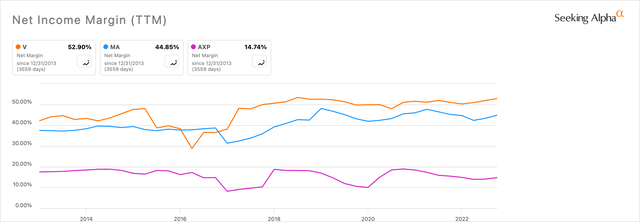

American Express has the highest revenue, yet when I compare these three on net income margins, the picture changes:

Visa’s net income margin of 52.90% is exceptional, in my opinion, and based on data by GuruFocus, it ranks in the top 15% of 526 companies in the credit services industry. I attribute this higher margin largely to the fact that Visa has a larger network than Mastercard, allowing for greater operational efficiencies, and also that it is a payment transaction processor rather than taking on a lot of credit risk, like American Express.

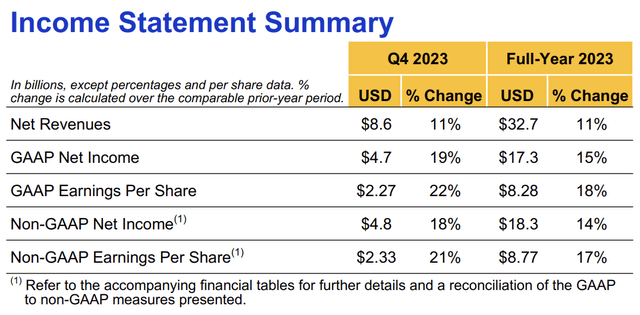

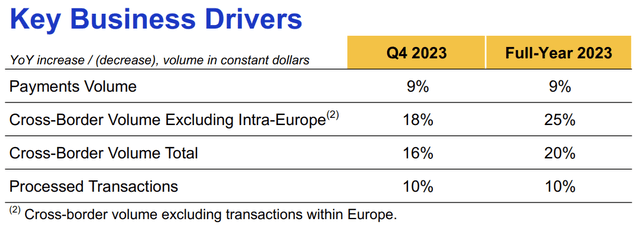

Visa reported an 11% revenue increase in Q4 2023, both on a quarterly and yearly basis. GAAP net income has jumped 19% on a quarterly basis and 15% on a yearly basis.

Payments volume jumped 9% on a quarterly and a yearly basis, and total cross-border volume increased 16% on a quarterly basis and 20% on a yearly basis, showing high growth in Visa’s ‘New Flows’ segment outlined above and representing a company initiative in driving new growth in previously untapped capabilities and areas.

Valuation

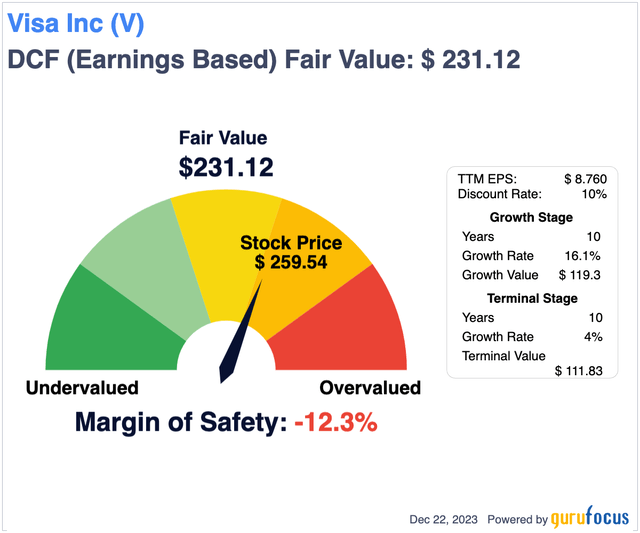

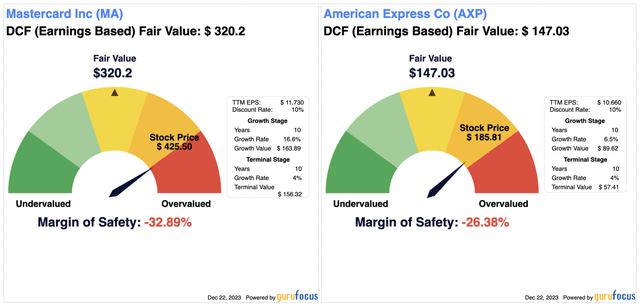

Visa’s least strong point is its valuation, which is why it is my largest risk when investing in the company and attempting to get above-market returns. The company’s forward P/E GAAP ratio is around 26 (Quant Rating D-). To compare this to peers, I’ve placed it alongside Mastercard and American Express again to get a closer look at the relative valuation:

Using EPS without NRI to look at a discounted cash flow model, the company looks moderately overvalued, too, but less so than Mastercard and Amex. For the calculations, I kept the standard 10-year average annual EPS without NRI growth rate, a typical 10% discount rate, and a defensive 4% terminal value for a period of 10 years. The result for each of the peers was as such:

Therefore, based on these defensive estimates using rudimentary 10-year averages and a conservative 4% terminal value growth rate, Visa performs quite well in comparison.

Risks

While I am particularly bullish on Visa stock, there are some significant risks I’ve made myself aware of to balance my thesis.

For example, Visa faces regulatory hurdles that could inhibit its growth somewhat, including Open Banking regulations. Europe’s Second Payment Service Directive (PSD2) allows customer payment data to be accessed by third-party payment providers. This could somewhat remove Visa’s position as a middleman in payments.

Also, the Federal Reserve’s FedNow Service was launched in July 2023, introducing a real-time payment system in the U.S. Its instant payment processing reduces credit risk for financial institutions, and its inclusion of banks and unions of all levels provides it with immense capabilities. This is a competitor to Visa’s network in some regards, and while not a threat to Visa’s card operations, it could inhibit its online payments and merchant services revenue.

Conclusion

I own Visa and Mastercard shares, but not American Express. I also hold my Visa allocation at about double my Mastercard allocation, at a weight of around 10% and 5%, respectively.

While Visa certainly could be stronger on valuation, and this presents some risk to price return prospects, the exceptional growth, and profitability aligned with strong operational strategies make my rating for Visa a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.