Summary:

- Visa Inc. controls a payment network unrivaled in scale, this supports a strong network effect.

- Regulators have caught on and are now looking to impede Visa’s vast market power.

- Together with an elevated valuation despite slowing growth, this creates an unattractive investment case to me, which is why I rate Visa stock a sell.

hatchapong

Investment thesis

Although Visa Inc. (NYSE:V) has a strong moat, a vast scale advantage that backs an impeccable network effect, the company is valued at a premium despite not being projected to achieve higher growth. To add to that, regulatory concerns raise uncertainty and are likely to impede growth and profitability and might force Visa to compete with new peers. I, therefore, rate Visa a sell, as I see more upside with less potential downside in other alternatives.

Visa overview

Visa, despite often being called a credit card company, does not take on any customer funds and does not have any lending operations. The company operates VisaNet, a payment network consisting of data centers and over 24 million miles of telecommunication network, which facilitates payments made by customers at merchant locations.

Merchants

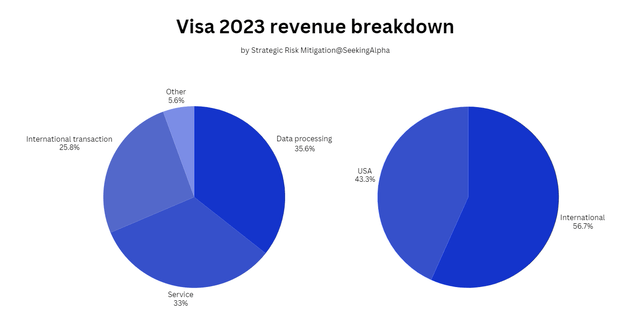

Visa 2023 revenue split by segment and geography (Author (10-K and marketscreener.com))

“Data processing” revenues represent the core business of processing payments. “Service revenue” is earned by support services delivered to customers like Banks, while “International transaction” is earned for converting currencies and facilitating cross-border payments.

Moat

The tremendous scale of its payment network is the engine of Visa’s amazing network effect, together they form the two sources of Visa’s strong moat.

Building a data center and communications network to the scale of Visa requires billions of dollars in capital expenditures, which increases the barriers to entry significantly. These barriers grow constantly as Visa deploys more than $1B in CapEx annually.

Networks benefit from the number of customers who are in them. As Visa facilitates payments at over 100 million merchant locations and has over 4.2 billion credit and debit cards in circulation globally, it becomes more attractive for merchants to accept Visa cards. The higher the number of merchants accepting Visa cards, the more inclined customers, on the other hand, become to use Visa cards for convenience and security. This makes large network effects self-reinforcing.

Together, they, in my opinion, establish a formidable moat – however, this has recently attracted regulation efforts by the DOJ, as I will cover below.

Financials

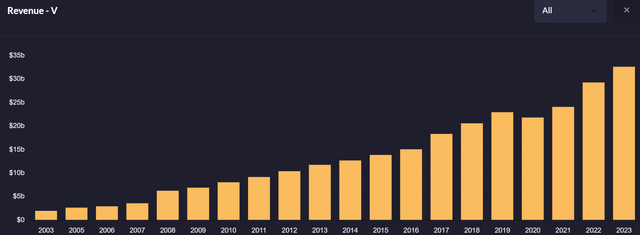

Revenue has proven to be very resilient, in line with the strong moat, and has grown at a 10% CAGR over the last decade as well as in the past 5 years. Only COVID-19 was able to put a dent into the otherwise magnificent revenue chart.

Visa annual revenue 2003-2023 (Qualtrim)

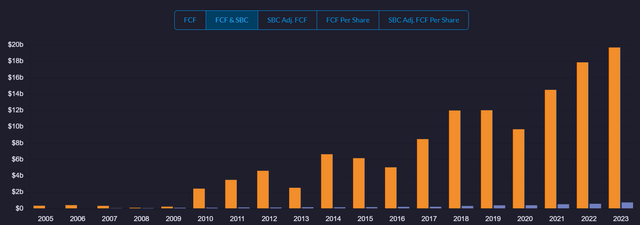

Despite cash flow being rather volatile, it has grown nicely, at a 10% CAGR in the past 5 years and at over 23% CAGR over the last decade, when accounting for stock-based compensation.

Visa annual free cash flow and stock-based compensation (blue) 2005-2023 (Qualtrim)

Visa’s balance sheet is less impressive, with $3.96B in net-of-cash debt. However, this only accounts for a little over 20% of Visa’s annual free cash flow and should thus be absolutely no problem to service, even in more turbulent times.

Shareholder returns

With a Buyback yield of about 2.3% over the last decade and the last few years and a Dividend yield of currently 0.76%, total shareholder returns are at about 3%. Which is equal to distributing approximately 85% of its free cash flow. While this is an elevated combined payout ratio, it does not seem like Visa’s management is neglecting reinvestment into the business when looking at R&D and CapEx spending.

Valuation

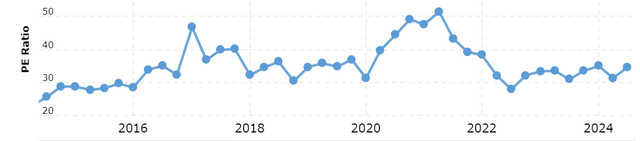

Looking at historical valuation, we can see that the Price-to-earnings ratio has steadily risen and is currently mildly elevated. That is in the context of slower expected growth going forward, as Earnings per share (EPS) grew at a CAGR of 15% over the last decade.

Visa PE ratio 2014-2024 (macrotrends.net)

As we can see, Analysts expect slower growth going forward, while competitors and peers are still growing faster or, in the case of AXP, recently accelerating.

| Company | Visa Inc. (V) | Mastercard Incorporated (MA) | American Express Company (AXP) |

| Last fiscal year’s P/E ratio** | 30.59x | 39.46x | 23.69x |

| Next 3y EPS CAGR estimates* | 12.64% | 16.39% | 15.12% |

| 3y PEG-ratio** | 2.42x | 2.408x | 1.57x |

*Analyst estimates from Seeking Alpha **With 9/25/24 opening prices

Valuation is historically elevated, despite the 5-6% drop yesterday, and growth seems to slow. In combination with recent regulatory concerns, which are likely to hamper Visa’s medium to long-term growth and/or profitability, this creates an investment case that is unattractive to me, despite the company’s excellent moat.

Risks

I, personally, see the ongoing, as well as the very recent, regulatory troubles as the biggest risk and potentially a significant problem for Visa’s operations and consequently, its stock.

After the US Department of Justice blocked the acquisition of Plaid, a $5.3B deal, in 2021, the DOJ also started investigating Visa about a year ago. More recently, a judge ruled against a $30B settlement and a temporary fee cap, which was the result of a class action lawsuit including the National Retail Federation and the National Association of Convenience Stores. This settlement being rejected by U.S. District Judge Margo Brodie means the US Justice is out for more.

And more came in yesterday; in the form of a new lawsuit by the DOJ, claiming Visa has illegally monopolized the debit card market.

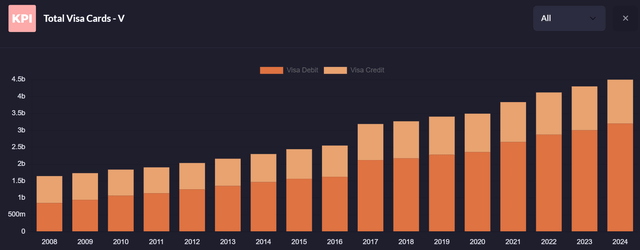

Something that is important to notice is that most of Visa’s cards are Debit cards. While the chart below shows Visa’s total globally outstanding cards by type, other sources suggest a similar picture for the US (1, 2, 3). There, debit cards are almost twice as common as credit cards – and make up more than 2/3 of Visa’s cards in the US.

Visa cards by type 2008-2024 (Qualtrim)

Now that the importance of debit cards to Visa is clear, it becomes apparent why the market was quick to determine the stock’s fate upon hearing about the DOJ’s lawsuit.

The DOJ’s claims;

…agreements are priced so that, unless all or nearly all debit volume runs over Visa’s payment rails, large disloyalty penalties can be imposed on all Visa transactions. Merchants cannot afford to use Visa’s smaller competitors for transactions where options do exist, even when those competitors offer lower per-transaction prices.

Are not unsupported, as it seems.

What has contributed to Visa’s immaculate moat, in the form of a network effect, in the past, now appears to be going far beyond just a strong customer lock-in and seems to resemble something like a headlock.

Similar can be said about Visa’s approach to new competition entering the sector:

…Visa aimed to stop that development by entering into agreements to pay potential competitors to partner instead of innovating.

These “Client incentives”, although not entirely used for these activities, amassed $12.3B in 2023, or over 37% of V’s revenues in that year.

Attorney General Merrick B. Garland further notes

…Visa has unlawfully amassed the power to extract fees that far exceed what it could charge in a competitive market…Visa’s unlawful conduct affects not just the price of one thing – but the price of nearly everything.

This lets Investors estimate possible consequences. The outcome, in my opinion, most likely desired by the DOJ, is probably a mixture of a forced fee reduction, a control on fee-hikes as well as forcing Visa to end the anti-competitive agreements and behavior.

If the DOJ’s lawsuit is successful, this will likely result in higher competition, lower fees, and fee increases (if any) for Visa. Possibly making it difficult to achieve future medium to long-term growth and profitability estimates that the current price demands from the company. This creates valuation risk, as the company is far from cheap.

While none of this has materialized yet, and will likely take years to play out, we should remember the government has the monopoly on force. Although it is possible to not be much more than a “slap on the wrist,” it is important to recognize that this campaign by the DOJ has been going on for years. It seems to intensify now, though, and in essence, was started by V’s own customers.

All of this applies on top of the risks of company-specific risks, as well as potential geopolitical/international risks. As the international revenue share is rather high, international regulation, like in India, is essential to keep an eye on as well, perhaps limiting long-term runway.

Conclusion

With legal pressure (importantly, from different sources) mounting and, if successful, possibly hampering growth, profitability, and competitiveness, I rate Visa a sell on regulatory and valuation concerns. As growth and/or profitability are likely to be confined by regulatory efforts, achieving the estimates the market has set for the company becomes much harder. Even if regulatory efforts don’t persist, I don’t see outperformance for Visa’s stock, as it is priced ambitiously and provides less value than peers and competitors. Although regulatory issues will likely only come into effect in the medium to long term, sentiment souring can hurt the stock in the short term as well.

A possible alternative, with little to no regulatory issues so far, I have recently covered is American Express. AXP’s growth is accelerating and yet, much cheaper than Visa from a valuation perspective, even when adjusting for growth and the credit risk discount. A major point of why I like American Express more is that the majority of Visa’s stakeholders likely see it as a necessary evil. This is evidenced by large class action lawsuits in the past, while AXP connects different customer groups to experience mutual benefit.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AXP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.