Summary:

- FOMO caution: AI stocks may be overpriced.

- Visa offers strong growth potential at a fair price.

- Consistent growth and dividend history make Visa a strong long-term investment.

2Ban

Now is not the time to fall prey to FOMO (the fear of missing out) and buy into the AI hype train.

That’s what I keep telling myself.

I started writing this article a week ago, but even after the sell-off that we saw in the semiconductor space during the last week, I still think many of the blue-chip stocks caught up in the AI rally look pricey.

Thankfully, I bought into many of these AI stories years ago.

That helps me tamp down those FOMO feelings.

But, already having exposure to the greatest companies in the world doesn’t mean that I don’t want more shares.

I’m human. Who wouldn’t want to ride this wave high a higher percentage of their portfolio?

As you can see below, the majority of my top-10 personal holdings hail from the tech sector.

|

Company |

Ticker |

Cost Basis |

% Gain/Loss |

% of Stock Holdings |

|

Apple Inc |

AAPL |

$22.79 |

810.44% |

8.52% |

|

NVIDIA Corp |

NVDA |

$9.10 |

1290.88% |

7.63% |

|

Broadcom Inc |

AVGO |

$234.30 |

607.91% |

6.14% |

|

Microsoft Corp |

MSFT |

$85.56 |

425.69% |

5.00% |

|

Amazon.com Inc |

AMZN |

$124.07 |

52.40% |

4.33% |

|

Alphabet Inc Class A |

GOOGL |

$45.45 |

295.23% |

4.21% |

|

Meta Platforms Inc |

META |

$467.29 |

5.88% |

2.94% |

|

Visa Inc |

V |

$124.24 |

121.52% |

2.80% |

|

Booking Holdings Inc |

BKNG |

$3,499.68 |

13.98% |

2.06% |

|

Realty Income Corp |

O |

$59.43 |

-10.57% |

2.00% |

Most of these are long-time holdings for me, though not all.

I aggressively built positions in Meta and Booking Holdings earlier this year…while also adding to high conviction growth stocks like Nvidia, Amazon, and Microsoft.

I think tech stocks like Meta, Salesforce, and Booking are more attractively priced than their semiconductor peers. But, they’re certainly not as cheap as they were a couple of months ago.

Obviously, I’m bullish on all of these companies over the long term; otherwise, I wouldn’t own them.

But, the most recent leg of the tech/AI rally has pushed shares of several of these stocks (namely, Nvidia and Broadcom) above my fair value estimates, meaning that they’re no longer attractive stocks to buy.

The company quality metrics on these types of stocks are through the roof.

They check all of the boxes that I’m looking for when thinking about owning shares over the long term.

Yet, knowingly overpaying for a stock, regardless of how great the company’s operations, cash flows, and growth expectations are, is a great way to perform poorly in the market.

For instance, NVDA’s rally above the $130/share threshold pushed its forward P/E ratio (looking at next year’s consensus EPS estimate) up above the 35x threshold.

AVGO shares are now trading for approximately 28x next year’s consensus EPS estimate.

Both of these multiples are higher than I’d want to pay. Therefore, NVDA and AVGO shares are now in “Hold” territory for me.

For weeks, it seemed like every day, when I looked at my portfolio’s heat map, the NVDA and AVGO tickets were glowing bright green. That was great. Now that these are such significant holdings for me, I love to see it. I’ve held several of these stocks for a decade or so and the plan is to hold them for decades more. NVDA and AVGO shares can run as high as they want to now. So long as the fundamental growth and dividend trajectories continue to trend upward, I’ll be happy to hold. But, when it comes to putting new cash to work in the markets these days, I’m no longer looking to add to these big winners.

I’m looking to buy other out of favor compounders which also offer – what I believe to be, anyway – market-beating total return potential.

With that in mind, instead of letting greed get the best of me when I’m staring at those big green numbers associated with high-flyers like NVDA or AVGO, I wanted to take the time to highlight a couple of other undervalued blue chip compounders that I am happy to buy at today’s prices.

Visa: The Dividend Growth Stock of all Dividend Growth Stocks

Prior to names like Alphabet (GOOGL), Booking Holdings (BKNG), Meta (META), and Salesforce (CRM) recently establishing dividends, investors like me who prioritize double-digit dividend growth prospects were flocking into stocks like Visa (NYSE:V) and Mastercard (MA).

These are two well-known brands that, prior to the COVID-19 pandemic period, had perfect fundamental and dividend growth streaks.

I think companies like Visa and Mastercard have been overlooked lately by growth investors who’re piling into the AI race and that presents an opportunity.

For the sake of simplicity, in this piece I’ll be focusing my attention on Visa. It’s slightly larger and slightly cheaper than Mastercard, though I should note that I own shares of both companies and love them both as long-term compounding machines.

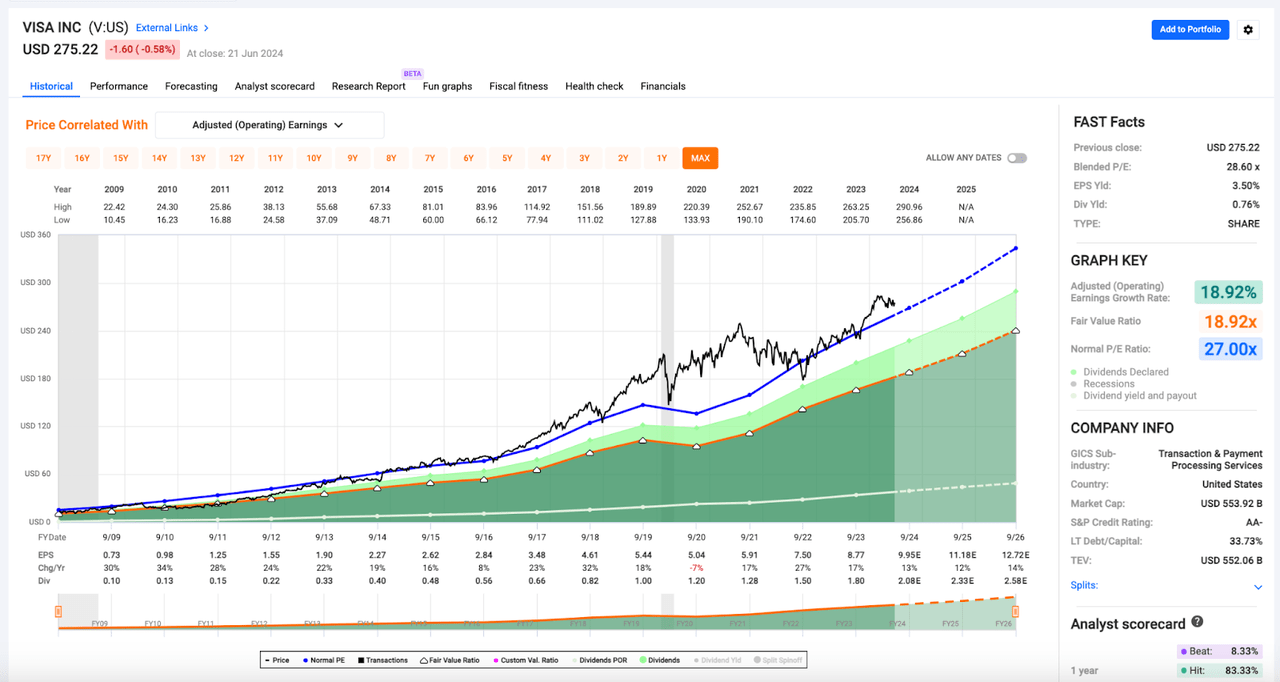

Visa IPOed in 2008 and as you can see below, only has one fundamental growth blemish on its long-term track record.

FAST Graphs

Long-term charts and bottom-line data sets don’t get much prettier than that.

I love the consistency with which Visa has compounded its earnings…and the relatively strong support level that shares have found at the 27x range (the blue line in the chart above).

Furthermore, I don’t fault this company for its lack of growth in 2020. No one could have foreseen the world shutting down like it did during the pandemic. And, after one year of negative y/y EPS growth, Visa quickly got back on track with double-digit growth results of 17%, 27%, and 17% in 2021, 2022, and 2023, respectively.

The consensus analyst estimate for Visa’s EPS growth rate this year is currently 13%.

Wall Street predicts 12% growth next year and 14% the year after that.

These double-digit growth results and future estimates are what compounding is all about.

They’re what have allowed Visa to grow its dividend at a 32% CAGR over its history as a publicly traded company.

And with all of this fantastic (and extremely reliable growth in mind), I’m always happy to buy shares of Visa when I believe that they’re trading at a discount.

Valuation: A Wonderful Company Trading for a Fair Price

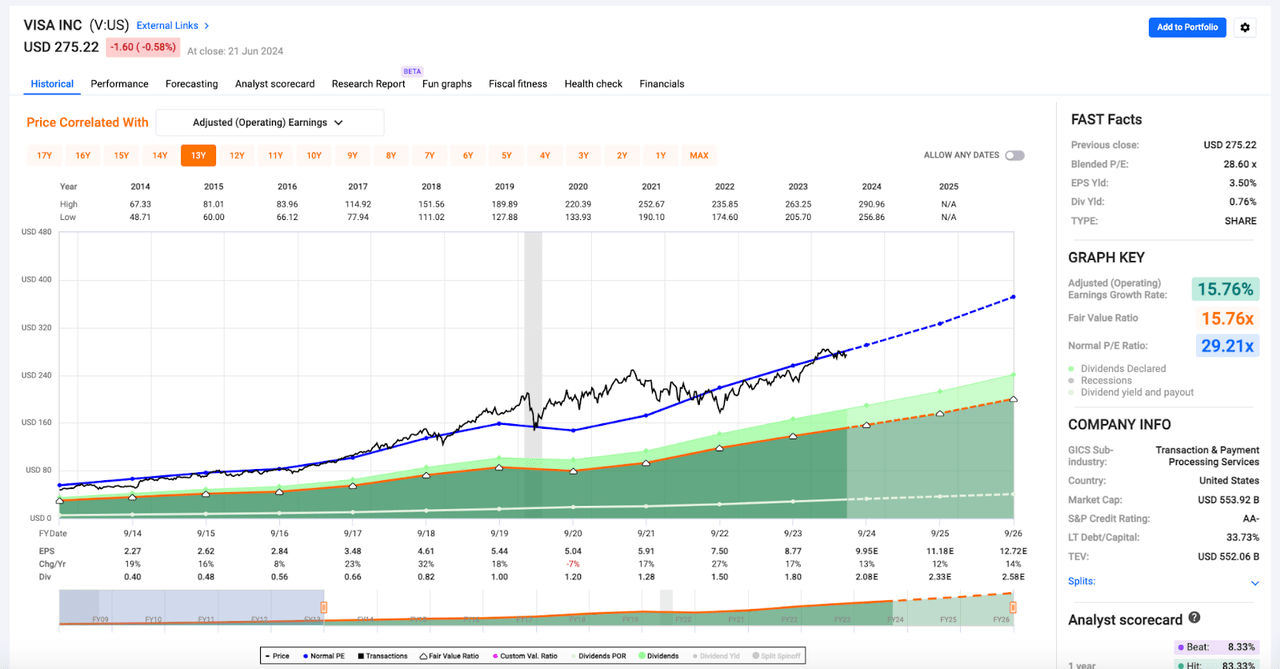

Today, at 28.6x earnings, Visa is trading at a slight discount to its 10-year average P/E ratio of 29.2x. .

FAST Graphs

It’s trading at an even steeper discount to its 5-year average P/E ratio of 32.0x.

I’m happy to pay 25x forward for a company of this caliber and therefore, looking at Visa’s consensus EPS estimate of $11.18 in fiscal 2025 (which ends in September), we’re talking about a $280 price target.

Shares are right below that level today, yet I think it’s important to remember that this PT is likely going to prove to be conservative.

First of all, Visa has beaten Wall Street’s consensus EPS estimate during 19 out of the last 20 quarters. With that in mind, I suspect that its fiscal 2025 EPS total will likely be higher than the current consensus of $11.18.

I wouldn’t be surprised to see 2025 EPS arrive closer to $12/share than $11 and if I’m right, then a 25x would result in a $300 share price.

What’s more, Visa shares have only dipped below the 25x threshold significantly one time during the past decade.

In other words, that’s a very conservative multiple.

This is a company that consistently trades in the ~30x range.

But, I always apply a discounted multiple to forward earnings estimates when coming up with my price targets to account for uncertainties associated with all equities (risk assets).

That’s how I limit risk and sleep well at night when putting cash to work in the markets.

But, assuming that Visa stays on its historical trend and trades with a multiple between the 27x and 32x range (in line with historical averages), then we’re talking about a stock that could be worth $300-$360 in a little over a year.

~$350/share would represent an annualized rate of return in the 23% range between now and September of 2025.

You’re never going to hear me complain about one of my holdings compounding at a 20% rate and therefore, even though Visa isn’t a high-flying AI play, I love this toll-booth like business model from the global payments space, and I’ll be looking to add to my position below the $280 level whenever investable cash becomes available.

Conclusion

No company comes without risk…not even blue chips like Visa.

For example, because of Visa’s dominant market share position, it’s likely going to face heightened regulatory threats from lawmakers who worry about an abuse of power.

I don’t buy into that notion. I love the reliable, safe, and secure transactions that I make on my Visa card every day (and frankly, even though they’re paying a small fee, I’m sure that all of the merchants that receive my payments do too).

I suspect that society is going to continue to move in a cashless direction, but I don’t really see an imminent threat from alternative “currencies” like Bitcoin and the like.

I know that there are huge crypto bulls out there, but I haven’t come across a real-world scenario where using crypto was going to be simpler, easier, or cheaper than swiping one of my Visa cards.

And ultimately, I trust that the management team that has built this wonderful company is well aware of all of their competitive threats and will continue to use its cash flow to fend them off, just like it has for decades.

Risk and reward has to be factored into the fundamental multiples that investors are willing to pay for companies, and like I said before, 25x forward is a price that I’m happy to pay for Visa.

I expect to generate double-digit returns when I buy V shares at that multiple. That’s right where we are today. And therefore, channeling my inner Warren Buffett, I feel really good about buying a wonderful company at a fair price here.

When it comes to blue chips like Visa, I don’t think investing needs to be any more complicated than that.

Keep it simple, Stupid…as they say.

Those double-digit total return expectations are good enough for me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, ACN, ADP, AMGN, AMZN, APD, ARCC, ARE, ASML, AVB, AVGO, AWK, BAH, BIL, BLK, BKNG, BR, CME, CNI, CP, CPT, CRM, CSL, DE,, ECL, ELV, ENB, SPAXX, GOOGL, HON, HSY, ICE, JNJ, KO, LIN, LMT, MA, MAIN, MCD, MCO, META, MSCI, MSFT, NNN, NOC, NVDA, O, OBDC, PEP, PH, PLD, PLTR, QCOM, REXR, RSG, RTX, SBUX, SHW, SPGI, TD, TXN, USFR, UNH, V, WM, ZTS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

Dividend Kings helps you determine the best safe dividend stocks to buy via our Master List. Membership also includes

- Access to our model portfolios

- real-time chatroom support

- Our “Learn How To Invest Better” Library

- Exclusive trade alerts from Nicholas Ward

Click here for a two-week free trial so we can help you achieve better long-term total returns and your financial dreams.