Summary:

- Visa Inc. represents a superior investment option: possessing an outstanding franchise, sound balance sheet, profits earned in cash, and shareholder-friendly management.

- Recent newsfeed items have caused softer share prices, potentially presenting an opportunity for investors to begin building a new position or accumulating shares.

- In this article, we cover why Visa is good investment now, why the management team is solid, why recent share prices are soft, and run through a valuation exercise.

onebluelight/iStock Unreleased via Getty Images

I’ve not written to you about Visa Inc. (NYSE:V) previously, but the stock has been a long-term mainstay in my portfolio. Recent events and softer share prices prompted me to share my current analysis.

In addition, within the last week I noted two Seeking Alpha neutral / negative articles about Visa. These further spurred me to think about the stock. Those articles are found here and here. You may wish to reference these alternative viewpoints.

Background

Visa runs the world’s largest retail electronic payments network, operating in more than 200 countries and territories. Visa’s core products include credit, debit, prepaid, and cash access programs. The company processes approximately 750 million transactions per day. There are over 4.4 billion Visa cards currently in circulation. Importantly, Visa is not a financial institution. Visa does not issue cards, extend credit, or set rates and fees for account holders of Visa products, nor does Visa earn revenues from or bear credit risk.

Effectively, Visa and peer Mastercard Inc (MA) own an electronic payments duopoly. Nonetheless, Visa processes about double the number of transactions as Mastercard. American Express (AXP), Discover Financial Services (DFS), and a several other entities also handle electronic payments; however, these are dwarfed by Visa and Mastercard.

Investment Thesis

Via my personal Investment Strategy Statement, I outline the characteristics for what I believe constitutes a good investment purchase. Visa stock ticks all the boxes:

-

sound balance sheet

-

earns profits in cash

-

strong franchise

-

well-managed

-

shareholder-friendly

- the stock trades meaningfully below Fair Value

Rarely are V shares a screaming buy. Currently, newsfeed items appear to be contributing to somewhat softer share prices. This may present an opportunity for investors to begin to build a new position or accumulate shares.

A Brief Fundamental Rundown

Note: financial data provided via the “Visa Quarterly Earnings” link on the company website.

Balance Sheet

Visa owns a sound balance sheet as exhibited by its liquidity, manageable debt, and equity build.

The current ratio is 1.4x, well above the typical 1.0x threshold indicating ample liquidity. Visa retains between $17 billion and $20 billion cash and marketable assets on its balance sheet. The company could pay about 5 quarters’ total operating expenses from cash-on-hand.

Debt-to-Equity runs about 50 percent. It’s easily managed. The Interest Coverage Ratio (EBIT / Interest Expense) is ~30x. For most businesses, a figure above 5x is considered adequate.

Visa management has a fine long-term record of creating shareholder value as measured by increasing total equity as a function of total shares outstanding (book value).

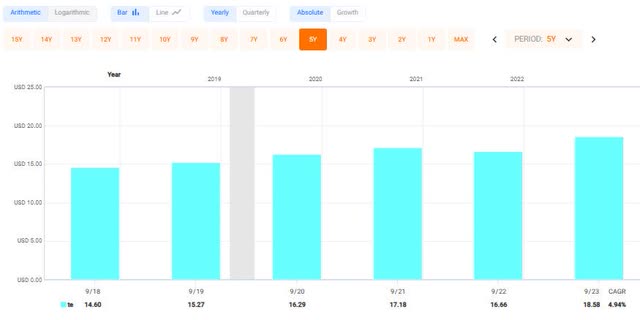

fastgraphs.com

Over the past five fiscal years, share equity build increased by about 5 percent a year. The trend continues unabated into FY2024.

Profits Earned in Cash

Visa is one of those premier companies that generates greater operating cash flow than net income.

Visa Inc – Annual Net Income and Cash Flow ($B)

|

FY2023 |

FY2022 |

FY2021 |

|

|

Net Income |

17.3 |

15.0 |

12.3 |

|

Operating Cash Flow |

20.8 |

18.8 |

15.2 |

|

Free Cash Flow |

19.7 |

17.9 |

14.5 |

Indeed, Visa generates more free cash flow (operating cash flow less capital expenditures) than net income.

The company’s fiscal year ends September 30. There is little question FY2024 cash flow will eclipse net income again.

Strong Franchise

The Visa franchise is unassailable. It’s the world’s largest electronic payment processor. Visa and Mastercard epitomize “wide moat” businesses.

Evidence of a strong franchise is exhibited by a measure of pricing power. Visa and MC have such capability. The long-term ability of these two companies to price their products is a driver for some of the current market hubbub surrounding these enterprises.

Perhaps ancillary to the franchise discussion, Visa routinely generates net margins between 53 percent and 57 percent. This is remarkable.

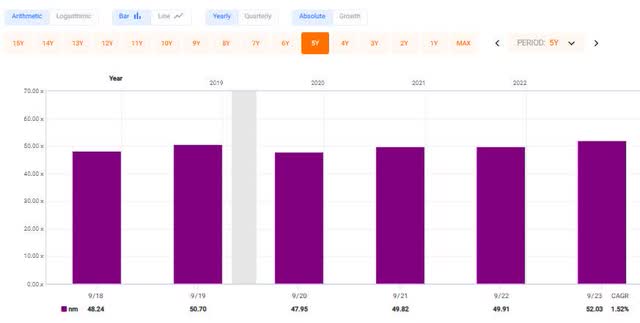

fastgraphs.com

Very few large corporations generate such wide margins consistently.

Peer Mastercard also enjoys high net margins, too, though generally several hundred basis points less than Visa Inc.

fastgraphs.com

Visa is Well-Managed

While evaluating management effectiveness includes elements of subjectivity, there are several quantitative / qualitative measures to assist investors. Here are a few:

-

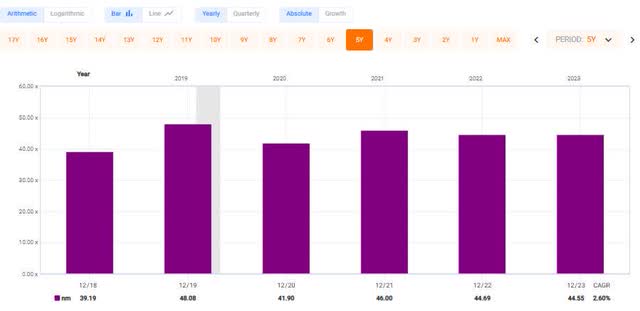

Management produces high and consistent long-term return on capital and return on equity.

fastgraphs.com

These figures are glossed by the fact that Visa’s WACC is about 9 percent.

-

Management creates long-term shareholder value as evidenced by book value per share. (See previous section of this article.)

-

The current board of directors’ tenure is about five years. (See Page 37 of the 2024 proxy statement). I dislike boards with entrenched directors. An orderly rotation is healthy.

-

There is an independent Chairman of the Board. I prefer to see an independent Chair versus a combined CEO / Chairman role.

-

Generally, management keeps Visa out of the spotlight.

-

Management provides clear, unambiguous guidance; sets Street expectations; then proceeds to meet or exceed such guidance.

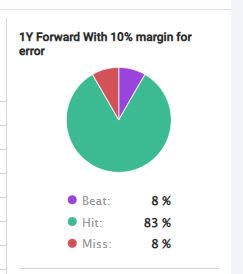

The pie chart below compiles Visa Inc actual EPS performance versus Street estimates for the period 2013 through 2023.

fastgraphs.com

Actual versus Street only missed one time in the past 11 years.

Management Is Shareholder-Friendly

As aligned with the proceeding section, I consider shareholder-friendly management to be demonstrated by the ability to provide clean, clear investor communications. Visa management does this, including detailed financial and operating statistics.

Such communications avoid perennial one-off expenses and / or financial adjustments to the income statement. Typically, Visa management offers quarterly earnings reports without any hair on it.

Management routinely provides timely investor updates and helpful investor conference presentations. Visa management participates in Street and investor events every quarter.

Cash dividends, if declared, are raised consistently. Over the past five years, the Visa board of director raised the cash dividend per share by 16 percent per annum.

Visa’s Recent Newsfeed

In recent weeks, Visa has found itself in the funny papers over a few issues.

On June 25, a judge appeared ready to reject a $30 billion swipe fee settlement by Visa and Mastercard. In March, the expectation was the settlement would be accepted.

On July 10, Visa disclosed that it will release ~$2.7B from its series B and series C convertible participating preferred stock in connection with the third mandatory release assessment on June 21, 2024. The net result will be slightly dilutive to current Visa common “A” stockholders. I found the release somewhat confusing and had to read it more than once. Investors hate complicated stories. This was one of them.

On the same day, a Bank of America analyst downgraded both Visa and Mastercard stock to “neutral” due to concerns about aforementioned regulatory issues, moderating growth to value added “services” revenue streams, and “limited upside” to valuation multiples and forward earnings estimates.

Commentary

The expected V / MC swipe fee settlement rejection is likely to prolong nearly two decades of litigation on this issue. I cannot predict the outcome, but based upon current public information, I would not dismiss the stock over it. Duopolies tend to find a way to come out alright. I would like to hear your views on this in the comment section below.

The conversion of the series B and C stock had been well-communicated. Nonetheless, it is not easy to understand without knowing the historical context. Bottom line: I expect “A” share dilution to be a relatively minor issue. For years, Visa management has been repurchasing over 2 percent per annum of total diluted shares outstanding.

The BoA analyst that downgraded the stock to “neutral” lowered his target price from $305 to $297; not earthshaking. Meanwhile, on June 25, Evercore ISI Group lowered their target price from $335 to $330. Back on May 13 Piper Sandler initiated coverage at $322. These are the three most recent brokerage reports I found. These estimates average to a $316 price target, representing a 19 percent upside from a recent $265 bid.

My Fair Value Estimate

As of March 31, 2024, my Visa Inc. Fair Value Estimate was $313.

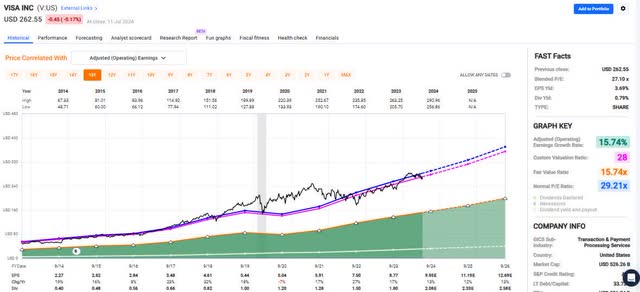

At core, this was based upon 28x the company’s FY2025 current $11.19 Street EPS consensus. The following FAST Graph illustrates the long-term relationship between V price-and-earnings.

fastgraphs.com

V has a long-term PE 29.2x on annualized 15.7% EPS growth. I reduced my FVE by one turn (to 28x or the pink line on the chart) to compensate for decelerating earnings growth.

Running the same 10-year valuation exercise using current 2025 Street estimates and modestly reduced historical multiples for P / OCF and P / FCF yields higher price targets: about $340 per share.

Therefore, I believe my $313 FVE is not aggressive. If you accept it, an investor wishing to start or augment a position in V stock may consider doing so with a decent factor of safety.

As with any position, I encourage investors to build a position slowly over time, seek to buy during periods of soft price performance, and never chase a stock.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock. Good luck with all your 2024 investments.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.