Summary:

- Visa dominates in the global payments technology sector, with a strong position in digital payment technology and a vast network of financial institutions.

- Visa’s regulatory licenses in multiple countries solidify its position as a leader in global payment processing.

- Visa’s financial performance remains resilient, with a focus on expanding its digital offerings and capitalizing on the growing demand for digital payments.

Justin Sullivan

Thesis

Visa (NYSE: V) stands as a global titan in the payments technology sector, a company that has experienced both meteoric rises and challenging downturns in the wake of the pandemic. As the worldwide payment landscape shifted, Visa faced its share of challenges, including disruptions in transaction volumes and the evolving digital payments ecosystem. Despite encountering setbacks such as delayed projects, Visa has fortified its core operations and is actively exploring innovative avenues for resurgence. Moreover, the company’s stock now presents an attractive valuation following successive rounds of selling pressure. In the unfolding recovery of the payments industry, Visa could emerge as a prominent contender poised for renewed success.

VISA dominates in digital payment technology

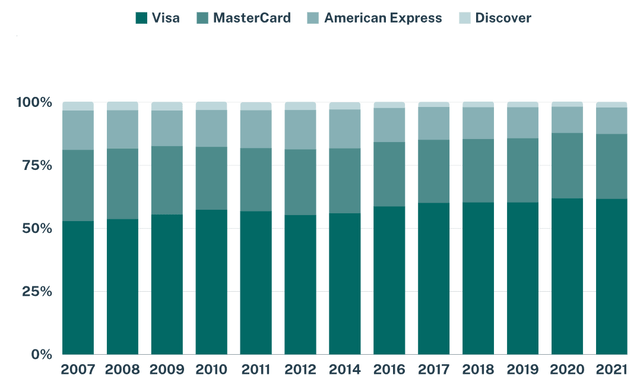

One of Visa’s paramount strengths lies in its unrivaled position within the global payments ecosystem, a dominance that has eluded its closest competitor, Mastercard. While Mastercard seeks to gain ground, Visa’s supremacy in this domain remains unchallenged. Visa’s strategic foothold in facilitating digital transactions and its extensive network of financial institutions provide a formidable foundation. Additionally, Visa’s relentless commitment to innovation and security continually bolsters its appeal to consumers and businesses alike. Despite Mastercard’s efforts to catch up, Visa’s market share and global presence have shown remarkable resilience. Moreover, Visa’s vast network of merchant acceptance points and strategic partnerships further solidify its stronghold, making it challenging for competitors to match Visa’s reach. This enviable position enhances Visa’s ability to not only maintain its market share but also explore new avenues for growth, solidifying its status as an enduring leader in the payments industry.

Regulatory licenses

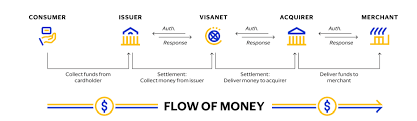

Visa’s regulatory licenses stand as a testament to its decades-long commitment to forging robust relationships with governments worldwide. With an expansive presence in over 200 countries and the ability to transact in 158 different currencies, Visa empowers individuals and businesses across the globe to seamlessly exchange funds. What sets Visa apart from its competitors is the breadth of its regulatory approvals, a distinction that eludes most other players in the fintech arena who are often confined to their home markets. The intricate process of acquiring and adhering to diverse regulatory licenses in foreign jurisdictions serves as a formidable barrier to entry, ensuring that Visa’s dominant position in global payment processing remains unassailable. Visa’s stature as a leader in facilitating peer-to-peer and business-to-consumer transactions on an international scale is reinforced by its comprehensive regulatory approvals, solidifying its role as a stalwart in the world of finance for the foreseeable future.

Digital Payment Technology

Visa’s catalytic force lies in its dynamic evolution within the digital payment landscape. Over a relatively short span, Visa has positioned itself as a pivotal player, adapting swiftly to the changing market dynamics. In 2022, Visa’s digital payment transactions accounted for a substantial portion of its revenue, representing over 13% (approximately $80 billion) of its total sales, a figure that continues to experience robust year-on-year growth ranging from 13% to 18%. This remarkable ascent can be attributed to Visa’s competitive advantage in offering cost-effective solutions coupled with its omnipresent retail presence, delivering unparalleled convenience to consumers. In tandem, Visa’s foray into e-commerce, particularly through its marketplace platform, has diversified options for consumers while simultaneously fostering the profitability of a substantial majority of its 100,000 sellers. This expansion into e-commerce has paved the way for Visa to venture into digital marketing, leveraging its extensive platform reach to harness the revenue potential of advertising. With high-margin prospects and rapid growth (30% YoY), this segment presents a promising avenue for bolstering future profits, a prospect underscored by CFO John Rainy’s optimism regarding its substantial contribution to the company’s bottom line.

Another catalyst for Visa’s transformative journey is its visionary pursuit of becoming a comprehensive super app in the realm of finance. This audacious project aims to consolidate banking, investment, and shopping services into a singular, all-encompassing application. As the digitization trend accelerates and consumers seek the simplicity of consolidated apps (akin to Uber and Lyft for ridesharing), PayPal is strategically positioned to become the sole finance app that fulfills diverse financial needs. Success in this endeavor would not only open up novel revenue streams reminiscent of traditional banks, trading platforms, and e-commerce but also elevate profit margins by streamlining marketing efforts toward a singular, successful app. Additionally, each additional service within PayPal’s super app ecosystem has exhibited the potential to increase average revenue per account by 25%, further solidifying the viability of this ambitious undertaking. PayPal’s transformation into a finance super app not only promises substantial growth but also fortifies its competitive moat as consumers increasingly gravitate toward an all-in-one financial solution.

Financials

Visa’s financial performance for Q3 2023 showcased resilience in the face of evolving market dynamics. With reported revenue of $8.12 billion, Visa managed to surpass expectations, though by a modest margin of $58.88 million. This performance marked a 11.65% year-on-year increase, signaling Visa’s ability to navigate challenges and capitalize on the growing global demand for digital payments. The company’s strategic focus on expanding its digital offerings, coupled with its enduring reputation for security and reliability, continued to drive growth in transaction volumes and fee-based revenue. Despite the ongoing uncertainties in the financial landscape, Visa’s management remains confident in the company’s growth prospects for the remainder of the year.

Looking ahead, Visa’s future financial growth hinges on its capacity to maintain its technological edge, capitalize on emerging market opportunities, and adapt to evolving consumer preferences. The company’s robust liquidity position positions it favorably to make strategic investments in expanding its payment ecosystem, potentially yielding substantial returns in the coming years. As the global shift towards digital payments gains momentum, Visa’s established presence and commitment to innovation position it as a key player poised to benefit from the projected growth of the digital payments industry, which is anticipated to exceed $6 trillion by 2026. Investors will closely monitor Visa’s strategic initiatives and market response as it continues to chart a course in the ever-evolving financial landscape.

Businessmodelanalyst.com

Valuation

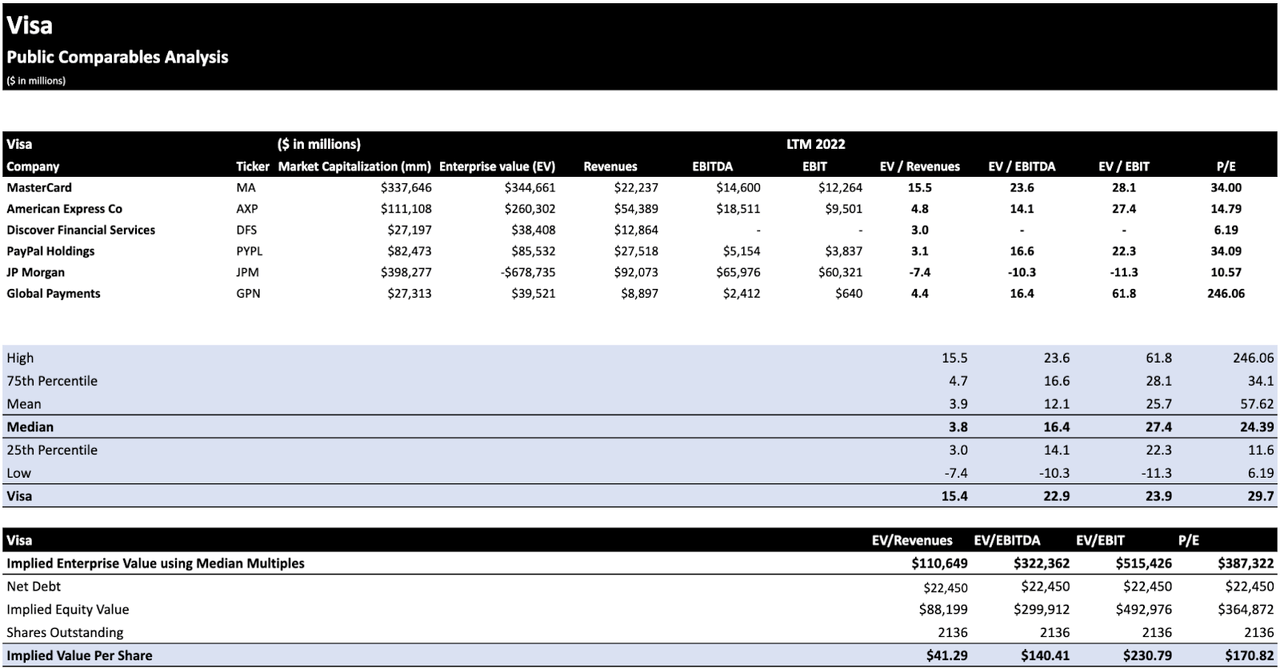

In my view, valuing Visa Inc. involves a comprehensive analysis of its financial health and market position. To arrive at a fair valuation for Visa stock, I have chosen to employ the median multiple approach in conjunction with the company’s competitors. This method allows for a more balanced assessment by taking into account the industry’s collective performance. By comparing Visa’s key financial metrics, such as price-to-earnings ratio, price-to-sales ratio, and price-to-book ratio, against the median of its peer group, I can gauge how Visa is positioned relative to its competitors. This approach considers both Visa’s unique strengths and any potential challenges it may face, offering a more nuanced perspective on the stock’s intrinsic value. Ultimately, this methodology aims to provide a well-rounded evaluation that reflects Visa’s standing within the dynamic financial services sector.

Risk

Visa, as a major player in the global financial services industry, faces several notable risks in its quest for continued growth and stability. One of the primary challenges lies in the evolving landscape of payment technology. As the industry rapidly shifts towards digital and blockchain-based solutions, Visa must continually adapt to stay competitive. Failure to do so could result in losing market share to emerging fintech companies that offer innovative alternatives to traditional payment methods. Additionally, the ever-present threat of cybersecurity breaches and data theft poses a significant risk to Visa’s reputation and trustworthiness. A major security incident could lead to regulatory penalties, loss of customer trust, and financial repercussions.

Another critical concern for Visa is regulatory scrutiny and changes in the financial sector. Governments and regulatory bodies worldwide are constantly updating and tightening their oversight of the payments industry to ensure security, consumer protection, and fair competition. Changes in regulations could impact Visa’s business operations, potentially increasing compliance costs and limiting its ability to pursue certain strategies. Moreover, geopolitical tensions and trade disputes could influence international financial regulations, introducing additional uncertainties and challenges for Visa’s global operations.

Lastly, economic and geopolitical factors can impact Visa’s revenue streams. Economic downturns, recessions, or financial crises can lead to reduced consumer spending and business transactions, directly affecting Visa’s transaction volumes and revenue. Additionally, geopolitical tensions or trade restrictions between countries can disrupt cross-border transactions, which are a significant part of Visa’s business. Visa must navigate these risks while maintaining its commitment to innovation, security, and customer satisfaction to sustain its leadership position in the global payments industry.

Conclusion

Visa Inc. has demonstrated remarkable resilience, even in the face of challenging market conditions. Amidst economic downturns and uncertainties, Visa has consistently proven itself as a stalwart in the financial industry. Its robust business model, founded on electronic payment solutions, has shown steady growth and adaptability. Visa’s commitment to innovation and its vast network of financial institutions worldwide make it a formidable player in the market. With a history of weathering market storms and a portfolio of strong assets, Visa remains a reliable choice for investors seeking value stocks. Its ability to thrive during adverse economic conditions underscores its status as a standout performer in the financial sector, and it’s poised to continue delivering strong returns to shareholders in the years ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.