Summary:

- Visa has been a dominant market leader for years despite growing competition.

- The company has enjoyed double-digit growth for years due to the shift towards electronic payments.

- Visa should benefit from the continued shift towards electronic payments and the rise in consumer spending.

Justin Sullivan

Thesis

Visa (NYSE:V) is the world’s dominant electronic payment network, underpinned by a wide economic moat. A continued shift towards electronic payments and an increase in consumer spending should drive low double-digit revenue growth in the near future. Visa has enjoyed double-digit growth in the last few years due to the shift towards electronic payments, and given its strong market position, I don’t expect that to change. The company’s moat will help them fend off competition for years to come. Payment volumes rise with consumer spending, which is expected to grow 6% a year from 2023 to 2028. I will explain each of the key drivers of my investment thesis below.

Business Overview

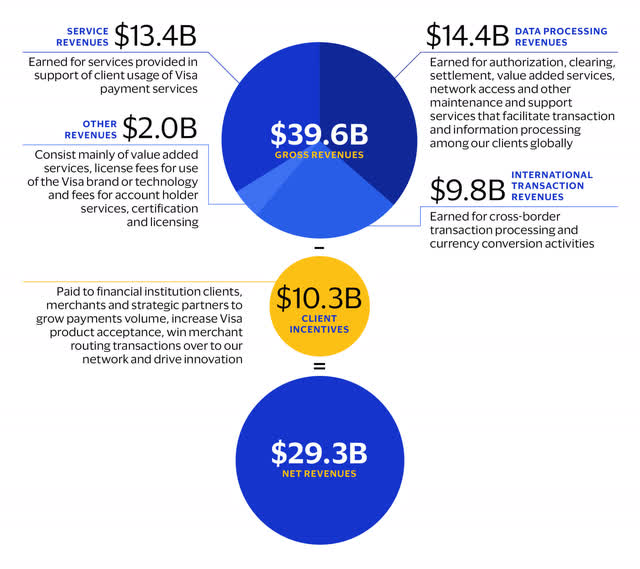

Visa facilitates global commerce and money movement across more than 200 countries and territories. Visa charges fees every time a cardholder makes a transaction using their card. The company operates in four main segments.

Company’s 10-k

Economic Moat

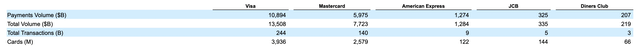

I assign Visa a wide economic moat, and I will explain why. Visa mainly benefits from its network effect. The greater the number of customers who use the payment network, the more desirable it is to merchants, which makes the network more appealing to consumers, and so on. The company has processed over $11 trillion in payments volume as of 2022. Visa has almost 16,000 financial institution partners, 3.9 billion Visa cards in circulation, and over 50 million merchants accepting Visa.

Company’s 10-K

The company processes almost double as many transactions as its biggest competitor, Mastercard. I believe that no company will surpass Visa in terms of volume and transactions processed anytime soon. Visa’s dominant market position has helped them maintain a high ROE (38%) and ROIC (24%) in the last 5 years. Visa is also very profitable, with a 51% net margin and 69% EBITDA margin on average for the past 5 years. The company processes about 40% of transactions globally and 61% of transactions in the U.S. I expect the company to keep dominating the electronic payments sector because it has the widest acceptance rate and leading market share. Additionally, the company has partnerships with four of the six biggest card issuers in the world.

Electronic Payments

Historically, Visa’s growth has been driven by the shift toward electronic payments. In 2022, cash transactions totaled more than $7 trillion. This tells me that electronic payments still have room for growth, and Visa is set to benefit from that growth since they are the global leader in payment processing. This is what the CEO had to say in the Q2 23 earnings call.

“Even with all the digitization over the last several decades, there is still a tremendous amount of cash and check spent globally. There is a very long runway for growth in this business.”

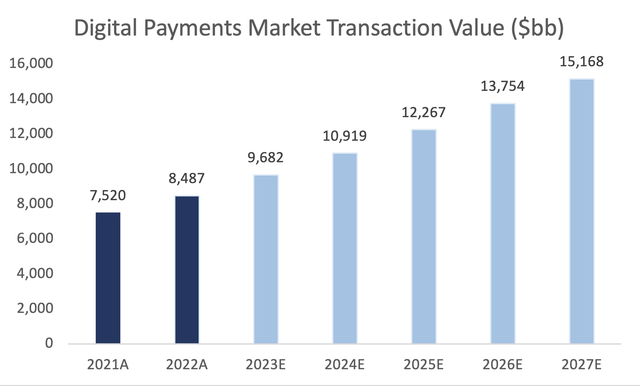

Created by the Author using Statista

As you can see from the chart above, digital payments are forecast to grow at a 12% CAGR from 2023 to 2027. Digital payments, or electronic payments, include payments using bank transfers, mobile apps, and instruments such as credit, debit, and prepaid cards. I expect Visa to share in this growth, given that it’s the leading payment processor. Generally speaking, it doesn’t really matter whether payment is by credit, debit, or mobile since Visa still earns fees regardless of the payment method. I think that emerging markets such as Africa and Southeast Asia will provide Visa with a little boost in growth, which can help them offset the slow growth in developed markets (if it were to happen). Visa’s revenue in Africa increased by 1.2% and by 1.3% in Asia/Pacific from 2021 to 2022. My view is that Visa has benefited from the shift from cash to digital payments so far, and I believe it will continue to do so as more people and countries adopt electronic payment methods.

Consumer Spending

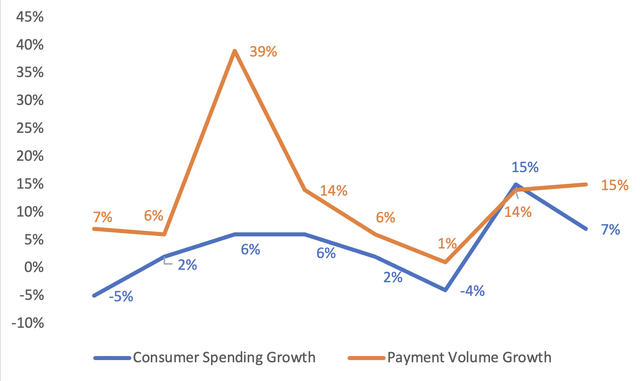

Payment volume tends to track consumer spending. One of Visa’s main revenue drivers is consumer payments. So as consumer spending rises, so does payment volume, and vice versa.

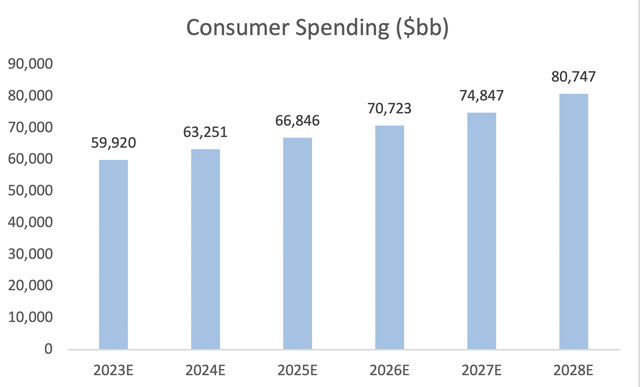

Created by the author using company filings and Statista

The chart above shows the correlation between Visa’s payment volume growth and consumer spending growth from 2015 to 2022. As you can see, the two lines tend to follow the same pattern, maybe not exactly the same because consumer spending in the chart above is for both cash and electronic spending. In 2022, despite high inflation in the U.S., consumer spending remained resilient. 48% of Visa’s revenue comes from the U.S., which can explain why Visa’s payment volume increased while consumer spending decreased globally in 2022. Consumer spending is forecast to keep growing at a CAGR of 6% from 2023 to 2028. This is what the CFO said in the Q2 23 investor call about consumers.

“Yes, the short answer is yes. We think the consumer is still in good shape. As we said, spending across most categories other than a couple I mentioned like fuel and some retail goods price cutting, is very strong across services, strong across travel and entertainment, strong in non-discretionary, so, yes, that’s how we feel.”

Created by the author using Statista

The chart above is composed of both cash and digital consumer spending. As consumer spending continues to grow. I believe payment volume should rise as well. Thus, Visa will be able to charge more fees, which will increase future revenue and earnings. Perhaps payment volume won’t increase at the same rate as consumer spending because the forecast above is composed of cash and electronic spending.

Competition

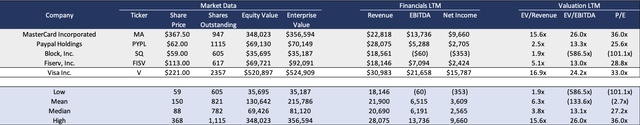

Below I listed a table that consists of Visa competitors and a comparison between key financial stats.

Created by the author using company filings

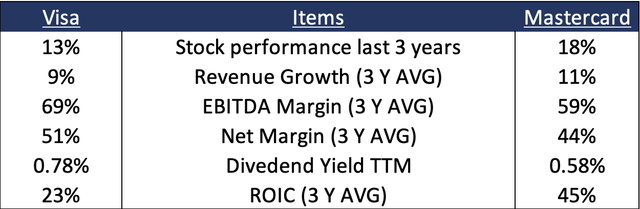

I want to focus on Visa’s biggest competitor Mastercard.

Created by the author using company filings

Visa has done a better job than Mastercard in terms of profitability. The company has enjoyed high-profit margins for years. Both companies have done a good job of returning money to shareholders. For the past 3 years, Mastercard spent 97% of its cash flow on dividends and share repurchases, and Visa spent 87%. Mastercard’s stock has outperformed Visa’s in the last 5 and 3 years, respectively. Overall, I think Visa is in a better position because they are an industry leader, process more transactions, and has more cards in circulation. I think it is worth mentioning that Mastercard is available in more countries than Visa.

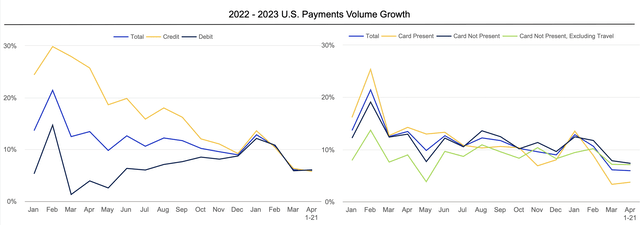

Recent Performance

Visa had a good second quarter, beating expectations. Revenue grew by 11% YoY and payment volume by 10%. What was most impressive was the growth in cross-border volume (24% YoY). Cross-border volume, excluding intra-Europe, grew by 32%. Volume growth was constant in April, suggesting that maybe consumers are finally dialing down on spending, but it is unclear and only time will tell.

Company’s Presentation

Overall, it was a very good quarter for Visa. The company did well considering its exposure to economic conditions. Looking ahead, Visa might experience some short-term headwinds, but I think that has already been priced in by investors due to all the recent recession talk.

Valuation

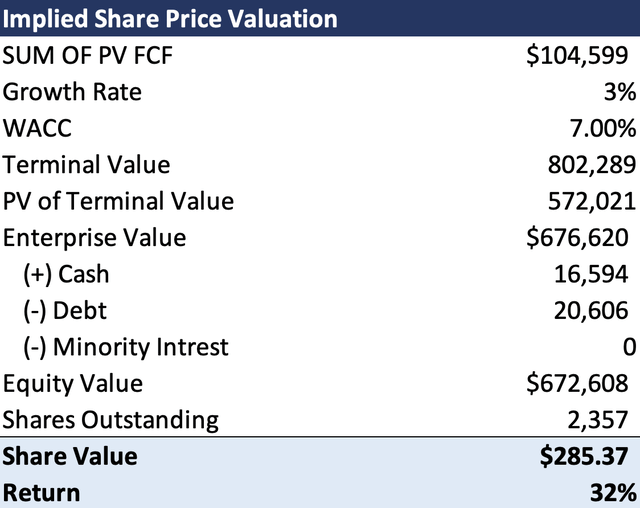

Visa’s current P/E ratio is 33x, and the current EV/EBITDA is 24.2x. To evaluate Visa, I used the discounted cash flow method. I believe that with the continued shift towards digital payment, an increase in cross-border transaction volume as travel gets back to pre-covid level (This segment declined back in 2020 due to COVID), and penetration in international markets (especially emerging markets), net revenues should grow at a 10% CAGR from 2023–2027. Given those assumptions I was able to forecast the company’s financials for five years, Using a WACC of 7.00%, I discounted the free cash flows and terminal value into the present. I arrived at an equity value of $673 billion, or $285 per share.

Created by the author

Risks

1) Visa’s business is heavily dependent on economic conditions. Conditions such as consumer spending and travel. The better these conditions are, the more transactions there will be, thus Visa making more money. In 2020, all of Visa’s revenue segments experienced growth except for international transactions, which suffered a 19% decline due to the drop in cross-border transactions (less travel because of COVID). As of May 2023, U.S. inflation was sitting at 4.93% and the European Union’s at 8.10%. As things become more expensive, consumers tend to only spend money on essentials, thus decreasing consumer spending and payment volume. As payment volume declines, Visa’s revenue tends to follow since one of its main revenue drivers is consumer payment.

2) FedNow is an instant payment infrastructure developed by the Federal Reserve that allows financial institutions in the U.S. to provide safe and efficient instant payment services. Any infrastructure or service that offers payment services can be a potential competitor of Visa. The question that is on everyone’s mind is: will FedNow replace Visa in the U.S.? Personally, I don’t think it will because other countries such as Brazil and India both have similar systems and as far as I know, Visa is doing just fine in those markets. This is what the CEO- Ryan McInerney had to say about FedNow in the Q2 23 earnings call.

“So if you put FedNow in the context of all of that. So just to talk specifically about FedNow, the first thing I would say is that modernizing the payments infrastructure in the United States is a smart thing to do. It’s a necessary thing to do, and it’s good for Americans. So that’s — it’s something that is a good thing happening in the U.S. And I’d also say that any force that digitizes money movement is a catalyzing force for all of us. And I expect that the FedNow, like TCH, it’s going to take some time. It will eventually get traction, but it will take some time to build adoption.”

3) Visa handles a lot of user data, and that makes the company a target for hackers trying to make a buck by holding them, hostage. In March 2012, the information of 1-3 million cardholders for both Visa and Mastercard was exposed in a hack that occurred at global payments. Global Payments is a company that helps Visa and MasterCard process transactions for merchants. Although this wasn’t Visa’s fault, their customers’ information was still out in the open. Also, the DOJ is currently investigating Visa for debit card practices. The company said that they are cooperating with the Department of Justice.

Conclusion

The bottom line is that Visa has a solid business model that is highly scalable with a nice moat around it. The company’s cash flow has been stable for many years with minimal capital expenditures. The company is riding on some nice trends that I believe will help them grow in the near future. An entry price below $210 can be a good opportunity to buy into this great business. There are some risks to consider, just like with any other business, but Visa has done a good job managing those risks, so I don’t think one should worry about them too much. Other than that, I will leave you with a quote, as always.

“Risk comes from not knowing what you’re doing” – Warren Buffet

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.